Normal Operation

Normal OperationInstaForex

10+Year

Basic Information

Country

RussiaMarket Type

foreign exchangeEnterprise Type

BrokerageService

Foreign exchange, precious metals, energy, cryptocurrency, stock index, CFD contracts, PAMM accounts, copy trading (ForexCopy), bonus activities, competitions, education and training, etc.Support Languages

English, Chinese, Russian, Vietnamese, Indonesian, Malay, Korean, Arabic, Spanish, Portuguese, Polish, French, German, Italian, Thai, etc.Domain Registration Date

2007-06-06Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

InstaForex was founded in 2007 and is headquartered in Elista, Kalmykia, Russia. On the surface, it is a world-renowned foreign exchange and contract for difference (CFD) broker. However, the market has never stopped controversies about it - although the company claims to have 7 million customers and provides a variety of financial products such as foreign exchange, commodities, metals, and cryptocurrencies, its actual compliance and fund security have always been questioned.

InstaForex's operating history is accompanied by a large number of complaints, mainly focusing on withdrawal difficulties, serious slippage, false advertising and other issues. Some investors reported that the company frequently experienced "platform freezes" during key trading hours, resulting in the inability to close positions or stop losses, seriously affecting the security of funds. In addition, InstaForex has a high correlation with Russian local licenses and has not obtained authoritative licenses in major international regulatory markets (such as the UK FCA and Australia ASIC), which greatly reduces its global credibility.

🌐 Global layout and brand background

InstaForex claims to have offices in many countries and cooperate with many international financial institutions. However, according to public information, InstaForex does not have actual regulated subsidiaries in major financial centers such as Europe and the United States. Although its domain name instaforex.com has a long history, its security score is low on independent rating platforms, and some browsers even prompt potential risks.

Many analysts in the industry believe that the platform relies more on overseas publicity and sponsorship of sports events to create brand exposure, rather than truly establishing compliance and technical advantages. For inexperienced investors, this kind of "brand endorsement" can easily lead people to mistakenly believe that the platform is safe and reliable, but risks still exist.

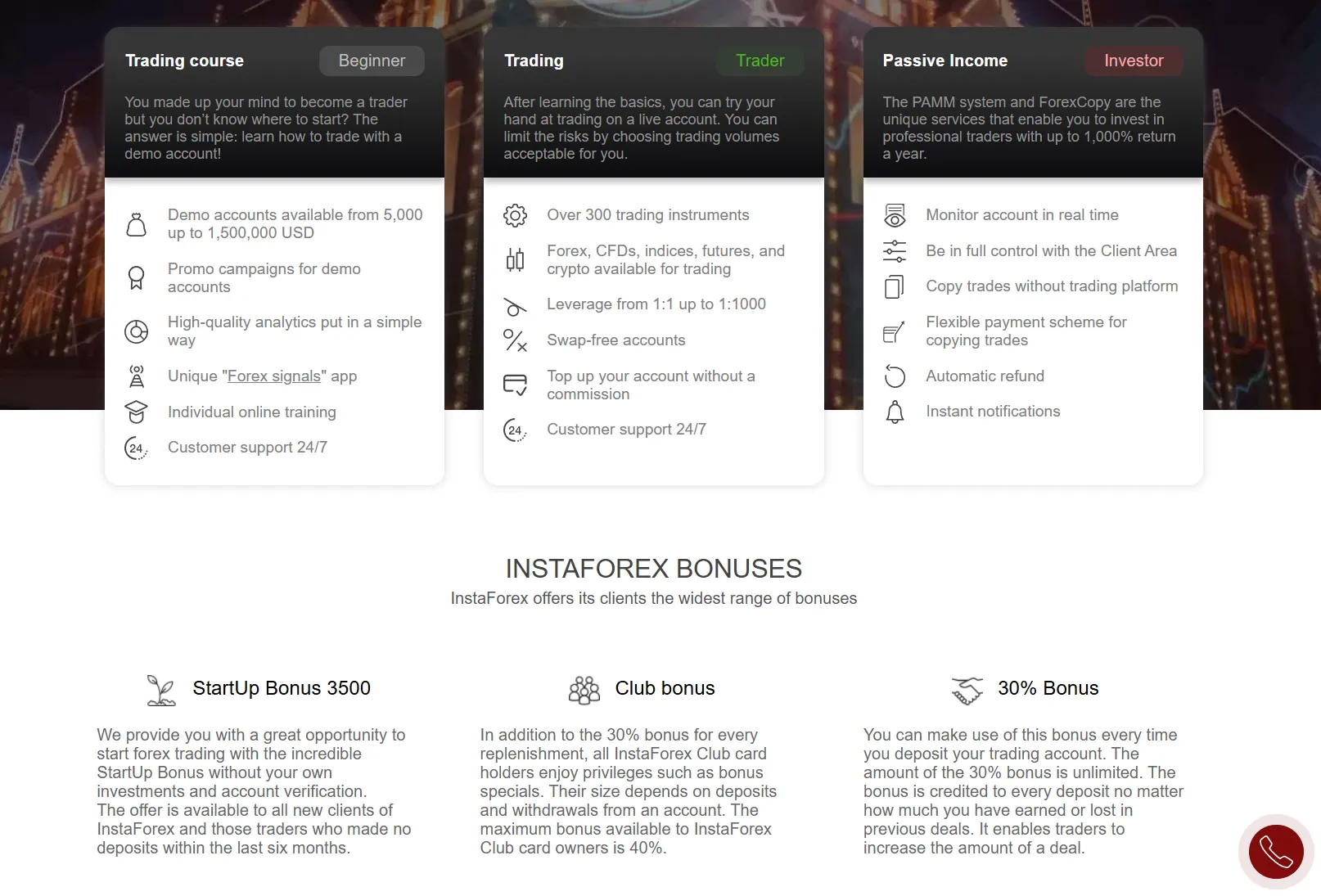

💹 Trading Products and Services

InstaForex offers CFD trading on Forex currency pairs, indices, commodities, metals, stock CFDs and popular cryptocurrencies.

However, from an external perspective, its transaction conditions have the following problems:

High spreads and hidden fees result in actual transaction costs far higher than the industry average;

The trading server is unstable, and high-frequency trading or short-term trading is easily affected;

The cryptocurrency products provided are only CFDs and no real asset delivery can be made;

High leverage settings attract high-risk speculation, but magnify the risk of losses.

In many foreign exchange rights protection communities, InstaForex is listed as a "cautious choice" or even a "high risk" list because a large number of investors have reported difficulties in recovering funds and opaque trading rules.

💻 Trading technology and platform experience

InstaForex uses the MetaTrader 4/5 platform, which is a common software in the industry, but it has no obvious technical advantages. The platform often freezes and disconnects during peak hours, making it impossible for investors to place orders or stop losses normally.

Compared with other regulated established brokers, InstaForex performs poorly in terms of transaction execution speed and slippage control, especially when the market fluctuates violently, which can easily lead to unreasonable spread widening. Many complaints mentioned that key point orders were "delayed in processing" and suspected human intervention in transactions.

🛡️ Regulatory compliance and fund security

Although InstaForex claims to be regulated by multiple financial regulators, its main licenses are from offshore regions, where regulatory intensity and legal protection are extremely limited and are not equivalent to the strict standards of mainstream European and American regulators.

Industry investigations have found that InstaForex has not obtained authoritative financial regulatory certifications such as the UK FCA, Australia ASIC or Cyprus CySEC, but relies on some offshore licenses to operate. This means that once the platform has financial problems, it is extremely difficult for investors to protect their legal rights.

In the risk ratings of multiple independent review websites, InstaForex is considered a high-risk foreign exchange platform due to its opaque compliance and frequent withdrawal disputes.

⚡ Trading conditions and experience

Although InstaForex advertises "low spreads" and "leverage up to 1:1000", the actual trading conditions are quite different from the promotion. Although ultra-high leverage can attract short-term speculative users, it is very easy to cause liquidation, and the risk control mechanism of the platform background is not transparent. A user once lost all his principal due to a violent fluctuation.

In addition, some users reported that the withdrawal cycle was long, sometimes requiring weeks or even months to arrive in the account, and customer service responses were very vague, shirking responsibility or requiring additional supporting documents, increasing the difficulty of withdrawals.

🎓 Customer Support and Value-added Services

InstaForex provides 24/7 online customer service, but most of them are outsourced customer service teams, and the problem solving efficiency is low. Although the official website claims to provide educational courses and market analysis, the content is relatively basic and lacks substantial professional research support.

Compared with other established compliant brokers, InstaForex's value-added services and customer education are more marketing-oriented rather than truly helping users improve their trading capabilities.

⚠️ Risk warning and platform positioning

Foreign exchange and CFDs are high-risk products in themselves, and the risks will be further magnified when trading on platforms that lack effective supervision. InstaForex has frequently appeared in foreign exchange rights protection forums due to negative comments such as difficulty in withdrawing funds, abnormal slippage, and platform freezes. Many industry insiders recommend being cautious or avoiding using such high-risk platforms.

🔍 Comprehensive analysis and evaluation

In summary, InstaForex has the following typical high-risk platform characteristics:

There is more branding than actual compliance background, and offshore supervision cannot guarantee the safety of funds;

The trading conditions are not transparent, and problems such as slippage and jamming affect the trading experience;

The withdrawal period is long, the rights protection is difficult, and there are many complaints;

High leverage attracts speculation, but at the same time amplifies losses and the risk of liquidation.

InstaForex is classified as a high-risk forex platform and is more suitable for users with extremely high risk tolerance and short-term speculation, and is not recommended for ordinary investors to participate in the long term.

Selected Enterprise Evaluation

4.00

Total 3 commentsI was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

When the platform froze my withdrawals, I initially hoped it was just a technical issue—but soon realised I had fallen victim to a scam. Mrs. Doris Ashley came highly recommended, and from our first interaction, she was transparent, professional, and responsive. Within 72 hours, she successfully recovered my funds—delivering exactly what she promised, with no false assurances. Email: (dorisashley71 (@) gmail. c 0 m ) WhatsApps:+1 (404) .-721 . -56 .-08 She’s the only one I personally trust when it comes to financial recovery. Stay safe and protect your money

Reply

One has to be careful with the brokers on the internet now. Last year I was scammed in the binary trade option by a broker I met on Instagram. I invested $14000 which I lost, I couldn’t make a withdrawal and I slowly lost access to my trade account for 3 months I was frustrated and depressed. After a few months, I met Barry white who is A recovery expert that works along side with the Federal Bureau of Investigation (FBI) and other law firm. he worked me through the process of getting my money back and all the extra bonus which I got during my trading. he can be of help to anyone who has a similar situation. You can contact him via his mail: barry white4390 @gmail.com

Reply

~ There's nothing more ~

About InstaForex's questions

Ask:Is InstaForex regulated? Is the safety of funds guaranteed?

Answer:InstaForex claims to hold multiple financial regulatory licenses, but they are mainly from offshore regions, with limited regulatory intensity and legal protection, and are not equivalent to mainstream regulatory agencies such as the UK FCA and Australia ASIC.

Ask:Is the trading environment of InstaForex stable? Will there be any problems of slippage or jamming?

Answer:Many investors have reported that during InstaForex trading hours, especially when the market fluctuates violently, there are often slippage expansion, delayed transactions, platform freezes and inability to close positions. Such problems can cause trading results to be inconsistent with expectations and increase the risk of losses.

Ask:Is it smooth to withdraw funds from InstaForex? Will there be any delays in cash withdrawal?

Answer:Many users complained in the foreign exchange rights protection community about difficulties in withdrawing funds, with withdrawal cycles ranging from weeks to months. During this period, customer service asked for additional proof and even shirked responsibility. Some cases ultimately failed to successfully retrieve funds.