Normal Operation

Normal OperationFXDD

10+Year

Basic Information

Country

MaltaMarket Type

foreign exchangeEnterprise Type

BrokerageService

Foreign exchange, precious metals, energy, indices, stocks, etc.Support Languages

Chinese, English, Japanese, Arabic, Spanish, Portuguese, etc.Domain Registration Date

2002-04-19Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

Founded in 2010 and headquartered in Attard, Malta, FXDD (Triton Capital Markets Ltd) is a forex broker offering diversified financial derivatives trading services, including forex, precious metals, energy, stocks, and indices. The company has branches in multiple countries and regions and holds licenses from leading regulators, including the Malta Financial Services Authority (MFSA), FINTRAC (Canada), the Mauritius Financial Conduct Authority (FSC), and the Malaysian Financial Conduct Authority (LFSA). Its business scope covers markets across Europe, Asia, the Americas, and Africa. Its domain name registration dates back to 2002, demonstrating its long brand history and operational experience in the industry.

🌐Global layout and brand background

FXDD, with its Malta headquarters as its core operations center, expands its global business network through registered entities in multiple locations, including Canada, Mauritius, Labuan, Malaysia, and Peru, where it maintains relevant local regulatory approvals. This multi-regional compliance structure not only enhances its international operational capabilities but also provides clients with diverse account services and fund protection channels. It is widely believed in the industry that FXDD's long-term existence and multi-regional compliance have helped to stabilize its brand reputation and are attractive to investors who value security and transparency.

💹Trading products and services

FXDD's product offerings cover a wide range of sectors, including foreign exchange, precious metals, energy, stocks, and indices, catering to diverse investor needs. The foreign exchange and precious metals sectors are suitable for clients seeking high liquidity and risk-averse investment strategies, while energy, stocks, and indices offer portfolio diversification opportunities. The platform offers both Standard and Premium accounts, both supporting trading in major currencies such as the US dollar, euro, British pound, and Japanese yen, with leverage up to 1:500 and automated trading capabilities. Standard accounts are commission-free and offer low spreads, while Premium accounts offer even better spread and commission rates.

💻Trading technology and platform experience

FXDD offers four trading platforms: MetaTrader 4, MetaTrader 5, WebTrader, and FXDD Mobile, catering to both desktop and mobile users. MT4 and MT5 are commonly used platforms in the industry, supporting a wide range of charting tools and automated trading strategies. WebTrader facilitates online trading anytime, while FXDD Mobile integrates global news and Trading Central analyst insights for an enhanced mobile trading experience. With its execution speed and feature set, the platform is suitable for a variety of trading styles, including short-term trading and automated strategies.

🛡️Regulatory compliance and fund security

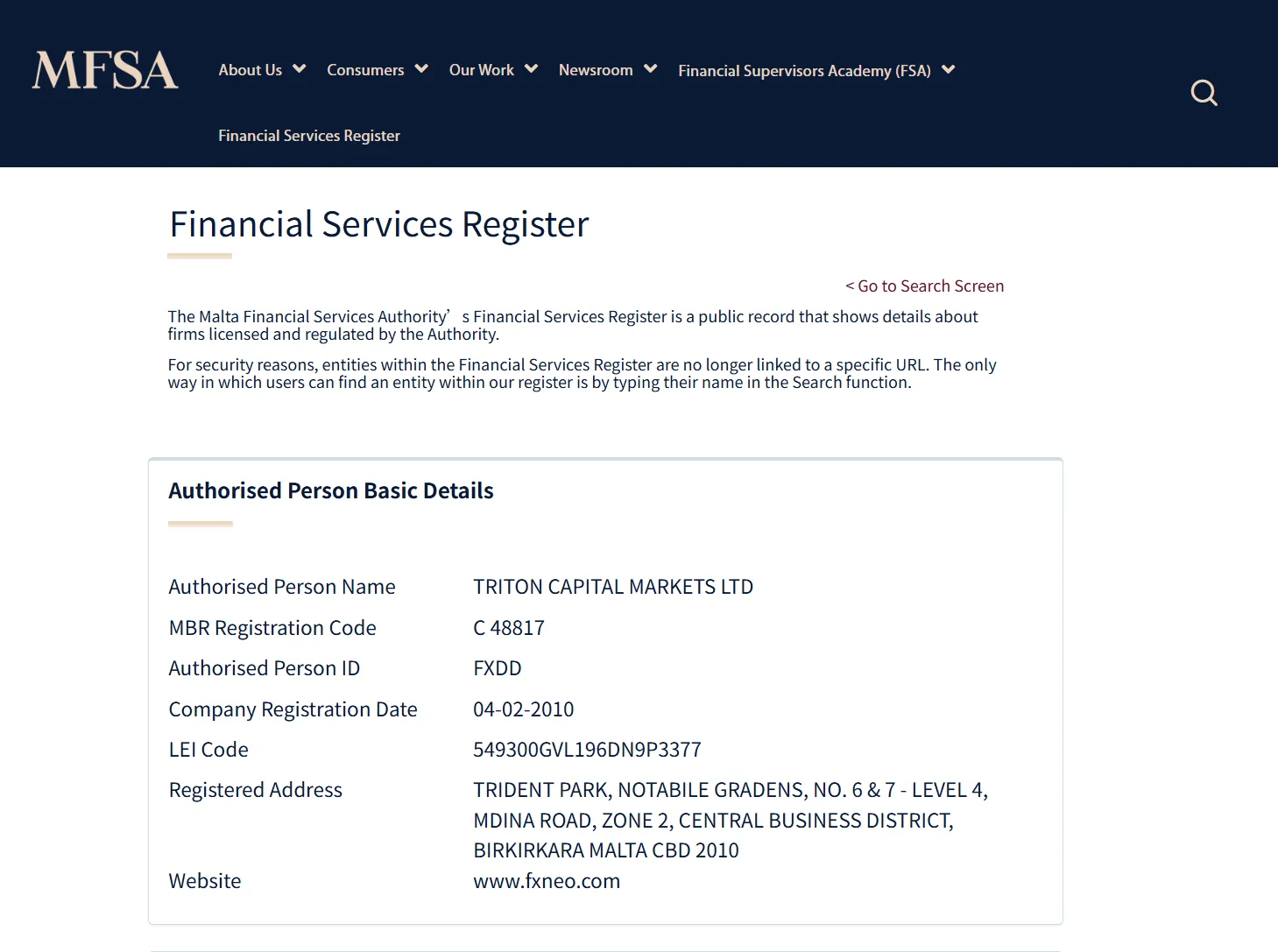

As a Malta-registered broker regulated by the MFSA, FXDD adheres to strict standards for client fund segregation, operational transparency, and regulatory compliance. Furthermore, its registered entities in Canada, Mauritius, and Labuan, Malaysia, are authorized by local financial regulators, reinforcing the confidence of global clients. Its core entity, Triton Capital Markets Ltd, is regulated by the Malta Financial Services Authority (MFSA) under license number 48817. Holding multiple regulatory licenses means investor funds are protected across various regulatory frameworks, but investors should remain aware of the potential risks associated with high leverage trading.

⚡Trading conditions and experience

FXDD offers a minimum account opening deposit of $200, flexible leverage options, and a variety of deposit and withdrawal methods, including bank cards, Skrill, Neteller, and bank transfers. Third-party deposits are not accepted, and withdrawals will be returned to the original deposit method. Its trading conditions are competitive among similar platforms and are particularly suitable for investors seeking flexible trading across multiple markets. However, before using high leverage, investors are advised to fully assess their risk tolerance.

🎓Customer support and value-added services

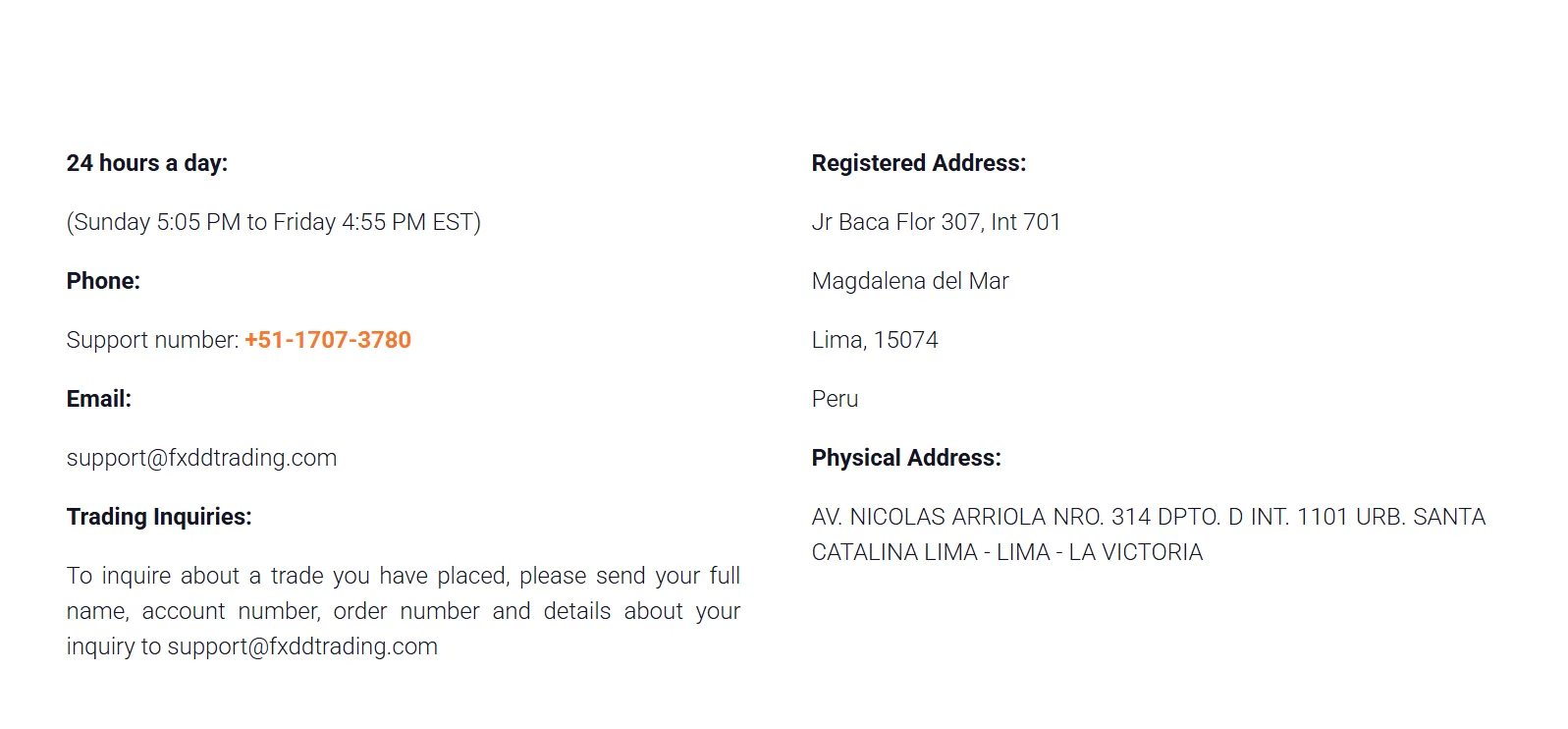

FXDD offers 24/5 multilingual customer service via phone, email, and online chat. The team is responsive and professional. Furthermore, the platform integrates market news, analytical tools, and expert insights to help traders stay informed about global market trends and optimize their trading decisions. These value-added services are invaluable to both new and experienced traders.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading are high-risk investments that can result in the loss of all invested capital. FXDD's regulatory and licensing compliance make it a suitable platform for investors who prioritize financial security and diversified trading. For those seeking a stable trading environment and the security of multiple regulatory bodies, FXDD offers a platform that balances traditional trading instruments with flexible account options. However, short-term speculators seeking excessive leverage and high returns should exercise caution.

Selected Enterprise Evaluation

3.50

Total 1 commentsI was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

~ There's nothing more ~

About FXDD's questions

Ask:Is FXDD regulated by an authoritative agency? Are my funds safe?

Answer:Yes. FXDD is headquartered in Attard, Malta, and its core entity, Triton Capital Markets Ltd, is regulated by the Malta Financial Services Authority (MFSA) under license number 48817. FXDD also holds licenses from relevant regulators in Canada, Mauritius, Labuan, Malaysia, and Peru. This multi-regional regulatory framework provides a degree of security for client funds and enforces segregation. However, investors should be aware of the inherent risks of high-leverage trading.

Ask:What trading products and account types does FXDD offer?

Answer:FXDD offers a wide range of trading products, including forex, precious metals, energy, stocks, and indices, supporting diversified investment portfolios. Account types include Standard and Premium accounts, with minimum deposits starting at $200 and leverage up to 1:500. Both accounts support trading in major currencies such as the USD, EUR, GBP, and JPY, as well as automated EA strategies. The Standard account is commission-free and offers low spreads, while the Premium account offers even lower spreads and commissions, making it suitable for investors with a more discerning trading style.

Ask:What is FXDD's trading platform and deposit and withdrawal methods like?

Answer:FXDD offers four platforms: MT4, MT5, WebTrader, and FXDD Mobile, catering to both desktop and mobile users. They support a rich set of charting tools and automated trading capabilities. Deposit and withdrawal methods include Visa, MasterCard, Skrill, Neteller, Sticpay, and bank transfer. Third-party deposits are not accepted, and withdrawals will be returned to the original deposit method. The platform offers 24/5 multilingual customer service and integrates global news and analytical tools, making it easy for investors to access market information and optimize trading decisions.