Normal Operation

Normal OperationAmegaFX

Time:5-10Year

|Basic Information

Country

CyprusMarket Type

foreign exchangeEnterprise Type

BrokerageService

Providing CFD trading on foreign exchange (Forex), stocks, commodities, indices, energy, and cryptocurrenciesSupport Languages

English, Chinese, French, Spanish, Arabic, Russian, Portuguese, Hindi, Thai, Vietnamese, etc.Domain Registration Date

2020-09-07Business Status

Normal Operation Company

Company Regulatory

Regulatory Risk Monitor

Risk Monitor Download

Download Documents

DocumentsCompany Introduction & Web Analytics

Company Introduction

Founded in 2018, AmegaFX is headquartered in Cyprus and regulated in Mauritius. It is a rapidly growing international forex and contracts for difference (CFD) broker. As an emerging fintech-driven trading platform, AmegaFX is committed to providing diversified financial trading services to clients from emerging markets such as Africa, Asia, and Eastern Europe, as well as globally. Its product offerings include forex, stocks, indices, commodities, metals, energy, and cryptocurrency CFDs, catering to the investment needs of traders of all levels. Leveraging the advanced MetaTrader 4 and MetaTrader 5 platforms, the company offers a seamless experience across desktop, web, and mobile platforms, emphasizing low-cost trading, high leverage options, and fast execution. Through continuous innovation and a customer-centric service approach, AmegaFX is steadily becoming a competitive and influential brand in the industry.

🌐Global layout and brand background

With internationalization at its core, AmegaFX is steadily advancing its global presence. Its Mauritius entity is regulated by the Financial Services Commission (FSC), providing regulatory compliance and client fund security. Furthermore, the company is continuously expanding its service network, enhancing user convenience for clients in various regions through multilingual support and localized payment channels. The brand's positioning within the industry extends beyond trade execution, emphasizing user retention and trust through education, cashback programs, and innovative features. For investors in emerging markets, AmegaFX's rapid expansion and regulatory compliance demonstrate a platform with both growth potential and transparency and security.

💹Trading products and services

AmegaFX offers a wide range of trading instruments:

Foreign exchange currency pairs cover mainstream and some niche markets;

Stock and index CFDs meet asset allocation and speculation needs;

Gold, silver and other metals and energy products provide options for hedging and diversified investment;

Popular cryptocurrency CFDs such as Bitcoin and Ethereum allow investors to invest in emerging asset classes.

In addition, the platform offers a cashback bonus program (rewards $1 per trade, with no cap), a unique service that helps high-frequency traders and active users reduce overall costs. Overall, AmegaFX's product line combines traditional markets with innovative asset classes, catering to a variety of risk appetites and strategic styles.

💻Trading technology and platform experience

Technically, AmegaFX supports the MT4 and MT5 platforms, familiar to traders worldwide. Users can perform advanced chart analysis and algorithmic trading, as well as optimize their strategies using an economic calendar, automated signals, and backtesting tools. The platform maintains high execution speed and stability, with an average order execution time of approximately 0.1 seconds. It supports scalping, hedging, and intelligent trading advisors (EAs). The mobile experience is also very user-friendly, ensuring investors can trade efficiently anytime, anywhere. For clients seeking flexibility and versatility, AmegaFX offers strong platform compatibility and tool support.

🛡️Regulatory compliance and fund security

AmegaFX is currently regulated by the Financial Services Commission (FSC) of Mauritius, with license number GB22200548. The platform implements a segregated custody system for client funds, ensuring their independence and security, and offers negative balance protection to mitigate risk in extreme market conditions. The company strictly enforces AML (Anti-Money Laundering) and KYC (Know Your Customer) policies to ensure compliance. While its regulatory level lags behind Tier 1 regulators like the UK's FCA and Australia's ASIC, AmegaFX has established a strong reputation in emerging markets for its transparency and security measures.

⚡Trading conditions and experience

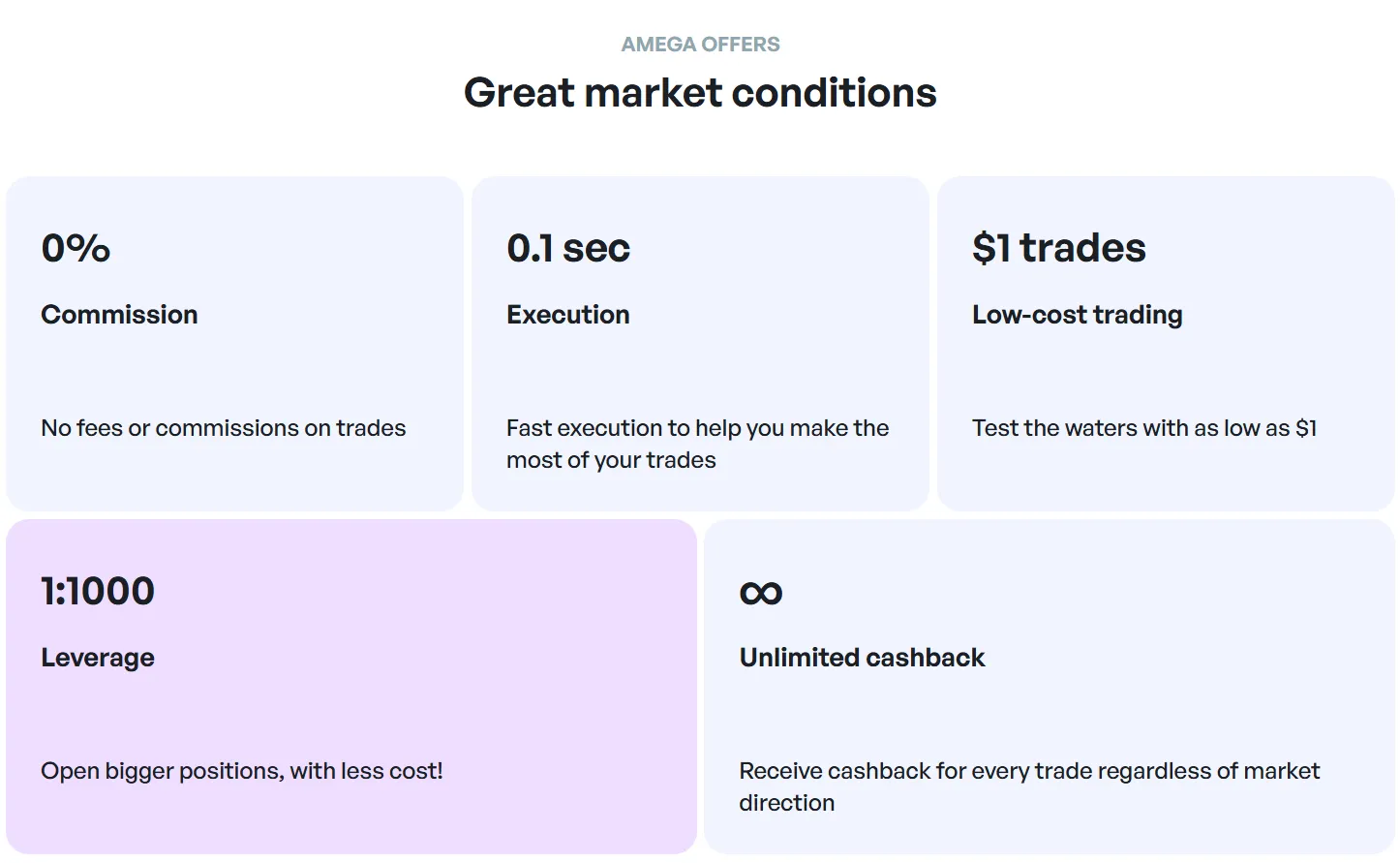

AmegaFX offers flexible trading conditions:

The spread is as low as 1 point, which has a certain competitive advantage;

The maximum leverage can reach 1:1000, providing more possibilities for investors pursuing capital efficiency;

No commission model, the overall cost is included in the spread;

Active users can further reduce transaction costs through cashback programs.

Overall, these conditions make the platform attractive for high-frequency and scalping trading strategies, while also meeting the diverse needs of medium- and long-term investors.

🎓Customer support and value-added services

AmegaFX offers multilingual customer service, available 24/5 and 24/7 via email, live chat, and a ticketing system. Its educational resources, including trading guides, an economic calendar, and signal notifications, help beginners and intermediate traders stay informed about market trends. While there is room for improvement in in-depth research and interactive courses, the platform provides comprehensive value-added support through market analysis and practical tools.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading are high-risk investments that may result in the complete loss of principal. AmegaFX clearly advises users on its website and risk disclosure document to assess their risk tolerance and encourages them to manage their exposure through risk management tools. Based on its platform positioning, AmegaFX is more suitable for investors who prioritize low-cost execution, strategy diversification, and regulatory compliance, especially those seeking flexibility in emerging markets.

🔍Comprehensive analysis and evaluation

Overall, AmegaFX, as a fast-growing international broker, has the following highlights:

Global layout and compliance supervision background;

Products cover traditional markets and emerging crypto assets;

The platform technology is stable and supports diverse trading strategies;

The cost structure is transparent and supported by a cashback program to enhance competitiveness.

With its continued investment in innovation and customer experience, AmegaFX is becoming a leading forex and CFD broker in emerging markets. For traders seeking multi-asset trading in a secure and compliant environment, AmegaFX is a trustworthy and reliable platform.

About AmegaFX's questions

Ask:Is AmegaFX regulated? Are my funds safe?

Answer:AmegaFX is regulated by the Financial Services Commission (FSC) of Mauritius, license number GB22200548. It implements a segregated client funds custody system and offers negative balance protection, ensuring clients are protected from the risk of exceeding their account balances due to market fluctuations. Although the FSC is a secondary regulator, lower than primary regulators like the UK's FCA and Australia's ASIC, AmegaFX maintains high standards of compliance, transparency, and fund protection, making it a relatively safe platform for emerging market investors.

Ask:What are the transaction costs and cashback mechanisms at AmegaFX?

Answer:AmegaFX operates a zero-commission model, with all fees included in the spread. Typical spreads on major forex pairs, such as EUR/USD, are approximately 1 pip. The platform also offers a cashback program, offering $1 per traded lot, with no cap. Withdrawals are available upon reaching $100 in accumulated funds. This program significantly reduces the effective costs for high-frequency and scalping traders, making it highly competitive among similar brokers.

Ask:What type of investors is AmegaFX suitable for?

Answer:AmegaFX's strengths lie in its low-cost structure, flexible leverage up to 1:1000, diverse product offerings (forex, stocks, indices, commodities, cryptocurrencies, and more), and support for both MT4 and MT5 platforms. It's ideal for: high-frequency traders seeking capital efficiency; emerging market investors seeking a multi-asset portfolio; and intermediate and advanced users who prefer algorithmic or mobile trading. For investors with a lower risk appetite, it's recommended to manage leverage appropriately and prioritize risk management tools.

Selected Enterprise Evaluation

AmegaFX offers a wide range of trading instruments with competitive spreads and no commission fees. The cashback program is a strong advantage for active traders, and the MT4/MT5 platforms provide a reliable trading experience. The only limitation is that it operates under a mid-tier regulator rather than a top-tier one.

![]() Reply

Reply

Impressive execution speed and user-friendly platforms make AmegaFX a solid choice for both beginners and experienced traders. The flexible leverage up to 1:1000, along with strong client fund protection measures, positions it as a trustworthy broker in emerging markets.

![]() Reply

Reply

~ There's nothing more ~