Normal Operation

Normal OperationBDSwiss

10+Year

Basic Information

Country

SeychellesMarket Type

foreign exchangeEnterprise Type

BrokerageService

Financial Products: Foreign Exchange (Forex), Contracts for Difference (CFDs), Stocks, Commodities, Indices, Cryptocurrencies, etc. Trading Platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), BDSwiss WebTrader, BDSwiss Mobile App Account Types: Standard Account, ECN Account, Zero Spread Account, etc. Customer Support: 24/5 multilingual support is available via phone, email, and online chat.Support Languages

English, Chinese, Portuguese, Spanish, French and other languages.Domain Registration Date

2013-09-06Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

Founded in 2012 and headquartered in Zug, Switzerland, BDSwiss is a leading broker in the global foreign exchange (forex) and Contracts for Difference (CFD) industries. As a diversified financial services provider, BDSwiss offers a wide range of trading products to retail and institutional clients, including forex, precious metals, commodities, stock indices, stock CFDs, and cryptocurrency CFDs.

Leveraging advanced trading technology and a robust operational model, BDSwiss has amassed a substantial global client base. The company prioritizes user experience, catering to diverse trading styles through platforms such as MT4, MT5, and its proprietary WebTrader platform, while also providing investors with a transparent and efficient trading execution environment. BDSwiss is regulated by multiple regulatory bodies, including CySEC in Cyprus and the FSC in Mauritius, ensuring regulatory compliance and fund security.

🌐Global layout and brand background

Headquartered in Switzerland, BDSwiss maintains offices and operations teams across Europe, Asia, and the Middle East, serving over millions of registered clients. Leveraging its regulatory compliance and multilingual support, BDSwiss has established a strong brand reputation in the international market. Its "global presence + localized service" model ensures its continued viability amidst intense market competition.

💹Trading products and services

BDSwiss' product line covers foreign exchange currency pairs, precious metals, energy, indices, stock CFDs and cryptocurrency CFDs, and can meet investment needs from traditional finance to emerging digital assets.

Foreign exchange: low spreads and high liquidity, suitable for short-term traders.

Precious metals and commodities: provide options for asset allocation and hedging needs.

Stock and Index CFDs: Allow investors to track global stock market performance.

Cryptocurrency CFD: Covers mainstream digital currencies and caters to investors with high risk appetite.

💻Trading technology and platform experience

BDSwiss supports multi-platform trading, including MT4, MT5 and the independently developed WebTrader.

MT4/MT5: Suitable for users who rely on EA and automated trading.

WebTrader: With a simple interface and intuitive functions, it is especially suitable for novice investors.

Stable order execution speed, coupled with a transparent pricing model, enhances the overall trading experience. BDSwiss also offers a mobile app, allowing investors to stay informed about market trends anytime, anywhere.

🛡️Regulatory compliance and fund security

BDSwiss is regulated by several leading regulatory bodies, including:

Cyprus Securities and Exchange Commission (CySEC)

Financial Services Commission (FSC) of Mauritius

Local licenses in other regions

The company implements a client funds segregation policy, ensuring that client funds are kept independently in regulated bank accounts. This compliance and fund protection system builds a higher level of trust for investors.

⚡Trading conditions and experience

BDSwiss provides users with flexible trading conditions, including:

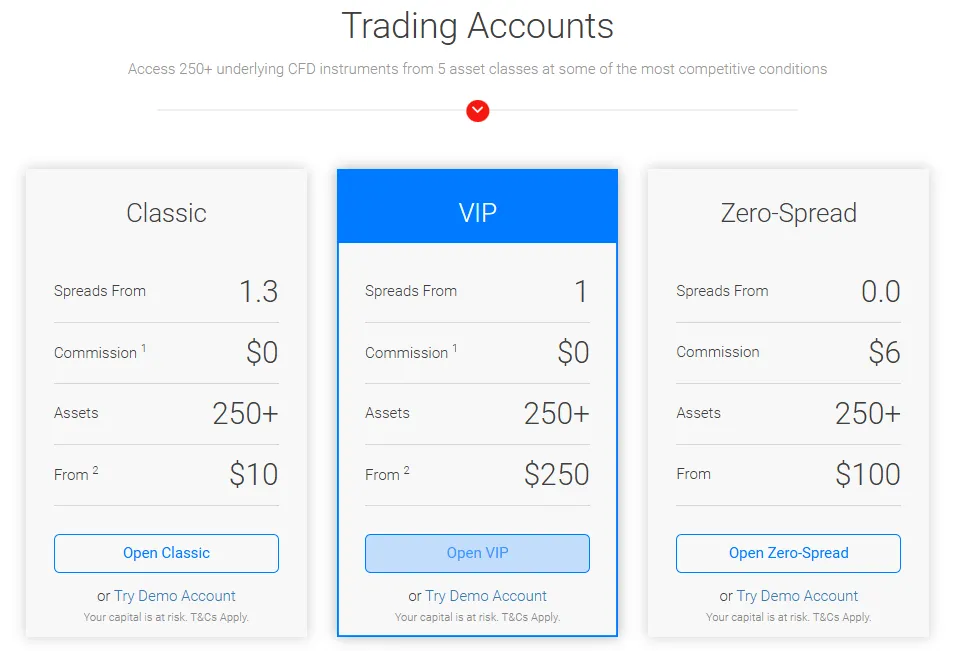

Spreads are competitive, and some account types offer ultra-low spreads.

Leverage settings vary depending on regional regulations and can be as high as 1:500.

We offer a variety of account types to meet the different needs of novice and professional traders.

🎓Customer support and value-added services

BDSwiss provides 24/7 multilingual customer support, and its response speed and professionalism are well-regarded in the industry.

In addition, the platform also provides investors with:

Market Analysis Report

Webinars and video tutorials

Trading strategy training

These educational and value-added services not only help novices get started quickly, but also provide advanced references for experienced traders.

⚠️Risk Warning and Platform Positioning

BDSwiss has clear risk disclosures on its official website and platform, reminding investors that foreign exchange and CFD trading are high-risk investments that may result in financial losses.

Overall, BDSwiss’ market positioning is: it is suitable for traditional investors who value compliance and security, while also providing a richer range of products and tool support for enterprising traders.

🔍Comprehensive analysis and evaluation

In summary, BDSwiss has the following advantages:

Multi-regional supervision ensures compliance and security

Comprehensive product coverage to meet diversified investment needs

The platform is stable and the trading experience is better

Focus on customer education and long-term service

As an international broker, BDSwiss continuously strives for service optimization based on stability and compliance. It is suitable for users who want to conduct multi-asset transactions in a secure environment and is one of the most trustworthy foreign exchange and CFD platforms.

Selected Enterprise Evaluation

2.75

Total 2 commentsI was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

When the platform froze my withdrawals, I initially hoped it was just a technical issue—but soon realised I had fallen victim to a scam. Mrs. Doris Ashley came highly recommended, and from our first interaction, she was transparent, professional, and responsive. Within 72 hours, she successfully recovered my funds—delivering exactly what she promised, with no false assurances. Email: (dorisashley71 (@) gmail. c 0 m ) WhatsApps:+1 (404) .-721 . -56 .-08 She’s the only one I personally trust when it comes to financial recovery. Stay safe and protect your money

Reply

~ There's nothing more ~

About BDSwiss's questions

Ask:How can I register a BDSwiss account?

Answer:You can register by clicking the “Open Account” button on the BDSwiss website and completing the registration process.

Ask:How do I verify my BDSwiss account?

Answer:After registering, you'll need to upload identification documents (such as a passport or driver's license) and proof of address (like a bank statement or utility bill) to complete the verification process. Verification typically takes 24 to 48 hours.