In Business

In BusinessHTFX

5-10Year

Basic Information

Country

BritainMarket Type

foreign exchangeEnterprise Type

BrokerageService

Forex, commodities, stocks, indices and cryptocurrencies tradingSupport Languages

English, Simplified Chinese, Traditional Chinese, Korean, Indonesian, Malay, Portuguese, Spanish, Thai, VietnameseDomain Registration Date

2001-10-03Business Status

In BusinessCompany IntroductionWeb Analytics

Company Introduction

HTFX is a global forex and CFD broker established in 2018. Initially registered in London, UK, HTFX has since established business entities in Cyprus, St. Vincent and the Grenadines, and other locations. HTFX primarily provides CFD trading services in forex, metals, commodities, energy, indices, and stocks to clients worldwide. Its official website supports multiple languages, including English, Chinese, Korean, and Spanish, demonstrating its strong international service capabilities.

🌐Global layout and brand background

As a broker registered and operating in multiple jurisdictions, HTFX differentiates its services through different regulatory entities. HTFX (EU) Ltd in Cyprus primarily serves retail clients, while HTFX Limited in the UK caters more to professional and institutional clients. The brand is primarily controlled by Silver Light Holding Ltd and individual shareholder Li Lijun, with a multi-faceted team of directors overseeing daily operations.

HTFX is characterized by its multi-regional registration and global presence, having established operating entities in the UK (registration number 11391132), Cyprus (registration number 348087), and St. Vincent (registration number 1659). While its domain name, htfx.com, was registered in 2001, it has a long history, but the overall brand is still in the process of market expansion and image building.

💹Trading products and services

HTFX offers a comprehensive product line across six key categories: foreign exchange, stocks, indices, commodities, precious metals, and energy CFDs. These products meet the diverse needs of investors for speculation, hedging, and asset allocation.

HTFX offers three account types: ECN Account, Standard Account, and Cent Account. All support Expert Advisors (EAs) and charge overnight interest. The ECN account features a 0-pip spread and a $7 commission per lot, while the Standard and Cent accounts offer no commission and a 1.5-pip spread, making them more suitable for entry-level users. The minimum deposit thresholds are $500 and $50, respectively.

💻Trading technology and platform experience

HTFX offers clients both MT4 and MT5 trading platforms, supporting multi-terminal operations, including desktop and mobile devices. The platforms include mainstream features such as technical analysis, order management, and strategy backtesting, catering to the diverse needs of both manual traders and quantitative strategy users.

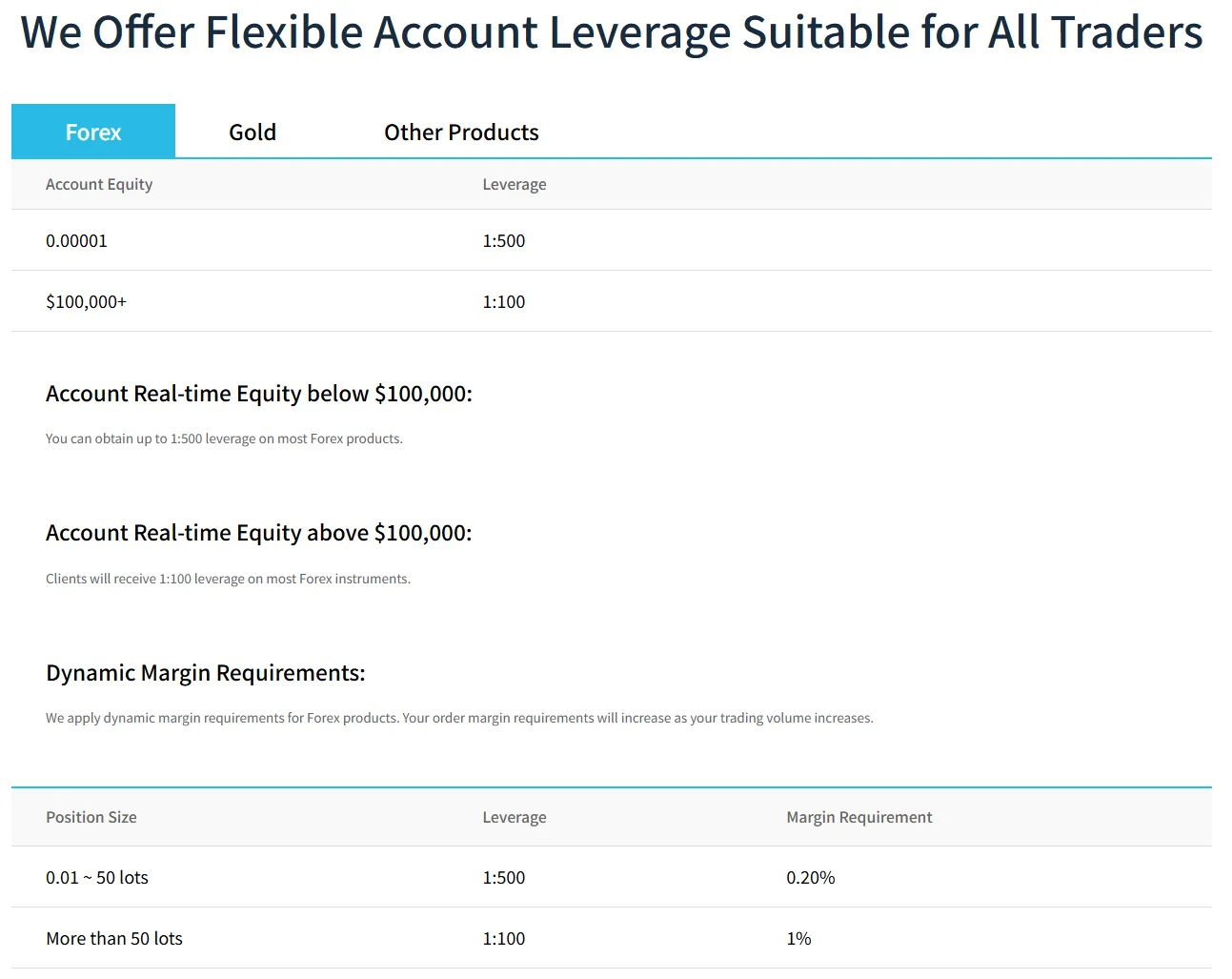

While HTFX lacks a proprietary platform, it offers a stable trading environment thanks to the widespread compatibility of MT4/MT5 in global markets. While offering a maximum leverage of 1:500, this is attractive, but also carries increased risk. Investors should carefully plan their trading plans and implement stop-loss mechanisms.

🛡️Regulatory compliance and fund security

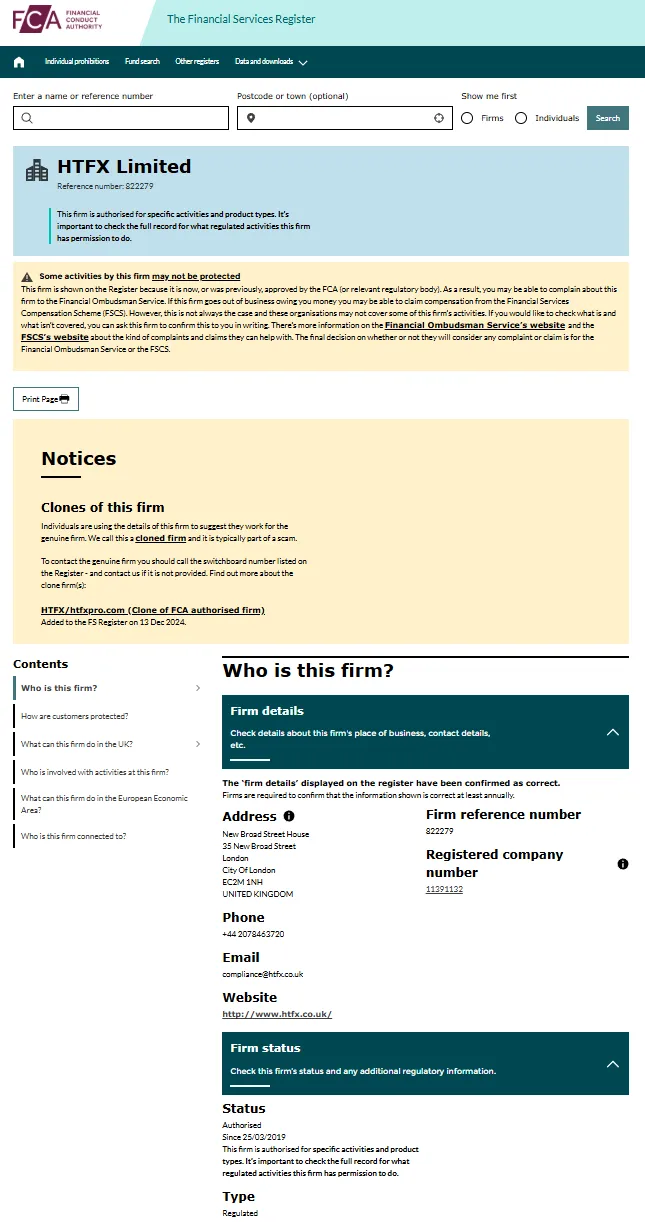

HTFX adopts a multi-licensing model. Its UK entity, HTFX Limited, is regulated by the FCA (license number 801701) and serves professional clients. Its Cyprus subsidiary, HTFX (EU) Ltd, is authorized by the CySEC (license number 332/17) and serves retail investors. HTFX also maintains a service entity registered in St. Vincent.

While multi-regional licensing provides a foundation for compliance, regulatory intensity varies significantly. Investors should focus on the legal protections and client funds segregation systems in the jurisdictions where they open accounts, to avoid misjudging the regulatory capabilities of all registered entities.

⚡Trading conditions and experience

HTFX offers flexible trading conditions, including a minimum trading volume of 0.01 lots, a maximum leverage of 1:500, a 100% margin call ratio, and a 30% liquidation level, suitable for multi-strategy traders.

ECN accounts are suitable for professional traders seeking the ultimate in cost-effective trading, while STANDARD and CENT accounts offer a low entry point and no commission, making it easy for beginners to experience the CFD market. Overall trading costs are kept at a moderately low level within the industry, maintaining a competitive edge.

🎓Customer support and value-added services

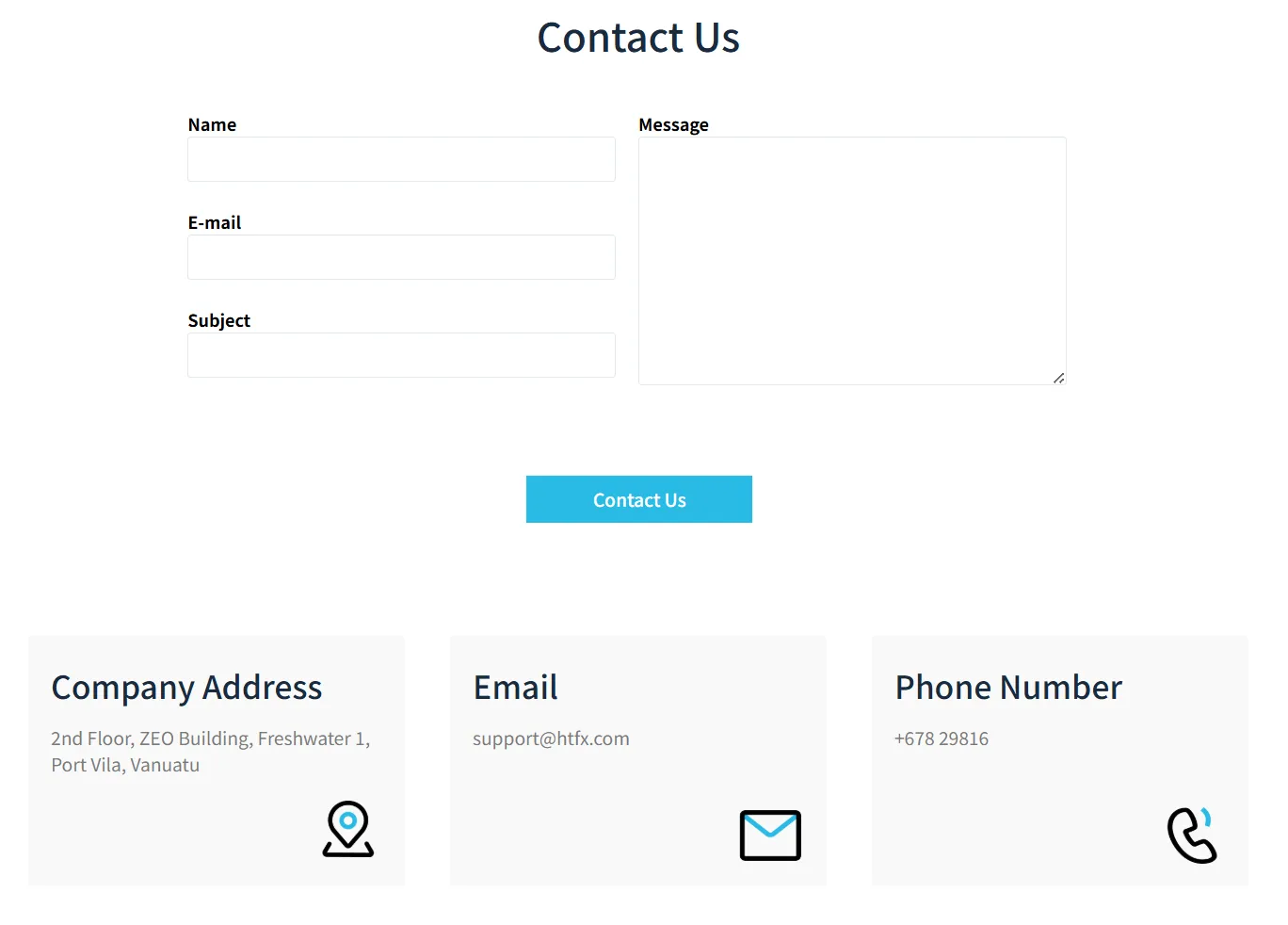

HTFX offers customer support via [email protected] and a form on its official website, with multilingual support available. Its website provides account information, trading instrument descriptions, and basic educational content, providing basic customer guidance.

Currently, investment in educational resources, market research, and investment research reports is still limited, and there is a lack of systematic content updates. Compared with industry leaders, there is still significant room for improvement in its value-added services.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading are characterized by high leverage and volatility, and investors may face the risk of losing all their principal. The HTFX website provides basic risk disclosures to remind users to understand the trading mechanisms and risk characteristics.

Overall, HTFX is positioned as a comprehensive broker with a medium entry barrier and cross-regional compliance, suitable for experienced investors seeking a flexible trading environment and diverse trading opportunities. High leverage is not recommended for inexperienced users.

🔍Comprehensive analysis and evaluation

HTFX has the following main features:

Registered and operating in multiple locations, the regulatory compliance framework has a foundation, but the intensity of supervision varies;

Rich product lines and flexible account types cover different types of users;

The platform technology is mature and the execution is stable, but it lacks differentiated innovation;

Educational services are weak and customer support can be further optimized.

For users with basic trading knowledge and a focus on platform compliance, HTFX is a worthwhile option. Investors are advised to clarify the regulatory information of the entities they use and make informed decisions based on their personal risk tolerance.

Selected Enterprise Evaluation

3.67

Total 9 commentsMy friends who joined also report positive experiences.

Reply

ch***nn

ch***nnA few months back, I fell for what looked like a professional online investment platform. The site looked real, the dashboard was convincing, and I even saw fake profits piling up. But when I tried to withdraw — silence. No replies, no support. I realized too late that I had been scammed. I felt embarrassed and angry with myself. Then I came across Mrs. Nora. She didn’t make fake promises or pressure me. She just explained what could be done and asked for the right details. Within a few days, she had my funds back in my account. I honestly didn’t think recovery was even possible. For anyone feeling stuck or hopeless, please don’t stay silent — there’s a way forward. 📧 brucenora 254(@)gmail. com | 📱 WhatsApp: +1 (8=7=0) 8=1=0-54=42

Reply

Even during flash events, slippage was kept to a minimum.

Reply

Support owns up to problems instead of passing the buck.

Reply

Even on holidays, withdrawals haven’t been delayed for days.

Reply

Having the Chinese interface and support makes it much easier for non-English speakers.

Reply

After years of unsuccessful attempts to recover my missing funds and falling victim to several fraudulent agents, I was beginning to lose hope. Fortunately, I came across Laura Cooper Terms, and although I was initially skeptical due to my past experiences, I decided to give them a chance. That decision changed everything they provided exceptional service and successfully helped me recover my lost funds, even offering valuable additional support. I highly recommend Laura Cooper Terms as a fast, reliable, and trustworthy recovery company. Resoxit 40 at gmail . c o m WhatsApp: +1 (309) 208-5151

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

ch***nn

ch***nnA few months back, I fell for what looked like a professional online investment platform. The site looked real, the dashboard was convincing, and I even saw fake profits piling up. But when I tried to withdraw — silence. No replies, no support. I realized too late that I had been scammed. I felt embarrassed and angry with myself. Then I came across Mrs. Nora. She didn’t make fake promises or pressure me. She just explained what could be done and asked for the right details. Within a few days, she had my funds back in my account. I honestly didn’t think recovery was even possible. For anyone feeling stuck or hopeless, please don’t stay silent — there’s a way forward. 📧 brucenora 254(@)gmail. com | 📱 WhatsApp: +1 (8=7=0) 8=1=0-54=42

Reply

I lost approximately $30,000 after depositing cryptocurrency into an online investment platform that later blocked all withdrawal attempts. The behavior strongly indicates a fraudulent operation. With the assistance of an asset-recovery specialist, I was able to recover the funds. While outcomes vary, seeking support from reputable professionals can be helpful. This incident reinforces the importance of cybersecurity awareness—always conduct thorough due diligence on digital investment platforms, verify credibility, and be wary of platforms that restrict withdrawals or request additional payments. Email:(dorisashley71. (@). gmail. . com) Whatsapp: +1 (404) - 721 - 56 - 08 Stay vigilant and protect your assets.

Reply

~ There's nothing more ~

About HTFX's questions

Ask:Is HTFX regulated by a leading financial regulatory body? Are my funds safe?

Answer:Yes, HTFX operates under multiple registered entities. HTFX Limited in the UK is regulated by the Financial Conduct Authority (FCA) (Regulation No. 801701), while HTFX (EU) Ltd in Cyprus is authorized by the Cyprus Securities and Exchange Commission (CySEC) (License No. 332/17). Additionally, HTFX Limited, registered in St. Vincent, caters to some overseas retail clients, though regulation in that region is relatively weak.

Ask:What types of accounts does HTFX offer? Are they suitable for beginners or professional traders?

Answer:HTFX offers three account types: ECN Account, Standard Account, and Cent Account. The ECN Account is suitable for professional traders, offering spreads as low as 0 pips, but with a commission of $7 per lot and a minimum deposit of $500. The Standard Account is suitable for most traders, offering no commission, spreads starting at approximately 1.5 pips, and a minimum deposit of just $50. The Cent Account is more suitable for beginners or micro-traders, with a low deposit threshold and convenient for practicing small amounts in a simulated live trading environment. All three accounts support trading from as low as 0.01 lots, allow the use of Expert Advisors, and offer leverage up to 1:500. This provides flexibility for both beginners testing the waters and professional traders.

Ask:Is the HTFX trading platform stable? What trading instruments does it support?

Answer:HTFX supports the mainstream MT4 and MT5 trading platforms, compatible with Windows, Mac, iOS, and Android systems, allowing users to choose the right operation method based on their preferences. The MT4/MT5 platforms have a wide market application base and comprehensive functionality, including technical indicators, automated trading EAs, strategy backtesting, and a pending order system, making them suitable for short-term and quantitative traders. According to third-party feedback, HTFX's order execution efficiency and server stability are above the industry average. However, investors should be aware of the risks of high leverage and set appropriate stop-loss orders to limit drawdowns.