Normal Operation

Normal OperationPSE

20+Year

Basic Information

Country

the PhilippinesMarket Type

foreign exchange|Stock|Futures|CFD|OptionEnterprise Type

BrokerageService

Forex, commodities, indices, stocksSupport Languages

EnglishDomain Registration Date

2001-03-27Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

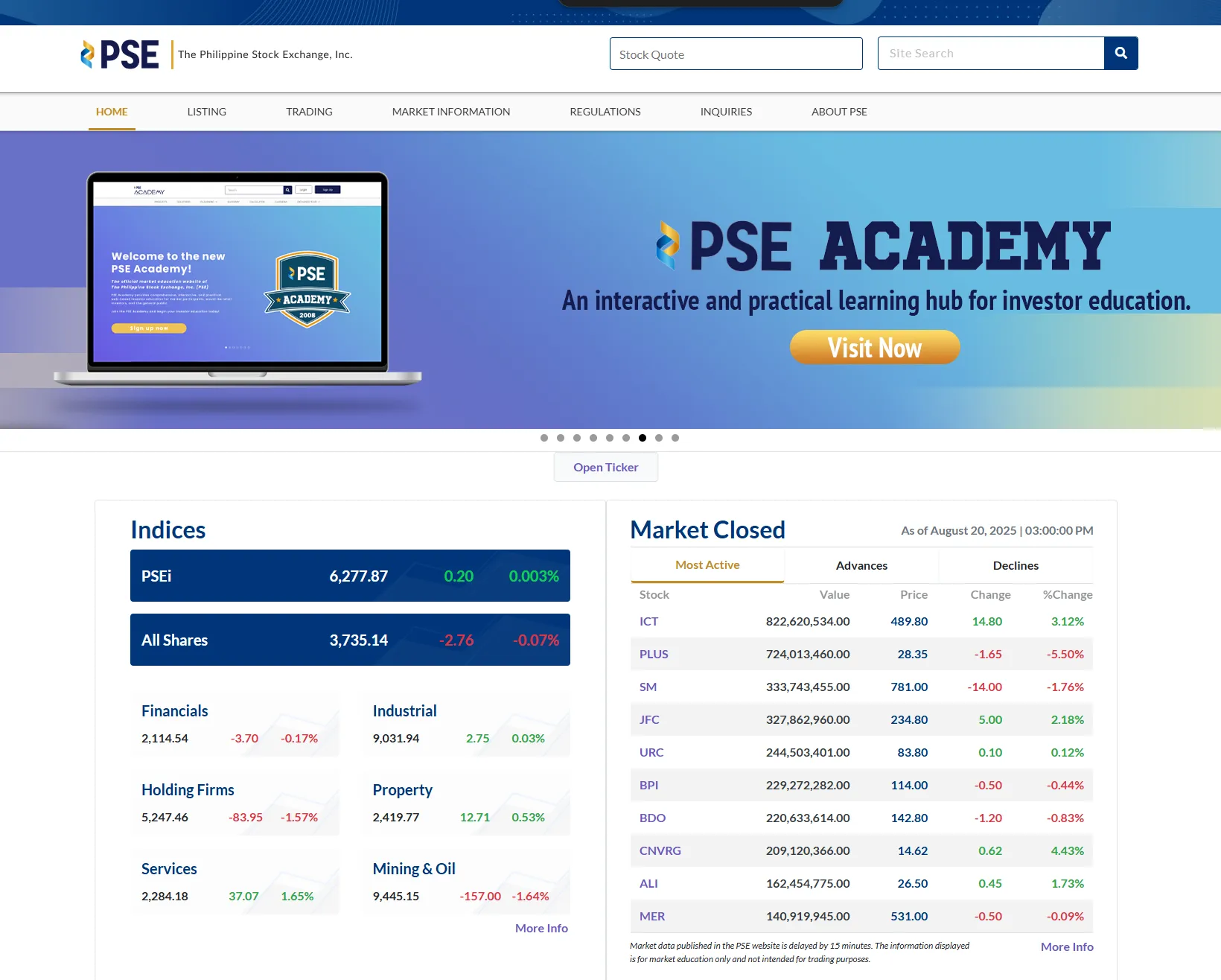

The Philippine Stock Exchange (PSE), the sole stock exchange in the Philippines, was established in 1992 and is headquartered in Makati City. Its predecessors were the Manila Stock Exchange and the Makati Stock Exchange, which merged to form the PSE. As the core institution of the country's capital market, the PSE provides trading and listing services for a diverse range of financial products, including stocks, bonds, and ETFs.

The PSE's primary services include securities listing, trade matching, clearing and settlement, as well as information disclosure and regulatory support. Through its electronic trading platform, the PSE ensures market transparency and efficiency, providing a reliable trading environment for both institutional and individual investors. Leveraging its unique position within the Philippine financial market, the PSE plays a key role in promoting corporate financing, attracting foreign investment, and supporting national economic development.

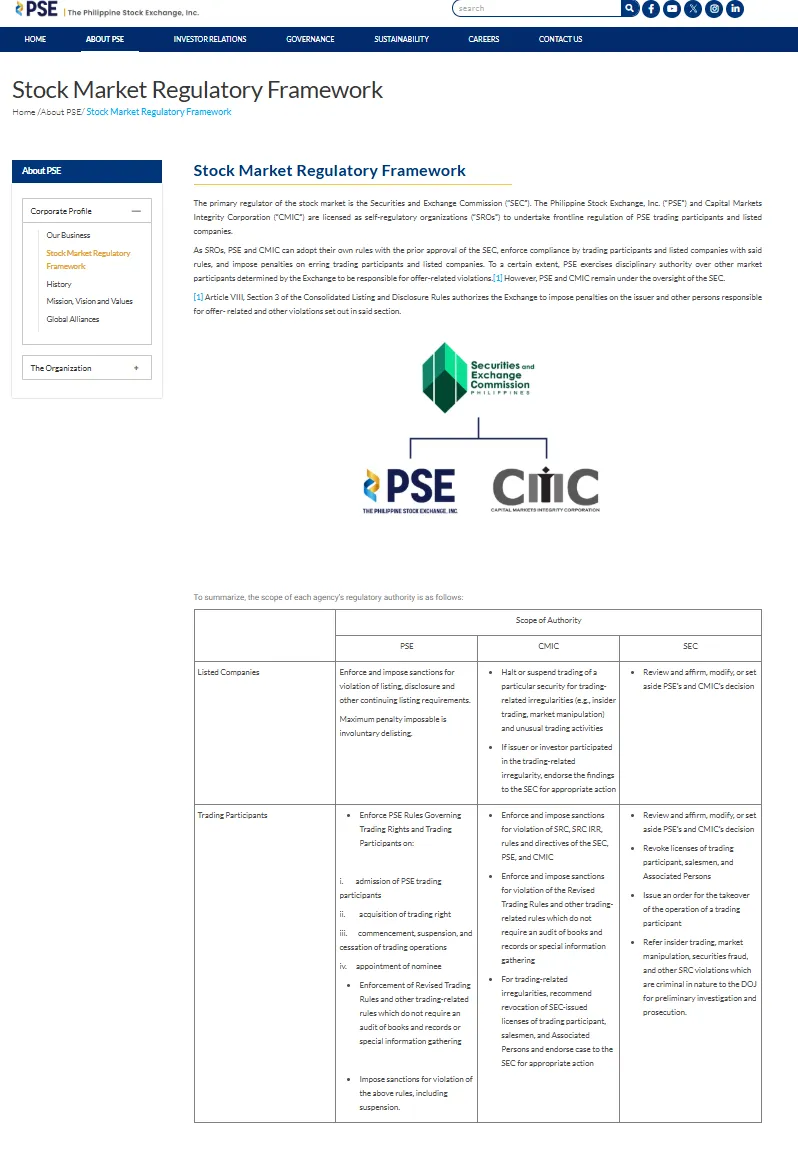

🌐Global layout and brand background

The PSE is the sole centralized exchange in the Philippine capital market and is strictly regulated by the Philippine Securities and Exchange Commission (SEC). As part of an emerging market, the PSE not only serves the financing needs of local businesses but also promotes internationalization by attracting foreign investment and using cross-border investment vehicles. In recent years, the PSE has strengthened its collaboration with other Asian exchanges to enhance the transparency and efficiency of its market mechanisms, gradually narrowing the gap with developed markets in the region.

From a brand perspective, the PSE represents the legitimacy and authority of the Philippine capital market and is the only official channel for companies to go public and investors to enter the local market. For investors, choosing the PSE trading platform means entering a relatively regulated market environment with clear policy support.

💹Trading products and services

The main products provided by PSE include:

Equities : Covers stocks of major listed companies in the Philippines, allowing investors to access corporate growth opportunities through centralized trading.

Bonds and fixed income instruments : provide financing channels for businesses and governments, while offering investors stable investment return options.

Exchange-traded funds (ETFs) : allow investors to participate in diversified market investments at a lower cost.

REITs (Real Estate Investment Trusts) : have gradually developed in recent years, providing investors with alternative investment options in the real estate sector.

These products meet the risk preferences and asset allocation needs of different investors. From conservative bond investments to high-risk, high-return stocks and derivatives, PSE has corresponding layouts.

💻Trading technology and platform experience

The PSE utilizes automated matching across the entire market through its electronic trading platform (PSEtrade), ensuring efficient and transparent trading. Its official website, available in both Filipino and English, provides investors with easy access to market announcements, real-time trading data, and research reports. As the market undergoes digital transformation, the PSE is introducing more technological tools, including mobile applications and data access services, to enhance the investor experience.

🛡️Regulatory compliance and fund security

The PSE is fully regulated by the Philippine Securities and Exchange Commission (SEC), and its trading rules and market practices must comply with local financial laws and regulatory frameworks. The exchange implements strict information disclosure and fund settlement procedures to ensure investor capital security and market transparency. Although the overall scale of the Philippine capital market is smaller than that of developed countries in the region, the PSE's regulatory environment is gradually improving, increasing its attractiveness to foreign and institutional investors.

⚡Trading conditions and experience

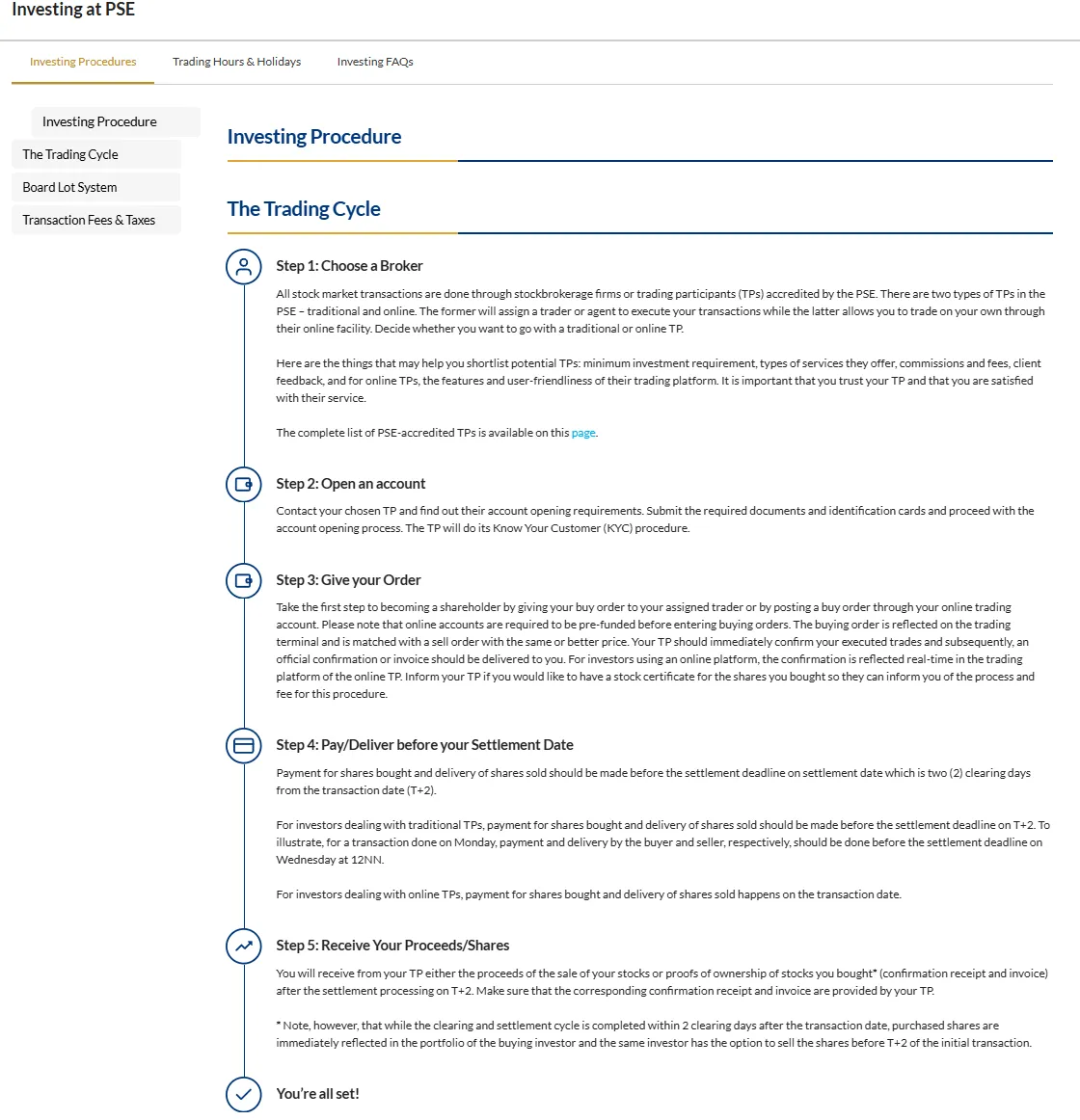

The PSE trades Monday through Friday, typically divided into two sessions: morning and afternoon. The market utilizes a T+2 settlement system and incorporates price limits to control market volatility. For investors, these conditions provide liquidity while managing risk. While market depth is limited, the PSE still offers unique value to long-term investors and institutions focused on the Southeast Asian market.

🎓Customer support and value-added services

The PSE not only serves as a trading platform but also provides investor education. Its official website and related platforms offer investment guides, training courses, and market research to help investors understand securities investment knowledge and market regulations. Furthermore, the PSE regularly publishes statistical and industry analysis reports to provide decision-making insights for researchers and institutions.

⚠️Risk Warning and Platform Positioning

As an emerging market exchange, the PSE's market size, liquidity, and international influence remain limited. Investors should note that the Philippine capital market is significantly impacted by macroeconomic fluctuations, policy changes, and international capital flows, and market volatility can be significantly higher than in mature markets. The PSE is positioned more as a financing channel for local businesses and long-term investment, rather than as a platform for high-frequency speculation.

🔍Comprehensive analysis and evaluation

Overall, the Philippine Stock Exchange (PSE) occupies a core position in the country's capital market, and with its uniqueness and compliance, it protects the legitimate rights and interests of investors.

Its advantages are:

The only national securities trading platform with authority and market monopoly;

The product line has gradually diversified to include stocks, bonds, ETFs and REITs;

The digitalization process promotes market transparency and convenience.

The shortcomings are:

limited market size and international liquidity;

The investor structure is relatively localized and has weak risk resistance;

Compared with developed markets, the variety of investment tools and derivatives is still not rich enough.

Therefore, for investors and institutions that value the potential of emerging markets and are willing to take higher risks, the PSE provides a key channel to enter the Philippine capital market.

Selected Enterprise Evaluation

3.33

Total 3 commentsPSE is a reliable gateway to the Philippine capital market, offering transparency and growing product diversity like ETFs and REITs.

Reply

While PSE ensures regulatory compliance, its limited market depth and liquidity remain challenges compared to larger Asian exchanges.

Reply

Be very cautious when investing. Recovering lost funds or dealing with crypto trading scams can be extremely stressful and frustrating once your money is in the wrong hands. I personally lost over $882,050 while trying to earn extra income through a fraudulent trading company. Fortunately, I was later introduced to Mrs. Susan Kaplan, who works with a reputable recovery firm. With her help, I was able to recover 90% of my total losses, including the profits stolen by these scammers. If you’ve had a similar experience, you can reach out to Mrs. Susan Kaplan: Email: [email protected] WhatsApp: +1 ( 36 0) 310-0351

Reply

~ There's nothing more ~

About PSE's questions

Ask:What are the unique advantages of PSE compared to other Southeast Asian exchanges?

Answer:The PSE is the Philippines' sole stock exchange, holding a national monopoly. All stocks and ETFs are listed here, ensuring market transparency and regulation. Compared to other Southeast Asian exchanges, the PSE focuses more on local corporate financing. In recent years, it has gradually diversified its product offerings through instruments such as REITs and ETFs, making it suitable for long-term investors interested in the potential of the Philippine market.

Ask:Can foreign investors directly participate in PSE trading?

Answer:Yes. Foreign investors can participate in the PSE market by opening an account with a licensed securities broker in the Philippines and investing in products such as stocks, ETFs, and REITs. However, it is important to note that some industries in the Philippines (such as media and land ownership) have restrictions on foreign ownership, so it is important to verify relevant regulations before investing.

Ask:What are the main risks of investing in PSE?

Answer:As an emerging market exchange, the PSE faces major risks including limited market liquidity, significant price volatility, and significant susceptibility to macroeconomic and policy changes. Furthermore, compared to mature markets, the PSE's product depth and derivatives market are less developed. Therefore, investors must possess a strong risk tolerance and are advised to mitigate risk through diversification or medium- to long-term holding.