BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX

Time: 1Year

| Company

Company Regulatory

Regulatory Risk Monitor

Risk Monitor Software Download

Software Download Documents

Documents~ No data ~

Kudotrade, headquartered in Singapore, claims to have made a name for itself in the global financial services industry through its fintech and professional team. However, external information reveals a lack of transparent data supporting its founding background, actual operational scale, and market reputation. While claiming to offer diversified trading services such as foreign exchange, contracts for difference (CFDs), commodities, and cryptocurrencies, the lack of independent and authoritative regulatory records to verify its compliance makes it difficult for investors to discern authenticity. For the average investor, there is uncertainty about the platform's true business capabilities and operational stability.

Kudotrade portrays a global and innovation-driven brand image on its official website. However, its domain registration information and public profile indicate limited market visibility, lacking positive coverage from mainstream international financial media or industry authorities. While claiming to integrate artificial intelligence and big data analytics to optimize the trading experience, Kudotrade offers no specific technical implementation details or independent third-party evaluations. For new traders, this lack of proven technology and market-proven branding presents significant risks.

The platform claims to cover a variety of asset classes, including forex, CFDs, precious metals, and energy, and provides users with real-time market data, intelligent trading tools, and investment advice. However, its business model and trading targets remain largely promotional, lacking regulatory filings or real trading volume data. For investors who prefer a transparent trading environment and real market liquidity, this information asymmetry may pose operational and fund security risks.

Kudotrade claims to support desktop, web, and mobile trading, offering one-click trading, automated strategies, and real-time chart analysis. However, there is currently no widespread user feedback or third-party trading technology reviews to verify the platform's stability and execution efficiency. For investors who rely on efficient matching and low-latency trading, investing without verification could lead to potential issues such as slippage, lag, and even order execution failure.

While the official website mentions obtaining financial regulatory licenses in multiple jurisdictions, it does not provide verifiable numbers or links to the relevant regulatory bodies. This obfuscation makes it difficult for investors to determine whether the company is truly regulated and significantly increases the difficulty of defending their rights in the event of a financial dispute. For traders who are highly sensitive to the security of their funds, this lack of transparency is a significant warning sign.

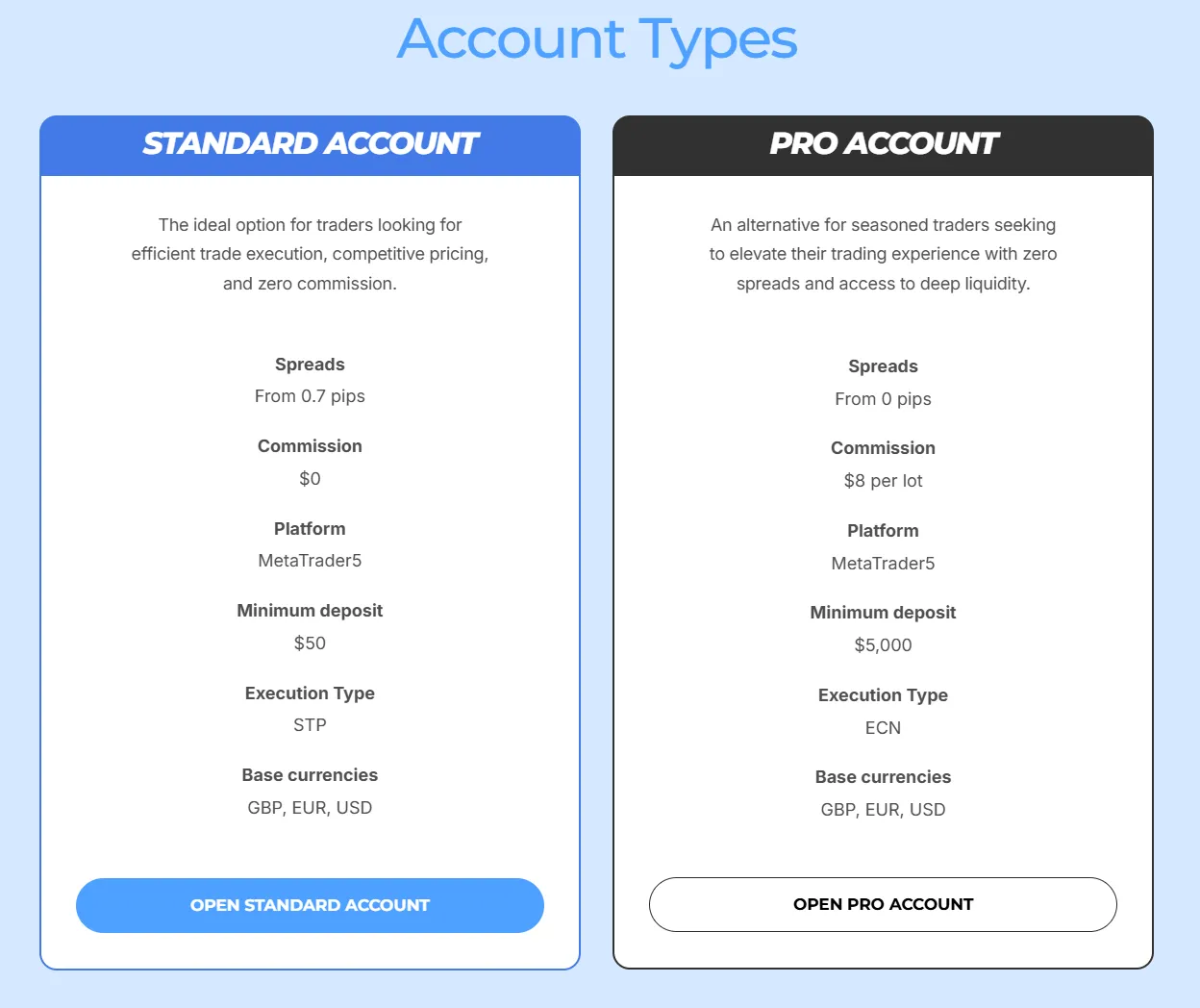

The platform emphasizes low spreads, fast execution, and flexible leverage, but fails to specify specific trading parameters for different account types, asset classes, or regions. While high leverage can lead to high returns, it also magnifies the risk of loss. In the absence of public risk disclosure and independent verification, investors may be lured into high-risk trading environments without realizing it.

Kudotrade claims to offer 24/7 customer support, market analysis, investment training, and other value-added services. However, public online reviews lack substantial positive feedback from real users. Some negative reviews cite unresponsive customer service and inefficient handling of fund-related issues. For investors who rely on timely customer support to address trading anomalies, this can negatively impact their overall trading experience and their sense of financial security.

Overall, Kudotrade's branding is significantly at odds with its verifiable market record. A lack of authoritative regulatory backing, insufficient public financial transparency, and limited user reviews raise questions about its investment security. Investors who prioritize compliance and financial security should exercise extreme caution when choosing this platform and conduct thorough due diligence and risk assessment before investing to avoid unnecessary risk of loss.

Answer:Currently, no verifiable regulatory number or link can be found on Kudotrade's official website, and public information does not indicate that it holds a valid mainstream international financial regulatory license. This means that investors cannot verify its compliance with regulatory authorities, making it difficult to defend their rights in the event of a financial dispute.

Answer:Due to the lack of authoritative regulatory endorsement and clear information on fund segregation and custody, the security of investors' funds is highly uncertain. If the platform encounters technical problems, withdrawal denials, or other disputes, investors may not be able to rely on regulatory intervention to protect their rights.

Answer:For novice investors, choosing a platform that lacks transparent regulatory information and user reputation is risky. While highly leveraged products may offer high returns, they also magnify the risk of losses. New investors are advised to prioritize platforms that are regulated by global authorities, offer transparent fund segregation and custody, and have positive user feedback.