Normal Operation

Normal OperationPepperstone

10-15Year

Basic Information

Country

AustraliaMarket Type

foreign exchangeEnterprise Type

BrokerageService

We offer commodities like metals (such as gold and silver), oil and gas, and a wide range of major stock indices.Support Languages

Chinese, EnglishDomain Registration Date

2016-06-29Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

Pepperstone is a global foreign exchange (forex) and Contracts for Difference (CFD) trading service provider established in 2010 and registered in New Providence, Bahamas. As a broker serving investors worldwide, Pepperstone specializes in providing professional and efficient trading services across forex, commodities, stock indices, and stock CFDs.

Pepperstone is committed to providing a superior trading experience for both retail and institutional traders through tight spreads, fast execution, deep liquidity, and advanced trading platforms. Currently, Pepperstone holds multiple international financial regulatory licenses and continuously improves client trading efficiency through technological innovation, making it a highly regarded and active player in the industry.

🌐 Global layout and brand background

Pepperstone's operating entity is Pepperstone Markets Limited, registered number 177174B. According to Whois information, its official website, pepperstone.org, was registered in 2022. The website features a simple and modern design, highlighting information such as quick account opening, trading platform selection, and regulatory safeguards, helping to enhance user trust.

Pepperstone holds trading licenses from regulators including the Australian ASIC, the UK FCA, Cyprus CySEC, Dubai DFSA, Germany's BaFin, the Bahamas SCB, and Kenya's CMA, demonstrating strong multi-regional compliance capabilities. With branches in several major foreign exchange markets, Pepperstone serves clients across Asia Pacific, Europe, Africa, and the Middle East.

As a brand, JetStone takes "institutional-level liquidity + retail-friendly experience" as its core selling point, taking into account the needs of both novices and high-frequency traders, and has a good market reputation and technical scalability.

💹 Trading Products and Services

Pepperstone offers a comprehensive range of trading products, including commodities such as foreign exchange, gold, silver, crude oil, and natural gas, CFDs on major global stock indices (such as the S&P 500, DAX, and FTSE), and CFDs on Australian and US stocks.

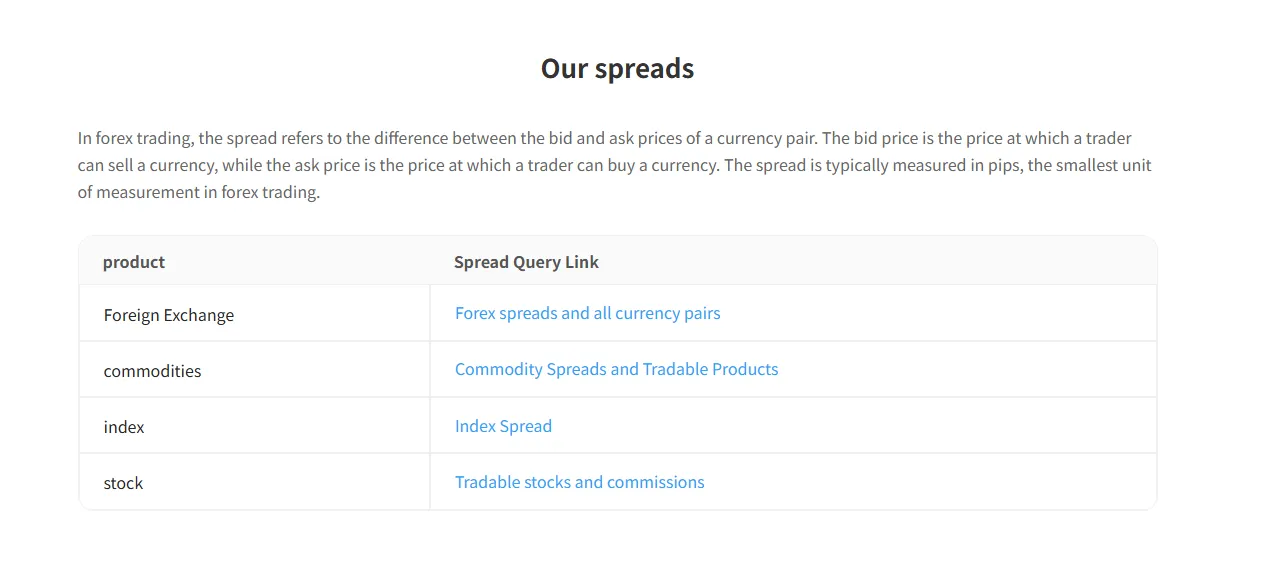

Foreign exchange trading is its core business. The platform supports a wide range of major and minor currency pairs with spreads starting from 0.0 pips, making it suitable for high-frequency and algorithmic traders. Commodity and stock index trading emphasizes low transaction costs and fast execution, with most products being commission-free. Furthermore, participating in US blue-chip stocks or Australian stocks through CFDs offers investors diverse investment opportunities.

Overall, Pepperstone's product layout is more inclined towards CFD trading of mainstream assets, which is suitable for professional users who pursue efficiency and liquidity.

💻 Trading technology and platform experience

In terms of platform support, Pepperstone provides four mainstream trading platforms: TradingView, MetaTrader 4, MetaTrader 5 and cTrader, to meet the needs of users with different trading styles.

MT4 and MT5 are popular among forex traders, suitable for both manual trading and automated EA strategies. cTrader offers advanced order management tools and a streamlined interface, suitable for professional traders. TradingView focuses on chart analysis and social interaction. Pepperstone offers low-latency execution, high-speed matching, and stable server support through these platforms, enhancing trading consistency and security.

According to user feedback and third-party reviews, the execution speed and smoothness of the Jishi platform are at an upper-middle level in the industry, making it one of the popular choices for quantitative traders and short-term traders.

🛡️ Regulatory compliance and fund security

Pepperstone holds licenses from leading financial regulators in multiple jurisdictions worldwide, including the Australian Securities and Investments Commission (ASIC), the UK Financial Conduct Authority (FCA, registration number 927552), the Cyprus Securities and Exchange Commission (CySEC), the Dubai Financial Services Authority (DFSA, registration number F004356), the Securities Commission of the Bahamas (SCB), Germany's Federal Financial Supervisory Authority (BaFin), and the Capital Markets Authority (CMA) of Kenya. This multi-regulatory framework provides strong compliance assurance for Pepperstone's global operations and further strengthens investor confidence in the transparency and legality of the platform's operations.

In terms of fund management, Pepperstone strictly implements a client fund segregation system, ensuring that client assets are independent of the company's operating funds and protected by the applicable legal and regulatory framework. This ensures maximum security for client funds even in the event of operational issues. According to third-party rating platforms such as BrokerHiver, Pepperstone's overall risk rating is low to medium, due to its multi-regional licensing and stable operating history, making it one of the more trustworthy brokers.

However, it's important to emphasize that forex and CFD trading are inherently highly leveraged financial products, potentially exposing investors to the risk of losses exceeding their initial investment. Before participating in these products, investors should fully understand the trading mechanisms and potential risks, and make informed decisions based on their own financial circumstances and risk tolerance.

⚡ Trading conditions and experience

Pepperstone offers a variety of flexible account types and trading conditions, including the Razor account (with spreads starting from 0.0, suitable for high-frequency and quantitative trading) and the Standard account (with no commission, suitable for beginners).

In terms of leverage, the Pepperstone platform supports up to 1:500 leverage, aligning with regional regulations to meet the strategic needs of advanced traders. Its order matching technology utilizes a No Dealing Desk (NDD) model, offering high execution efficiency and minimal slippage.

The official website of Pepperstone supports Chinese services. The account opening process is clear and simple. Users can quickly register an account, select a platform and complete the deposit operation. The overall trading experience is user-friendly and is especially suitable for beginners and intermediate traders who want to enter the market quickly.

🎓 Customer Support and Value-Added Services

Pepperstone offers 24/5 multilingual customer service via phone, email, and live chat. Chinese support is also comprehensive, and investors can contact the customer service team at [email protected] or by calling +613 9020 0155.

In addition, the platform offers a wealth of market research reports, video tutorials, and online training courses to help users improve their trading skills and market understanding. The TradingView community feature encourages interaction and strategy sharing among users, making it suitable for self-motivated traders who are willing to learn in depth.

In terms of customer education, although Pepperstone is not a social trading platform, its basic research and content support still maintain a high level.

⚠️ Risk Warning and Platform Positioning

As a globally compliant broker with an extensive presence, Pepperstone targets professional traders who prioritize execution quality, high liquidity, and low costs. Its low spreads, high leverage, and diverse platform options make it ideal for users seeking active trading through CFDs.

However, all products offered on the Pepperstone platform are over-the-counter (OTC) products, which carry the risk of losing principal or even exceeding the initial investment. Investors should fully understand leverage mechanisms, stop-loss logic, and fund management methods before trading, and seek professional advice if necessary.

🔍 Comprehensive analysis and evaluation

In summary, Pepperstone possesses the following core competitive advantages:

Strong regulatory compliance system in multiple regions and isolated management of customer funds;

The platform is technologically rich and supports MT4/MT5/cTrader/TradingView;

Low spreads and fast execution, suitable for short-term and algorithmic traders;

The product line is mainstream, covering foreign exchange, commodities, stock indices and stock CFDs;

Customer service and educational resources are stable and suitable for independent investors.

It is suitable for intermediate and advanced traders to trade CFDs on diversified assets in a stable and compliant environment. It is especially suitable for professional users who have high requirements for execution efficiency and technical environment.

Selected Enterprise Evaluation

4.21

Total 7 commentsThe UI is simple but functional; editing stop-loss levels is a breeze.

Reply

be***h2

be***h2I lost a substantial amount of money to a scammer after investing and being promised high returns. Once I tried to withdraw my profits, my account was suddenly frozen. I battled with the scammer, but nothing worked.Just when I had almost given up, I came across Mr. Nora, a recovery expert. I shared my experience with her, and to my surprise, in just about 52 hours, she successfully recovered my money in full. If you've been a victim of a similar scam, I strongly recommend getting in touch:Email: brucenora 254 @)gmail. com Phone: + 1 870-810-5442 Help is out there—don’t lose hope.

Reply

No hidden fees on deposits or withdrawals—pretty honest.

Reply

Even detailed inquiries get a clear, step-by-step response.

Reply

Stop-loss and take-profit orders trigger exactly where set.

Reply

Licensed and regulated—knowing that is priceless.

Reply

be***h2

be***h2I lost a substantial amount of money to a scammer after investing and being promised high returns. Once I tried to withdraw my profits, my account was suddenly frozen. I battled with the scammer, but nothing worked.Just when I had almost given up, I came across Mr. Nora, a recovery expert. I shared my experience with her, and to my surprise, in just about 52 hours, she successfully recovered my money in full. If you've been a victim of a similar scam, I strongly recommend getting in touch:Email: brucenora 254 @)gmail. com Phone: + 1 870-810-5442 Help is out there—don’t lose hope.

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

~ There's nothing more ~

About Pepperstone's questions

Ask:Is Pepperstone regulated by a reputable regulator? Are my funds safe?

Answer:Yes, Pepperstone holds valid financial regulatory licenses in multiple regions around the world, including from internationally recognized authorities such as the Australian ASIC, the UK FCA, Cyprus CySEC, the Dubai DFSA, Germany's BaFin, Kenya's CMA, and the Bahamas' SCB. These regulations require the company to strictly implement a client funds segregation and custody system, ensuring that client funds are separate from the company's operating funds, effectively enhancing asset security. Investors can rest assured that they are trading within a compliant framework.

Ask:What are the main trading products offered by Pepperstone? Is it suitable for beginners?

Answer:Pepperstone offers a diverse range of trading products, including forex, commodities (such as gold and crude oil), global stock index CFDs, and Australian and US stock CFDs. For beginners, the platform offers a Standard account and a Razor account with lower spreads. The platform also provides extensive educational resources, a demo account, and Chinese-speaking customer support, helping beginners get started and gradually build trading experience.

Ask:What trading platforms can I use? Does Pepperstone's trading technology offer advantages?

Answer:Pepperstone supports major trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView, covering a wide range of needs, from manual trading to automated quantitative trading. The platform offers fast execution, low spreads, and excellent slippage control, making it particularly suitable for high-frequency and algorithmic traders. Users can freely choose from a selection of user interfaces, offering a simple yet comprehensive interface and a well-regarded trading experience.