Normal Operation

Normal OperationHugosWay

2-5Year

Basic Information

Country

SeychellesMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provides foreign exchange (Forex), commodities, indices, cryptocurrencies and contracts for difference (CFD) trading, supports the MetaTrader 4 platform, and allows automated trading and scalping.Support Languages

English, FrenchDomain Registration Date

2020-01-01Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

HugosWay is an online forex and contracts for difference (CFD) broker serving a global audience. Headquartered in Saint Vincent and the Grenadines, HugosWay is a relatively recent but rapidly growing broker. The platform primarily offers CFD trading in forex, precious metals, commodities, stock indices, and cryptocurrencies, supporting high leverage and a variety of account types.

HugosWay's core features include "no dealer intervention (ECN/STP) straight-through execution" and low spreads, combined with the MetaTrader 4 (MT4) platform, providing clients with a transparent trading experience. The company also offers Bitcoin as a primary deposit method, lowering the barrier to international capital transfers. Although not regulated by major financial regulators such as the FCA or ASIC, its market-based conditions and trading convenience have attracted investors seeking high leverage and cryptocurrency trading.

🌐Global layout and brand background

As a broker registered in an offshore jurisdiction, HugosWay's business covers Europe, Asia, and selected emerging markets. The brand emphasizes global accessibility, offering clients access to account opening and trading conditions regardless of geographic location.

The industry generally believes that HugosWay's advantages lie in its flexible account opening process and cryptocurrency payment channels, which are attractive to digital asset users. However, its offshore registration background also means higher risks in terms of compliance and fund security, requiring investors to exercise caution.

💹Trading products and services

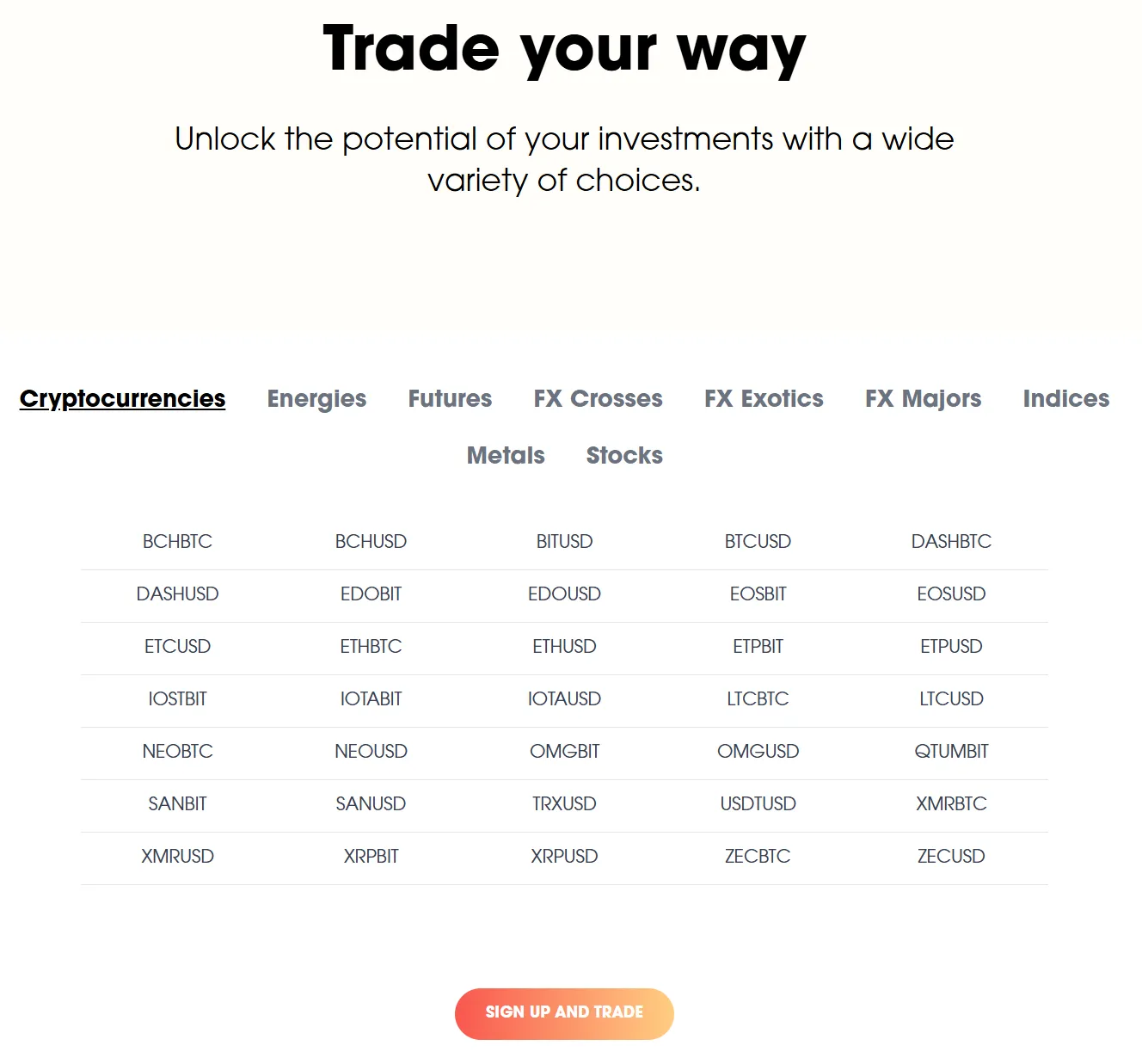

HugosWay offers trading in over 70 forex currency pairs, covering both major and exotic currencies, as well as CFDs on gold, silver, crude oil, stock indices, and well-known stocks. Furthermore, the platform excels in cryptocurrency products, offering CFD trading on a variety of digital assets, including Bitcoin, Ethereum, and Ripple, catering to traders interested in emerging assets.

This diversified product portfolio enables HugosWay to cover the needs of short-term traders, asset diversifiers and cryptocurrency enthusiasts. However, since all products are provided in the form of CFDs, investors need to pay attention to the risks of spreads, overnight fees and liquidity fluctuations.

💻Trading technology and platform experience

HugosWay utilizes MetaTrader 4 (MT4) as its core platform, supporting desktop, web, and mobile platforms, making it suitable for trading in various scenarios. MT4 is widely recognized for its ease of use, support for EA automation, and stability, making it particularly suitable for users accustomed to quantitative strategies and short-term trading.

Regarding execution, HugosWay claims to utilize an ECN straight-through model with spreads starting from 0.0, combined with high-speed execution servers, making it suitable for high-frequency and scalping trading. However, some user reviews indicate that its execution stability and liquidity depth can vary in extreme market conditions.

🛡️Regulatory compliance and fund security

HugosWay is registered in Saint Vincent and the Grenadines and is not currently regulated by major financial regulators such as the UK's FCA, Australia's ASIC, or Cyprus' CySEC. This means that investor protection relies primarily on the platform's own governance, rather than third-party regulatory frameworks.

The platform claims to implement client fund segregation and negative balance protection, but the lack of endorsement from a reputable regulatory body raises questions about the credibility of these promises. In risk ratings, HugosWay is often considered a high-risk platform, suitable for traders with a high risk appetite rather than conservative investors seeking long-term financial security.

⚡Trading conditions and experience

HugosWay offers leverage options up to 1:500, spreads starting from 0.0, and supports a variety of order types. These conditions are attractive to users seeking low transaction costs and high leverage. However, high leverage also means increased risk. If the market fluctuates drastically, investors may face significant losses in a short period of time.

From a fee perspective, HugosWay's commission-based + low spread model is attractive to high-frequency and professional traders. However, for novice users, understanding margin and risk control mechanisms is particularly important.

🎓Customer support and value-added services

HugosWay offers 24/7 customer support, primarily responding to user questions via live chat and email. Its educational resources are relatively limited, primarily consisting of basic trading guides and FAQs, which falls short of the seminars and research reports offered by established brokers.

For investors who rely on self-study and existing trading experience, this level of service is basically sufficient, but for completely novice investors, the platform may lack education and research support.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading are high-risk, highly leveraged investments that can result in the loss of all funds. HugosWay's risk disclosure on its website clearly warns users to use leverage with caution and points out that trading may not be suitable for everyone.

From the perspective of platform positioning, HugosWay is more suitable for investors who pursue high leverage, low costs and cryptocurrency transactions. However, for users who value regulatory compliance and fund security, its offshore registration and lack of authoritative supervision are significant disadvantages.

🔍Comprehensive analysis and evaluation

In general, the main features of HugosWay include:

Registered in an offshore area, lacking mainstream financial regulatory endorsement;

The product line covers a wide range, especially in cryptocurrency CFDs;

Supports MT4 platform, with flexible execution conditions, suitable for high-frequency and EA trading;

High leverage and low spreads attract investors with high risk appetite, but there are obvious risks to fund security.

As an offshore broker serving global investors, HugosWay's appeal lies in its relaxed trading conditions and diverse product offerings. However, the risks include a lack of regulation and insufficient fund security. While it may be a good option for those seeking short-term, high-risk returns, investors seeking long-term trading in a compliant, secure environment should exercise caution.

Selected Enterprise Evaluation

1.00

Total 2 commentsAfter years of unsuccessful attempts to recover my missing funds and falling victim to several fraudulent agents, I was beginning to lose hope. Fortunately, I came across Laura Cooper Terms, and although I was initially skeptical due to my past experiences, I decided to give them a chance. That decision changed everything they provided exceptional service and successfully helped me recover my lost funds, even offering valuable additional support. I highly recommend Laura Cooper Terms as a fast, reliable, and trustworthy recovery company. Resoxit 40 at gmail . c o m WhatsApp: +1 (309) 208-5151

Reply

Had a bad experience regarding investing my funds here, wasn’t easy for me as I was scam severally. I lost almost all of my money until I came across a recovery expert named Barry white. He help and assisted me and helped in terms of recovery my funds . I got my funds recovered in just 4 days with just little effort. I will highly recommend Barry, he is sincere and honest in all way round he helped me got everything i lost. Contact him now if you need his help Email [email protected]

Reply

~ There's nothing more ~