BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX

Time: 10+Year

| Company

Company Regulatory

Regulatory Risk Monitor

Risk Monitor Download

Download Documents

Documents~ No data ~

Equiti is an international forex and contracts for difference (CFD) broker established in the Seychelles, providing online trading services for a wide range of assets, including forex, commodities, stocks, indices, and ETFs, to investors worldwide. Its core business focuses on building an efficient and secure financial trading environment for both retail and institutional clients.

Equiti is part of the Equiti Group, which operates and holds relevant financial regulatory licenses in multiple countries and regions, covering core markets such as the Middle East, Europe, Africa, and Asia Pacific. As a globally oriented broker, Equiti not only offers services in multiple languages (including English, Spanish, Arabic, Thai, Portuguese, and Filipino), but also strives to provide a localized customer support experience.

Its brand concept focuses on technology-driven and compliance-based guarantees, and it uses advanced trading platforms, institutional-level liquidity and high leverage policies to build transparent and efficient trading channels for all types of investors.

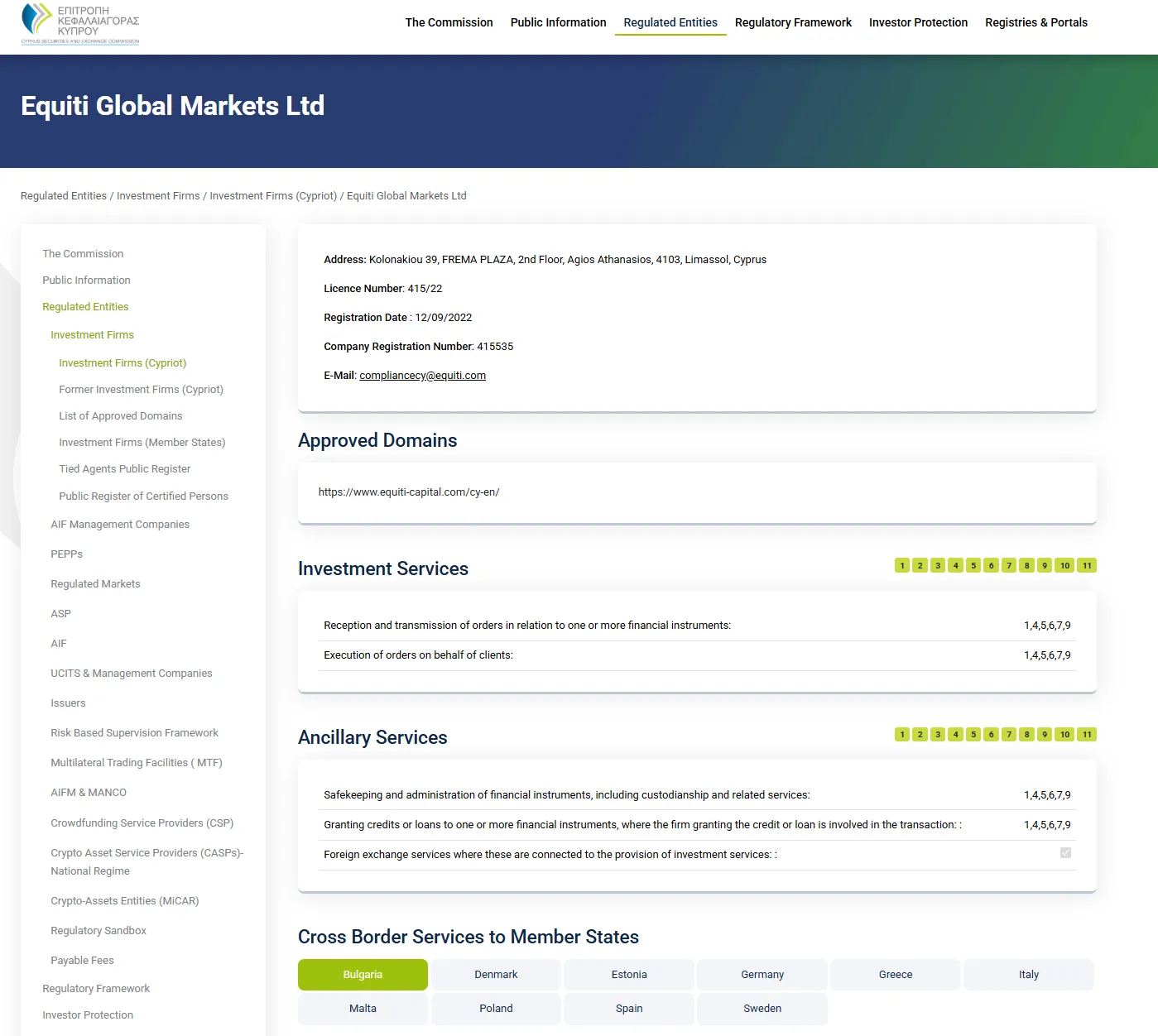

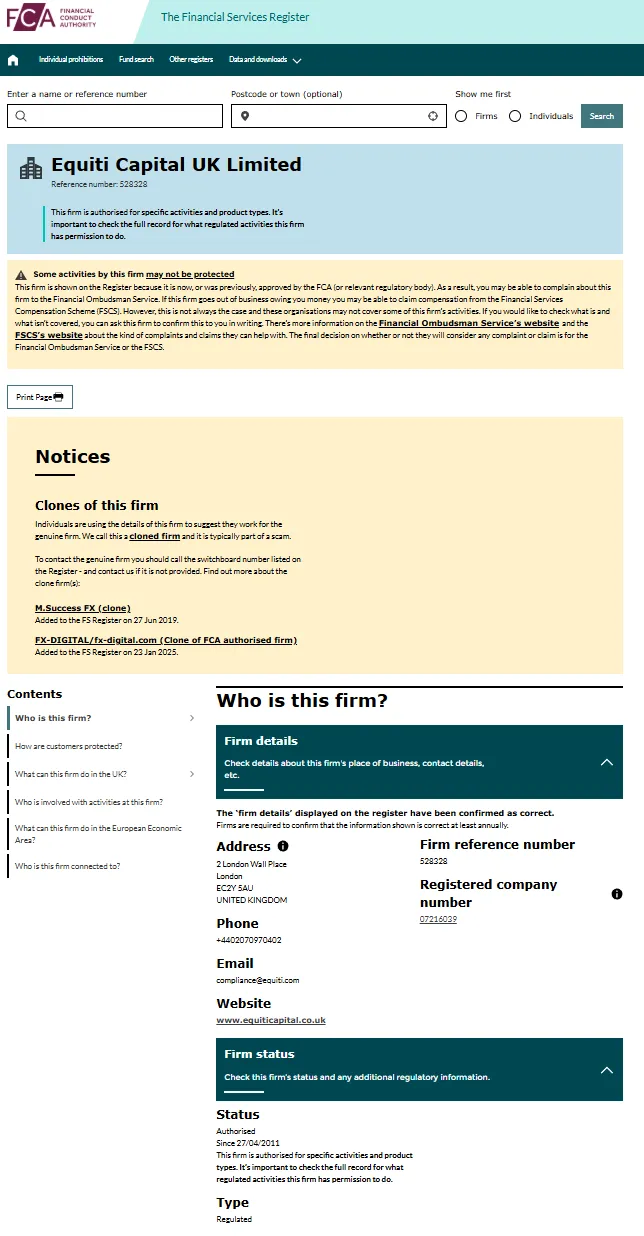

Equiti has registered entities and regulatory approvals in numerous countries around the world, including the UK (FCA), Jordan (JSC), Seychelles (FSA), the UAE (SCA), and Cyprus (CySEC). Its operating entities include Equiti Capital UK Limited, Equiti Securities Currencies Brokers LLC, and Equiti Brokerage Ltd.

This multi-regional compliance deployment not only enhances its global service capabilities but also demonstrates the company's legal qualifications and stable operational capabilities across jurisdictions. A Whois domain name query indicates that Equiti's official website domain has been registered since 2004 and has a long history of stable operation, providing fundamental trust for investors.

In terms of brand development, Equiti emphasizes institutional cooperation and technology platform construction. It has provided liquidity and transaction solution support for many large financial projects in the Middle East, and gradually built up brand influence in the global market.

Equiti offers trading products across major financial categories, including forex, metals, energy, commodities, global stocks, indices, and ETFs. Through its MT5 platform, users can access hundreds of tradable assets, suitable for a variety of strategies such as day trading, trend following, and asset allocation.

Some account types support leverage up to 1:2000 (depending on region), providing greater flexibility for high-frequency traders and those starting with smaller amounts. Equiti's website also displays trading hours and swap information for different products, helping users optimize their trading plans.

However, compared to some other brokers, Equiti does not fully disclose detailed parameters such as commissions, spreads, minimum order sizes, etc. for various asset classes on its official website, which may be unfavorable for investors who are first evaluating their cost structure.

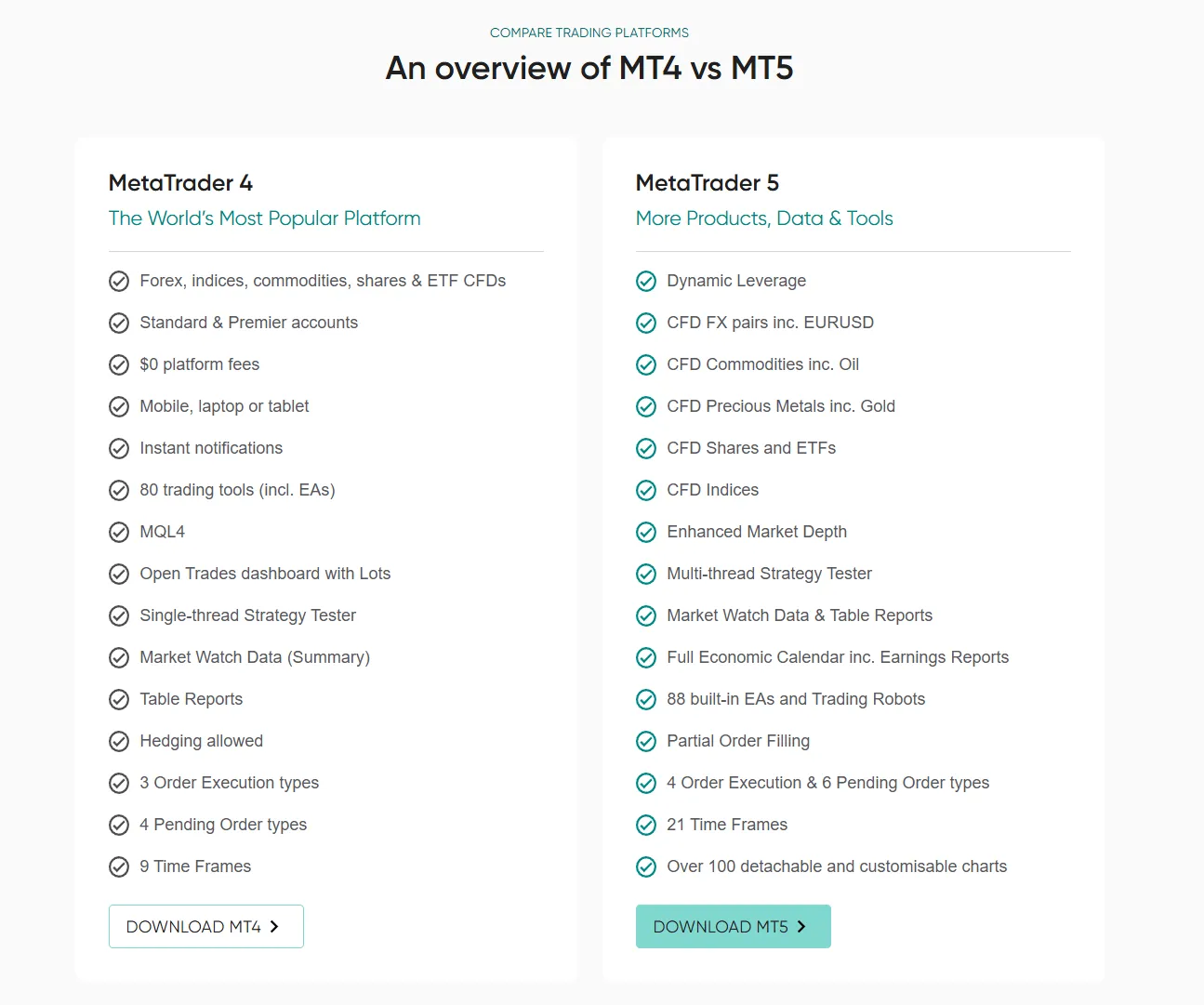

Equiti supports the MetaTrader 5 (MT5) platform, offering desktop, web, and mobile apps for major operating systems including Windows, macOS, Android, and iOS. Its servers are strategically distributed, with data access nodes in multiple regions around the world, ensuring stable order execution.

The MT5 platform supports a variety of order types, automated trading (EAs), technical analysis indicators, and charting tools, making it suitable for both day traders and programmatic traders. However, it's worth noting that downloading the Android platform may be difficult in some countries or regions, requiring users to use alternative methods to obtain the installation package.

In addition, Equiti does not provide a public registration channel for demo accounts, which may limit the initial testing experience of entry-level users.

The Equiti Group is regulated in multiple countries, including the UK's Financial Conduct Authority (FCA), the Jordan Securities Commission (JSC), the Seychelles Financial Services Authority (FSA), the UAE Securities and Commodities Authority (SCA), and the Cyprus Securities and Exchange Commission (CySEC). Within these regulatory frameworks, Equiti strictly enforces client fund segregation to ensure that client assets are not diverted for operational purposes. In certain jurisdictions, such as the UK, Equiti Capital UK Limited offers additional compensation protection, such as the FSCS program, to further enhance client fund security. However, investors should be aware that while Equiti has previously disclosed regulatory information for some of its subsidiaries under the Central Bank of Armenia (CBoA), this cannot be independently verified through authoritative channels. Clients are advised to prioritize account registration and trading operations in jurisdictions with clear and transparent regulations to mitigate potential compliance risks.

Equiti's website states that its maximum leverage can reach 1:2000 (depending on account type and region), making it attractive to clients with smaller capital. Supported deposit methods include credit cards (Visa, Mastercard), bank transfers, wire transfers, and e-wallets (such as Skrill and Neteller). It also offers a variety of deposit and withdrawal methods, supporting multiple currencies.

The official website also clearly displays the currencies supported, transaction fees, and arrival time of different payment channels, which is an advantage for users who pursue efficient fund management.

However, its official website does not provide a detailed description of the various account types, nor does it disclose the standard structure of spreads and execution costs, which is somewhat insufficient for users who compare prices and strategy adaptation.

Equiti offers multilingual website support, online customer service, and a FAQ document. Its educational content covers market terminology, trading strategy guidance, risk management techniques, and fundamental analysis, making it suitable for users of all levels.

Furthermore, its official website regularly updates market news and analysis, providing investors with external data references. However, Equiti currently lacks a clear focus on community building and social features, failing to incorporate interactive learning and strategy sharing mechanisms like some emerging platforms.

While Equiti offers high leverage and diversified asset services, it is still a CFD and leveraged trading platform, which carries high risks. Clear risk disclosures are included on its official website and registration page, reminding investors to fully understand the trading mechanisms and assess their risk tolerance.

In terms of platform positioning, Equiti is suitable for intermediate and advanced traders and clients with cross-border trading needs, especially those who value multilingual support and multi-regional regulatory backgrounds. However, for those seeking ultra-low spreads or innovative asset trading (such as DeFi and physical cryptocurrencies), the platform's functionality may still seem traditional.

Overall, Equiti is a global broker with strong compliance and a long history of operation. Its advantages are:

Multi-national regulatory background to enhance fund security;

Supports MT5 platform and high leverage configuration, with high technical flexibility;

It offers a variety of trading products and multilingual support, suitable for an international user base.

However, the platform still has room for improvement in terms of transparency (such as spread structure and account type descriptions), making it less user-friendly for novice users. Furthermore, participation in emerging trends such as user communities and social trading is low.

In summary, Equiti is more suitable for investors with some experience who prefer traditional trading platforms and high leverage. If you're concerned about transaction security and a globally compliant platform, Equiti is a worthwhile option.

Answer:Yes, Equiti has obtained legal financial regulatory licenses in multiple countries and regions, including the UK FCA, Seychelles FSA, Jordan JSC, UAE SCA, and Cyprus CySEC. The company implements a client fund segregation system to ensure that client funds are not commingled with the company's operating funds. Some subsidiaries, such as Equiti Capital UK Limited, also offer FSCS compensation protection. Overall, its regulatory coverage is extensive and its fund security mechanisms are relatively comprehensive.

Answer:Equiti offers investors CFD trading across a wide range of asset classes, including forex, commodities, stocks, indices, and ETFs, all accessible via the MT5 platform. Its product line is suitable for all types of traders, particularly those seeking to diversify their asset allocation across global markets. However, Equiti currently does not disclose specific trading spreads or account types on its official website. Users are advised to contact customer service to confirm compatibility before opening an account.

Answer:Equiti supports a variety of convenient deposit and withdrawal methods, including credit cards (Visa/Mastercard), bank wire transfers, and e-wallets like Skrill and Neteller. Most methods are processed within 1-3 business days, though the exact time it takes to reach your account depends on the chosen channel and your bank's processing speed. The Equiti website also lists the supported currencies, fees, and processing times for each method, making it easier for users to choose the most suitable funding channel.