BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX Suspected of fraud

Suspected of fraudTime:5-10Year

| Company

Company Regulatory

Regulatory Risk Monitor

Risk Monitor Download

Download Documents

DocumentsLMFX Markets (LMFX Markets) is an online broker that claims to offer foreign exchange (forex) and contracts for difference (CFD) trading services. According to its website, the company offers clients access to a variety of financial derivatives, including currency pairs, indices, commodities, metals, and energy.

However, unlike licensed brokers in the industry, which are overseen by authoritative regulatory bodies, LMFX is not licensed by major regulatory bodies in Europe, the US, or Asia-Pacific (such as the FCA, ASIC, and CySEC). Its operating entities are primarily registered in offshore jurisdictions, lacking effective investor protection mechanisms. Due to the lack of transparent compliance information and third-party endorsements, LMFX is generally considered to carry a high risk within the industry, and investors should exercise extreme caution when choosing it.

LMFX claims to provide online trading services to clients worldwide and boasts multilingual and multi-regional support for investors. However, due to its failure to obtain licenses in major financial centers, its so-called "internationalization" remains more than just publicity.

From a brand perspective, LMFX's visibility is far lower than that of established, compliant brokers. Its long-standing lack of public capital and parent company support has weakened its market credibility, making it difficult for investors to verify its long-term sustainability. This opaque background has created significant uncertainty for its brand image.

LMFX offers common CFDs, including forex, commodities, stock indices, and precious metals. Some account types advertise low spreads and flexible leverage. However, investor feedback indicates that actual transaction costs differ from the platform's advertised costs, with some cases experiencing significant slippage, widened spreads, and delayed order execution.

Compared with regulated platforms, LMFX's products lack transparency, especially in terms of capital flow and spread execution. There is a lack of independent auditing and external verification, making it difficult for investors to ensure a real trading environment.

LMFX uses the popular MetaTrader 4 (MT4) platform, offering both desktop and mobile access. However, user reviews have often raised concerns about platform stability and execution speed. During periods of high market volatility, investors have reported significant order slippage, and in some cases, even experienced difficulty closing positions.

Although it appears to be consistent with industry standard platforms, due to the lack of supervision from authoritative institutions, it remains questionable whether LMFX's technical environment is truly fair and transparent, making it difficult to guarantee investor rights.

The biggest risk of LMFX lies in its lack of authoritative regulation. The company is not licensed by mainstream European and American financial markets (such as the UK's FCA, Australia's ASIC, or Cyprus' CySEC), and is registered in a high-risk offshore jurisdiction. This means that investor funds are not protected by any authoritative regulatory body.

Furthermore, its client funds segregation system has not been independently verified. If the company encounters operational risks or funding issues, investors may face difficulty in recovering their funds. This opaque compliance environment has resulted in it being ranked as high-risk in the risk ratings of multiple third-party platforms.

LMFX advertises high leverage (up to 1:1000) and tight spreads on its website. However, while high leverage can amplify profits, it also significantly increases investors' risk of loss. Due to the lack of regulatory oversight, these advertised conditions lack real guarantees.

Some users reported relatively smooth deposits, but frequent delays or even non-availability of withdrawals. This situation has heightened investors' concerns about the security of their funds and highlighted the risks inherent in the lack of transparent oversight.

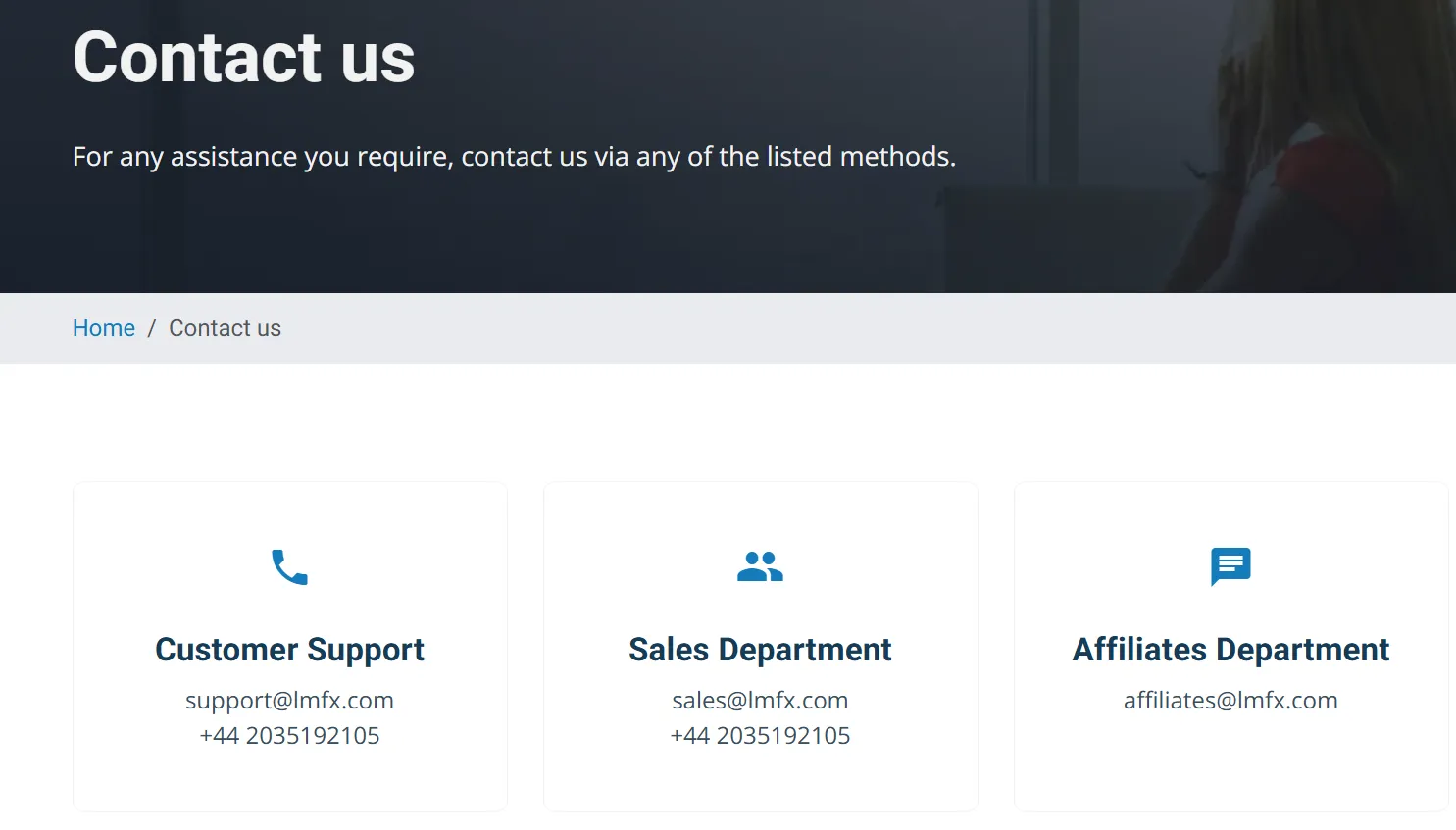

LMFX offers 24/5 online customer service and multilingual support, but investor reviews have been mixed. Some clients report that customer service is responsive before deposits, but often evades responsibility or lacks substantive solutions when it comes to withdrawal disputes or funding delays.

Its so-called educational resources and market analysis are mostly basic content, lacking depth and professionalism, and are more marketing-oriented rather than truly helping investors improve their trading skills.

Forex and CFD trading are inherently high-risk investments, and LMFX's lack of authoritative oversight and financial security makes the risks significantly higher than those of regulated platforms. Investors may not only suffer losses from market fluctuations, but also face the possibility of losing their principal due to the platform's opaque operations and financial risks.

From the perspective of positioning, LMFX is more like a typical high-risk offshore broker and is not suitable for investors seeking a safe and compliant trading environment.

In summary, LMFX has the following prominent problems:

Lack of mainstream authoritative supervision, and financial security is not guaranteed;

The brand background is not transparent and lacks long-term credibility;

Transaction costs and execution quality do not match the hype;

Problems frequently occur in the withdrawal process, and user reputation is severely divided.

Therefore, LMFX is considered a high-risk offshore broker and investment is not recommended. Investors who prioritize fund security and long-term trading experience should prioritize compliant platforms with authoritative regulatory bodies such as the FCA, ASIC, and CySEC, and robust fund segregation systems, and avoid taking risks with high-risk, unregulated brokers.

Answer:No, LMFX is not licensed by mainstream financial regulators like the UK's FCA, Australia's ASIC, or Cyprus' CySEC. Its registration is in an offshore jurisdiction, lacking transparent compliance oversight. This means client funds lack the protection of authoritative institutions, making it difficult for investors to protect their rights in the event of disputes or platform risks.

Answer:LMFX advertises leverage of up to 1:1000 and tight spreads, which may seem attractive, but are in fact extremely risky. Some users report relatively smooth deposits, but withdrawals often experience delays or even non-receipts. These situations highlight significant risks in the platform's fund management and commitment to delivering on its promises.

Answer:Not suitable. LMFX lacks regulation, offers no guarantees on fund security, and suffers from a highly mixed reputation for customer support, making its overall risk significantly higher than that of industry-compliant platforms. LMFX is not a suitable choice for beginners or those seeking long-term, stable investment. Investors should prioritize reputable brokers with robust fund segregation and regulatory oversight.

Although the platform provides MT4 access and high leverage, the absence of trusted oversight and inconsistent customer support make LMFX unsuitable for long-term or beginner traders.

![]() Reply

Reply

LMFX offers a wide range of forex and CFD products, but the lack of recognized regulation raises serious concerns. Many traders report delays in withdrawals, making it a high-risk choice for investors.

![]() Reply

Reply

I was scammed by a fake trading site and lost access to my funds. Thankfully, Mrs. Bruce Nora, a true recovery expert, helped me get everything back. Her professionalism and dedication were outstanding. Highly recommended! Email: bruce nora2 54(@)gmail. com | .web, trazevault.org

![]() Reply

Reply

After falling victim to a fraudulent broker who locked me out of my account and ignored my attempts to contact them, I was left feeling helpless. In my search for help, I found Mrs. Bruce Nora, a skilled fund recovery expert. She took the time to thoroughly review my case, communicated clearly every step of the way, and successfully helped me recover my lost funds. Her professionalism and dedication were outstanding. If you're facing a similar issue, I highly recommend contacting her. Email: bruce nora2 54(@)gmail. com | .web, trazevault.org

![]() Reply

Reply

~ There's nothing more ~