Normal Operation

Normal OperationBlackBull

10+Year

Basic Information

Country

New ZealandMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provides online trading services for financial products such as foreign exchange (Forex), contracts for difference (CFD), stocks, ETFs, indices, commodities, cryptocurrencies, etc.Support Languages

English, Chinese, Portuguese, Spanish, French and other languages.Domain Registration Date

2014-02-15Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

BlackBull (Black Bull Group Limited), founded in 2014 and headquartered in Auckland, New Zealand, is a rapidly growing global forex and contracts for difference (CFD) broker. As an industry innovator, BlackBull offers a diverse range of trading products, including forex, metals, commodities, indices, stocks, and digital assets, to both retail and institutional clients. BlackBull is renowned for its fast execution, transparent trading conditions, and customer-centric service, and continues to expand its business through a technology-driven approach.

BlackBull's core strength lies in its advanced trading infrastructure and liquidity support. Its data center, located in Equinix NY4, guarantees millisecond order execution and is equipped with VPS and API interfaces to meet the needs of high-frequency and quantitative trading. The platform not only supports MetaTrader 4 and MetaTrader 5, but also offers its proprietary BlackBull Shares platform, providing investors with direct access to DMA global stock markets, demonstrating a combination of specialization and diversification.

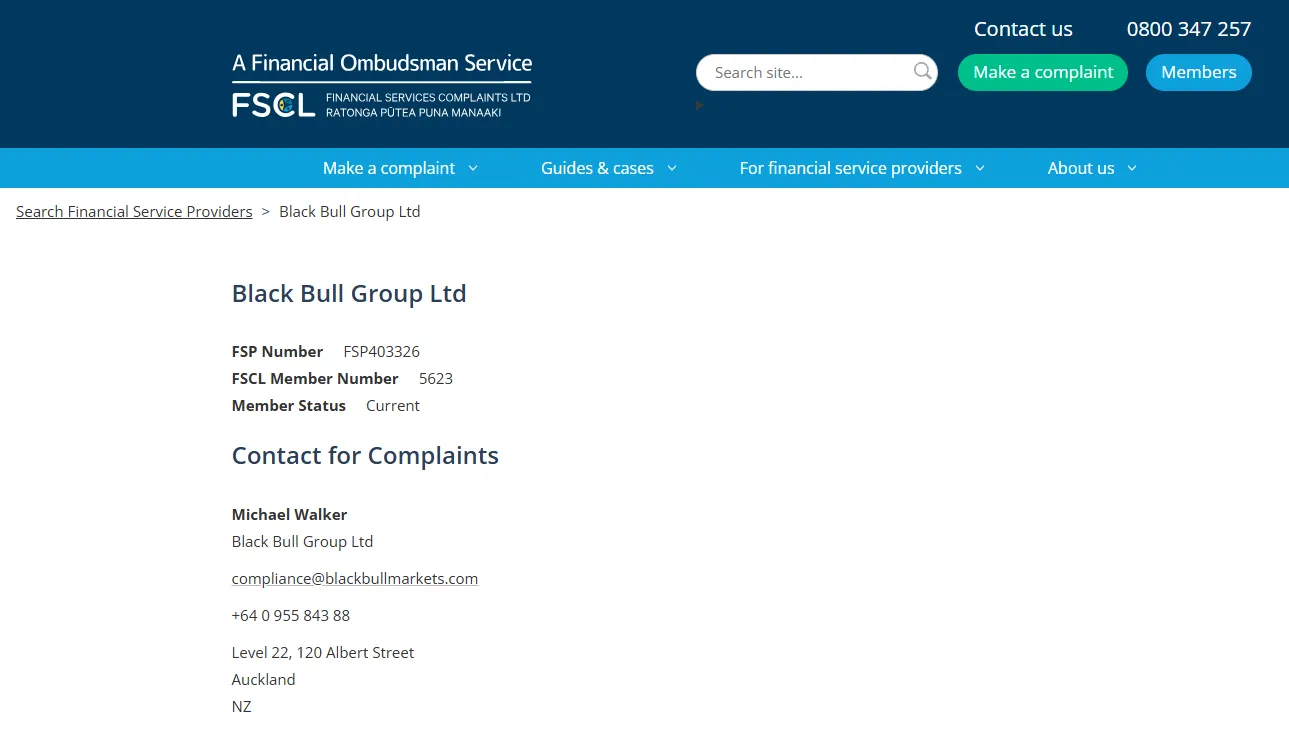

In terms of regulatory compliance, Black Bull Group Limited is regulated by the New Zealand Financial Markets Authority (FMA), the New Zealand Financial Services Providers Register (FSPR), the Seychelles Financial Services Authority (FSA) and the Vanuatu Financial Services Commission (VFSC). It implements strict fund segregation systems and AML/CFT policies to enhance the security of investors' funds.

🌐Global layout and brand background

BlackBull Markets, originating in New Zealand, has now established a presence in Asia Pacific, Europe, Latin America, and other regions. It partners with top liquidity providers to ensure access to deep markets. With its robust compliance system and transparent trading environment, BlackBull has become a trusted brand among global investors. Industry experts cite the platform's strong growth potential and risk resilience in the rapidly evolving forex industry, further strengthening its brand image.

💹Trading products and services

BlackBull offers a wide range of trading instruments, including forex, precious metals, energy, indices, cryptocurrencies, and stocks. Whether you're a short-term trader seeking tight spreads and high liquidity, or a long-term investor seeking diversified asset allocation, BlackBull can find the right product on its platform. Its BlackBull Shares platform supports over 26,000 global stocks and ETFs, further expanding trading options. Through a one-stop account system, clients can flexibly trade across multiple markets and assets.

💻Trading technology and platform experience

On a technical level, BlackBull prioritizes platform stability and execution speed. Clients can choose to use MT4, MT5, or BlackBull Shares, freely combining automated trading tools, Expert Advisors (EAs), and a wide range of technical indicators. Independently tested, BlackBull's server stability and execution speed have proven exceptional, making it particularly suitable for high-frequency and quantitative traders. For casual users, BlackBull offers a user-friendly interface and comprehensive functionality, enabling smooth operation across both desktop and mobile platforms.

🛡️Regulatory compliance and fund security

BlackBull Markets holds multiple regulatory licenses and maintains independent custody of client funds, enhancing transparency and security. The company adheres strictly to international compliance requirements and has passed AML/CFT audits to ensure a legal and compliant trading environment. Furthermore, BlackBull is a member of the Financial Services Complaints Authority (FSCL) in New Zealand, providing clients with additional dispute resolution channels. This compliance framework has earned BlackBull a reputation within the industry as a low-risk, trustworthy broker.

⚡Trading conditions and experience

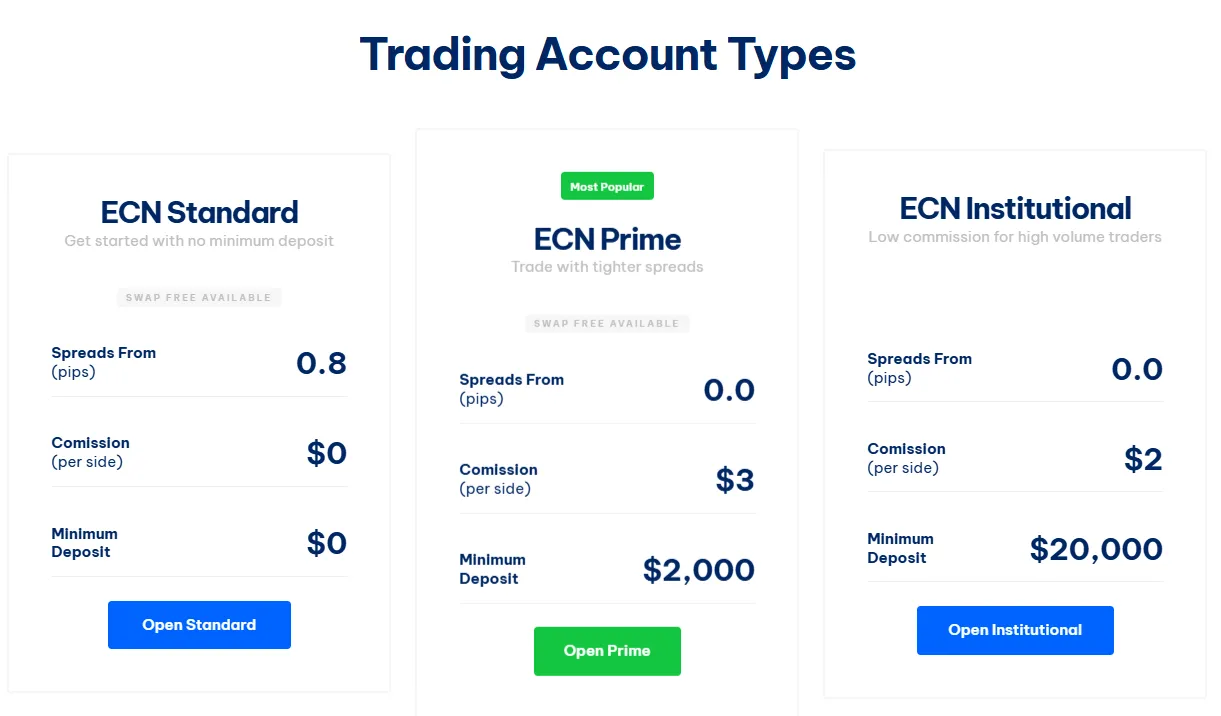

BlackBull offers flexible account types: Standard, Prime, and Institutional, catering to traders from beginners to professional. The Standard account offers zero entry requirements, tight spreads, and no commissions; the Prime account features spreads as low as 0.2 pips and low commissions; and the Institutional account offers customizable trading conditions to meet the needs of high-volume and institutional clients. Leverage up to 1:500, combined with high-speed matching technology and low-latency execution, ensures a competitive trading experience.

🎓Customer support and value-added services

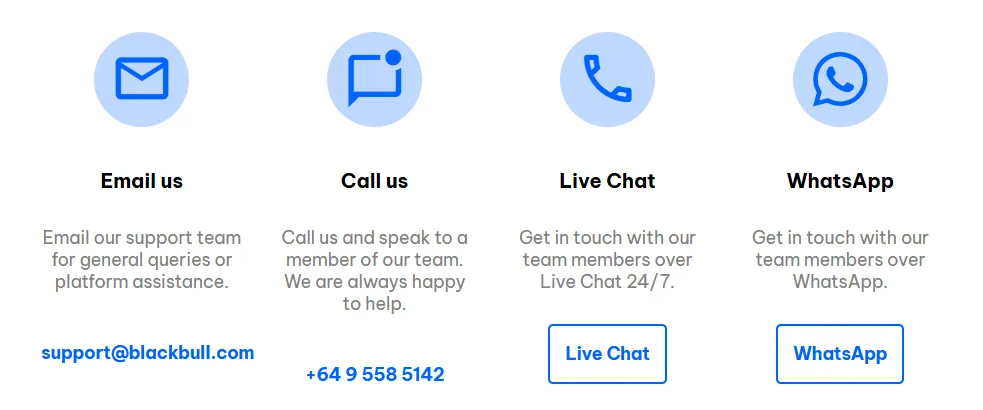

BlackBull offers 24/5 multilingual customer support with professional and efficient response times. It also provides users with educational resources, market analysis reports, and research tools to help traders enhance their knowledge and skills. Prime and Institutional members also benefit from dedicated account managers. These value-added services reflect BlackBull's long-term investment in customer experience and educational empowerment.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading are high-risk investment products that can result in financial loss. BlackBull provides clear risk disclosures on its official website and third-party platforms, reminding investors to understand trading mechanics and assess their risk tolerance before entering the market. Overall, BlackBull is positioned as a comprehensive broker offering "high execution, diversified asset management, and compliance and security," making it a suitable choice for investors who value stability and professional service.

🔍Comprehensive analysis and evaluation

In summary, BlackBull has the following characteristics:

Multiple regulatory safeguards ensure strong fund security;

Wide coverage of trading products, supporting global stocks and mainstream CFDs;

The platform has advanced technology and fast execution speed, making it suitable for high-frequency trading;

Customer service and educational resources are improved, and brand credibility is continuously improving.

As a fast-growing, compliant, and robust international broker, BlackBull Markets demonstrates strong market competitiveness in 2025. For users seeking multi-market trading in a secure, transparent, and highly enforceable environment, BlackBull Markets is a trusted, premium option.

Selected Enterprise Evaluation

4.50

Total 2 commentsGreat range of trading products and good customer support. The only downside is the $5 fee per transaction for deposits/withdrawals, but overall the service is professional and trustworthy.

Reply

BlackBull offers excellent execution speed and transparent pricing. Deposits and withdrawals are smooth, and the platform choice between MT4, MT5, and BlackBull Shares gives a lot of flexibility. Definitely one of the more reliable brokers I’ve used.

Reply

~ There's nothing more ~

About BlackBull's questions

Ask:Is BlackBull Markets regulated? Are my funds safe?

Answer:Yes. BlackBull Markets is regulated by various authorities, including the Financial Markets Authority (FMA) of New Zealand, the Financial Services Providers Register (FSPR) of New Zealand, the Financial Services Authority (FSA) of Seychelles, and the Vanuatu Financial Services Commission (VFSC). The company maintains segregation of client funds and provides independent dispute resolution through the Financial Services Complaints Body (FSCL). This means client funds are legally protected and offer a high level of security.

Ask:What trading products and platforms does BlackBull offer?

Answer:BlackBull offers a diverse range of trading products, including forex, indices, commodities, metals, cryptocurrencies, and over 26,000 global stocks and ETFs. BlackBull supports MetaTrader 4 and MetaTrader 5, as well as its proprietary BlackBull Shares trading platform. BlackBull is also compatible with VPS and API interfaces, catering to a wide range of needs, from individual investors to high-frequency/quantitative traders.

Ask:Is it difficult to open an account? What are the trading conditions?

Answer:BlackBull offers three account types: Standard: no minimum deposit requirement, suitable for beginners; Prime: minimum deposit of $2,000, spreads as low as 0.2 pips, and low commissions; Institutional: starting at $20,000, with customized terms. Leverage up to 1:500, combined with low-latency execution and a variety of payment methods (bank cards, e-wallets, cryptocurrencies, etc.), provides flexible and competitive trading conditions.