Suspected of fraud

Suspected of fraudFNMarkets Ltd.

1Year

Basic Information

Country

Sao Tome and PrincipeMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provides a variety of trading products such as foreign exchange, commodities, stocks, indices, crypto assets, etc. Multi-asset platform Suitable for retail and institutional traders Support account manager services, including automated trading and crypto wallet functions (as shown in user feedback)Support Languages

English, Français, Simplified ChineseDomain Registration Date

2022-09-16Business Status

Suspected of fraudCompany IntroductionWeb Analytics

Company Introduction

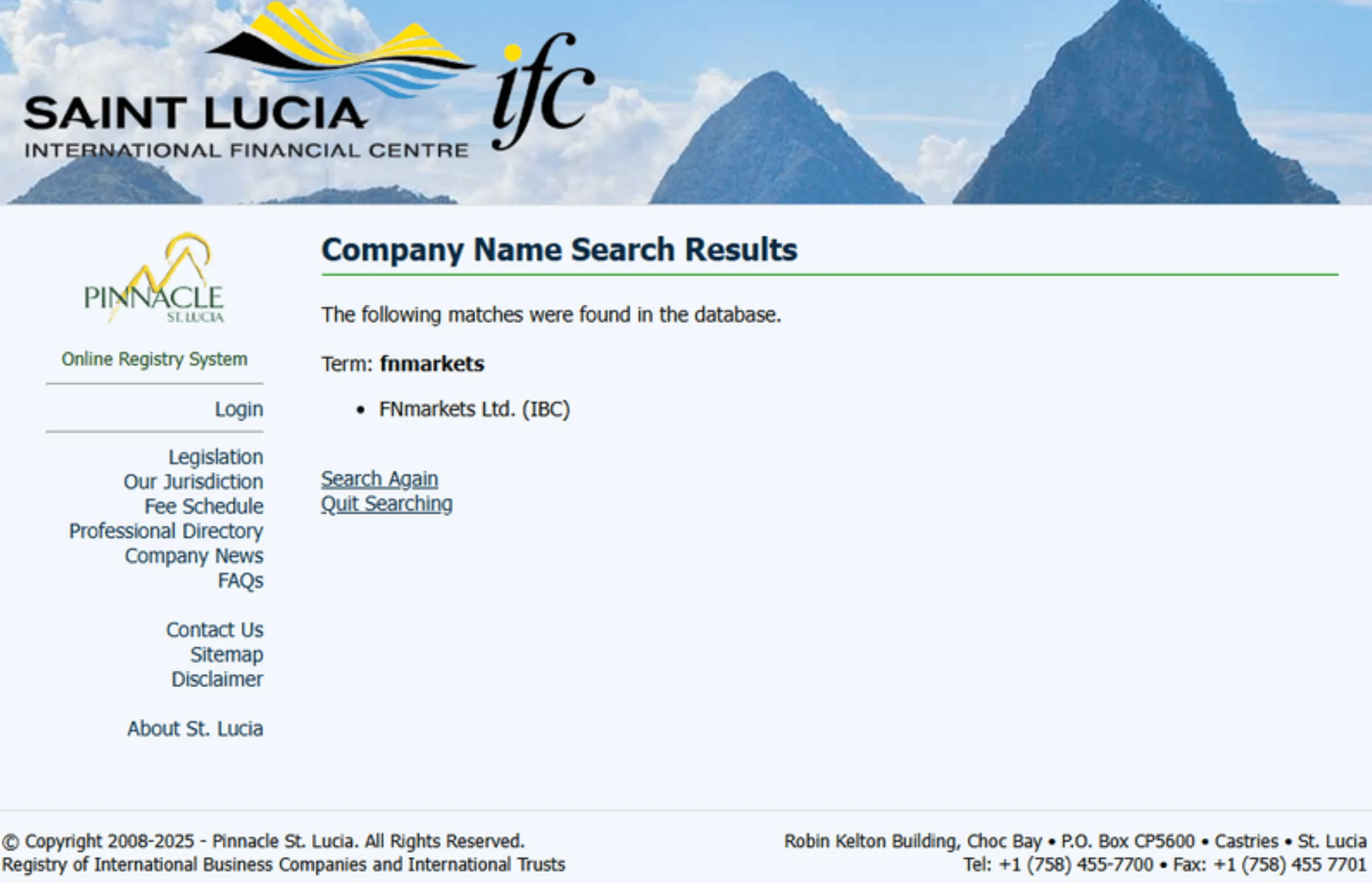

FNmarkets is an online foreign exchange and CFD trading platform that claims to be registered in Saint Lucia and has a "Mwali International Service Bureau" license in the Union of Comoros. Its official website claims that the operating entity is FNmarkets Limited, which supports MetaTrader 5 multi-terminal trading, with an account deposit threshold of only US$50, and payment methods including bank cards, e-wallets and cryptocurrencies, which seem flexible and convenient. However, after in-depth verification, it was found that although the platform has completed the company registration information disclosure in Saint Lucia, it has not filed effective regulatory qualifications with the local Financial Regulatory Authority (FSRA). At the same time, the official website traffic is extremely low, the market activity is almost zero, and there is a lack of brand endorsement and user trust.

🌐 Global layout and brand background

FNmarkets is registered in Saint Lucia and claims to have an office address in Cyprus, but the financial background or work experience of the actual operating team cannot be verified from public channels. The domain name fnmarkets.com was registered on September 16, 2022, and has only been in existence for more than two years. It has frequent update records but no historical credit precipitation. The platform has no positive reports from mainstream financial media or third-party institutions, and its online influence is weak. Semrush data shows that the average monthly visits are less than 100 times, there is almost no stable user base, and the overall brand credibility is extremely low.

💹 Trading Products and Services

FNmarkets offers a limited range of products, mainly covering foreign exchange currency pairs and a small number of index CFDs, and lacks support for commodities, precious metals and diversified derivatives. Trading accounts are divided into three categories: Standard, Raw and Islamic. The deposit threshold is low, and the spread and commission settings are similar to the conventional STP model in the market. However, the platform does not provide a transparent explanation of the actual trading environment, and the order execution quality and liquidity source cannot be verified at all. There is no external liquidity provider or bank custody cooperation information. The so-called "STP" execution model lacks third-party monitoring and confirmation, and there is a risk of high slippage or internal gambling.

💻 Trading technology and platform experience

FNmarkets claims to support MT5 desktop and mobile terminal transactions, and the client can also be downloaded from the official website, but there is no independent verification whether the MT5 server line is truly connected to external market liquidity. Due to the doubts about the overall regulatory qualifications of the platform, even if users trade on MT5, they cannot confirm whether the order enters the real market or only stays in the internal hedging environment. Although the registration logic of the platform's official website is simple, the content of some menu pages is scattered, and there are no basic auxiliary modules such as demo accounts or economic calendars and strategy tools. The experience is very elementary, and the overall technical capabilities and long-term stability are difficult to guarantee.

🛡️ Regulatory compliance and fund security

Although FNmarkets claims to have obtained license number BFX2024210 from the "Mwali International Services Authority" in the Union of Comoros, Comoros is not a mainstream financial regulatory jurisdiction, and such licenses have almost no actual binding force. At the same time, it only completed the registration of an international business company in Saint Lucia, but no effective regulatory record was found in the Saint Lucia Financial Services Regulatory Authority (FSRA). This means that the platform is not subject to any mandatory supervision or fund isolation requirements, and customer funds lack security. Once withdrawals are blocked or disputes occur, investors can hardly protect their rights through formal channels.

⚡ Trading conditions and experience

The trading conditions provided by the platform include superficial benefits such as maximum 1:500 leverage, low spreads and free deposits, but such conditions are often a common marketing strategy used by high-risk platforms that lack supervision. Due to the lack of independent audits or third-party order reports, the platform may refuse users to withdraw profits or adjust trading parameters at any time on the grounds of "abnormal transactions" or "market fluctuations". Some users reported that the withdrawal cycle is unclear, the fee rules are not transparent, and the overall trading environment lacks trust.

🎓 Customer support and real reputation

FNmarkets' official website provides a customer service email and phone number, but it has not opened an official account on mainstream social media, lacking external communication channels. There is very little actual user feedback, and online reputation and community activity are almost zero, making it impossible to verify the authenticity and efficiency of customer service responses. More importantly, once a technical failure or financial dispute occurs, no third-party arbitration or regulatory agency can intervene, resulting in high rights protection costs and low success rates.

⚠️ Risk warning and platform positioning

Overall, although FNmarkets has completed company registration in Saint Lucia and Comoros, it is not equivalent to being effectively supervised by mainstream regulatory agencies. It lacks transparent fund isolation and liquidity disclosure, has a short domain name life, extremely low official website traffic, insufficient brand precipitation, and no educational resources or tool support. Overall, it is more like an offshore registered shell platform in its early stages. For ordinary investors, its potential risks include difficulty in cash withdrawal, order betting, and lack of customer funds. It is recommended to be vigilant.

🔍 Comprehensive analysis and conclusion

The core problems of FNmarkets are the lack of regulatory compliance, insufficient transparency in technology and liquidity, and extremely low brand credit and market activity. Although it provides regular STP accounts and MT5 terminals, it does not have the real strength and security endorsement of an international broker. Compared with established platforms regulated by FCA, ASIC and other authorities, it lacks long-term operation and risk control capabilities. If ordinary traders rashly participate, they are very likely to face information asymmetry and financial risks.

Therefore, FNmarkets has been included in the blacklist of high-risk companies and investors should avoid using it as a trading channel.

Selected Enterprise Evaluation

2.82

Total 11 commentsI unfortunately fell victim to an online investment scam that promised high returns but quickly froze my funds and blocked withdrawals. After extensive research, I came across Mrs. Nora, who had successfully assisted many others in similar situations. I decided to reach out, followed her clear instructions, and provided the necessary details. To my amazement, within 72 hours my funds were fully recovered. If you’ve lost money to online fraud, I highly recommend contacting Mrs. Nora—her professionalism and efficiency are unmatched. Email: bruce.nora254@ gmail.com | WhatsApp: +1 (8 7 0) 810 54 42

Reply

As a victim of a cryptocurrency scam, I understand the frustration and fear that comes with losing significant investments. I was persuaded to invest $188,600 in what turned out to be a bogus platform, and the realization hit hard when I discovered I had been scammed. It felt like I had lost everything, especially since this was my life savings. However, after nearly losing hope, a friend recommended a service called MRS SELETINA DE-ALAGRENS , and I decided to give it a try. Thanks to their expertise and dedication, I was able to recover my funds in just 42 hours. If you find yourself in a similar situation, I highly recommend reaching out to professionals with proven success in recovering lost crypto assets. With the right help, there is hope, and you can regain what was taken. Contact on via email: ([email protected])

Reply

Exercise extreme caution when engaging with this website. Deposits are accepted easily, but withdrawals are consistently blocked. My attempts to recover funds for over a week have been unsuccessful, and the so-called “financial manager” became hostile when questioned. Many of the platform’s positive reviews also appear inauthentic. If you encounter similar issues, consider seeking professional chargeback assistance. You may contact Madam Doris at Email: dorisashley71 @ gmail. com or via WhatsApp at +1 .- (404) -.721.-56.-08.

Reply

Hi everyone. the stress, the regret, the silence. I lost nearly $17,300 to what I thought was a legit trading platform. It was hard to accept, and even harder to explain to others. But someone recommended Mrs. Nora to me, and I’m glad I reached out. She handled the case professionally and didn’t judge me at all. She focused on getting results — and she did. I had my funds returned within a few days. If anyone here is going through the same thing, I just want to say: don’t give up too quickly. There’s still hope, and help is out there. brucenora 254 (@) gmail. com | WhatsApp: +1 (8=7=0) 8=1=0-54=42

Reply

Exercise extreme caution when engaging with this website. Deposits are accepted easily, but withdrawals are consistently blocked. My attempts to recover funds for over a week have been unsuccessful, and the so-called “financial manager” became hostile when questioned. Many of the platform’s positive reviews also appear inauthentic. If you encounter similar issues, consider seeking professional chargeback assistance. You may contact Madam Doris at Email: dorisashley71 @ gmail. com or via WhatsApp at +1 .- (404) -.721.-56.-08.

Reply

I had already accepted that my investment was gone for good. But a friend encouraged me to contact MRS SELETINA DE-ALAGRENS. They asked the right questions, helped me stay calm, and showed me it was still possible to recover what I’d lost. Within a few days, the money was back in my account. I’ll always be grateful for that.Get in contact with her if scammed ([email protected])

Reply

I thought I was being smart when I invested in what looked like a professional trading platform. The website was sleek, the support team was responsive at first, and there were even tutorials that seemed legit. Everything was fine for the first few weeks—I even saw my supposed balance growing. But everything changed when I tried to withdraw—even a small amount. That’s when I realised I’d been conned. My stomach dropped, and I felt physically sick. I didn’t know who to tell or what to do. A colleague pointed me to Mrs. Nora, and honestly, I didn’t expect much. I was cautious at first, but she walked me through the process patiently and explained every step. She helped me gather my evidence and submitted everything on my behalf. Within a few days, I was shocked to see the funds returned. I wouldn’t be writing this if it weren’t true. She gave me a second chance when I thought it was all over. bruce.nora 254 (@) gmail . com | trazevault . org

Reply

I had already accepted that my investment was gone for good. But a friend encouraged me to contact MRS SELETINA DE-ALAGRENS. They asked the right questions, helped me stay calm, and showed me it was still possible to recover what I’d lost. Within a few days, the money was back in my account. I’ll always be grateful for that.Get in contact with her if scammed ([email protected])

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

When the platform froze my withdrawals, I hoped it was a temporary glitch — but deep down, I knew I’d been scammed. MRS SELETINA DE-ALAGRENS came highly recommended, and from the very first message, they were professional and straightforward. Within 72 hours, my funds were recovered — no empty promises, just results.Get in contact with her if scammed aHello everyone. I just want to quickly share my experience, in case it helps someone out there. A few months ago, I fell into an online investment scam that looked very professional. At first, everything seemed fine, but when I tried to withdraw, I realized I had been tricked. It felt horrible. I was embarrassed and honestly didn’t know what to do. That’s when I found MRS SELETINA DE-ALAGRENS. She was calm, professional, and didn’t make any fake promises. She asked for the right documents and kept me updated. Within a few days, I had my money back. I didn’t think it was possible, but it was. So if you’ve been in a similar situation, don’t stay silent — there’s still a way out. [email protected]

Reply

I invested a massive chunk of my capital and savings into the care of this unregulated broker who vividly convinced me into investing more over time. I was told pulling out of the investment is easy and I could make withdrawals. They kept asking for more funds, while using charges and taxes as an excuse. This kept going on for weeks, I couldn't stop because I'd invested over $240,000. Later I told my wife about what I did with all the money. Then, we started to research how to recover the funds. We found an article about Jeff silbert a wealth recovery agent specialist that took up the case. With no further hassle, we were able to recoup 95% of the funds. All thanks to him, I recommend you contact him on email - J𝐞𝐟𝐟𝐬𝐢𝐥𝐢𝐛𝐞𝐫𝐭 𝟑𝟗 𝕒𝕥 gmail cOm or 𝑾𝒉𝒂𝒕𝒔𝒂𝒑𝒑 him +① ⑤ ⓪⑤ .⑤.③ ④ ⓪⑨ ⑨⓪

Reply

When the platform froze my withdrawals, I hoped it was a temporary glitch — but deep down, I knew I’d been scammed. MRS SELETINA DE-ALAGRENS came highly recommended, and from the very first message, they were professional and straightforward. Within 72 hours, my funds were recovered — no empty promises, just results.Get in contact with her if scammed 📧 ([email protected])

Reply

Be very cautious when investing. Recovering lost funds or dealing with crypto trading scams can be extremely stressful and frustrating once your money is in the wrong hands. I personally lost over $882,050 while trying to earn extra income through a fraudulent trading company. Fortunately, I was later introduced to Mrs. Susan Kaplan, who works with a reputable recovery firm. With her help, I was able to recover 90% of my total losses, including the profits stolen by these scammers. If you’ve had a similar experience, you can reach out to Mrs. Susan Kaplan: Email: [email protected] WhatsApp: +1 ( 36 0) 310-0351

Reply

I had some trouble withdrawing my funds after trading, and it was quite stressful. (NordevamberCom, Whatsapp: +1 334 679 5376) guided me through the process clearly and professionally, and I was finally able to complete my withdrawal without issue

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

As a victim of a cryptocurrency scam, I understand the frustration and fear that comes with losing significant investments. I was persuaded to invest $188,600 in what turned out to be a bogus platform, and the realization hit hard when I discovered I had been scammed. It felt like I had lost everything, especially since this was my life savings. However, after nearly losing hope, a friend recommended a service called MRS SELETINA DE-ALAGRENS , and I decided to give it a try. Thanks to their expertise and dedication, I was able to recover my funds in just 42 hours. If you find yourself in a similar situation, I highly recommend reaching out to professionals with proven success in recovering lost crypto assets. With the right help, there is hope, and you can regain what was taken. Contact on via email: ([email protected])

Reply

I recently fell victim to an investment scam broker and lost $70,000. These schemes often begin with a small initial deposit—such as $500—and gradually pressure victims to invest more. Their promises are misleading, and they operate without any real accountability. Although online reviews can be deceptive, I was able to find support from a specialist who assisted me in navigating the recovery process. If you’ve experienced a similar situation, don’t lose hope, you can reach out too Mrs. Email: (dorisashley71@ gmail.com) WhatsApp: +1 (404) 721-56-08 (Note: Always thoroughly verify the legitimacy of any recovery service, as many fraudulent groups pose as “fund recovery experts.”). Above all, conduct careful due diligence before committing to any investment. Your financial security must remain your top priority. Stay cautious and protect yourself.

Reply

Load More

About FNMarkets Ltd.'s questions

Ask:Is FNmarkets a legitimate platform? Is the security of funds guaranteed?

Answer:It is not formal, and the funds lack any security. Although FNmarkets has completed company registration in Saint Lucia and claims to hold a license from the Comoros "Mwali International Services Authority", these regions are not mainstream financial regulatory jurisdictions, and such licenses have almost no substantive regulatory constraints. The official website also cannot find effective regulatory records in the Saint Lucia Financial Services Regulatory Authority (FSRA), which is equivalent to no actual supervision. This means that the platform has no mandatory fund isolation, no compensation fund or legal arbitration mechanism. Once withdrawals are blocked or disputes occur, users can hardly protect their rights through formal channels.

Ask:Is the trading environment of the platform reliable? Is it really connected to market liquidity?

Answer:The trading environment has very low transparency and its authenticity is questionable. The MT5 trading terminal provided by FNmarkets cannot verify whether it is truly connected to external market liquidity, and may only remain in the "betting" or virtual matching environment within the platform. The platform lacks disclosure and independent auditing of third-party liquidity providers, and users cannot confirm the authenticity of order execution. Some users reported that the withdrawal cycle is unclear, the handling fee rules change arbitrarily, and the profit withdrawal may be refused on the grounds of "abnormal transactions" and "market fluctuations".

Ask:What is the reputation of this platform? Can users protect their rights if they encounter problems?

Answer:The reputation is extremely poor and there is almost no channel for rights protection. The traffic of FNmarkets official website is extremely low. According to Semrush data, the average monthly visits are less than 100 times. The market activity is close to zero. There is no positive evaluation from any mainstream financial media or community. The official website only provides email and telephone customer service, and lacks social media or public communication channels. If users encounter technical failures or financial problems, there is no third-party supervision or arbitration intervention, and the cost of rights protection is high and the success rate is extremely low.