Normal Operation

Normal OperationIronFX

10+Year

Basic Information

Country

CyprusMarket Type

foreign exchangeEnterprise Type

BrokerageService

CFD trading in foreign exchange, precious metals, energy, stocks, indices, commodities, cryptocurrencies, etc.; MT4 platform, ECN accounts, fixed/floating spreads, zero/low commission accounts, copy trading, VPS, analytical tools, educational resources, etc.Support Languages

English, Chinese, Russian, Arabic, Indonesian, Vietnamese, Portuguese, Malay, Polish, Korean, Spanish, French, German, Italian, etc.Domain Registration Date

2009-11-13Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

IronFX, a well-known financial trading brand under Notesco Financial Services Limited, was founded on January 12, 2010. Headquartered in Cyprus, it also maintains offices in the UK and Bermuda. As a diversified international broker, IronFX offers a wide range of financial trading services, including forex, metals, indices, commodities, futures, and stocks. It serves clients worldwide, but excludes residents of certain jurisdictions, including the United States, Iran, Cuba, Sudan, Syria, and North Korea. The company caters to the diverse needs of traders, from beginners to professional, through a flexible account system and diverse trading conditions. IronFX has attracted market attention for its stable trading environment and compliant operations.

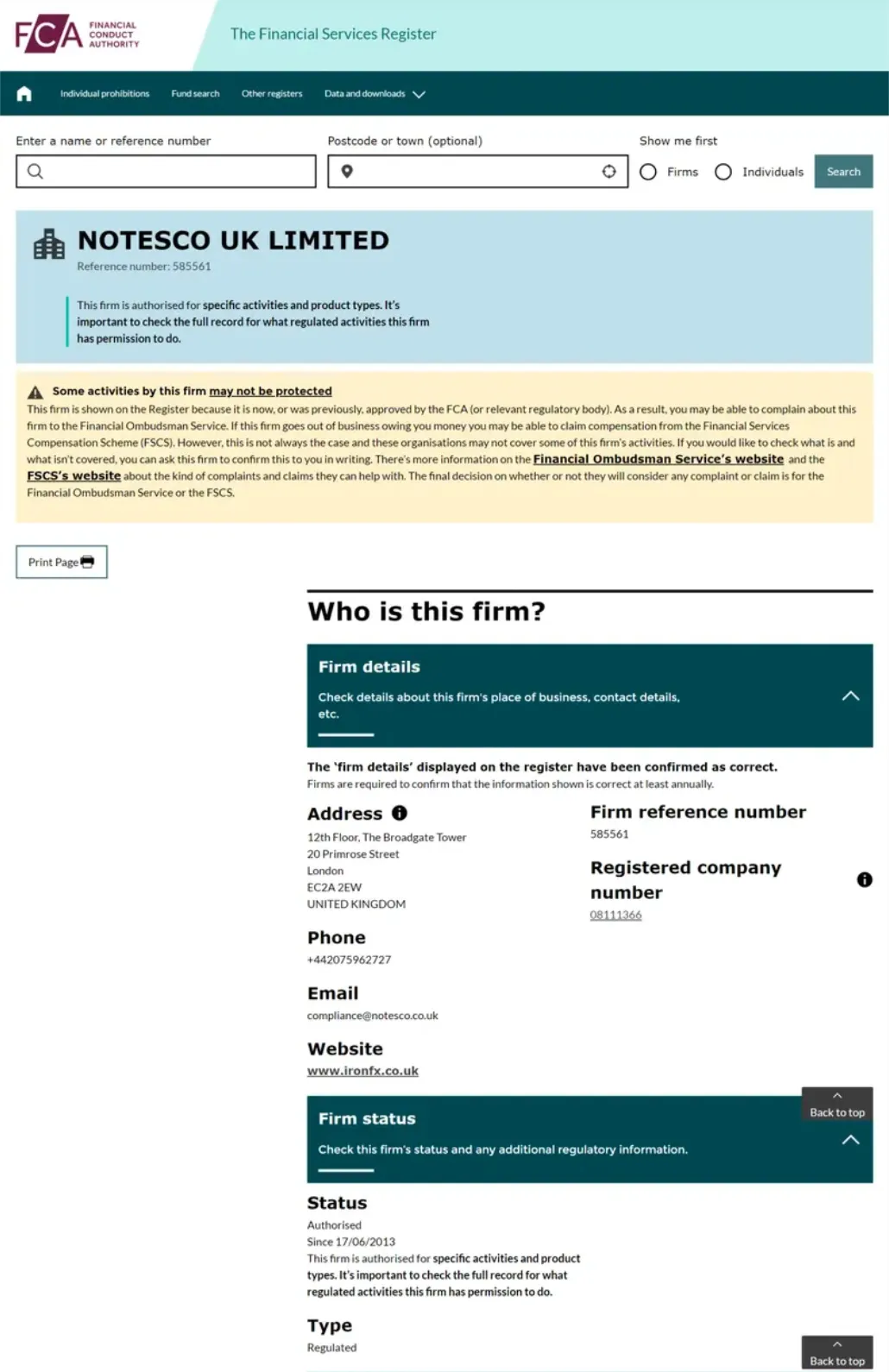

🌐 Global layout and brand background

IronFX operates globally through multiple regional entities. Notesco Financial Services Ltd (formerly IronFX Global Limited, etc.), a Cyprus entity, is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 125/10 and operates the IronFX and FXlift brands. Notesco UK Limited (formerly IronFX Global UK Limited, etc.), a UK entity, is regulated by the Financial Conduct Authority (FCA) under license number 585561 and operates the IronFX and FXGIANTS brands. Notesco Limited, a Bermuda entity registered under registration number 51491, operates www.ironfx.com and www.ironfxcn.com. While unregulated, it serves multiple regions worldwide. This multi-regional presence not only enables IronFX to provide localized support to clients in diverse markets, but also enhances the brand's international reach.

💹 Trading Products and Services

IronFX's product line covers foreign exchange, precious metals, indices, commodities, futures and stocks, suitable for users with different investment strategies:

Foreign exchange: provides a variety of major, minor and rare currency trading opportunities;

Precious metals and energy: including commodities such as gold, silver and crude oil;

Stocks and indices: covering stocks and indices in major international markets;

Futures contracts: provide hedging and speculation tools for multiple asset classes.

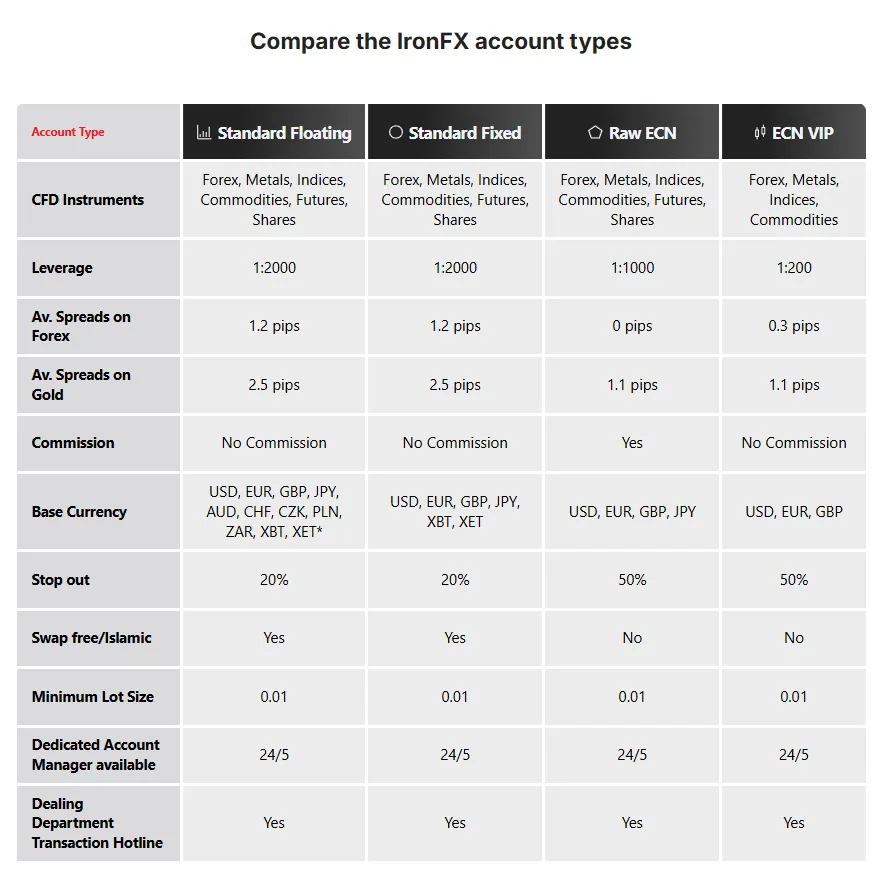

Flexible account types are available, divided into two categories: Live Floating/Fixed Spreads and STP/ECN, for a total of seven account types. Different accounts vary in spreads, commissions, base currencies, and trading conditions to meet the needs of low-cost trading, fixed-cost strategies, or high-precision trading with zero spreads.

💻 Trading technology and platform experience

IronFX primarily offers the industry-leading MetaTrader 4 (MT4) trading platform, available across desktop, web, and mobile platforms. It features a rich suite of charting tools, technical indicators, automated trading (EA) capabilities, and high-speed order execution. The platform's servers are jointly hosted in Cyprus and Bermuda, ensuring fast and stable connections for users in different regions. For traders seeking efficient execution and customizable tools, MT4 remains a reliable choice.

🛡️ Regulatory compliance and fund security

IronFX's core entity, Notesco Financial Services Ltd, is regulated by the CySEC (license number 125/10), while Notesco UK Limited is regulated by the FCA (license number 585561). Both entities implement a segregated client funds custody system, ensuring the separation of client funds from the company's operational funds. Although the Bermuda entity is unregulated, the overall multi-regional compliance framework strengthens investor confidence. Investors should be aware that high leverage trading can lead to the risk of rapid capital fluctuations, and caution is advised even within the compliant system.

⚡ Trading conditions and experience

IronFX offers flexible trading conditions, with spreads as low as 0 pips (for certain account types), leverage up to 1:30 (subject to regulatory restrictions), a minimum trading size of 0.01 lots, and support for a variety of base currencies. Deposit and withdrawal methods include credit/debit cards, bank wires, Skrill, and Neteller. Deposits are fee-free, while withdrawal fees vary depending on the payment method. The overall trading experience is focused on stability and cost control, making it suitable for traders who prioritize execution quality and fund security.

🎓 Customer Support and Value-Added Services

IronFX offers 24/5 multilingual customer service via phone, email, and online chat. Its official website provides account opening instructions, account types, trading conditions, and educational and market information to help users better understand the market and product structure. While its value-added services are relatively conservative in terms of social trading or innovative features, the platform's resources are already valuable for investors who prefer independent analysis and decision-making.

⚠️ Risk Warning and Platform Positioning

Forex and CFD trading are inherently high-risk, highly leveraged investments that can result in total capital loss. IronFX provides clear risk warnings on its website and related channels, reminding investors to fully understand the leverage mechanism and market volatility risks before participating in trading. The platform positions itself as a traditional brokerage firm with compliant operations and a stable trading environment. It is more suitable for medium- to long-term investors who prioritize security and execution quality, rather than those who simply seek high-leverage, short-term speculation.

🔍 Comprehensive analysis and evaluation

IronFX's comprehensive advantages lie in its multi-regional regulatory framework, rich account types, comprehensive trading categories and stable MT4 technical support.

Key highlights:

Multi-regional supervision and global layout enhance brand trust;

Flexible account system, adaptable to different trading strategies;

Stable MT4 platform, supporting automated trading and multi-terminal access;

The customer funds isolation system ensures the safety of funds.

Overall, IronFX is suitable for users who want to invest in multiple categories in a stable, compliant international trading environment, and is especially suitable for traders who focus on execution quality and cost control.

Selected Enterprise Evaluation

0.75

Total 2 commentsI’m so grateful for the excellent assistance I received in recovering my lost item. I had almost given up hope, but thanks to their quick response, professionalism, and attention to detail, I was able to get my belongings back safely. Their communication was clear throughout the process, and I truly appreciate the effort they put in to help me. Highly recommended! Mail: olivetraderecover 5 5 A t g mail.c0m Website: https://iconicrecovery.org

Reply

Exercise extreme caution when engaging with this website. Deposits are accepted easily, but withdrawals are consistently blocked. My attempts to recover funds for over a week have been unsuccessful, and the so-called “financial manager” became hostile when questioned. Many of the platform’s positive reviews also appear inauthentic. If you encounter similar issues, consider seeking professional chargeback assistance. You may contact Madam Doris at Email: dorisashley71 @ gmail. com or via WhatsApp at +1 .- (404) -.721.-56.-08.

Reply

~ There's nothing more ~

About IronFX's questions

Ask:What is the minimum deposit?

Answer:Minimum deposit is $100.

Ask:How can I deposit and withdraw funds?

Answer:Bank transfer, credit/debit card, Skrill, Neteller, FasaPay, local payment agents, etc.