BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX

Time: 15-20Year

| Company

Company Regulatory

Regulatory Risk Monitor

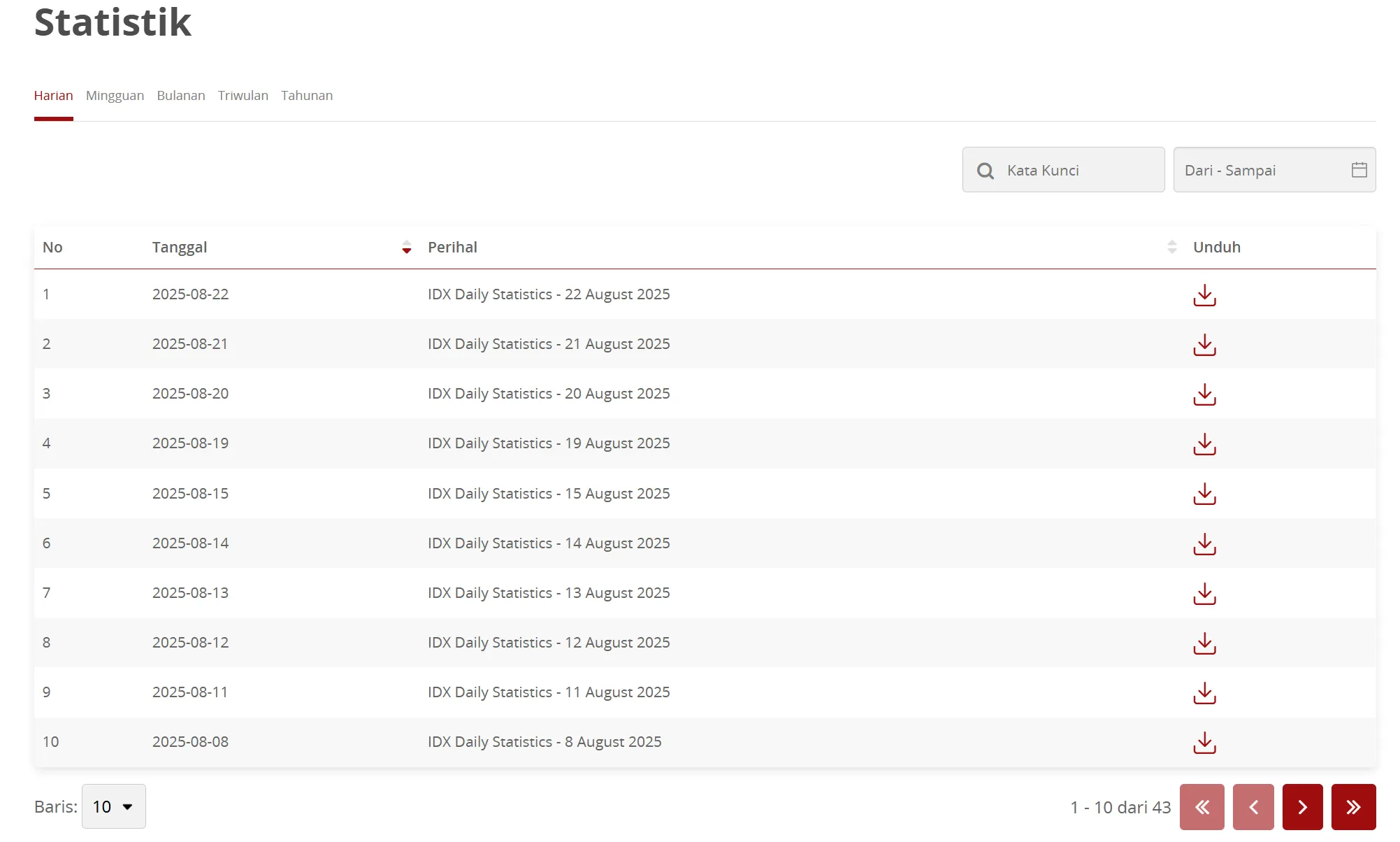

Risk Monitor Download

Download Documents

DocumentsThe Indonesia Stock Exchange (IDX), known as Bursa Efek Indonesia (BEI) in Indonesian, is Indonesia's sole official stock exchange, headquartered in Jakarta. IDX was formed in 2007 through the merger of the Jakarta Stock Exchange and the Surabaya Stock Exchange, but its history dates back to 1912. As the core infrastructure of Indonesia's capital market, IDX offers a diverse range of trading products, including stocks, ETFs, bonds, and derivatives. It is committed to promoting the development of the domestic capital market and providing convenient access for international investors to the Indonesian and ASEAN markets. IDX's mission is to enhance the competitiveness of Indonesia's capital market within the regional and global financial system through a standardized market environment and transparent trading mechanisms.

IDX holds a significant financial position in Southeast Asia, being one of the largest exchanges in ASEAN by market capitalization and consistently attracting global investor attention. By collaborating with other international exchanges and multinational institutions, IDX promotes regional integration and facilitates cross-border investment. The exchange not only operates the capital market but also serves as a self-regulatory organization (SRO), promoting market discipline and transparent information disclosure. IDX actively participates in the global sustainable development agenda and has clear strategic objectives in ESG and green finance. Its brand value lies in its national positioning and long-standing stable market performance, making it a key gateway for international capital into Indonesia.

IDX offers a wide range of market products, including stocks, ETFs, bonds, REITs, and benchmark indices (such as the IDX Composite and LQ45), providing investors with diverse investment options. Through derivatives services on the Indonesian futures market, investors can also participate in risk hedging and asset allocation. IDX's market services encompass securities issuance, listing services, market data dissemination, and investor education, forming a complete market ecosystem. The platform also provides electronic trading and real-time market information systems to ensure efficient market operations.

IDX utilizes an advanced electronic matching trading system to support efficient order execution and trading across a wide range of products. The company continuously upgrades its IT architecture to accommodate growing trading volume and internationalization. IDX provides real-time market information through its official website, data services, and mobile products, enhancing investor accessibility and transparency. In recent years, IDX has also actively explored digital and fintech innovations to enhance investor experience and market efficiency.

As a national exchange, IDX is strictly regulated by the Indonesian Financial Services Authority (OJK) and implements comprehensive information disclosure and risk management measures. Listed companies are required to adhere to strict financial disclosure and compliance standards, while the exchange ensures transparent and fair market operations. This regulatory framework provides confidence for both domestic and international investors and enhances the market's appeal. As a self-regulatory organization, IDX not only operates the market but also sets rules and oversees their implementation, thereby safeguarding investor rights.

The IDX offers diverse investment opportunities, with listed companies covering a wide range of sectors, including finance, energy, manufacturing, and technology. The market's daily trading volume and liquidity remain among the highest in Southeast Asia. Investors can access the IDX market through local brokerages, enjoying real-time data and a relatively low-cost trading environment. However, as an emerging market, investors should remain aware of potential market impacts from Indonesia's macroeconomic fluctuations, exchange rate risks, and the political and economic environment.

IDX is committed to investor education and financial literacy, operating dedicated investor education programs and online platforms to enhance public financial literacy. The exchange regularly hosts roadshows, seminars, and training courses to help both novice and institutional investors understand market dynamics and trading rules. Its official website is available in both Indonesian and English, ensuring convenient access to information for both local and international investors.

While the IDX is a well-regulated and transparent market, investing in emerging markets carries inherent risks. Investors should be mindful of potential market volatility due to economic slowdowns, currency devaluations, or policy adjustments. For international investors, in addition to market opportunities, macro risks and market maturity should also be considered in their investment decisions. The IDX serves as a bridge connecting regional and global capital, making it suitable for medium- to long-term investors seeking growth opportunities in emerging markets.

Overall, the Indonesia Stock Exchange (IDX), as Indonesia's only national capital market platform, has the following characteristics:

It has a long history, a solid market foundation, and a leading market capitalization in the ASEAN region;

Comprehensive product lines covering stocks, ETFs, bonds and derivatives;

Advanced technical systems and transparent transaction mechanisms;

Significant investment in compliance supervision and investor education;

As an emerging market, opportunities and risks coexist, and investors need to remain rational.

The core value of IDX lies in its pivotal position within the Indonesian and ASEAN markets, and its positive role in sustainable investment and market internationalization. For global investors, IDX is not only a key gateway to the Indonesian market, but also a vital platform connecting emerging economies with international capital.

Answer:IDX offers a diverse range of investment instruments, including stocks, ETFs, bonds, real estate investment trusts (REITs), and benchmark indices such as the IDX Composite and LQ45. Investors can also trade futures and options in the derivatives market. These products cater to diverse investor needs, ranging from long-term allocations to short-term arbitrage opportunities.

Answer:Yes. The IDX is strictly regulated by the Indonesian Financial Services Authority (OJK). As a self-regulatory organization (SRO), it is also responsible for setting and enforcing market rules. Listed companies must adhere to strict disclosure and compliance standards, resulting in high trading transparency. This framework provides strong investor protection, but as Indonesia is an emerging market, investors still need to be aware of macroeconomic and policy risks.

Answer:IDX is one of the largest and most liquid exchanges in the ASEAN region, with over 800 listed companies across a wide range of sectors, including energy, finance, consumer goods, manufacturing, and technology. For international investors, IDX offers access to Indonesia, Southeast Asia's largest economy, and the opportunity to share in the dividends of its economic growth and regional integration. IDX also actively promotes ESG and green finance, providing more options for investors focused on sustainable investing.

As Indonesia’s only official stock exchange, IDX offers strong regulation, high transparency, and serves as a key gateway to Southeast Asia’s capital markets.

![]() Reply

Reply

The market provides diverse products including stocks, ETFs, and bonds, but as an emerging market, investors should remain cautious of macroeconomic and currency risks.

![]() Reply

Reply

~ There's nothing more ~