Normal Operation

Normal OperationNOMURA

15-20Year

Basic Information

Country

JapanMarket Type

foreign exchange|Stock|Futures|CFD|OptionEnterprise Type

BrokerageService

Forex, commodities, indices, stocks, cryptocurrenciesSupport Languages

JapaneseDomain Registration Date

1994-05-20Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

Nomura Securities Co., Ltd., headquartered in Tokyo and founded in 1925, is one of Japan's most representative comprehensive financial services companies. As a core subsidiary of Nomura Holdings, Inc., Nomura Securities has long been committed to providing diversified financial services such as securities trading, investment banking, asset management, and research and analysis to individual and institutional investors.

With a century of development, Nomura not only maintains a leading position in the Japanese market but also continuously expands into international markets, establishing a global business network spanning Asia, the Americas, and Europe. Emphasizing a client-first and innovation-driven approach, the company is committed to combining its expertise in capital markets with global resources to create sustainable, long-term value for its clients.

🌐Global layout and brand background

As one of Asia's largest investment banks, Nomura maintains significant branches in Tokyo, Osaka, and Nagoya, and has established a strong business network in major global financial centers such as New York, London, Hong Kong, and Singapore. Its cross-border capabilities provide clients worldwide with comprehensive financial solutions across equities, fixed income, investment banking, and asset management.

From a brand perspective, Nomura is considered a key representative of Japan's financial system. It maintains a high level of global visibility and credibility, particularly in cross-border investment and financing, and in research on Asian capital markets. Leveraging its robust capital base and long-standing client trust, Nomura is widely regarded as a reliable partner for global investors.

💹Trading products and services

Nomura's financial services system covers a wide range, including:

Securities trading: stocks, bonds, ETFs and various financial derivatives;

Investment banking services: equity and debt financing, M&A advisory, structured financing;

Asset Management: Providing fund management, pension and wealth management solutions to institutions and high net worth clients;

Research and Analysis: Provides macro research and in-depth industry analysis covering global markets.

Nomura's strength lies in its deep roots in the Japanese market and its profound understanding of emerging Asian markets, which enables it to provide financial services to global clients with both local insights and an international perspective.

💻Trading technology and platform experience

Nomura continuously invests in technology and digital transformation to enhance transaction execution speed and customer experience. Its securities trading platform offers high reliability and powerful processing capabilities, meeting the diverse needs of both professional institutional and individual investors.

Nomura is also actively promoting digital financial services, optimizing customer experience through smart investment advisors, mobile platforms, and big data analysis technologies, and applying advanced technologies in risk management and compliance.

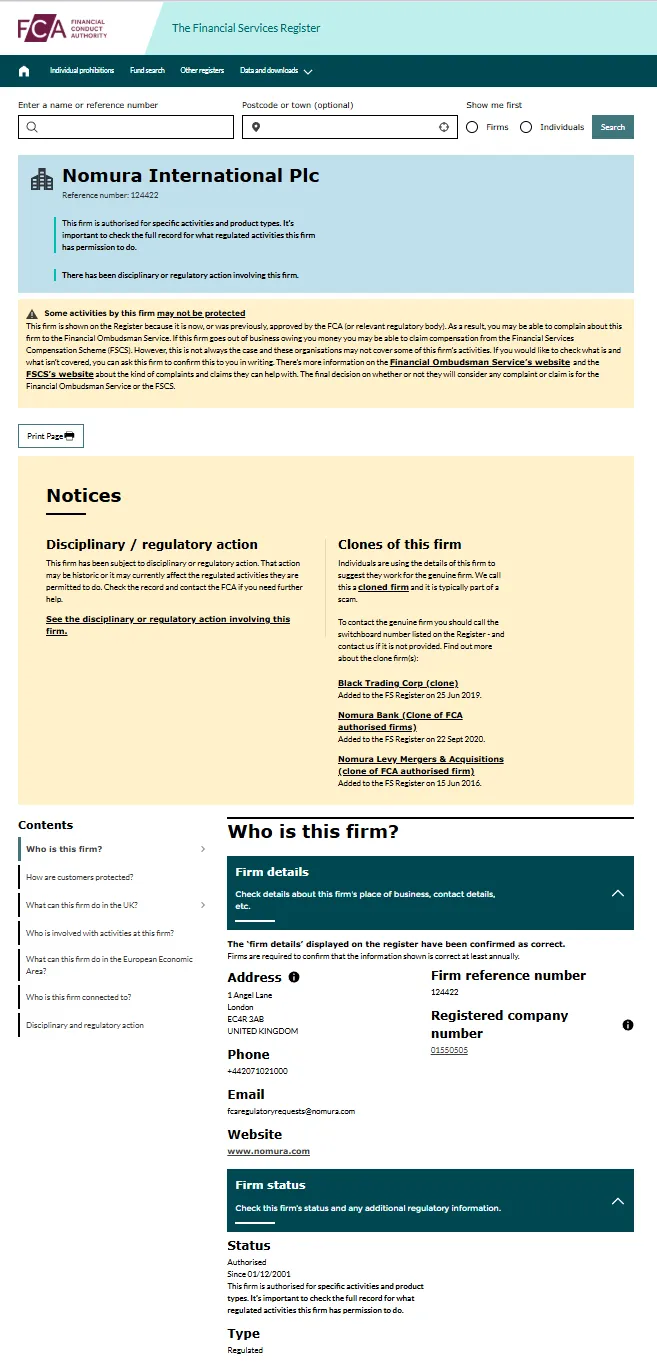

🛡️Regulatory compliance and fund security

As one of Japan's largest securities firms, Nomura strictly adheres to the regulatory requirements of the Financial Services Agency (FSA) and is supervised by the Tokyo Stock Exchange and other institutions. Client funds are strictly segregated and legally protected to ensure asset security and transparency.

Nomura adheres to local regulatory standards in its international operations, including those of the US SEC, the UK FCA, and the Hong Kong Securities and Futures Commission (SFC). This cross-border, multi-regulatory system provides a solid foundation for the security of client funds and transactions.

⚡Trading conditions and experience

Nomura offers flexible trading conditions for traditional financial products, including low transaction costs, professional investment research support, and personalized services for high-end clients. In terms of institutional investment services, Nomura leverages its deep capital markets experience to provide competitive solutions for large-scale financings, cross-border mergers and acquisitions, and fixed income investments.

For individual investors, Nomura also provides diversified wealth management and investment channels to ensure that customers at different levels can receive corresponding support and services.

🎓Customer support and value-added services

Nomura provides multilingual support services, including Japanese, English, and other major international languages, covering 24-hour customer consultation and technical support. The company also prioritizes investor education, regularly launching market research reports, investment training courses, and seminars to help investors enhance their financial knowledge and decision-making skills.

These value-added services not only enhance customer stickiness, but also reflect Nomura's role as a long-term partner.

⚠️Risk Warning and Platform Positioning

Despite Nomura's century-old brand and global influence, financial markets are inherently volatile and risky. Nomura clearly states on its website and in related documents that investment products may involve market, credit, and liquidity risks.

Overall, Nomura is more suitable for investors who value fund security and seek professional wealth management and cross-border investment and financing services, rather than speculators who simply pursue short-term high returns.

🔍Comprehensive analysis and evaluation

From a holistic perspective, Nomura Securities has the following characteristics:

The brand has a long history: nearly a hundred years of development, establishing a leading position in the industry;

Perfect regulatory system: multi-national compliance supervision, high fund security;

Global layout: obvious core advantages in Asia and deep penetration into international markets;

Comprehensive business coverage: balanced development of securities, investment banking, and asset management;

Technology and Services: Active digital transformation and comprehensive customer support.

As an international, integrated financial services provider, Nomura's core values lie in robust compliance, a global presence, and professional services. For investors seeking to connect Asia with global markets, Nomura is a trusted, long-term partner.

Selected Enterprise Evaluation

3.50

Total 5 commentsAs one of the largest securities firms in Japan, Nomura provides highly professional services and in-depth research reports, making it a strong choice for long-term investors.

Reply

be***h2

be***h2*The fake platform I used blocked me right after I deposited a larger amount. I was embarrassed to tell my family. That’s when I came across Mrs. Nora through a financial recovery group. She asked for proof and a few documents—then took care of the rest. Within a few days, my account was restored and my funds were released. She treated me with respect and understanding.* 📧 brucenora254(@)gmail.com

Reply

Nomura offers diverse international investment channels and strong regulatory compliance, which makes clients feel more confident about the safety of their funds. However, the website can be complex for beginners to navigate.

Reply

When the platform froze my withdrawals, I initially hoped it was just a technical issue—but soon realised I had fallen victim to a scam. Mrs. Doris Ashley came highly recommended, and from our first interaction, she was transparent, professional, and responsive. Within 72 hours, she successfully recovered my funds—delivering exactly what she promised, with no false assurances. Email: (dorisashley71 (@) gmail. c 0 m ) WhatsApps:+1 (404) .-721 . -56 .-08 She’s the only one I personally trust when it comes to financial recovery. Stay safe and protect your money

Reply

The official website is almost entirely in Japanese, which makes it difficult for international investors to browse. It would be great if more English pages were added to improve accessibility.

Reply

I never imagined I’d see my money again after being scammed. The whole situation felt hopeless until a friend recommended Mrs. Nora. I reached out to her, shared my case, and carefully followed her guidance. To my surprise, everything was recovered within just three days. It still feels surreal, but I’m beyond grateful. If you’ve ever been in my shoes, don’t give up—Mrs. Nora is someone you can truly trust. 📧 Email: bruce.nora254(@)gmail.com | 📱 WhatsApp: +1 (8 7 0) 81=0 5=4 42

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

~ There's nothing more ~

About NOMURA's questions

Ask:Is Nomura Securities regulated? Is it reliable?

Answer:Yes. Nomura Securities, Inc. is one of Japan's largest and oldest financial institutions, a subsidiary of Nomura Holdings Group and regulated by the Financial Services Agency (JFSA). With a history spanning over a century, the company enjoys a high reputation and credibility in the Japanese and global capital markets, and is considered a trusted securities broker in Asia and globally.

Ask:What financial services does Nomura Securities provide?

Answer:Nomura Securities offers a wide range of financial services, including securities brokerage, asset management, investment banking, research and consulting, and trading services. Its product offerings include stocks, bonds, futures, options, foreign exchange, mutual funds, and structured financial products, catering to the diverse needs of both retail and institutional investors.

Ask:In which countries and regions does Nomura Securities conduct business?

Answer:Nomura Securities is headquartered in Tokyo, Japan, but operates globally. The company has branches in major international financial centers such as New York, London, Hong Kong, Singapore, and Sydney, serving clients across Asia, Europe, and the Americas.