Normal Operation

Normal OperationBlack Bull Group Ltd

10+Year

Basic Information

Country

New ZealandMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provides online trading services for financial products such as foreign exchange (Forex), contracts for difference (CFD), stocks, ETFs, indices, commodities, cryptocurrencies, etc.Support Languages

English, Chinese, Portuguese, Spanish, French and other languages.Domain Registration Date

2014-02-15Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

BlackBull (Black Bull Group Limited), founded in 2014 and headquartered in Auckland, New Zealand, is a rapidly growing global forex and contracts for difference (CFD) broker. As an industry innovator, BlackBull offers a diverse range of trading products, including forex, metals, commodities, indices, stocks, and digital assets, to both retail and institutional clients. BlackBull is renowned for its fast execution, transparent trading conditions, and customer-centric service, and continues to expand its business through a technology-driven approach.

BlackBull's core strength lies in its advanced trading infrastructure and liquidity support. Its data center, located in Equinix NY4, guarantees millisecond order execution and is equipped with VPS and API interfaces to meet the needs of high-frequency and quantitative trading. The platform not only supports MetaTrader 4 and MetaTrader 5, but also offers its proprietary BlackBull Shares platform, providing investors with direct access to DMA global stock markets, demonstrating a combination of specialization and diversification.

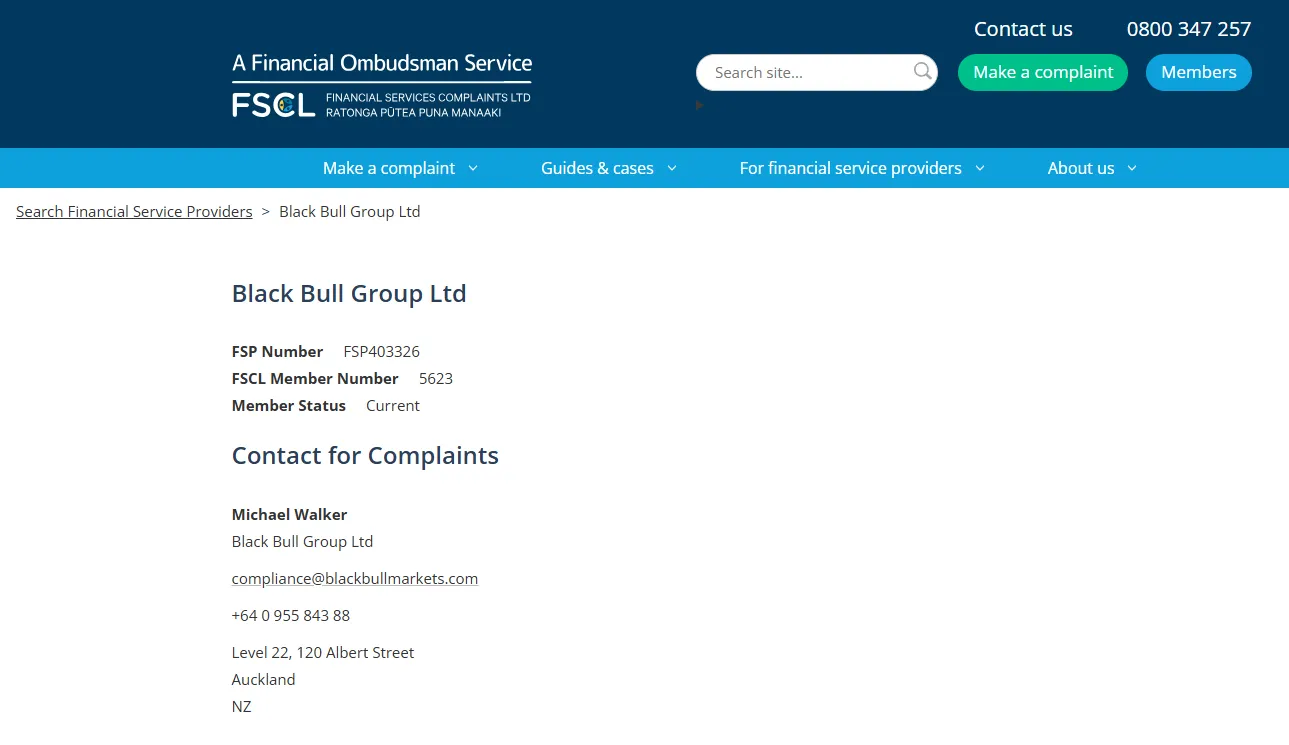

In terms of regulatory compliance, Black Bull Group Limited is regulated by the New Zealand Financial Markets Authority (FMA), the New Zealand Financial Services Providers Register (FSPR), the Seychelles Financial Services Authority (FSA) and the Vanuatu Financial Services Commission (VFSC). It implements strict fund segregation systems and AML/CFT policies to enhance the security of investors' funds.

🌐Global layout and brand background

BlackBull Markets, originating in New Zealand, has now established a presence in Asia Pacific, Europe, Latin America, and other regions. It partners with top liquidity providers to ensure access to deep markets. With its robust compliance system and transparent trading environment, BlackBull has become a trusted brand among global investors. Industry experts cite the platform's strong growth potential and risk resilience in the rapidly evolving forex industry, further strengthening its brand image.

💹Trading products and services

BlackBull offers a wide range of trading instruments, including forex, precious metals, energy, indices, cryptocurrencies, and stocks. Whether you're a short-term trader seeking tight spreads and high liquidity, or a long-term investor seeking diversified asset allocation, BlackBull can find the right product on its platform. Its BlackBull Shares platform supports over 26,000 global stocks and ETFs, further expanding trading options. Through a one-stop account system, clients can flexibly trade across multiple markets and assets.

💻Trading technology and platform experience

On a technical level, BlackBull prioritizes platform stability and execution speed. Clients can choose to use MT4, MT5, or BlackBull Shares, freely combining automated trading tools, Expert Advisors (EAs), and a wide range of technical indicators. Independently tested, BlackBull's server stability and execution speed have proven exceptional, making it particularly suitable for high-frequency and quantitative traders. For casual users, BlackBull offers a user-friendly interface and comprehensive functionality, enabling smooth operation across both desktop and mobile platforms.

🛡️Regulatory compliance and fund security

BlackBull Markets holds multiple regulatory licenses and maintains independent custody of client funds, enhancing transparency and security. The company adheres strictly to international compliance requirements and has passed AML/CFT audits to ensure a legal and compliant trading environment. Furthermore, BlackBull is a member of the Financial Services Complaints Authority (FSCL) in New Zealand, providing clients with additional dispute resolution channels. This compliance framework has earned BlackBull a reputation within the industry as a low-risk, trustworthy broker.

⚡Trading conditions and experience

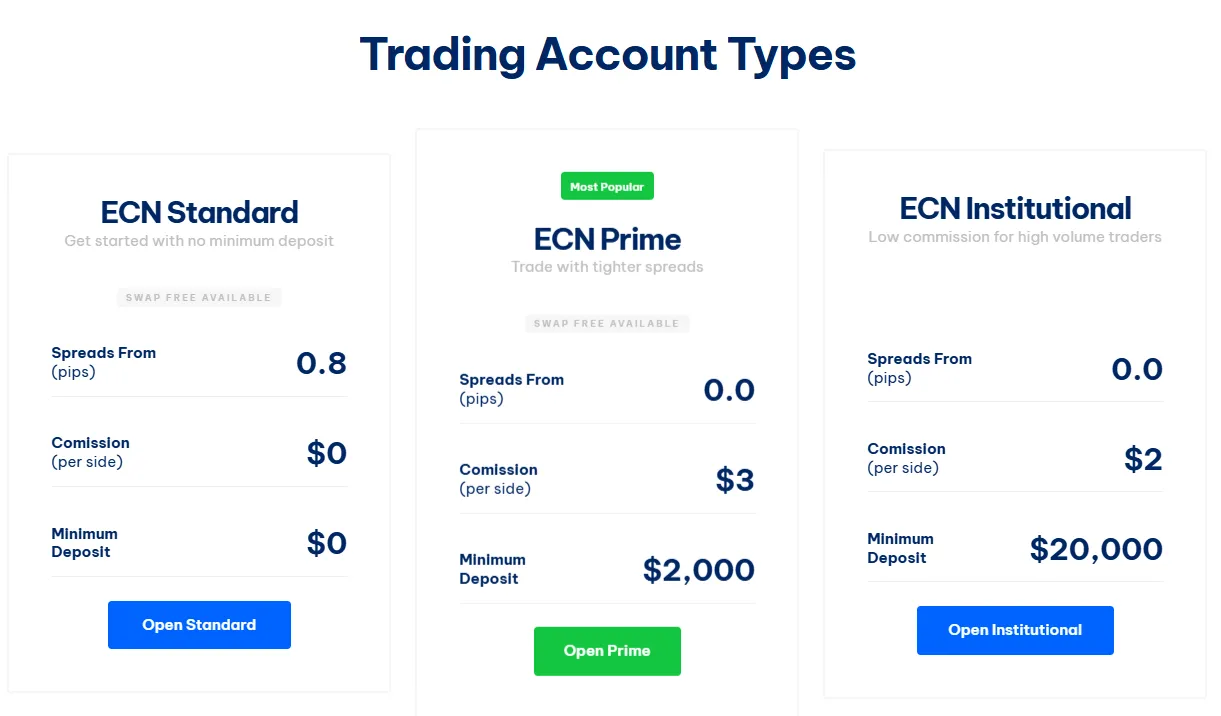

BlackBull offers flexible account types: Standard, Prime, and Institutional, catering to traders from beginners to professional. The Standard account offers zero entry requirements, tight spreads, and no commissions; the Prime account features spreads as low as 0.2 pips and low commissions; and the Institutional account offers customizable trading conditions to meet the needs of high-volume and institutional clients. Leverage up to 1:500, combined with high-speed matching technology and low-latency execution, ensures a competitive trading experience.

🎓Customer support and value-added services

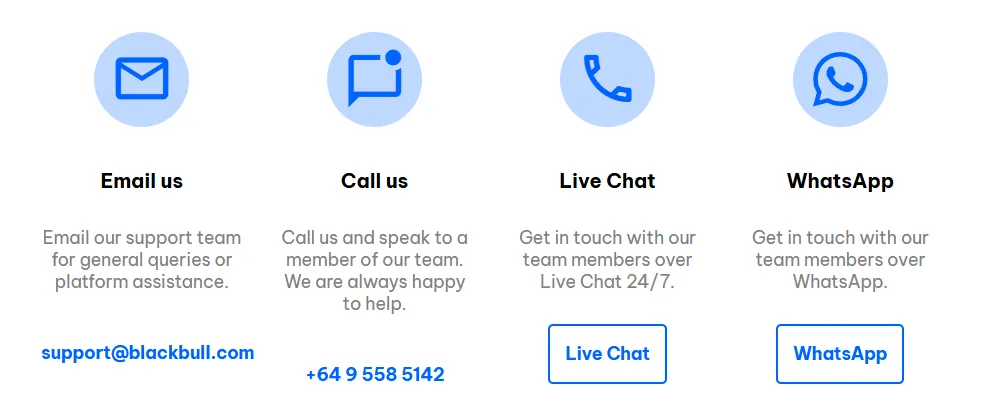

BlackBull offers 24/5 multilingual customer support with professional and efficient response times. It also provides users with educational resources, market analysis reports, and research tools to help traders enhance their knowledge and skills. Prime and Institutional members also benefit from dedicated account managers. These value-added services reflect BlackBull's long-term investment in customer experience and educational empowerment.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading are high-risk investment products that can result in financial loss. BlackBull provides clear risk disclosures on its official website and third-party platforms, reminding investors to understand trading mechanics and assess their risk tolerance before entering the market. Overall, BlackBull is positioned as a comprehensive broker offering "high execution, diversified asset management, and compliance and security," making it a suitable choice for investors who value stability and professional service.

🔍Comprehensive analysis and evaluation

In summary, BlackBull has the following characteristics:

Multiple regulatory safeguards ensure strong fund security;

Wide coverage of trading products, supporting global stocks and mainstream CFDs;

The platform has advanced technology and fast execution speed, making it suitable for high-frequency trading;

Customer service and educational resources are improved, and brand credibility is continuously improving.

As a fast-growing, compliant, and robust international broker, BlackBull Markets demonstrates strong market competitiveness in 2025. For users seeking multi-market trading in a secure, transparent, and highly enforceable environment, BlackBull Markets is a trusted, premium option.

Selected Enterprise Evaluation

3.75

Total 6 commentsBlackBull offers excellent execution speed and transparent pricing. Deposits and withdrawals are smooth, and the platform choice between MT4, MT5, and BlackBull Shares gives a lot of flexibility. Definitely one of the more reliable brokers I’ve used.

Reply

I invested a massive chunk of my capital and savings into the care of this unregulated broker who vividly convinced me into investing more over time. I was told pulling out of the investment is easy and I could make withdrawals. They kept asking for more funds, while using charges and taxes as an excuse. This kept going on for weeks, I couldn't stop because I'd invested over $240,000. Later I told my wife about what I did with all the money. Then, we started to research how to recover the funds. We found an article about Jeff silbert a wealth recovery agent specialist that took up the case. With no further hassle, we were able to recoup 95% of the funds. All thanks to him, I recommend you contact him on email - J𝐞𝐟𝐟𝐬𝐢𝐥𝐢𝐛𝐞𝐫𝐭 𝟑𝟗 𝕒𝕥 gmail cOm or 𝑾𝒉𝒂𝒕𝒔𝒂𝒑𝒑 him +① ⑤ ⓪⑤ .⑤.③ ④ ⓪⑨ ⑨⓪

Reply

Great range of trading products and good customer support. The only downside is the $5 fee per transaction for deposits/withdrawals, but overall the service is professional and trustworthy.

Reply

I thought I was being smart when I joined what looked like a legitimate trading platform. At first, everything seemed perfect — my balance appeared to grow, and the support team responded quickly. But the moment I tried to withdraw even a small amount, everything changed. That’s when I realized I had been deceived. A colleague referred me to MRS SELETINA DE-ALAGRENS, who patiently guided me through every step of the recovery process. Within just a few days, I was stunned to see the funds returned. It truly felt like a second chance to get in contact with: ([email protected])

Reply

After years of unsuccessful attempts to recover my missing funds and falling victim to several fraudulent agents, I was beginning to lose hope. Fortunately, I came across Laura Cooper Terms, and although I was initially skeptical due to my past experiences, I decided to give them a chance. That decision changed everything they provided exceptional service and successfully helped me recover my lost funds, even offering valuable additional support. I highly recommend Laura Cooper Terms as a fast, reliable, and trustworthy recovery company. Resoxit 40 at gmail . c o m WhatsApp: +1 (309) 208-5151

Reply

I can’t remember feeling as powerless as I did when the platform I invested in vanished overnight. No replies, no working phone numbers — just silence. I almost gave up until someone recommended [MRS SELETINA DE-ALAGRENS]. From our first conversation, they explained every step clearly and stayed in constant communication. It took a bit of time, but in the end, I recovered my full balance — something I thought was impossible. To anyone in a similar situation: don’t lose hope.It truly felt like a second chance to get in contact with: ([email protected])

Reply

ανσι∂ тнєѕє ѕ¢αммєяѕ, тнєу тαкє уσυя мσηєу, ρяєтєη∂ тнαт тнєу αяє мαкιηg ρяσƒιтѕ αη∂ єη¢συяαgє уσυ тσ ιηνєѕт уσυя ℓιƒє ѕανιηgѕ. тнєη ωнєη уσυ яєqυєѕт мσηєу вα¢к тнєу ∂ση’т яєтυяη αηутнιηg αη∂ ¢ℓσѕє ∂σωη ємαιℓ α∂∂яєѕѕєѕ. ι ωαѕ ¢σηηє∂. тнαηкѕ ʝєƒƒ ƒσя нєℓριηg мє gєт вα¢к му ℓσѕт мσηєу ƒяσм тнσѕє ѕ¢υмвαgѕ, уσυ ¢αη gєт ιη тσυ¢н ωιтн нιм ƒσя нєℓρ νια /αтѕρρ +1 5 05 .5.3 4 09 90 αιℓ α∂∂яєѕѕ ʝєƒƒѕιℓвєят39 gм8ℓ.¢σм.

Reply

When the platform froze my withdrawals, I hoped it was a temporary glitch — but deep down, I knew I’d been scammed. MRS SELETINA DE-ALAGRENS came highly recommended, and from the very first message, they were professional and straightforward. Within 72 hours, my funds were recovered — no empty promises, just results.Get in contact with her if scammed 📧 ([email protected])

Reply

I recently fell victim to an investment scam broker and lost $70,000. These schemes often begin with a small initial deposit—such as $500—and gradually pressure victims to invest more. Their promises are misleading, and they operate without any real accountability. Although online reviews can be deceptive, I was able to find support from a specialist who assisted me in navigating the recovery process. If you’ve experienced a similar situation, don’t lose hope, you can reach out too Mrs. Email: (dorisashley71@ gmail.com) WhatsApp: +1 (404) 721-56-08 (Note: Always thoroughly verify the legitimacy of any recovery service, as many fraudulent groups pose as “fund recovery experts.”). Above all, conduct careful due diligence before committing to any investment. Your financial security must remain your top priority. Stay cautious and protect yourself.

Reply

Hello everyone. I just want to quickly share my experience, in case it helps someone out there. A few months ago, I fell into an online investment scam that looked very professional. At first, everything seemed fine, but when I tried to withdraw, I realized I had been tricked. It felt horrible. I was embarrassed and honestly didn’t know what to do. That’s when I found MRS SELETINA DE-ALAGRENS. She was calm, professional, and didn’t make any fake promises. She asked for the right documents and kept me updated. Within a few days, I had my money back. I didn’t think it was possible, but it was. So if you’ve been in a similar situation, don’t stay silent — there’s still a way out. [email protected]

Reply

~ There's nothing more ~

About Black Bull Group Ltd's questions

Ask:How do I open an account with BlackBull Markets?

Answer:To open an account with BlackBull Markets, visit their website and click "Open an Account." You will need to provide personal details and submit identity verification documents. After approval, you can start trading.

Ask:What payment methods can I use to deposit and withdraw funds?

Answer:BlackBull Markets supports several payment methods, including bank transfers, credit/debit cards, and electronic wallets like Skrill and Neteller for deposits and withdrawals.