Normal Operation

Normal OperationExness

10-15Year

Basic Information

Country

CyprusMarket Type

foreign exchangeEnterprise Type

BrokerageService

We offer clients a wide range of financial instruments, including currency pairs, metals, cryptocurrencies, energies, indices and stocks.Support Languages

Bengali, Indonesian, Thai, Arabic, Vietnamese, Korean, Urdu, Hindi, English, Spanish, French, Portuguese, Japanese, Russian, Chinese,Domain Registration Date

2008-08-26Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

Exness is a leading global online broker, founded in 2008 and headquartered in Limassol, Cyprus. As a multi-regulated financial institution, Exness is committed to providing a secure and transparent trading environment for its clients worldwide, with operations spanning Europe, Asia, and Africa.

Exness' core business encompasses trading services across a wide range of financial instruments, including currency pairs (forex), precious metals (such as gold and silver), cryptocurrencies (such as Bitcoin and Ethereum), energy (such as oil and gas), global indices, and stocks. Through advanced trading technology and exceptionally low spreads, Exness provides clients with an efficient trading experience.

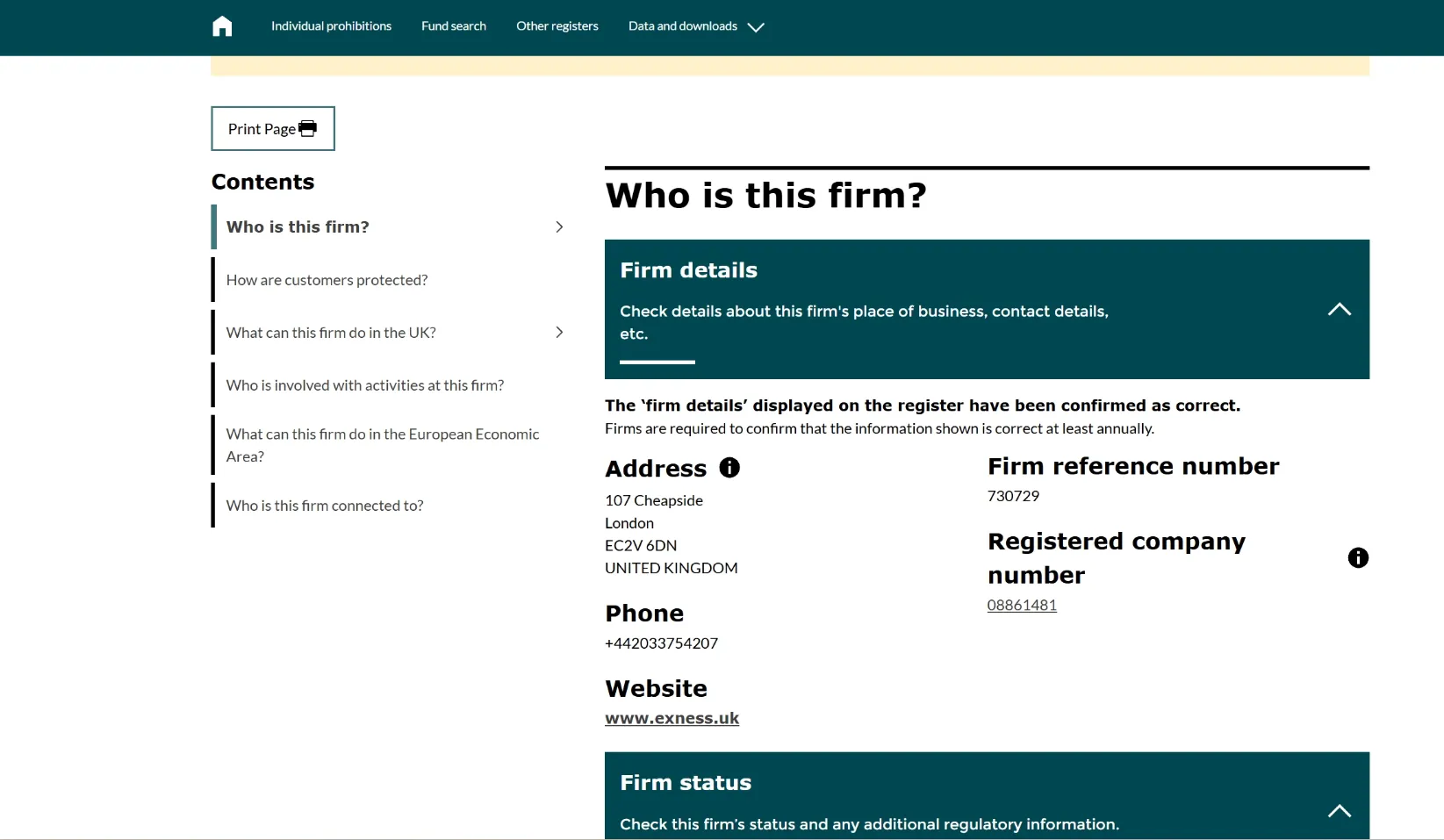

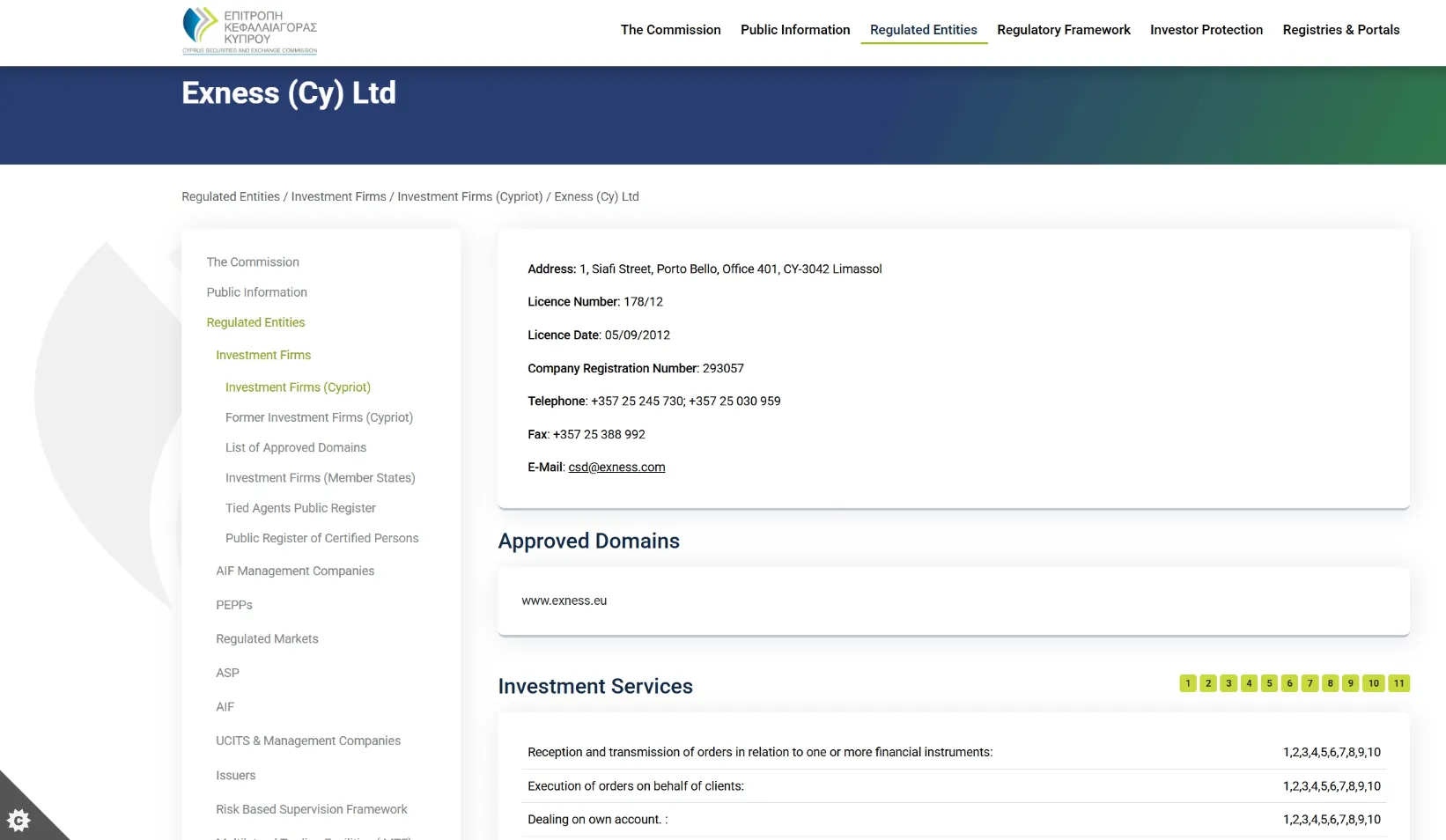

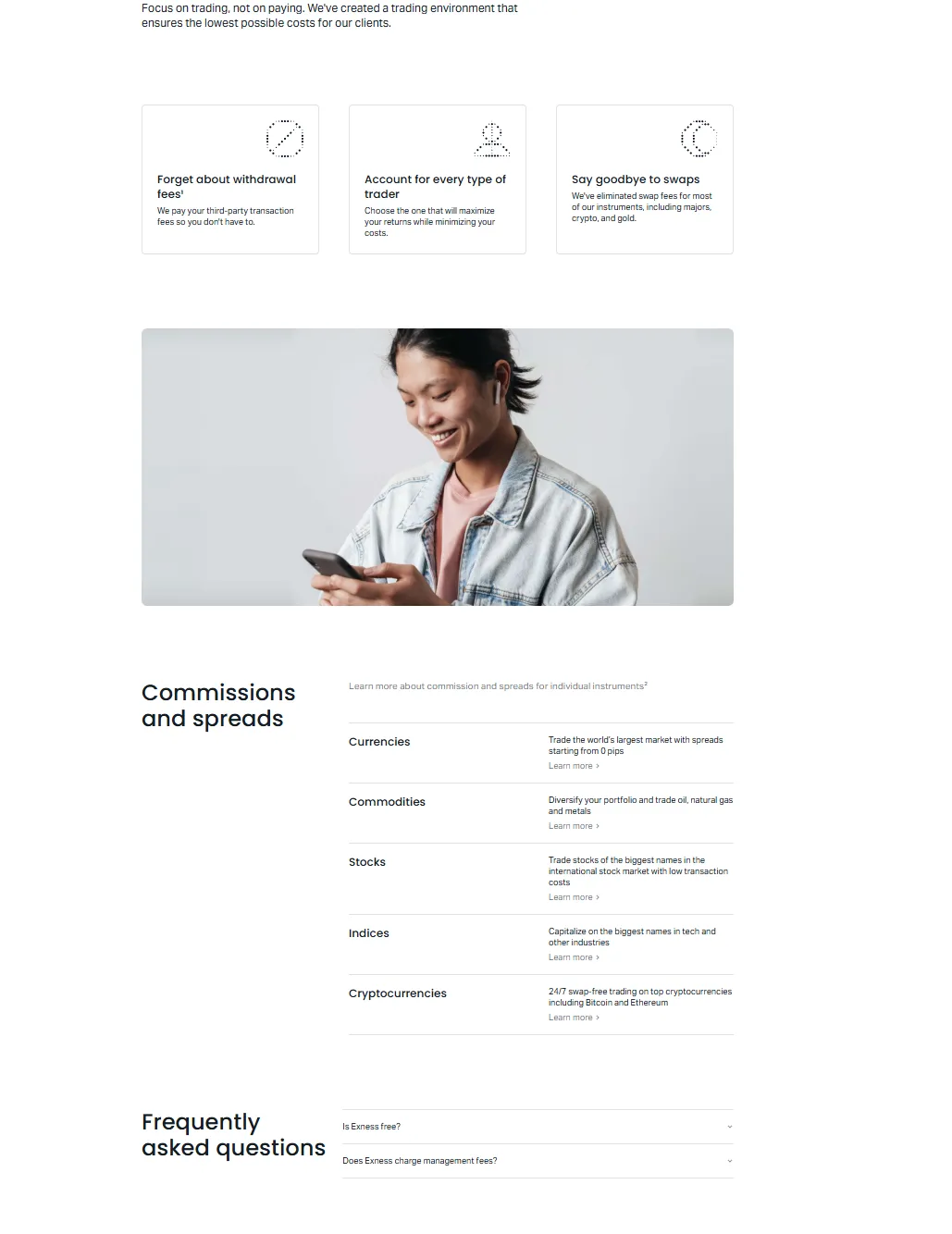

Exness' strengths lie in its exceptional trade execution speed, high leverage options (up to unlimited leverage), and flexible withdrawal policies, including instant withdrawals with no transaction fees. Furthermore, Exness focuses on technological innovation, offering multi-platform support (such as MT4, MT5, and proprietary trading platforms), and continuously optimizing its customer service to meet the needs of traders at all levels. Leveraging strict regulatory approvals (such as those from CySEC and the FCA) and a customer-centric approach, Exness has become a trusted brand for traders worldwide, committed to promoting inclusiveness and convenience in the financial markets.

🌐Global layout and brand background

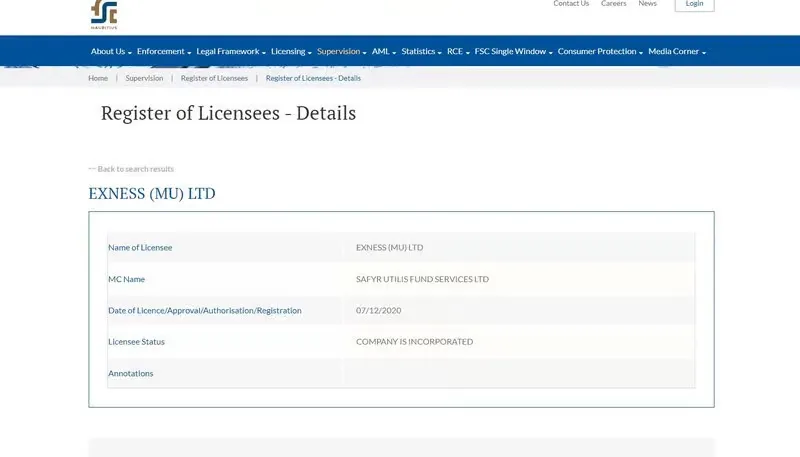

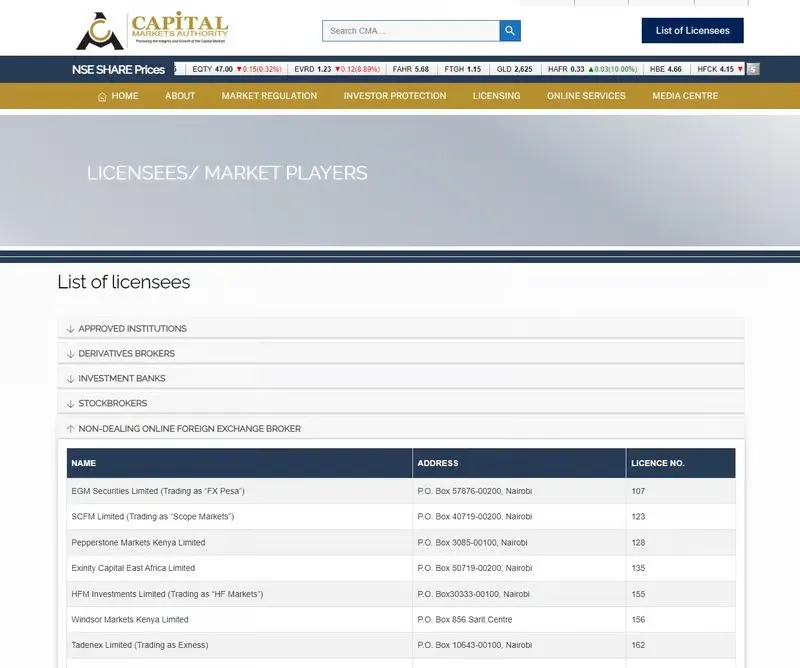

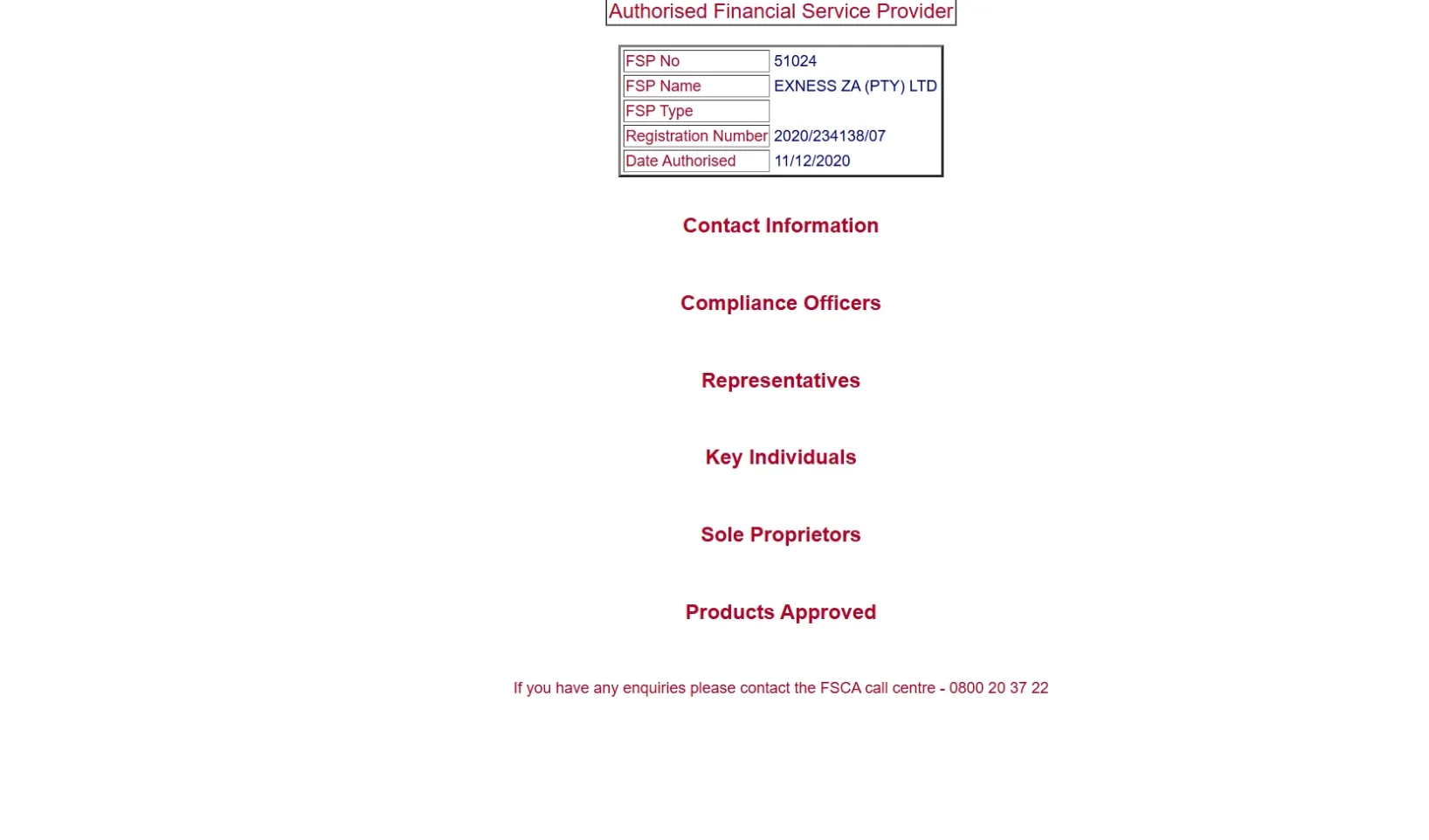

Since its founding, Exness has continuously expanded its international presence. It currently maintains compliant operations in multiple regions across Europe, Asia, Africa, and the Middle East, holding licenses from multiple regulatory bodies, including CySEC (Cyprus), the UK FCA, the South African FSCA, and the Seychelles FSA. This multi-regional regulatory framework ensures the platform's compliance across diverse markets while fostering investor trust. With continued growth in trading volume and user numbers, Exness has established a globally recognized brand. Industry insiders generally believe that Exness's success stems from its continued investment in technological innovation and its focus on customer experience, particularly its consistent performance in risk management systems and market transparency. For traders prioritizing security and long-term sustainability, Exness's established brand and global operations guarantee a more reliable trading environment and superior service.

💹Trading products and services

Exness offers a comprehensive range of financial trading products, allowing investors to diversify their investment portfolios on a single platform. Foreign exchange trading remains its core strength, with the platform offering tight spreads on both major and minor currency pairs, ensuring lower-cost order fulfillment in a highly liquid market. Commodity trading, encompassing precious metals, energy, and agricultural products, allows traders to diversify their asset allocations. Index and stock CFDs offer flexible opportunities for investors seeking exposure to global markets. Furthermore, the platform supports CFDs on popular cryptocurrencies, helping risk-averse traders capitalize on digital asset volatility. With its transparent pricing mechanism and stable execution speed, Exness offers clients a more competitive choice of products and services, catering to diverse needs, from short-term high-frequency trading to long-term investment.

💻Trading technology and platform experience

In terms of trading technology, Exness is focused on creating an efficient and stable execution environment for its clients. Its core trading platforms, MetaTrader 4 and MetaTrader 5, not only offer a wealth of technical analysis tools but also support automated trading with Expert Advisors (EAs), copy trading, and seamless multi-terminal integration, providing investors with a solution tailored to their trading styles. The platform boasts industry-leading order execution speeds and a unique "Market Protection" feature, providing traders with an additional risk buffer during periods of volatile market conditions, delaying or preventing margin calls. Combined with extremely low transaction costs and ultra-fast execution speeds of milliseconds, Exness is particularly well-suited for clients pursuing high-frequency and short-term trading. However, its technological stability and scalability also appeal to long-term strategies and large-volume traders. Overall, Exness strikes a balance between platform flexibility, technical performance, and user experience, resulting in a highly adaptable platform.

🛡️Regulatory compliance and fund security

Exness has always emphasized the importance of compliance and fund security. It currently holds regulatory licenses from numerous authoritative institutions, including the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the South African Financial Sector Conduct Authority (FSCA), the Seychelles Financial Services Authority (FSA), and the Mauritius Financial Services Commission (FSC). The platform employs a segregated client fund custody system, storing user funds in multiple independent, top-tier bank accounts. Fund security is ensured through multiple measures, including 3D Secure, PCI DSS, and one-time password authentication. Third-party risk assessment platforms rank Exness as a reputable, low-risk broker due to its diverse compliance licenses and long-standing track record. However, it should be noted that forex and CFD trading inherently carry high leverage and carry significant risk. Investors should carefully assess their risk tolerance and manage their funds carefully before trading.

⚡Trading conditions and experience

Exness offers a flexible account structure to suit different types of traders. The Standard account is suitable for entry-level users and short- to medium-term traders, with no commissions and spreads starting from 0.2 pips. Professional accounts, including Pro, Zero, and Raw Spread, require a minimum deposit of only $200, offer spreads as low as 0.0, and offer flexible commission plans, making them particularly suitable for high-frequency or professional traders. Exness also offers global and convenient deposit and withdrawal services, supporting multiple major payment channels, providing instant withdrawals and multiple fund verification processes to ensure efficient and secure capital flow. Combined with ultra-low transaction costs, transparent quotes, and stable execution technology, Exness's comprehensive trading conditions have a strong competitive advantage in the industry, suitable for investors who seek a balance between cost and efficiency.

🎓Customer support and value-added services

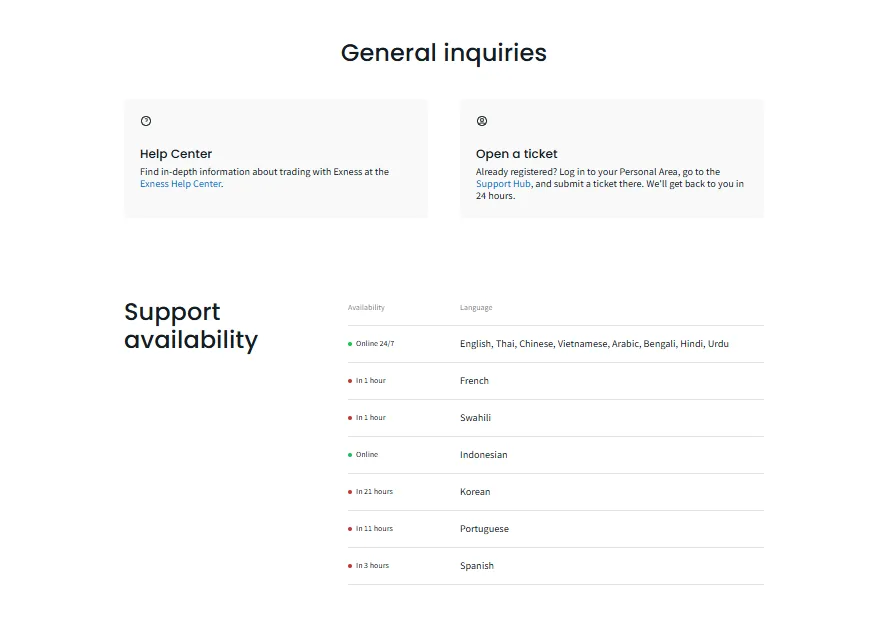

Exness's extensive customer support system offers 24/7 multilingual support in dozens of languages, including English, Chinese, Russian, Arabic, Japanese, and Thai. Users can reach out by phone or email at any time. Furthermore, the platform provides clients with real-time market analysis reports, educational videos, webinars, and the latest financial news updates to help traders understand market trends and optimize their trading strategies. For novice investors, Exness's educational and value-added services significantly ease the entry level, while experienced traders will appreciate the platform's in-depth market tools and informative support. Overall, the user experience demonstrates a high level of professionalism and responsiveness.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading are highly leveraged and high-risk products that can result in significant gains or losses in a short period of time, or even the complete loss of account funds. Exness clearly discloses risks on its official website and third-party platforms, reminding investors to fully understand the product mechanics before trading and to allocate funds and manage risk appropriately based on their individual circumstances. Overall, Exness is more suitable for users who prioritize a stable trading environment, fast execution, and regulatory compliance, especially those seeking flexible opportunities in global multi-asset markets. Those seeking only extremely high leverage or short-term speculation should carefully weigh the risks.

🔍Comprehensive analysis and evaluation

From a comprehensive perspective, Exness has the following characteristics:

Compliance supervision in multiple locations ensures high brand credibility;

Rich trading products, covering foreign exchange, commodities, stocks and digital assets;

The platform technology is stable, with fast execution and low spreads;

Flexible account types and instant withdrawal services with friendly trading conditions.

BrokerHive x 's comprehensive review of Exness states: "Exness has established a unique competitive advantage in the forex and CFD markets through technological innovation and fund security, making it a particularly suitable platform for investors who prioritize execution efficiency, transaction costs, and regulatory compliance." Therefore, for users seeking to trade across multiple categories in a secure and compliant environment while balancing cost and efficiency, Exness remains a high-quality platform worth considering.

Selected Enterprise Evaluation

3.88

Total 12 commentsWhen trading gold during high-volatility sessions, the platform stays stable.

Reply

I’ve never felt as helpless as when the platform I invested in just disappeared. No replies to emails, no working phone numbers, and no way to access my funds. It was as if the entire company vanished into thin air. I almost gave up after weeks of trying to contact someone—anyone—who could help. Then someone online recommended Mrs. Bruce Nora. I was skeptical, but figured I had nothing to lose. From the very beginning, she stayed in touch consistently and explained what was happening behind the scenes. She knew exactly how to approach these situations and made the process feel less overwhelming. It took a bit of time, but in the end, I recovered my full balance—something I thought was impossible. If you’ve been scammed, don’t stay quiet—reach out for help. There’s still hope. bruce.nora 254 (@) gmail . com | trazevault.org

Reply

Support reminded me about correct blockchain networks, which saved me trouble.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

The in-site chat and WeChat support are both very responsive.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

Copy-trading syncs almost perfectly—minimal slippage.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

Not flashy, but very substantive—exactly what I want.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

I’ve never felt as helpless as when the platform I invested in just disappeared. No replies to emails, no working phone numbers, and no way to access my funds. It was as if the entire company vanished into thin air. I almost gave up after weeks of trying to contact someone—anyone—who could help. Then someone online recommended Mrs. Bruce Nora. I was skeptical, but figured I had nothing to lose. From the very beginning, she stayed in touch consistently and explained what was happening behind the scenes. She knew exactly how to approach these situations and made the process feel less overwhelming. It took a bit of time, but in the end, I recovered my full balance—something I thought was impossible. If you’ve been scammed, don’t stay quiet—reach out for help. There’s still hope. bruce.nora 254 (@) gmail . com | trazevault.org

Reply

Be very cautious when investing. Recovering lost funds or dealing with crypto trading scams can be extremely stressful and frustrating once your money is in the wrong hands. I personally lost over $882,050 while trying to earn extra income through a fraudulent trading company. Fortunately, I was later introduced to Mrs. Susan Kaplan, who works with a reputable recovery firm. With her help, I was able to recover 90% of my total losses, including the profits stolen by these scammers. If you’ve had a similar experience, you can reach out to Mrs. Susan Kaplan: Email: [email protected] WhatsApp: +1 ( 36 0) 310-0351

Reply

I had some trouble withdrawing my funds after trading, and it was quite stressful. (NordevamberCom, Whatsapp: +1 334 679 5376) guided me through the process clearly and professionally, and I was finally able to complete my withdrawal without issue

Reply

I had some trouble withdrawing my funds after trading, and it was quite stressful. (NordevamberCom, Whatsapp: +1 334 679 5376) guided me through the process clearly and professionally, and I was finally able to complete my withdrawal without issue

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

Load More

About Exness's questions

Ask:Is Exness safe? How is the fund protection?

Answer:Exness was founded in 2008 and is headquartered in Limassol, Cyprus. It has long been supervised by authoritative regulatory agencies in many countries, including the UK FCA, Cyprus CySEC, South Africa FSCA, Seychelles FSA, etc. It has high compliance and its brand reputation is highly recognized in the industry. The platform adopts a customer fund isolation custody system, which stores user funds in independent primary bank accounts, and is supplemented by multiple security measures such as 3D secure payment and one-time password verification to protect customer funds to the greatest extent. Third-party risk assessment platforms also generally rate it as a regular broker with low risk. However, it should be made clear that foreign exchange and CFD trading are highly leveraged products, and market fluctuations may still lead to capital losses. Investors should trade reasonably based on their own risk tolerance when using the platform.

Ask:What are the advantages of Exness' trading products and conditions, and what types of investors are suitable for them?

Answer:Exness provides a comprehensive range of financial trading products, with foreign exchange as its core advantage. Both mainstream and secondary currency pairs offer low spread trading. At the same time, the platform supports precious metals such as gold and silver, energy such as oil and gas, commodities, global popular indices and stock CFDs, as well as cryptocurrency CFDs such as Bitcoin and Ethereum, which can meet a variety of needs such as short-term trading, long-term investment and asset allocation. The trading conditions are very flexible. The Standard account is free of handling fees and the spread starts from 0.2 points, while the Professional account (Pro, Zero, Raw Spread) has a minimum deposit of only US$200, a spread as low as 0.0 and a flexible handling fee plan, which is suitable for professional or high-frequency traders. Deposits and withdrawals support multiple channels, and provide instant withdrawals and security verification processes. The efficiency and transparency are competitive in the industry. Overall, it is suitable for traders who pursue a balance between cost and efficiency. Both novice and advanced users can find a suitable account type.

Ask:How does Exness perform in terms of trading technology and customer service?

Answer:Exness has outstanding performance in trading technology, supporting MetaTrader 4, MetaTrader 5 and proprietary platforms. Its execution speed is leading in the industry, and it has market protection functions, providing additional buffers for high volatility and avoiding slippage or liquidation risks. The platform is not only suitable for high-frequency trading and EA automated strategies, but also for large orders and long-term investors. Customer service covers 7×24 hours multi-language support, providing more than a dozen languages including English, Chinese, Russian, Arabic, Japanese, etc., with professional and timely responses; at the same time, it provides value-added services such as market analysis reports, real-time financial information, educational videos and webinars to help novices lower the entry threshold, and also provide more in-depth market references for experienced traders. Overall, Exness combines the stability and flexibility of trading technology with customer experience, and is suitable for investors who focus on transaction execution efficiency, service quality and multi-asset layout.