BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX

Time: 15-20Year

| Company

Company Regulatory

Regulatory Risk Monitor

Risk Monitor Download

Download Documents

DocumentsHNX plays a vital role in Vietnam’s capital market, especially in government bonds and derivatives, offering stability for long-term investors.

![]() Reply

Reply

As an emerging exchange, HNX still lacks the depth of global markets but shows strong growth potential alongside Vietnam’s expanding economy.

![]() Reply

Reply

~ There's nothing more ~

The Hanoi Stock Exchange (HNX) is one of Vietnam's two official stock exchanges. Founded in 2005 and headquartered in Hanoi, Vietnam, HNX is directly under the Ministry of Finance and regulated by the State Securities Commission (SSC). HNX is responsible for the operation and regulation of the stock, bond, and derivatives markets. Its business scope encompasses stock listings, the issuance and trading of corporate and government bonds, and the listing of securities derivatives, providing important support for the diversification and internationalization of Vietnam's capital market.

HNX, formerly the Hanoi Stock Exchange, was renamed the Hanoi Stock Exchange in 2009 and has become a key component of Vietnam's capital market reform. With Vietnam's rapid economic development, HNX has played a central role in promoting financing for small and medium-sized enterprises, developing the government bond market, and innovating the derivatives market. In recent years, HNX has collaborated with numerous international exchanges and financial institutions to promote the integration and interconnection of market mechanisms, gradually increasing the international recognition of Vietnam's capital market.

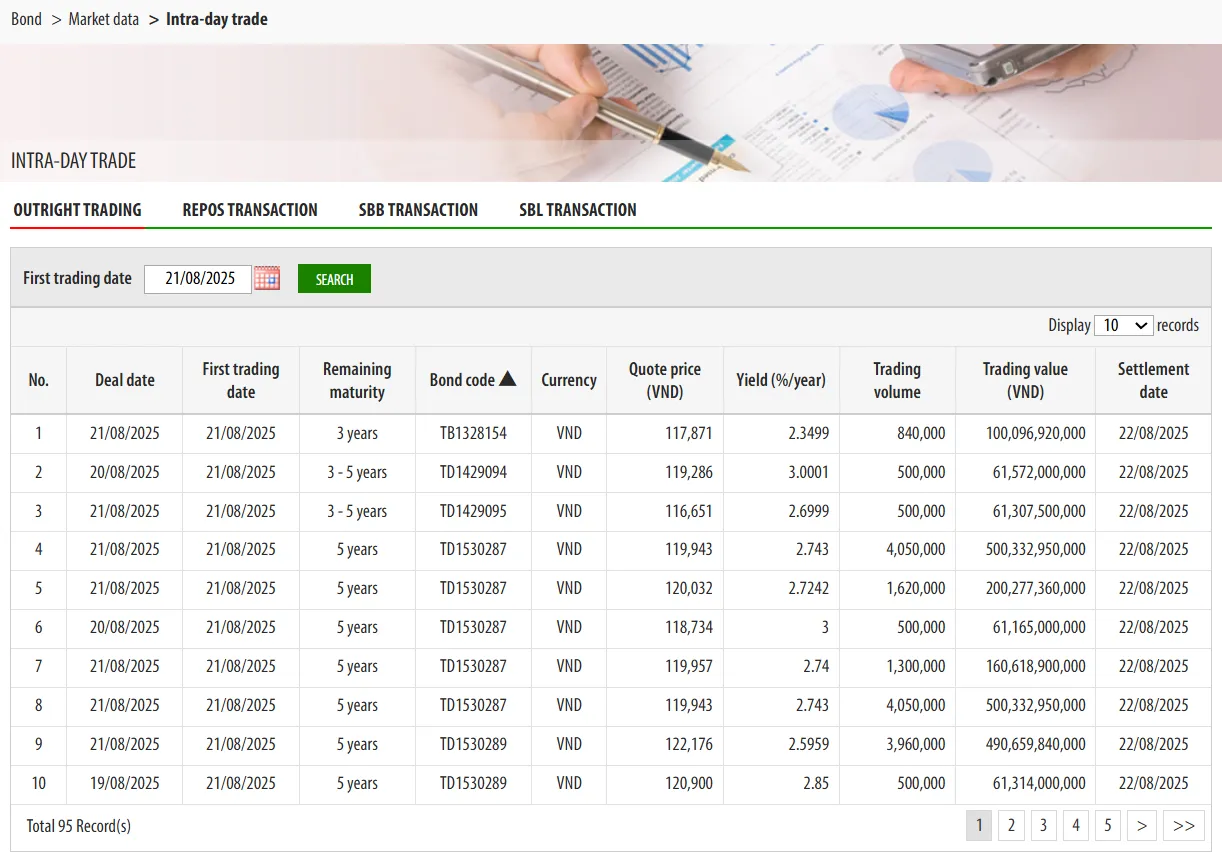

HNX offers a wide range of products, including stocks, government bonds, corporate bonds, and derivatives. Its stock segment focuses on listed small and medium-sized enterprises and growth companies. Its core strength lies in the bond market, particularly in the issuance and trading of government bonds. HNX is the leading trading platform for Vietnamese government bonds. Furthermore, HNX offers derivatives such as stock index futures, providing investors with risk hedging and asset allocation tools. Through these products, HNX fulfills the dual role of expanding financing channels and promoting market liquidity in the Vietnamese capital market.

HNX continuously promotes the development of electronic and modern trading systems, utilizing advanced electronic matching and clearing platforms to enhance trade execution efficiency and market transparency. Its official website is bilingual in Vietnamese and English, providing users with real-time access to market announcements, bond issuance information, trading data, and market reports. For institutional investors, HNX offers data subscription and accessibility services for secondary development and quantitative analysis. Overall, its platform experience is centered on transparency, information disclosure, and compliance.

HNX is fully under the jurisdiction of the Ministry of Finance and regulated by the National Securities Commission, ensuring market operations comply with legal and policy requirements. Its core sector, the bond market, plays a crucial role in government financing and public investment, and trading adheres to strict disclosure and compliance standards. While Vietnam's capital market is still developing, HNX's regulatory framework and legal environment are gradually improving, providing investors with a relatively safe market environment.

HNX utilizes a centralized bidding and continuous trading mechanism to ensure market fairness and transparency. The bond market's issuance and trading systems are particularly mature, allowing investors to access real-time prices and yield curves through HNX. For the stock and derivatives markets, HNX offers a diverse range of investment targets and trading methods to meet the needs of investors at all levels. Overall trading conditions are robust and standardized, making it suitable for institutional investors and medium- and long-term capital allocation.

HNX provides a diverse range of market information services, including daily market briefs, monthly reports, and annual statistics. Investors can access policy documents, research materials, and educational materials through its official website, enhancing their understanding and participation in the market. Furthermore, HNX regularly organizes investor education events and international exchange seminars to help local and foreign investors better understand the rules and opportunities of Vietnam's capital market.

As an emerging market exchange, HNX still lags behind developed markets in terms of market depth and international liquidity. Investors should be aware that Vietnam's capital market is highly volatile and significantly influenced by policy and macroeconomic factors. HNX, with its core focus on the bond market, is positioned more towards serving government financing and the medium- and long-term funding needs of enterprises, rather than high-frequency short-term speculation.

Overall, HNX plays an irreplaceable role in Vietnam's capital market. Its leading position in the bond market, continued development in the stock and derivatives markets, and gradual improvements in regulation and transparency have made it a key exchange in the region. While still lagging behind top international exchanges, HNX possesses strong growth potential and strategic value, fueled by Vietnam's continued economic growth and internationalization reforms. For institutions seeking emerging market opportunities, particularly those focused on bonds and long-term investments, HNX remains a valuable platform worthy of attention and investment.

Answer:HNX primarily manages the SME stock market, government and corporate bond markets, and derivatives, while HOSE focuses on large corporate stocks and the main board market. Together, the two comprise Vietnam's capital market system, which has been under the unified management of the Vietnam Stock Exchange (VNX) since 2020.

Answer:HNX is the primary issuance and trading platform for Vietnamese government bonds, regulated by the Ministry of Finance and the State Securities Commission (SSC). As sovereign-backed products, government bonds carry a relatively low risk of default and are relatively safe. However, investors should still monitor yield fluctuations and Vietnam's macroeconomic trends.

Answer:Foreign investors can participate in the HNX market, including bonds, stocks, and derivatives, through accounts with local securities firms or licensed brokers. The Vietnamese government has gradually relaxed foreign ownership restrictions, but certain sectors still have ceilings. Investors are advised to verify regulatory policies and market access rules before investing.