Normal Operation

Normal OperationMoneta Markets

5-10Year

Basic Information

Country

South AfricaMarket Type

foreign exchange|Stock|Futures|Crypto|CFDEnterprise Type

BrokerageService

Forex, Stocks, Indices, Commodities and ETFsSupport Languages

Chinese, English, French, German, Spanish, Portuguese, Russian, Korean, Indonesian, Malay, VietnameseDomain Registration Date

2018-07-18Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

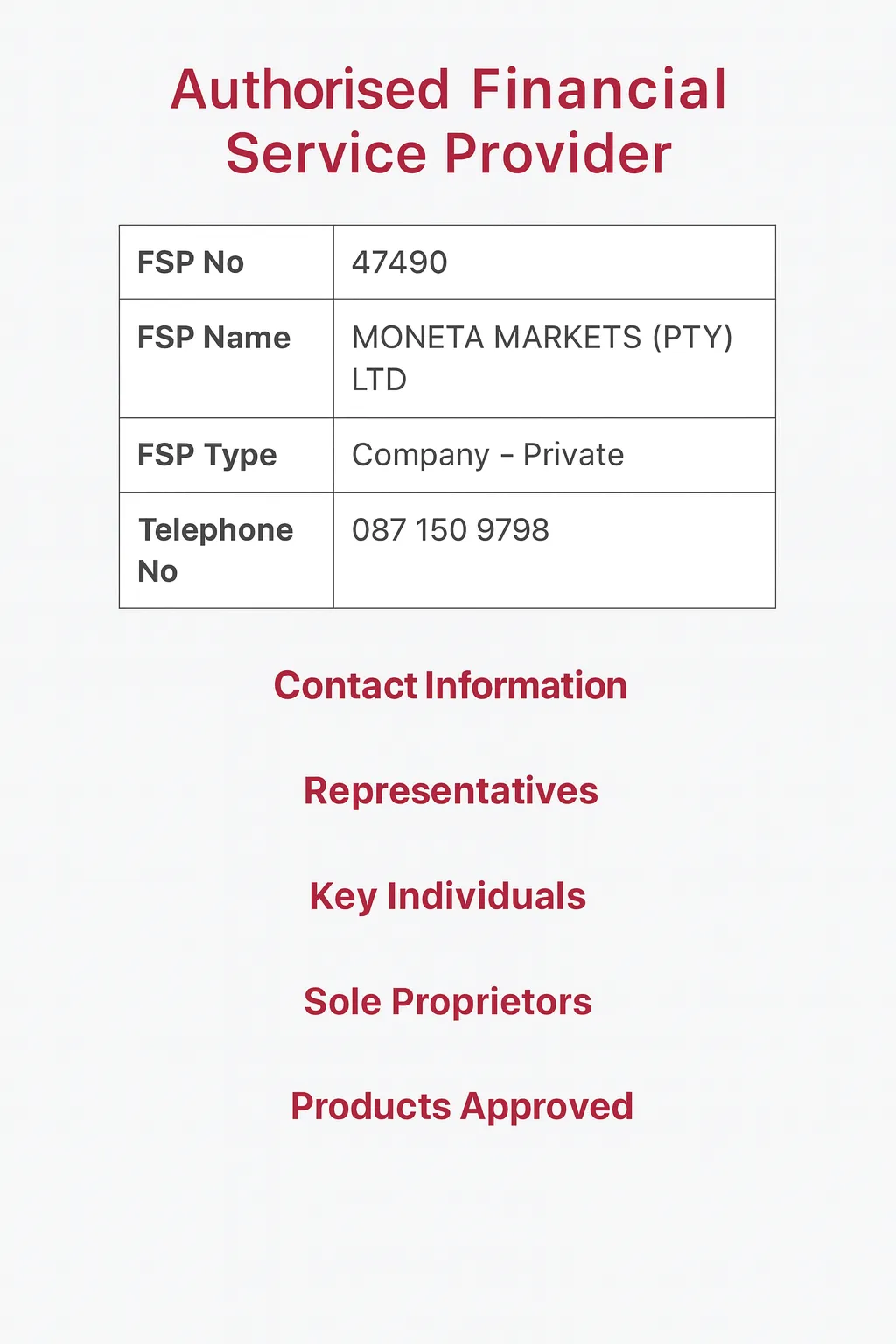

Moneta Markets is a forex and contracts for difference (CFD) brokerage registered in South Africa in 2018 and headquartered there. Moneta Markets Pty Ltd, the parent company, is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa, holding license number 47490. Moneta Markets also has affiliates in Seychelles, Cyprus, Saint Lucia, and Hong Kong, each registered as a separate legal entity to meet the needs of global business expansion and compliance.

Moneta Markets primarily provides diversified financial derivatives trading services to retail and institutional clients worldwide, covering foreign exchange, stocks, stock indices, commodities, and ETFs. Leveraging its professional trading environment and strict regulatory framework, the company has steadily established a leading position in the global CFD industry. Its domain name (monetamarkets.com) was registered on July 18, 2018, and remains operational to date.

🌐 Global layout and brand background

Moneta Markets has established a multinational business structure through multi-regional registration and regulatory compliance. In addition to its headquarters in South Africa, it has registered entities in Seychelles (regulated by the FSA), Cyprus, Saint Lucia, and Hong Kong, creating a multi-faceted regulatory and geographic presence.

This multi-regional operating model provides Moneta Markets with global flexibility, enabling it to offer trading services to clients across Europe, Asia Pacific, Africa, and the Middle East. Although the brand is relatively new, it has already established a strong industry presence through the expansion of its platform functionality and services.

💹 Trading Products and Services

Moneta Markets offers a wide range of trading products, including foreign exchange currency pairs, global stock CFDs, major indices, commodities, and ETF CFDs, meeting the trading needs of different types of investors:

Foreign exchange trading: We offer a wide range of major and minor currency pairs, allowing you to participate in the foreign exchange market with a low barrier to entry.

Stock & Index CFDs: Supports stocks of well-known companies and major global indices, facilitating portfolio diversification.

Commodities: Covers CFDs on crude oil, metals and other raw materials.

ETF Trading: Track different industry sectors with a single tool, offering high transparency and efficient execution.

In terms of services, Moneta Markets also offers a variety of account types (DIRECT, PRIME, ECN), with minimum deposit requirements of US$50, US$200, and US$20,000 respectively, and maximum leverage of up to 1000:1, meeting the different needs of novice and professional traders.

💻 Trading technology and platform experience

Moneta Markets supports multiple trading platforms, including MetaTrader 4 and its own PRO Trader (based on TradingView) .

MetaTrader 4: Features automated trading with expert advisors (EAs), a wide range of technical indicators, and diverse charting tools, with execution latency as low as 15ms.

PRO Trader: Integrates TradingView charting functionality, providing 100+ technical indicators, 50+ graphical tools, 11 chart types, and multiple layout support, perfect for traders who require more intuitive visual analysis.

This multi-platform selection allows Moneta Markets to cater to both conservative investors and advanced traders seeking strategy flexibility.

🛡️ Regulatory compliance and fund security

Moneta Markets Pty Ltd is regulated by the South African Financial Conduct Authority (FSCA ) (licence number 47490), ensuring its forex, stock, index, commodity, and ETF services operate within a compliant framework. Moneta Markets Ltd, its overseas registered entity, is also authorised by the Seychelles FSA .

Brokers implement segregated funds custody measures, ensuring investor funds are separate from the company's own funds, enhancing client fund security. Despite this, high-leverage CFD products carry inherent risks, and investors should maintain reasonable position management.

⚡ Trading conditions and experience

Moneta Markets offers flexible trading conditions, including tight spreads, high leverage (up to 1:1000), and multiple accounts. Minimum deposits start at $50, making it suitable for beginners, while ECN accounts are designed for high-net-worth and professional traders.

For deposits and withdrawals, the platform supports international wire transfers, Visa, Mastercard, Fasapay, JCB, STICPAY, and other methods. However, the official website does not fully disclose withdrawal channels, fees, and processing times, so investors should further confirm this information before opening an account.

🎓 Customer Support and Value-Added Services

Moneta Markets offers 24/5 multilingual customer support via phone, email, and live chat. Email support is available at [email protected] and phone number is +0283301233 .

In addition, Moneta Markets offers a variety of educational resources, such as trading tutorial videos, webinars, market news TV, as well as tools such as economic calendars and trading calculators, to help users improve their market understanding and risk management capabilities.

⚠️ Risk Warning and Platform Positioning

Forex and CFD trading carries a high level of risk, which can result in the complete loss of invested capital. Moneta Markets clearly discloses these risks on its website and emphasizes that investors should fully understand leverage and risk management strategies.

Overall, Moneta Markets is positioned as a mid-sized international brokerage firm with multiple product lines and a focus on compliance and technology . It is suitable for clients who want to conduct diversified trading within a global regulatory framework. For completely novice investors, it is necessary to make full use of its demo account and educational resources before investing in real trading.

🔍 Comprehensive analysis and evaluation

From an overall perspective, Moneta Markets' strengths and positioning are mainly reflected in:

Although it was recently established, its multi-regional compliance layout provides it with market expansion capabilities;

Rich product lines, covering foreign exchange, stocks, indices, commodities and ETFs;

The platform experience is flexible and supports MT4 and PRO Trader;

Comprehensive education and tool resources focus on investor growth.

The shortcomings are that the disclosure of some deposit and withdrawal channels and conditions is not transparent enough, and as an emerging broker, its brand is not as well established as that of old-established securities firms.

Overall, Moneta Markets is more suitable for traders who want to experience diversified markets and seek high leverage conditions. However, clients who pursue stability and long-term brand trust still need to make a careful choice based on their own risk preferences.

Selected Enterprise Evaluation

3.64

Total 7 commentsDeposit and withdrawal are fairly smooth, though the fees feel a bit higher than expected.

Reply

Be careful out there—scams are everywhere these days." I got tricked by a fake investment platform. They made everything look professional until it came time to withdraw my funds. That's when the red flags started. Thankfully, I found Mrs. Nora online. She was responsive, professional, and helped me recover my funds quickly. I recommend her to anyone trying to get their money back. Contact: [email protected] | Website TRAZEVAULT.ORG

Reply

The trading platform runs steadily with minimal slippage, quite friendly for beginners.

Reply

Every attempt to contact their support team was ignored, and I was left feeling helpless. Thankfully, I came across Mrs. Bruce Nora, who specializes in fund recovery.

Reply

Customer support responds, but usually takes some back-and-forth before issues are resolved.

Reply

I had an extremely frustrating experience with this online trading site that suddenly locked me out of my account after I deposited a significant amount of money. Every attempt to contact their support team was ignored, and I was left feeling helpless. Thankfully, I came across Mrs. Bruce Nora, who specializes in fund recovery. With her guidance, I was able to retrieve my lost investment. If you're dealing with a similar issue, I suggest reaching out to her at [email protected] or website (trazevault.org)

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

I had an extremely frustrating experience with this online trading site that suddenly locked me out of my account after I deposited a significant amount of money. Every attempt to contact their support team was ignored, and I was left feeling helpless. Thankfully, I came across Mrs. Bruce Nora, who specializes in fund recovery. With her guidance, I was able to retrieve my lost investment. If you're dealing with a similar issue, I suggest reaching out to her at [email protected] or website (trazevault.org)

Reply

Be very cautious when investing. Recovering lost funds or dealing with crypto trading scams can be extremely stressful and frustrating once your money is in the wrong hands. I personally lost over $882,050 while trying to earn extra income through a fraudulent trading company. Fortunately, I was later introduced to Mrs. Susan Kaplan, who works with a reputable recovery firm. With her help, I was able to recover 90% of my total losses, including the profits stolen by these scammers. If you’ve had a similar experience, you can reach out to Mrs. Susan Kaplan: Email: [email protected] WhatsApp: +1 ( 36 0) 310-0351

Reply

Hello everyone. I just want to quickly share my experience, in case it helps someone out there. A few months ago, I fell into an online investment scam that looked very professional. At first, everything seemed fine, but when I tried to withdraw, I realised I had been tricked. It felt horrible. I was embarrassed and honestly didn’t know what to do. That’s when I found Mrs. Nora. She was calm, professional, and didn’t make any fake promises. She asked for the right documents and kept me updated. Within a few days, I had my money back. I didn’t think it was possible, but it was. So if you’ve been in a similar situation, don’t stay silent — there’s still a way out. brucenora 254 (@) gmail. com | WhatsApp: +1 (8=7=0) 8=1=0-54=42

Reply

~ There's nothing more ~

About Moneta Markets's questions

Ask:Is Moneta Markets a regulated and legitimate platform?

Answer:Moneta Markets is registered in South Africa as Moneta Markets Pty Ltd and is regulated by the Financial Sector Conduct Authority (FSCA) (FSP No. 47490). This regulatory framework can provide a degree of assurance regarding client fund security and compliance, but investors should be aware that it differs in level of oversight from first-tier regulators such as the UK's FCA and Australia's ASIC. Therefore, investors are advised to prioritize opening accounts with regulated entities and maintain independent risk management.

Ask:What are the main trading products and services provided by Moneta Markets?

Answer:Moneta Markets offers CFD trading across forex, stocks, indices, commodities, cryptocurrencies, and more. Furthermore, the platform supports multiple trading terminals, including MT4/MT5 and its proprietary WebTrader, and provides investors with copy trading, market analysis tools, and educational resources. This comprehensive product offering caters to diverse investment needs.

Ask:How is the deposit and withdrawal experience and customer support experience with Moneta Markets?

Answer:The platform supports a variety of deposit and withdrawal methods (credit/debit card, wire transfer, e-wallet, etc.). Deposits are generally instant, while withdrawals can take between 1-3 business days depending on the method. Regarding customer support, Moneta Markets offers multilingual online customer service, supporting both Chinese and English. However, investors have reported that customer service response speeds vary. It is recommended to familiarize yourself with the process by conducting small test transactions before making large transactions.