BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX

Time: 5-10Year

| Company

Company Regulatory

Regulatory Risk Monitor

Risk Monitor Software Download

Software Download Documents

Documents~ No data ~

RoboMarkets Ltd claims to have been established in 2012 and is headquartered in Cyprus. It claims to be a European brokerage firm that provides multi-asset trading to global clients and emphasizes that it has "cutting-edge financial technology" and "EU regulatory licenses." However, after comparing multiple information and investigating external channels, it was found that there were significant differences between its promotional content and actual verifiable evidence.

Although the platform lists a variety of trading products such as foreign exchange, stocks, indices, commodities, energy and cryptocurrencies, it does not clearly disclose core conditions such as transaction details, actual spreads, and margin requirements on its official website. In addition, the official website information is lengthy but lacks focus, and is more of a marketing slogan, making it difficult for investors to confirm the platform's true operating model and service capabilities.

RoboMarkets Ltd advertises itself as being located in the Cyprus financial center and claims to comply with EU regulatory standards. However, after verification through public channels, its regulatory information and actual license scope are unclear, and it is impossible to confirm whether its specific CySEC-regulated business scope covers all the financial services it claims to have.

In addition, the platform describes "innovative technology" and "multi-national service capabilities" in great detail on its official website, but does not provide substantive company background information, shareholder structure or operating team information. Although the domain name robomarkets.com.cy has a certain history of registration, the actual ownership and management entity behind it lack transparency, and no matching records have been found in other major EU regulatory databases, so the brand's credibility is questionable.

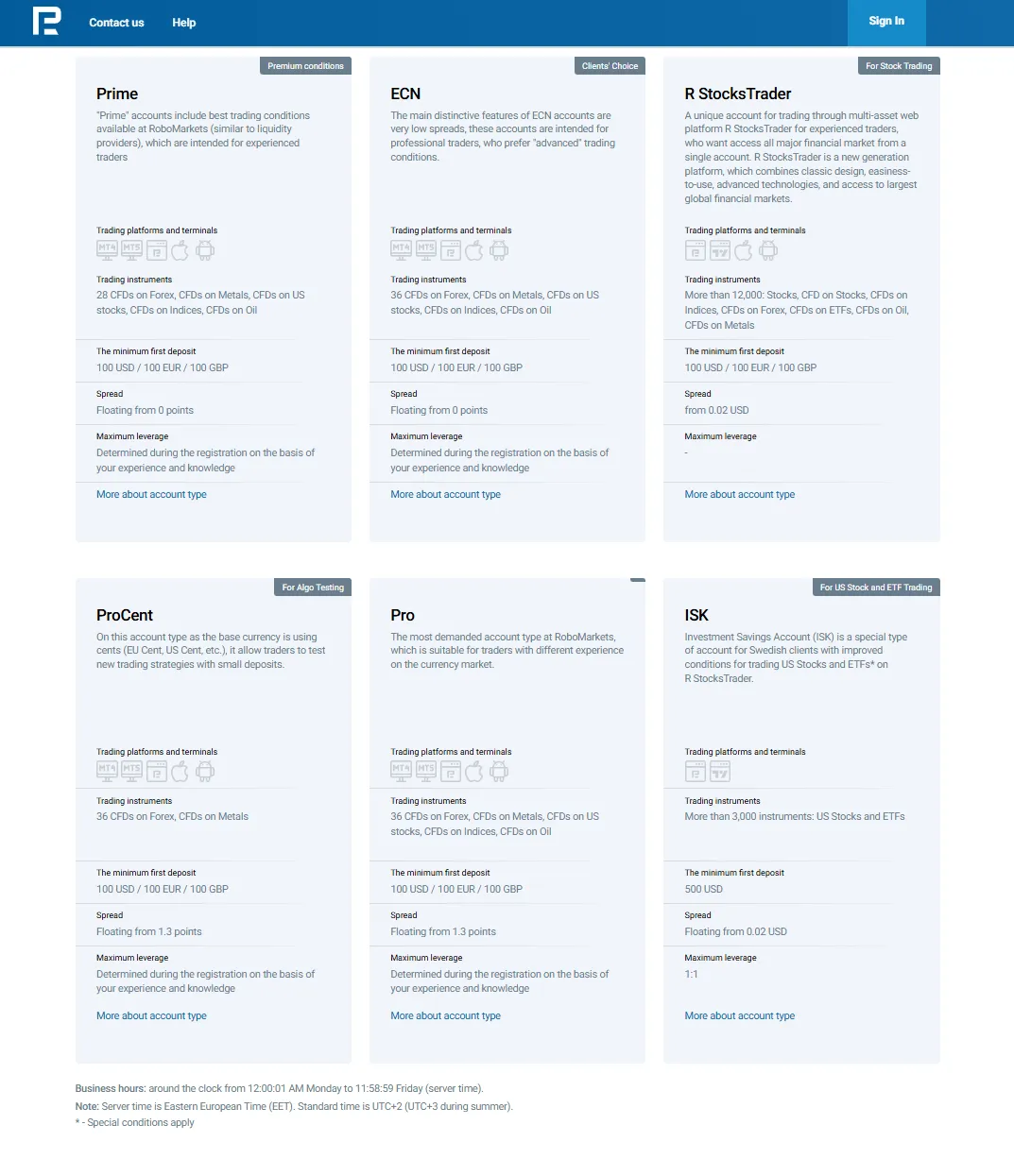

RoboMarkets Ltd claims to support more than 12,000 trading products, including foreign exchange, indices, stock CFDs, energy, metals and cryptocurrencies, but the official website lacks specific transaction execution details and clear risk disclosure. For example:

Failure to clearly disclose transaction costs and leverage limits for different account types

Lack of complete product risk classification and historical transaction execution data

Its so-called "AI-driven trading suggestions" have no third-party verification and are questionable in terms of authenticity

Compared with compliant and transparent licensed platforms, RoboMarkets Ltd is more like attracting novice users with broad product descriptions, but the actual feasibility and service stability are difficult to verify.

The official website advertises support for MetaTrader 4, MetaTrader 5 and cTrader platforms, and provides "automated trading scripts" and "real-time market analysis". However, external user feedback shows that the speed of transaction execution and the volatility of spreads are relatively common, and the trading conditions between customer accounts are inconsistent and lack unified standards.

In addition, RoboMarkets Ltd does not disclose the server locations and actual technical architecture, which raises questions about whether users can get timely technical support in the event of a system failure. For professional traders who require a highly stable environment, this lack of technical transparency may bring additional risks.

Although RoboMarkets Ltd claims to hold a Cyprus CySEC license, its official website does not disclose its complete regulatory number and cross-border business coverage, making it difficult for investors to confirm whether its international business is legally authorized in other jurisdictions.

Unclear regulation means:

The segregated custody of customer funds cannot be confirmed

If a financial dispute occurs, legal recourse may be limited to Cyprus, and it will be extremely difficult for investors in other regions to protect their rights.

The platform claims to be compliant with EU standards but does not display any independent audits or compliance reports

In the absence of authoritative endorsement, the security and legality of funds remain questionable.

RoboMarkets Ltd’s official website does not clearly list all transaction fees, account types, spread models and other potential costs in a prominent position. Users need to contact customer service to understand some of the fee details. Although the official claims that “no hidden fees” are charged, in the absence of a complete fee list and third-party supervision, it is still impossible to rule out the existence of additional costs.

Especially for cryptocurrencies and high-leverage products, the official website does not clearly disclose key risk parameters such as real slippage and liquidation mechanism. Investors may suffer unexpected account losses during the transaction process.

RoboMarkets Ltd provides telephone, email and online customer service channels, which seem to have relatively complete contact methods. However, external evaluations show that the customer service response efficiency and problem-solving capabilities vary. When it comes to sensitive issues such as account withdrawals and abnormal transactions, users often need to communicate multiple times or even wait for a long time.

In addition, although the platform provides basic educational materials and market analysis, it lacks in-depth compliance education or independent analysis tools. Compared with compliance platforms that truly value the long-term development of users, its value-added services are more like marketing assistance rather than professional support.

Brand and regulatory information are questionable: it is impossible to verify its cross-border compliance scope and true regulatory strength

Trading conditions are not transparent: fees, spreads, and leverage rules are not fully disclosed

Fund security cannot be guaranteed: there is no independent third-party audit or fund isolation certificate

Unstable customer support experience: Inefficient handling of sensitive issues

Although RoboMarkets Ltd is packaged as a "European licensed financial services provider", it has obvious risk characteristics in terms of transparency, compliance and external user feedback, and investors should remain highly vigilant.

From the perspective of externally verifiable information, platform transparency, and user protection:

Regulatory compliance is limited and questionable

The trading environment and fee conditions are not transparent enough

Lack of consistency in technical and customer support

Fund security cannot be effectively guaranteed

RoboMarkets Ltd has a high risk attribute. Although it claims to be regulated, it lacks clear compliance and fund protection mechanisms. Investors are advised to carefully evaluate and give priority to formal platforms with clear regulatory backgrounds and transparent information.

Answer:There are obvious doubts about its regulatory compliance. The platform claims to be regulated by CySEC in Cyprus, but the official website does not disclose the complete regulatory number and cross-border authorization scope, and it is difficult to find corresponding records in other major EU regulatory databases. This means that its so-called "EU regulation" may be limited to some businesses, and it cannot ensure that all externally advertised trading services are within the regulatory scope, making it extremely difficult for cross-border users to protect their rights.

Answer:Fund security is not guaranteed, and the risk of withdrawal is high. The platform has not published a clear fund isolation custodian bank or independent audit report, and it is impossible to confirm whether customer funds are separated from the company's operating account. External users have reported that the withdrawal cycle is long and customer service is slow. If an account dispute or technical failure occurs, the scope of legal recourse may be limited to Cyprus, and it is difficult for investors in other regions to obtain actual compensation.

Answer:Regulatory information is not transparent → The scope of regulatory licenses is vague, and it is impossible to confirm the real authorized business; Trading conditions lack details → Leverage, spread, and margin rules are not fully disclosed, and hidden costs are difficult to eliminate; Technical and customer service support is unstable → Poor response efficiency when encountering abnormal transactions or withdrawal problems; There is no third-party endorsement for fund security → Lack of independent audit and segregated account proof. Compared with the old platforms that are truly strictly regulated by FCA, ASIC, etc., RoboMarkets Ltd lacks clear fund protection and transparency, and has a greater risk exposure.