Normal Operation

Normal OperationTranslinks

2Year

Basic Information

Country

AmericaMarket Type

foreign exchange|Stock|Futures|CFDEnterprise Type

BrokerageService

Forex, commodities, stocks, indices and other CFD trading servicesSupport Languages

Chinese, EnglishDomain Registration Date

2025-07-16Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

Translinks is a comprehensive fintech platform serving the global market, dedicated to providing users with multi-asset class trading solutions and investor education services through technology. According to its official website, Translinks aims to build an ecosystem integrating a trading platform, investment research content, educational resources, and global financial information, helping investors of all levels improve their trading efficiency and understanding. The platform's core philosophy focuses on "technology-driven financial inclusion," striving to lower investment barriers, simplify trading processes, and empower users to make more informed decisions through intelligent tools.

Translinks offers products covering mainstream financial assets such as forex, indices, commodities, ETFs, stocks, and funds, suitable for diversified investment strategies and portfolio management. The platform integrates mainstream global trading terminals such as MT5, supplemented by its proprietary FlashTrader plug-in and intelligent investment research tools to enhance order execution efficiency and strategy development capabilities. Furthermore, Translinks has launched an investor growth path system, providing systematic educational courses and research reports from beginners to practical strategies, ensuring a complete closed-loop from learning to trading.

🌐 Global layout and brand background

Translinks, registered in Aurora, Colorado, USA, positions itself as a "global unified platform" and aims to provide standardized investment research services and trading tools to users worldwide. Currently, the platform primarily provides information and services to users globally through its official website and has not yet disclosed information about its overseas branches or multi-location operations.

From a brand positioning perspective, Translinks is committed to building a converged "content + trading" ecosystem, driving trade execution through education, strategy, and real-time market information. Its Global Investment Research Map, Content Knowledge Base, and Strategy Center modules demonstrate the brand's strategic direction of connecting users with global financial market insights, with a particular emphasis on strengthening users' long-term investment capabilities through structured learning.

💹 Trading Products and Services

Translinks offers trading products across a diverse range of asset classes, including foreign exchange currency pairs, major global indices, commodities, ETFs, stocks, and funds. The platform provides users with leveraged trading opportunities through Contracts for Difference (CFDs), allowing investors to flexibly participate in the ups and downs of global financial markets. Popular digital assets such as Bitcoin and Ethereum are also included in the trading system, along with accompanying market updates and strategic content to cater to users interested in emerging markets.

In addition to trading products, Translinks also offers a wealth of strategic reference and educational resources, including real-time market updates, economic data interpretation, daily trading insights, and other modules, supporting users with an integrated investment experience from information acquisition to strategy formulation.

💻 Trading technology and platform experience

Translinks supports the MetaTrader 5 platform and offers a stable trading environment via both web and mobile platforms. To enhance execution efficiency and strategy practicality, the platform also features the FlashTrader smart plug-in, which includes built-in features such as one-click trading, order management, and stop-loss and take-profit presets.

Translinks is also actively developing AI-powered calendars, strategy backtesting tools, and trading signal systems to provide traders with more intelligent decision-making support. The overall interface design is simple, and the technical structure is suitable for both novice and intermediate users, meeting both manual and partial automation needs.

🛡️ Regulatory compliance and fund security

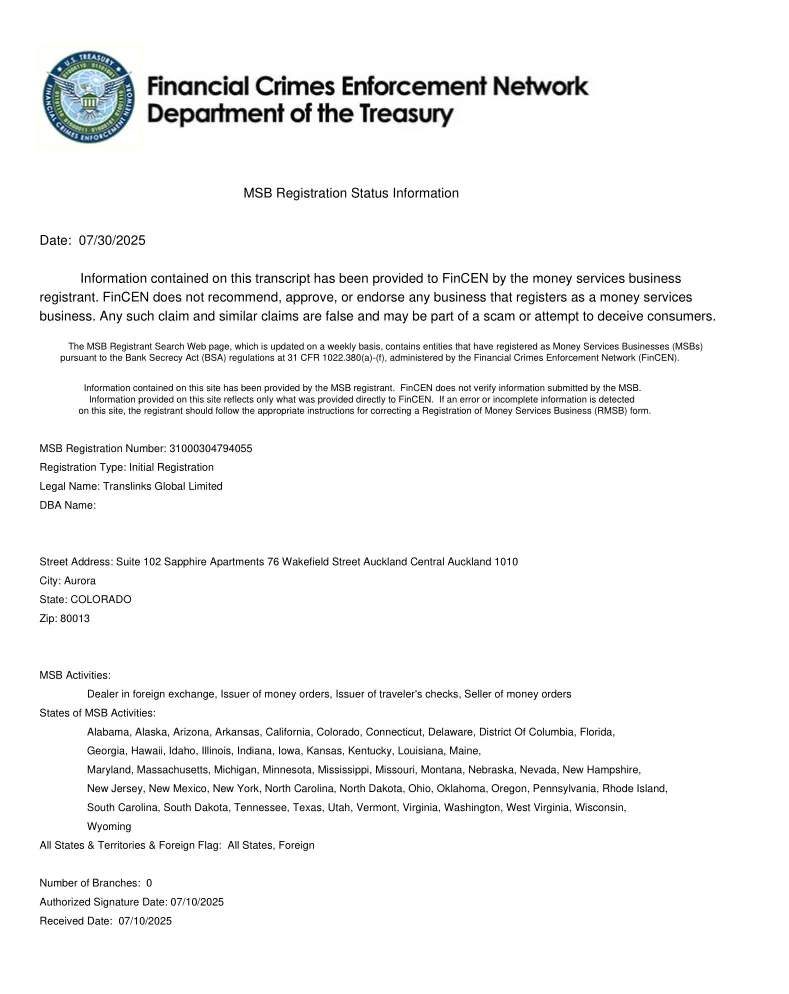

Translinks' registered entity is Translinks Global Limited, with its registered address in Aurora, Colorado, USA, and its office address at Suite 102 Sapphire Apartments, 76 Wakefield Street, Auckland Central, New Zealand. According to an official FinCEN filing dated July 30, 2025, Translinks is registered as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN), registration number 31000304794055.

Its registered business scope includes foreign exchange transactions, traveler's check issuance, money order sales, and other services, operating in all 50 U.S. states and overseas territories. This registration verifies that Translinks has obtained the legal qualification to provide relevant financial services in the United States.

Although the company has obtained an MSB regulatory number, its official website currently does not clearly display details such as its segregated custody mechanism for client funds, third-party fund custodian arrangements, or compensation protection plan. Investors are advised to confirm the fund security plan before trading, especially when considering large transactions, to ensure that the fund protection level is in place.

⚡ Trading conditions and experience

Translinks' official website doesn't detail core trading parameters like account types, spread structures, leverage levels, or minimum deposit requirements. Instead, it emphasizes "high liquidity," "low latency execution," and "full-range trading support" in its marketing slogans. Users should register an account or contact customer service for detailed trading conditions.

Due to the lack of clear disclosure of matching mechanisms (such as STP, ECN, and market maker models), it is currently impossible to determine whether they provide real market quotes and deep liquidity support. Investors are advised to fully test the trading experience in a demo account before deciding whether to trade live.

🎓 Customer Support and Value-Added Services

Translinks offers basic multilingual customer support. Its official website features a "Help Center," "Educational Courses," and "Strategy Center," offering structured learning paths for users of varying skill levels. The platform divides investor education into three levels: beginner, intermediate, and advanced. Content covers topics such as candlestick analysis, technical indicators, trading discipline, and psychological management.

In addition, the platform pushes out market news and opinion articles every week, and plans to carry out live courses and strategy discussion activities. The overall education system is more inclined to the teaching concept of "cognition-driven trading" and is suitable for traders who prefer self-improvement.

⚠️ Risk Warning and Platform Positioning

Translinks features risk warnings on multiple pages, emphasizing that forex and CFD trading carries a high level of risk and that users may face the possibility of total loss of funds. However, overall, the platform's risk disclosures still need improvement, particularly regarding trading leverage, margin call mechanisms, and forced liquidation conditions. A comprehensive and transparent information system is still lacking.

In terms of product design and content structure, Translinks is more inclined to build a content-based financial platform that integrates trading tools and educational resources, targeting investors seeking steady learning and initial market participation. For users with larger capital volumes or stricter compliance requirements, the platform still has room for improvement, especially in terms of fund security and risk control mechanisms.

🔍 Comprehensive analysis and evaluation

Translinks is a FinCEN MSB-registered fintech platform in the US, ensuring it meets the basic regulatory requirements for engaging in foreign exchange and money services business. The platform offers a diverse product offering, a modern interface, and comprehensive educational content, ideal for beginners and intermediate users to gradually build their trading skills.

However, it currently has low visibility on mainstream review platforms. Trustpilot has only one 5-star review, ScamAdvisor gives it a low trust score, and professional communities like Forex Peace Army and Myfxbook have yet to offer any discussion or feedback. Its transparency and user reputation need improvement.

Initially, users are advised to test the platform's functionality with a small amount of capital to further verify transaction execution, customer service response, and fund security mechanisms. Until regulatory oversight continues and user reviews accumulate, the platform is more suitable as a learning aid and a light trading platform.

Selected Enterprise Evaluation

2.25

Total 2 commentsI’m so grateful for the excellent assistance I received in recovering my lost item. I had almost given up hope, but thanks to their quick response, professionalism, and attention to detail, I was able to get my belongings back safely. Their communication was clear throughout the process, and I truly appreciate the effort they put in to help me. Highly recommended! Mail: olivetraderecover 5 5 A t g mail.c0m Website: https://iconicrecovery.org

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

~ There's nothing more ~

About Translinks's questions

Ask:Is Translinks a licensed organisation? Is it regulated?

Answer:Yes, Translinks' registered entity is Translinks Global Limited, which was registered in the US on July 10, 2025, and obtained an MSB (Money Services Business) regulatory license from FinCEN (the US Financial Crimes Enforcement Network) with registration number 31000304794055. This means that it is legally qualified to engage in foreign exchange and money transmission services within the US. However, it should be noted that this license does not constitute securities trading regulation, and investors should still pay attention to its fund protection mechanisms and risk disclosures.

Ask:What trading products does Translinks offer? What type of investors are suitable for it?

Answer:Translinks offers a diverse range of trading products, including forex, indices, commodities, ETFs, stocks, and funds. It supports market exposure through CFDs (Contracts for Difference) and covers some major crypto assets such as Bitcoin and Ethereum. The platform also offers educational courses, strategy research, and real-time data services, making it ideal for novice and intermediate investors looking to gradually establish a trading system based on regulatory compliance.

Ask:Are funds on the Translinks platform safe? What safeguards are in place?

Answer:Translinks has completed US MSB registration and possesses basic regulatory compliance qualifications. However, its official website currently does not disclose key details such as fund segregation, custodian banks, or investor compensation mechanisms. Before engaging in live trading, investors are advised to conduct a small-scale test to verify the platform's deposit and withdrawal procedures, customer service response speed, and account risk control mechanisms to ensure the security of their funds.