BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX

Time: 20+Year

| Company

Company Regulatory

Regulatory Risk Monitor

Risk Monitor Download

Download Documents

DocumentsWithdrawal processes are clearly laid out—no confusing steps.

![]() Reply

Reply

Withdrawal processes are clearly laid out—no confusing steps.

![]() Reply

Reply

The fill-out and confirm steps are minimal—very user-friendly.

![]() Reply

Reply

Never had to deal with “ping-pong” ticket transfers—big plus.

![]() Reply

Reply

Social trading feature is very beginner-friendly and helpful.

![]() Reply

Reply

Hearing others in my trading chat recommend them confirms it’s real.

![]() Reply

Reply

~ There's nothing more ~

HYCM CAPITAL MARKETS (UK) LIMITED (HYCM, known as Xingye Investment in Chinese) was established in 1993 and is headquartered in London, UK. It is a long-established international CFD and foreign exchange broker. The company's predecessors include Henyep Capital Markets (UK) Limited, Henyep Investment (UK) Limited, and Augurship 30 Limited. It has been deeply involved in the financial market for many years, with business footprints covering Europe, the Middle East and Asia, and has branches in Cyprus, Dubai, Kuwait, Hong Kong and the Cayman Islands.

As an important financial brand of Henyep Group, HYCM continues to expand its global business with its strong international capital background. Currently, the company has operation centers in the UK, Cyprus, UAE, Kuwait, Hong Kong and Cayman Islands, with comprehensive cross-regional services and localized support capabilities.

It is generally believed in the industry that HYCM, as a long-standing and established broker, has established a solid brand reputation by virtue of its deep cultivation and compliance operations in the European and Middle Eastern markets. It has won numerous awards in international financial awards, including Asian Capital Markets Awards Best Forex Broker, UK Forex Awards Best Forex Trading Platform, Global Forex Awards Best Forex Broker in Europe and Best Forex Platform in the Middle East/Asia, further strengthening its brand influence.

HYCM's product coverage is wide and can meet the needs of investors at all levels:

Foreign exchange trading: providing major and cross currency pairs, suitable for short-term and medium- to long-term strategies;

Index and stock CFDs: Covering major stock indices and popular stocks in Europe, America and Asia, facilitating asset allocation and market speculation;

Commodities: including popular commodities such as gold, silver, and crude oil, meeting the needs of risk hedging and swing trading;

Contracts for Difference (CFDs): Provide flexible leveraged trading opportunities for a variety of asset classes.

External analysis platforms generally believe that HYCM has obvious advantages in the foreign exchange and commodity markets, but its core product is still in the form of CFDs, which is suitable for traders who are not involved in spot delivery.

HYCM provides MT4 and MT5 platforms, supporting advanced charting tools, automated trading (EA), multi-product strategy backtesting and other functions, providing flexible choices for beginners and professional traders.

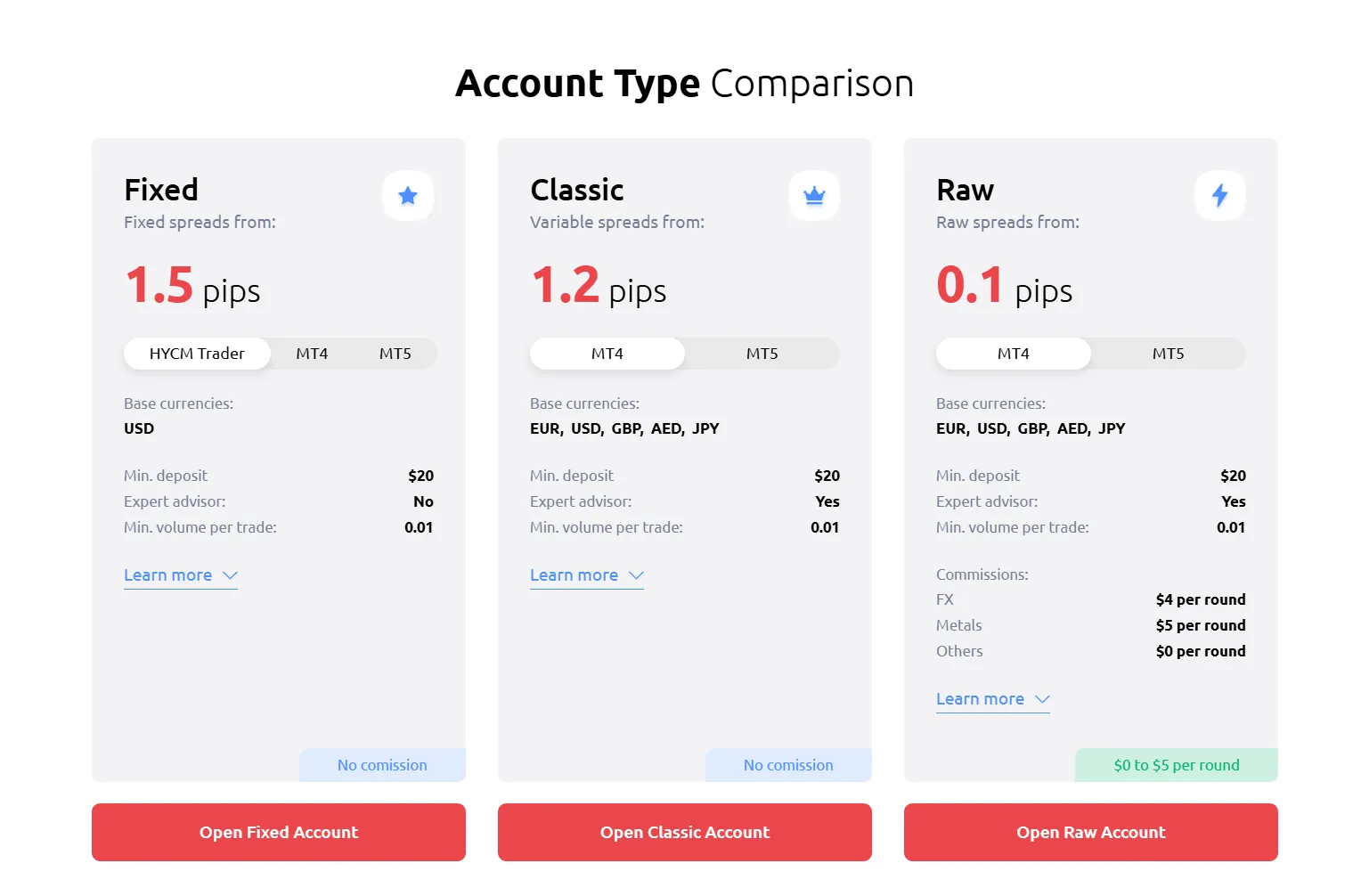

In terms of account system, HYCM offers three different trading accounts:

FIXED account: fixed spread, no commission, suitable for investors who are accustomed to stable costs;

CLASSIC account: spreads from 1.2, no commission, suitable for regular traders;

RAW account: Spreads start from 0.1, commissions are calculated based on transaction volume, suitable for scalping and high-frequency trading strategies.

Third-party evaluations show that HYCM's server execution speed and platform stability are at the upper-middle level in the industry, especially suitable for users who want to trade quickly in multiple markets. However, the leverage limits and trading conditions in different regions will vary due to regulatory requirements, so local rules must be clarified before opening an account.

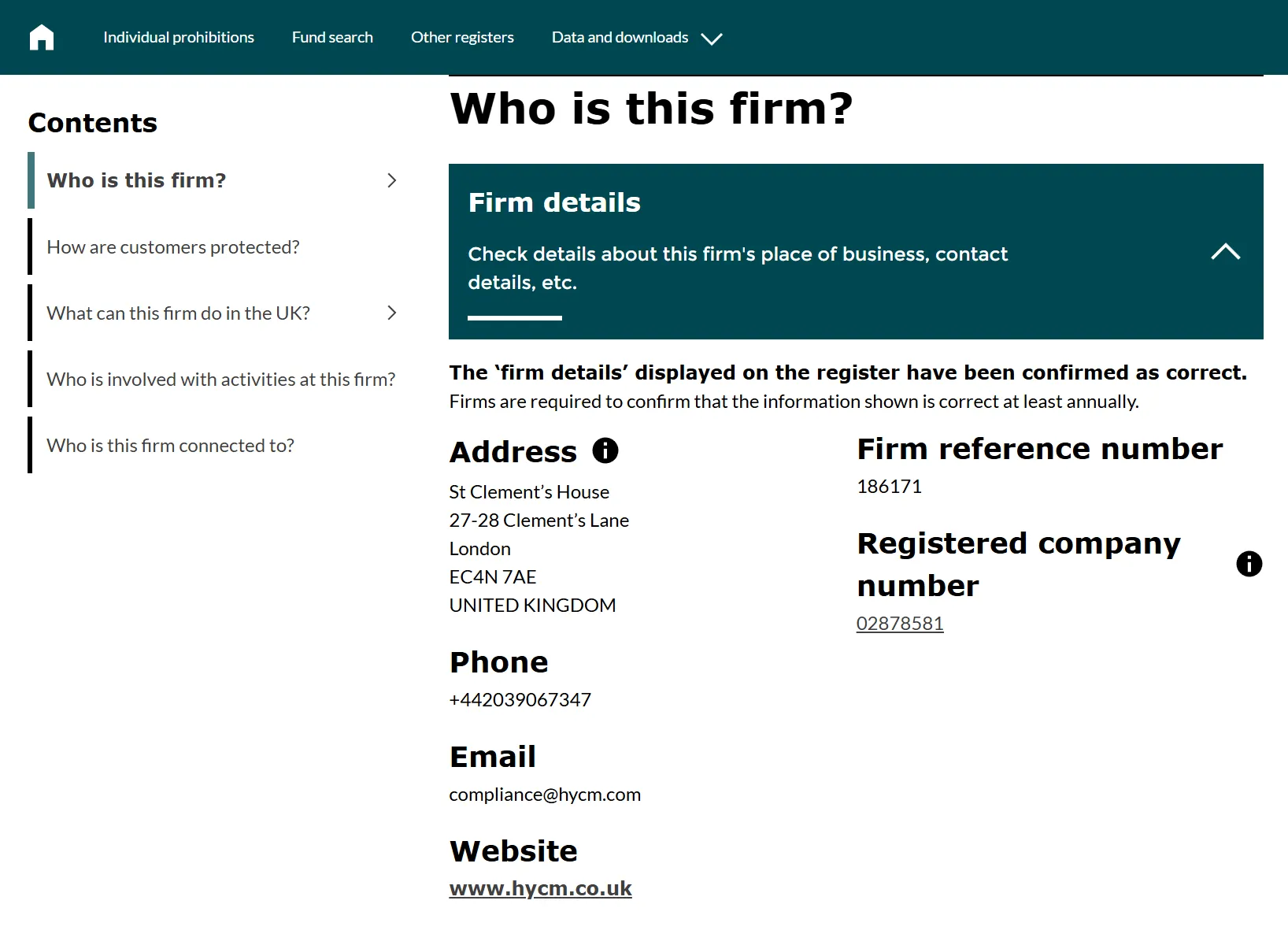

HYCM is regulated by a number of authoritative financial regulators, including:

Financial Conduct Authority (FCA)

Cyprus Securities and Exchange Commission (CySEC)

Cayman Islands Monetary Authority (CIMA)

Dubai Financial Services Authority (DFSA)

As an international broker operating in compliance with regulations in multiple locations, HYCM strictly implements the client funds isolation and custody system to ensure that client funds are completely separated from the company's operating funds, thereby minimizing the impact of potential operational risks.

In external risk rating platforms, HYCM is considered a relatively low-risk established broker due to its compliance supervision and years of international operating experience. However, it should be noted that foreign exchange and CFD transactions are essentially high-leverage and high-risk products, and investors should carefully assess their own risk tolerance.

HYCM offers flexible and competitive trading conditions:

Account types include fixed spread, floating spread and low spread commission system to meet different strategy requirements;

Maximum leverage varies by region, with accounts in EU and UK regulatory areas limited to 1:30 and international regulatory areas up to 1:500;

Deep liquidity and fast order execution reduce the risk of slippage and transaction delays.

Industry experts recommend that investors fully understand the margin and risk management mechanisms when choosing a high-leverage account to avoid losses due to leverage.

HYCM offers 24/5 multilingual customer support, providing real-time assistance to customers via phone, email and online chat.

In addition, HYCM has invested more in investor education, providing market analysis reports, trading guides, video tutorials and online seminars to help novice traders quickly understand the market, while also providing professional users with the latest strategies and market insights. Compared with some emerging platforms that focus on social trading, HYCM pays more attention to traditional education and training and personal trading research.

Foreign exchange and CFD trading are highly leveraged and volatile products that may result in the loss of all invested capital. HYCM clearly discloses risks on its official website and compliance documents, reminding customers to trade within a reasonable risk tolerance range and develop a fund management strategy that suits them.

From the perspective of platform positioning, HYCM is more suitable for professional and semi-professional traders who focus on compliance supervision, security and a stable trading environment, rather than novice speculators who simply pursue high returns.

In summary, HYCM's core advantages are:

Multiple regulatory compliance and fund isolation systems ensure high fund security;

Covering a variety of CFD products such as foreign exchange, commodities, stock indices, etc., suitable for a variety of trading needs;

Flexible account types, stable platform, high execution efficiency, suitable for short-term, high-frequency and automated trading users;

The international brand has a long history, has won numerous industry awards, and has strong brand credibility.

External reviews generally believe that HYCM is an established international broker that has found a balance between security, compliance and trading experience, and is suitable for users who conduct multi-category transactions in a mature trading environment.

Answer:Yes, HYCM is regulated by authoritative financial regulators in many places, including the UK Financial Conduct Authority (FCA), the Dubai Financial Services Authority (DFSA), the Cayman Islands Monetary Authority (CIMA), and previously held a Cyprus CySEC license (which has been voluntarily revoked). The platform adopts a segregated custody system for customer funds, which separates customer funds from the company's own funds in top bank accounts to ensure that even if risks occur in the company's operations, customer funds are still protected by law and regulation.

Answer:HYCM provides a variety of trading services such as foreign exchange, indices, commodities, stocks and CFDs, covering major markets around the world. Account types include: Fixed account: fixed spread, no commission, suitable for novices or medium and long-term traders; Classic account: floating spread starting from 1.2, no commission, suitable for regular traders; Raw account: spread starting from 0.1, commission charged according to transaction volume, suitable for high-frequency and scalping transactions.

Answer:HYCM offers flexible leverage, which is adjusted according to the regulatory region: In FCA/EU regulatory areas, the maximum leverage is 1:30; In international or offshore regulatory areas, the maximum leverage can reach 1:500. In terms of transaction costs, the Raw account has very low spreads, suitable for active traders who pursue low transaction costs, while the Fixed and Classic accounts are commission-free and have slightly higher spreads, which are more suitable for investors who prefer stable costs.