Normal Operation

Normal OperationTrade Nation

10-15Year

Basic Information

Country

BritainMarket Type

foreign exchangeEnterprise Type

BrokerageService

Forex, commodities, indices, stocks, CFDsSupport Languages

EnglishDomain Registration Date

2013-08-19Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

Founded in 2009, Trade Nation is a London-based forex and contracts for difference (CFD) brokerage, offering services in financial markets such as forex, stocks, indices, and commodities. As a multinational financial services company, Trade Nation has established branches in the UK, Australia, South Africa, Seychelles, and the Bahamas, demonstrating its strong global reach.

Its core business focuses on providing a diverse range of trading products to retail and institutional clients, offering trading services through its proprietary TN Trader platform and the mainstream MetaTrader 4 (MT4). With an intuitive trading experience and flexible trading conditions, Trade Nation is committed to providing users with efficient and transparent market access.

🌐 Global layout and brand background

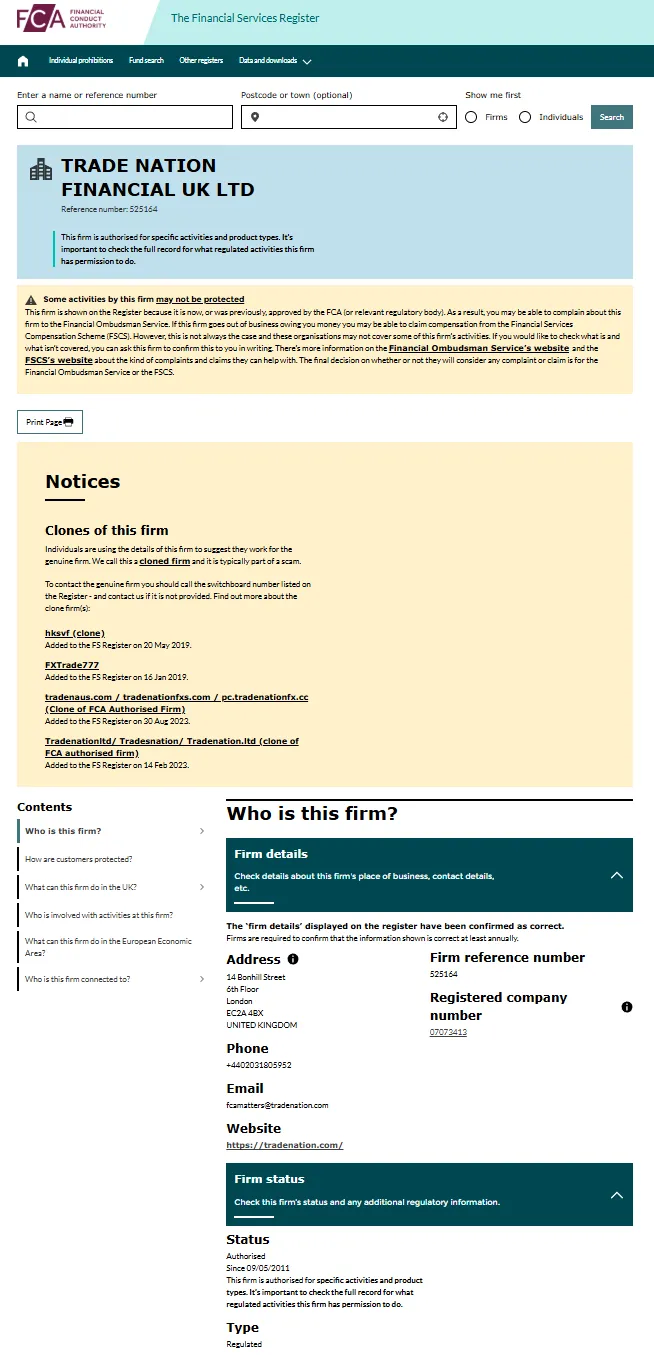

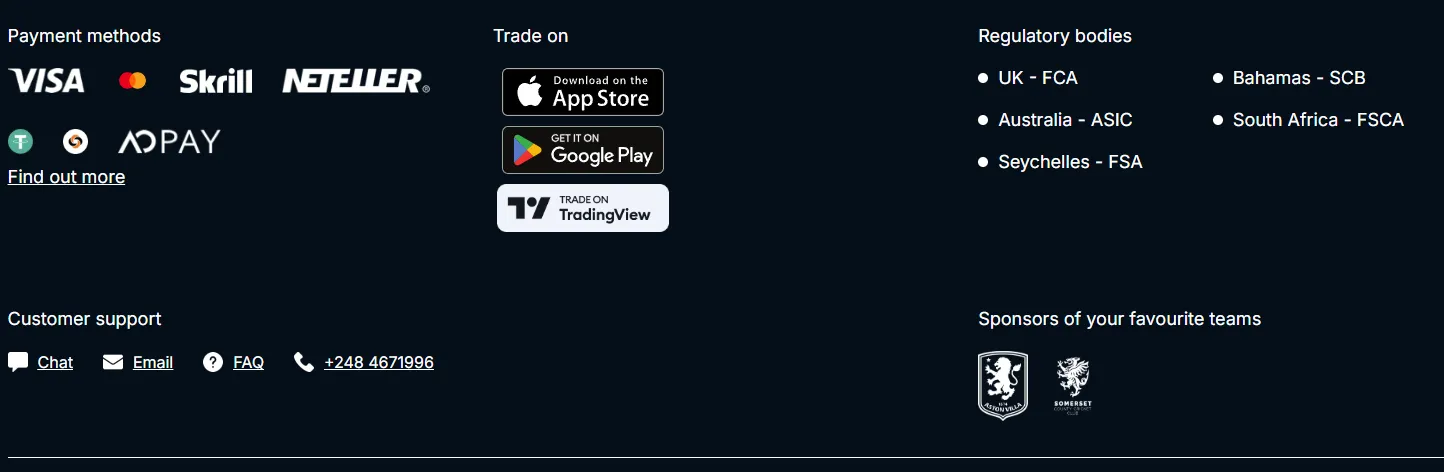

Trade Nation is operated by Trade Nation Financial Markets Ltd and is strictly regulated by multiple regulatory bodies, including the UK Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Securities Commission of the Bahamas (SCB), the Financial Services Authority of Seychelles (FSA), and the Financial Sector Conduct Authority (FSCA) of South Africa.

This multi-regulatory framework ensures the company's long-term stable operations in the global market and strengthens investor confidence in the security of its funds. Trade Nation's official website has been operational since 2002, according to domain registration data. Industry insiders generally believe that its multi-regional compliance and global operations give it advantages in cross-border services and brand credibility.

💹 Trading Products and Services

Trade Nation offers over 2,000 financial products, covering forex currency pairs, stocks, indices, commodities, and more, catering to the diverse needs of different traders. Whether it's day trading, long-term investment allocation, or risk hedging management, the platform has the right products to meet your needs.

Furthermore, the platform supports leverage of up to 1:500, offering traders greater flexibility and potential profit potential, but also increasing potential risk. Overall, Trade Nation's product portfolio strikes a balance between broad coverage and high leverage flexibility, suitable for investors with varying risk appetites.

💻 Trading technology and platform experience

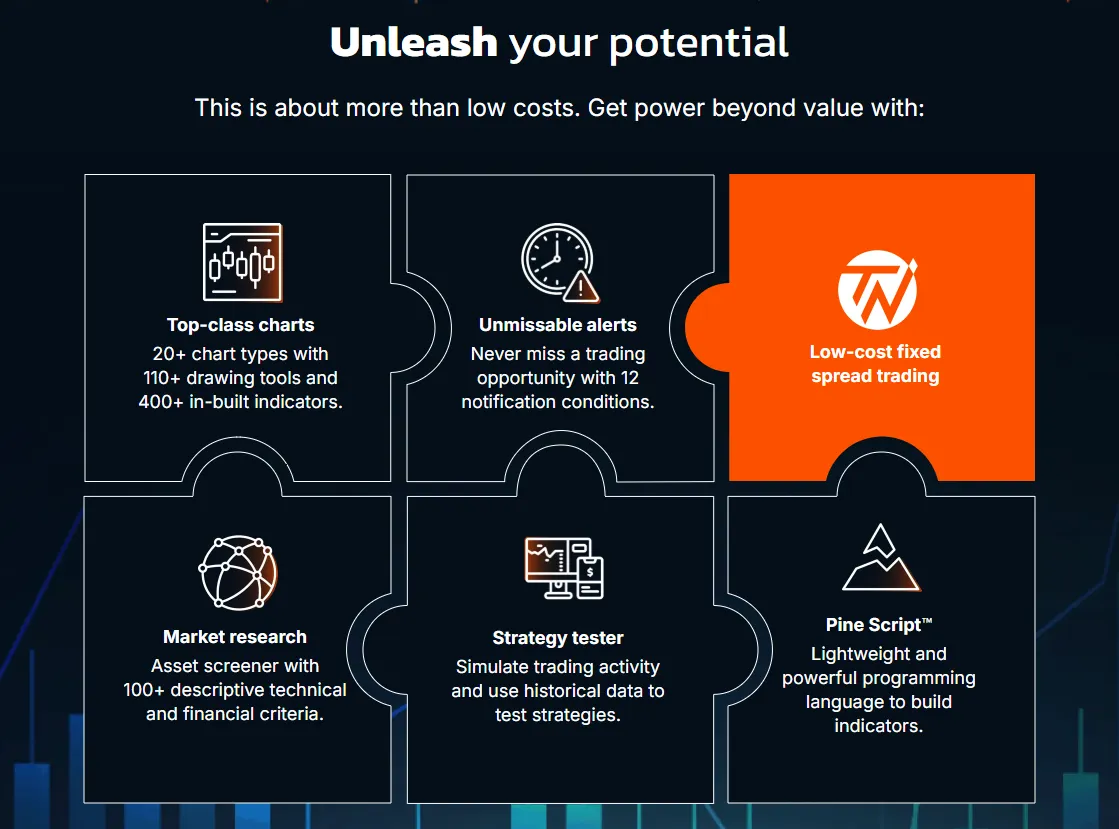

Trade Nation offers two main trading platforms: its proprietary TN Trader and the widely used MetaTrader 4 (MT4).

The TN Trader platform offers a simple and intuitive interface, making it suitable for beginners and those seeking ease of use. MT4, with its rich charting capabilities and support for automated strategies, is the preferred choice for professional traders and automated trading enthusiasts. Overall, Trade Nation balances user experience with professional functionality in its trading platform selection.

🛡️ Regulatory compliance and fund security

As a multi-regionally regulated international broker, Trade Nation's subsidiaries hold the appropriate licenses in various regions. Authorizations from regulatory bodies such as the UK FCA (Company No. 525164), Australia ASIC (AFSL No. 422661), the Bahamas SCB, the Seychelles FSA, and the South African FSCA ensure compliance and transparency across various markets.

This cross-regional compliance oversight not only enhances fund security but also demonstrates the company's commitment to and commitment to compliance management. Before trading, investors should confirm the regulatory entity of their account to clarify trading conditions and leverage limits.

⚡ Trading conditions and experience

Trade Nation offers flexible trading conditions, emphasizing convenient deposits and withdrawals, zero fees, and no minimum deposit requirement. It supports a variety of payment methods, including VISA, MasterCard, and Grab Pay, ensuring efficient capital inflows and outflows.

Trade Nation prioritizes transparency and fast order execution, providing clients with a trading experience close to the real market. This platform offers a competitive advantage for traders seeking high leverage and low-cost operations.

🎓 Customer Support and Community Operations

Trade Nation offers 24/5 multilingual customer support across live chat, email, and phone channels, ensuring investors receive a quick response to their questions.

The company also prioritizes community building and brand promotion, not only strengthening user engagement through online education and market training, but also establishing partnerships with numerous sports brands and clubs, such as Aston Villa and Somerset County Cricket. These cross-border collaborations have significantly enhanced Trade Nation's market exposure and community engagement.

⚠️ Risk Warning and Platform Positioning

Foreign exchange and CFD trading are high-risk investments. Trade Nation has clear risk disclosures on its official website and third-party platforms, reminding investors to be cautious when using high leverage.

Overall, Trade Nation's platform is positioned at a balance between compliance and security and diversified product coverage, suitable for investors who want to gain rich market access opportunities while also paying attention to the transparency of the trading environment.

🔍 Comprehensive analysis and evaluation

From a comprehensive perspective, the main features of Trade Nation include:

Many locations are supervised by authoritative institutions, and the funds are relatively safe;

The product coverage is wide and the leverage is flexible, suitable for users with different risk preferences;

The platform technology is stable, taking into account both novice-friendliness and professional needs;

Active community and brand operations have enhanced user stickiness and brand image.

As an established international broker, Trade Nation offers advantages in compliance and branding. For investors seeking a stable, compliant environment and a diverse range of trading products, Trade Nation is a platform worth considering.

Selected Enterprise Evaluation

4.25

Total 6 commentsNo surprise fees or withdrawal hold-ups—big relief.

Reply

ch***nn

ch***nnI had a deeply frustrating encounter with a deceptive trading platform that abruptly blocked my access after I made a substantial deposit. Despite multiple attempts to resolve the issue through their so-called support team, I received no response. That’s when I was fortunate enough to find Mrs. Bruce Nora, a seasoned professional in the field of asset recovery. She approached my case methodically, requested all necessary documentation, and handled the situation with impressive competence. Within a short time, she was able to retrieve my lost funds. Her service exceeded my expectations, and I can confidently vouch for her credibility and skill in tackling financial fraud cases.brucenora254 [@]gmail. com or WhatsApp +1 (8 7 0) 8 1 0 54 4 2

Reply

Trading costs are mid-to-low range compared to the industry.

Reply

During onboarding, I got one-on-one help—felt very personal.

Reply

On-chain tracking for crypto withdrawals gives full transparency.

Reply

The built-in charting tools are comprehensive—I don’t need any third-party plugins.

Reply

I had a deeply frustrating encounter with a deceptive trading platform that abruptly blocked my access after I made a substantial deposit. Despite multiple attempts to resolve the issue through their so-called support team, I received no response. That’s when I was fortunate enough to find Mrs. Bruce Nora, a seasoned professional in the field of asset recovery. She approached my case methodically, requested all necessary documentation, and handled the situation with impressive competence. Within a short time, she was able to retrieve my lost funds. Her service exceeded my expectations, and I can confidently vouch for her credibility and skill in tackling financial fraud cases.brucenora254 [@]gmail. com or WhatsApp +1 (8 7 0) 8 1 0 54 4 2

Reply

~ There's nothing more ~

About Trade Nation's questions

Ask:Is Trade Nation regulated by an authoritative authority and are my funds safe?

Answer:Yes, Trade Nation is overseen by leading regulators in multiple countries, including the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Securities Commission of the Bahamas (SCB), the Financial Services Authority (FSA) of Seychelles, and the Financial Sector Conduct Authority (FSCA) of South Africa. These regulatory frameworks ensure segregated custody of client funds and transparency in transactions, providing investors with a high degree of financial security.

Ask:What are the main trading products and platforms provided by Trade Nation?

Answer:Trade Nation offers over 2,000 financial products, including forex currency pairs, stocks, indices, and commodities, catering to the needs of diverse investors. The company supports both its proprietary TN Trader platform and the widely used MetaTrader 4 (MT4), balancing the intuitive experience of beginners with the technical requirements of professional traders.

Ask:What are the leverage levels and trading conditions at Trade Nation?

Answer:The platform offers leverage of up to 1:500, providing investors with flexible capital utilization, but also increasing risk. Trade Nation supports a variety of deposit and withdrawal methods (VISA, MasterCard, Grab Pay, etc.), with no minimum deposit requirement and free deposit and withdrawal services. Overall trading conditions are competitive in the industry, but investors should fully understand the risk management mechanisms when using high leverage.