Suspected of fraud

Suspected of fraudInefex

2-5Year

Basic Information

Country

MauritiusMarket Type

foreign exchangeEnterprise Type

BrokerageService

Forex CFD Cryptocurrency Commodities StocksSupport Languages

English (English) French (Français) Spanish (Español) German (Deutsch) Italian (Italiano) Portuguese (Português) Russian (Русский) Arabic (العربية) Japanese (日本語) Traditional Chinese (繁體中文) Korean (한국어) Thai (ไทย) Malay (Melayu) Turkish (Türkçe) Hindi (हिन्दी)Domain Registration Date

2020-01-20Business Status

Suspected of fraudCompany IntroductionWeb Analytics

Company Introduction

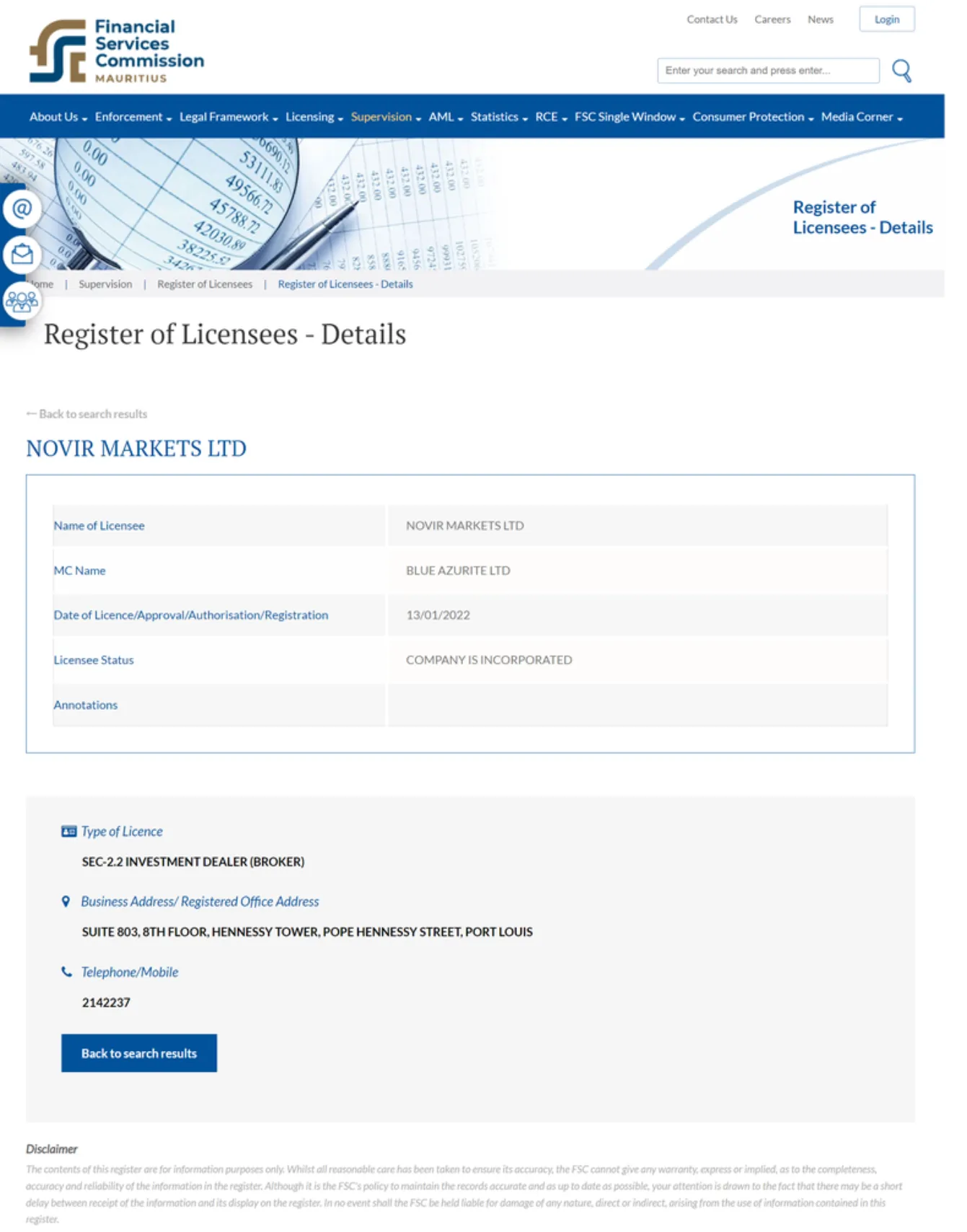

Inefex is a foreign exchange and contract for difference (CFD) trading platform registered in Mauritius, claiming to provide a variety of financial derivatives trading services such as foreign exchange, cryptocurrency, stocks, commodities and indices. According to the official website, its corporate entity is Novir Markets Ltd, with registration number 184916, and claims to hold a license issued by the Mauritius Financial Services Commission (FSC) (GB21026833).

However, although Inefex has displayed seemingly compliant registration information, the specific operating address of its headquarters is not clear, and its actual regulatory status is difficult to verify, which shows a lack of transparency. For investors, the authenticity of the platform's background and the security of funds still need to be vigilant.

🌐Global layout and brand background

Inefex's official website claims that its services are global, but it clearly does not provide services to the European Economic Area, the United States, British Columbia, and some other jurisdictions. Such a vague compliance scope often means that its actual license may not meet the regulatory requirements of most major markets, relying only on offshore regulatory endorsements such as Mauritius, and lacking higher-level international compliance standards.

From a brand perspective, Inefex was established relatively recently. Although the domain name was registered in 2020, the platform's actual business only began in 2022, and it has not yet accumulated long-term credibility in the foreign exchange industry. External data tools show that its official website traffic is extremely low, and market awareness and active user groups are relatively limited.

💹Trading products and services

Inefex offers four account types: Basic, Gold, Platinum and VIP. The initial deposit threshold ranges from 250 euros to 250,000 euros, the maximum leverage is 1:500, and the spread structure is floating and relatively high. However, this type of high-leverage, high-threshold account design often amplifies trading risks and is similar to typical high-risk platform strategies.

In addition, Inefex does not support the industry-standard MetaTrader 4/5 platform, but uses a self-developed platform that lacks the transparency and extensive verification of third-party platforms. The actual market connection for transaction execution cannot be confirmed, and investors cannot determine whether the order actually enters the external liquidity market.

💻Trading technology and platform experience

Regular brokers usually provide mature MT4 or MT5 trading environments, and have stable servers and real liquidity sources. However, Inefex only provides a self-developed trading platform, lacks independent third-party certification and usage evaluation, and it is difficult for investors to confirm the stability and fairness of the trading environment.

Some external surveys have reported that the platform is simple in functionality and cannot meet the in-depth needs of professional traders. It also lacks automated trading, plug-in extensions, and transparent order execution reports, which to some extent increases the risk of price manipulation and back-end intervention.

🛡️Regulatory compliance and fund security

Inefex claims on its official website that its regulatory body is the Mauritius FSC. However, as an offshore regulatory region, Mauritius has relatively loose regulatory intensity and investor protection mechanisms, which cannot be compared with high-standard regulatory agencies such as the UK FCA and Australia ASIC.

As for fund security, once the offshore regulatory platform encounters difficulties in cash withdrawal or stops operating, it is difficult for investors to recover funds through legal means. At the same time, Inefex lacks a clear statement of segregated custody of customer funds, which means that investor funds may be mixed with the platform's own funds, which poses an extremely high risk.

⚡Trading conditions and experience

The account spreads provided by Inefex are relatively high, and at the same time, it requires high initial deposits for high net worth clients. VIP accounts even require a deposit of 250,000 euros. This type of design is usually difficult for ordinary investors to accept.

In addition, although the platform supports deposits and withdrawals by credit card, e-wallet and bank wire transfer, there are no large number of real successful withdrawal cases found in external channels. Some investors have reported that the withdrawal process is lengthy or even impossible to complete, and the potential risks to fund security deserve attention.

🎓Customer support and value-added services

Inefex's educational resources are relatively simple, almost only staying at the basic account opening and platform operation guidance. It lacks in-depth market analysis or trading strategy training content, and cannot provide investors with professional knowledge support.

Although its official website displays some contact information and social media channels, the activity level is extremely low and no real social media interaction records are found, further showing that its operational activity and customer service level are questionable.

⚠️Risk warning and platform positioning

Comprehensive analysis shows that Inefex has the following obvious risk characteristics:

The regulatory license is an offshore FSC, which has limited protection and is difficult to protect the rights and interests of investors

Short actual operation history, low market awareness, and insufficient brand accumulation

Using a self-developed trading platform, lacks third-party verification and real market depth connection

High leverage and high deposit threshold design amplify financial risks

The authenticity of cash withdrawal lacks independent user verification, and the security of fund flow is questionable

From the perspective of positioning, Inefex is more like a high-risk platform that relies on low-cost offshore regulatory endorsement and is unable to provide investors with long-term and stable trading protection.

🔍Comprehensive analysis and evaluation

Although Inefex claims to have offshore regulatory qualifications, it still has high potential risks in terms of platform transparency, user base, fund protection mechanism and trading environment. For investors who are sensitive to fund security and focus on long-term stability, Inefex is not a trustworthy choice.

Investors are advised to weigh the offshore regulatory risks and fund security risks before considering opening an account, so as to avoid unnecessary losses caused by high leverage and opaque trading environment.

Selected Enterprise Evaluation

3.60

Total 5 commentsAfter being scammed by a platform that blocked all withdrawals, I had almost given up hope. Then I found Mrs. Nora. She guided me step by step, and within 72 hours, every cent was back in my account. Fast, reliable, and trustworthy—she’s the real deal. 📧 Email: bruce.nora254@gmail. com | 📱 WhatsApp: +1 (8 7 0) 810 54 42

Reply

After being scammed by a platform that blocked all withdrawals, I had almost given up hope. Then I found Mrs. Nora. She guided me step by step, and within 72 hours, every cent was back in my account. Fast, reliable, and trustworthy—she’s the real deal. 📧 Email: bruce.nora254@gmail. com | 📱 WhatsApp: +1 (8 7 0) 810 54 42

Reply

INEFEX brokers are scam platform they allow you deposit money and trade but in the end you will be denied access to make withdrawals on the trading platform. I made my legal claim with the help of gavinray78 at gmail .com , who help me recover my money from this platform. I Highly recommend reaching out to him

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

I had difficulty withdrawing funds after trading and felt stuck at first. (alg @ nordevamber. com, +1 334 679 5376) support team provided clear instructions, answered my questions patiently, and helped me complete the withdrawal successfully. The whole process was handled professionally and I appreciated the transparency. This would be helpful for anyone who needs guidance with similar problems.

Reply

~ There's nothing more ~

About Inefex's questions

Ask:Is Inefex's Mauritius FSC regulatory license reliable and can it guarantee the safety of investors' funds?

Answer:Although Inefex claims to hold a license from the Mauritius Financial Services Commission (FSC), Mauritius is an offshore regulatory jurisdiction with looser regulatory standards and its investor protection mechanism is far inferior to high-standard regulations such as the UK FCA or Australia ASIC. Offshore licenses are more of a formal filing and cannot provide strong fund isolation or rights protection channels. Once the platform encounters withdrawal difficulties or stops operating, it is difficult for investors to recover their funds. Therefore, from the perspective of fund security, relying on offshore regulatory platforms is extremely risky.

Ask:Is the self-developed trading platform used by Inefex reliable? Do the orders actually enter the real market?

Answer:Unlike MetaTrader 4/5, which are widely used in the industry, Inefex only provides a self-developed trading platform, lacks independent verification by a third party, and has no public order execution report or proof of real market depth connection. External feedback shows that the platform has simple functions and does not support automated trading. It lacks transparency and has the risk of back-end manipulation of prices and spreads. Investors cannot confirm whether orders have entered the external market, and the fairness of transactions is questionable.

Ask:Is Inefex's withdrawal process smooth? Are there any successful withdrawal cases?

Answer:Inefex claims to support deposits and withdrawals via credit cards, e-wallets, and bank wire transfers, but external channels have not yet found a large number of real successful withdrawal cases, and some users have reported that the withdrawal process is complicated or even impossible to complete. In the absence of fund isolation and authoritative third-party custody, once withdrawals are blocked, it is extremely difficult for investors to protect their rights, and there are obvious risks to fund security.