BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX

Time: 20+Year

| Company

Company Regulatory

Regulatory Risk Monitor

Risk Monitor Download

Download Documents

DocumentsCME Group offers the world’s most liquid futures and options markets, with strong regulation and high transparency.

![]() Reply

Reply

As a global leader in derivatives trading, CME provides reliable risk management and clearing systems.

![]() Reply

Reply

The platform is highly professional, but its products can be complex for beginners.

![]() Reply

Reply

~ There's nothing more ~

CME Group Inc. (CME) is a leading global derivatives market operator. Founded in 2007, it was formed through the merger of the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBOT), the New York Mercantile Exchange (NYMEX), and the Comex Exchange (COMEX). Its headquarters is in Chicago, USA.

As the world's largest futures and options marketplace, CME Group offers investors a broad range of financial derivatives products, including interest rates, stock indices, foreign exchange, energy, agricultural products, metals, and cryptocurrencies. Leveraging advanced technology and a global clearing network, CME provides investors with an efficient, transparent, and secure trading experience.

CME Group plays a vital role in the global financial market, with services covering North America, Europe and the Asia-Pacific region. It is an important platform for global risk management and asset allocation.

CME Group has branches and data centers in financial centers such as the United States, the United Kingdom, Singapore, and Japan, with operations in over 150 countries and regions. Its trading platform, CME Globex, was the world's first electronic derivatives trading system and has become a core infrastructure for global financial markets.

As a publicly traded company (NASDAQ: CME), CME Group boasts not only strong capital but also comprehensive clearing and regulatory mechanisms, providing investors with a highly transparent and secure market environment. Its long-standing leadership in the futures and options markets has earned it the trust and recognition of international investors.

CME Group offers a wide range of trading products, covering the following major markets:

Interest rates: such as U.S. Treasury bonds and Eurodollar futures, are the most liquid interest rate instruments in the world.

Stock indices: including S&P 500, Nasdaq 100, Dow Jones and other world-renowned index futures and options.

Forex: Over 30 major and emerging market currency pairs.

Energy: crude oil, natural gas and electricity-related derivatives.

Agricultural products: covering traditional agricultural products such as corn, soybeans, and wheat.

Metals: precious metals such as gold, silver, copper, and industrial metals.

Digital assets: CME is the first mainstream exchange to launch Bitcoin futures and Ethereum futures.

This broad product coverage meets the diverse needs of institutional investors, hedge funds, corporations and individual traders.

CME Group's CME Globex electronic trading platform offers 24/7 cross-time zone trading support. Featuring a high-speed matching engine, low-latency network, and a wide range of order types, the platform is well-suited for high-frequency traders and large institutions.

CME also provides investors with real-time market information, analytical tools, risk management models, and API-based programmatic trading. For regular investors, its data services and educational resources facilitate understanding market dynamics and investment strategies.

As a major derivatives exchange group in the United States, CME is strictly regulated by the Commodity Futures Trading Commission (CFTC), and its own clearing house (CME Clearing) is responsible for transaction clearing and settlement to ensure market stability and transparency.

CME Clearing provides a strong safety barrier to the global financial system through its margin system, risk modeling, and default handling mechanisms. This institutionalized arrangement ensures that trades can be settled securely even during periods of extreme market volatility.

CME Group offers investors flexible trading conditions, including high liquidity, tight spreads, and comprehensive leverage tools. Institutional clients can access deep market liquidity, while retail investors can also participate in CME products through authorized brokers.

It's important to note that derivatives trading is a highly leveraged investment with significant potential risks. CME clearly discloses these risks on its website, reminding investors to fully understand the product attributes and risk management.

CME Group provides multilingual support to global customers, covering major languages such as English, Chinese, and Japanese, and has service teams in major financial centers.

Its official website offers educational content, training courses, market research reports, and investment tools to help users improve their market understanding and risk management skills. Furthermore, CME has partnered with platforms like TradingView and Bloomberg to further expand access to information and data.

CME explicitly states that derivatives trading, such as futures and options, carries high risk and may result in losses exceeding initial margin deposits. Therefore, trading in these products is more suitable for institutional and individual investors with specialized knowledge and risk tolerance.

As the core infrastructure of the global market, CME is not only positioned as an exchange, but also an important support for the stability of the global financial system and risk management.

Overall, CME Group has the following characteristics:

The world's largest derivatives market, covering a comprehensive range of trading products.

The technology and clearing system are leading, suitable for high-frequency and cross-border transactions.

Multiple supervisions and comprehensive risk management ensure the safety of funds.

Rich educational resources and market research help clients improve their professional capabilities.

For investors seeking global market access and risk management tools, CME Group is undoubtedly one of the preferred platforms. Its advantages in compliance, security, and market depth make it an irreplaceable player in the international financial market.

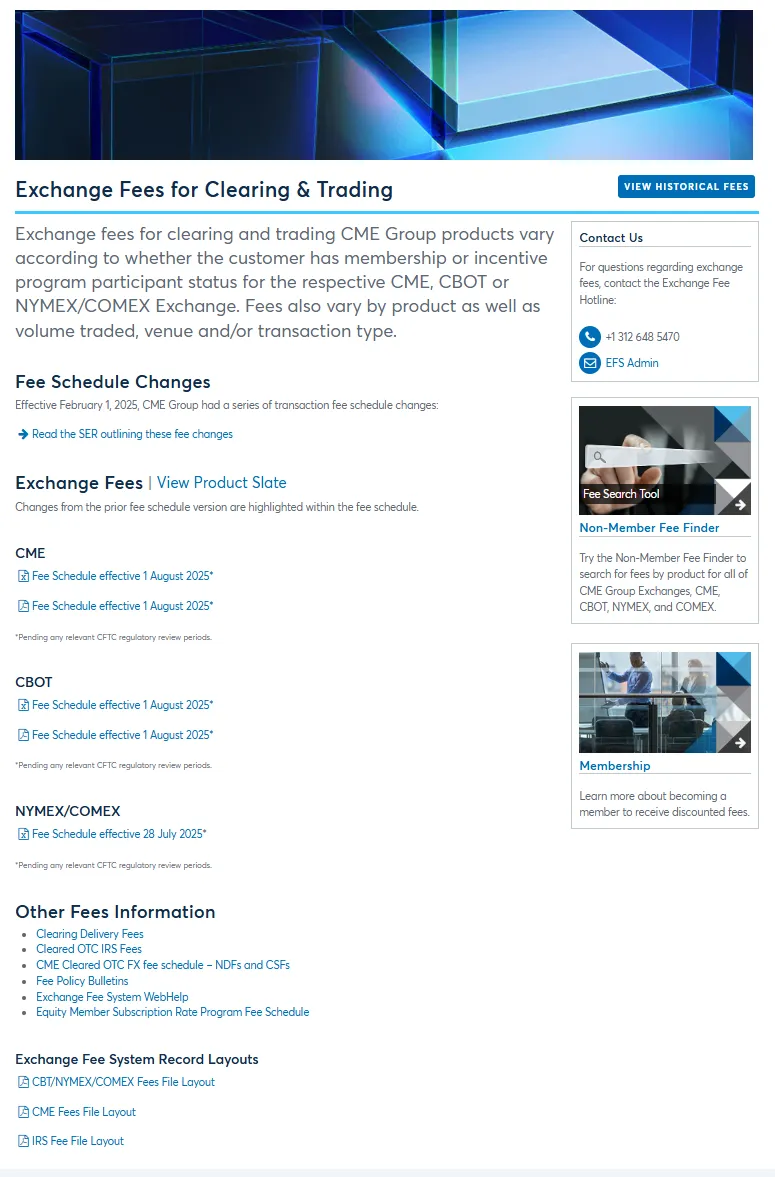

Answer:CME Group is a leading global derivatives exchange, operating across a diverse range of markets, including interest rates, stock indices, foreign exchange, energy, agricultural products, and metals. Through its four major exchanges – CME, CBOT, NYMEX, and COMEX – CME Group offers futures and options products, along with clearing and risk management services. As one of the world's largest derivatives marketplaces, CME Group's products are widely used for risk hedging and price discovery.

Answer:CME Group is strictly regulated by the U.S. Commodity Futures Trading Commission (CFTC) and adheres to international financial regulatory standards. Its clearing subsidiary, CME Clearing, provides centralized clearing and risk management services, ensuring the secure execution and settlement of all trades. As a Nasdaq-listed company (ticker: CME), CME Group regularly discloses financial and compliance information, ensuring a high level of transparency and credibility.

Answer:CME Group serves institutional investors, hedge funds, banks, commodity trading firms, and retail traders. Investors can access trading through globally recognized dealers and brokers, as well as through CME Globex, an electronic trading platform. Additionally, CME Group offers a rich array of market data, research tools, and risk management solutions to help users better manage their investments and hedging strategies.