Normal Operation

Normal OperationDukascopy

15-20Year

Basic Information

Country

SwitzerlandMarket Type

foreign exchange|Stock|Futures|Crypto|CFDEnterprise Type

BrokerageService

Foreign exchange and online trading, CFDs, digital currencies, financial management and account services, multi-currency bank accounts, bank cards, payment services, etc.Support Languages

English, Chinese, Japanese, French, German, Spanish, Russian, Arabic, etc.Domain Registration Date

1998-12-12Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

Dukascopy Bank SA is an online banking and trading services provider headquartered in Geneva, Switzerland. Founded in 2004, it is strictly regulated by the Swiss Financial Market Supervisory Authority (FINMA). As a bank offering both retail and institutional services, Dukascopy is renowned for its comprehensive solutions for foreign exchange, contracts for difference (CFDs), commodities, cryptocurrencies, and precious metals trading. The bank also offers multi-currency accounts, payment cards, asset management, and digital banking services, combining the stability of a traditional financial institution with the innovation of a fintech platform. Leveraging its Swiss financial compliance background and international market positioning, Dukascopy Bank has become a vital gateway for investors to explore global trading and digital assets.

🌐Global layout and brand background

Dukascopy is headquartered in Geneva, Switzerland, with subsidiaries in Riga (Latvia) and Tokyo (Japan), covering multiple markets across Europe, Asia, and globally. Leveraging its Swiss brand reputation, the bank emphasizes security, transparency, and compliance. Its subsidiary, Dukascopy Europe, is regulated by the Latvian Financial Supervisory Authority, while Dukascopy Japan operates under a license in Japan. This overall presence demonstrates its cross-regional compliance and business expansion capabilities, providing trading channels and account services to investors in various countries and regions. From a brand perspective, Dukascopy has established a unique position in integrating traditional banking with modern financial technology.

💹Trading products and services

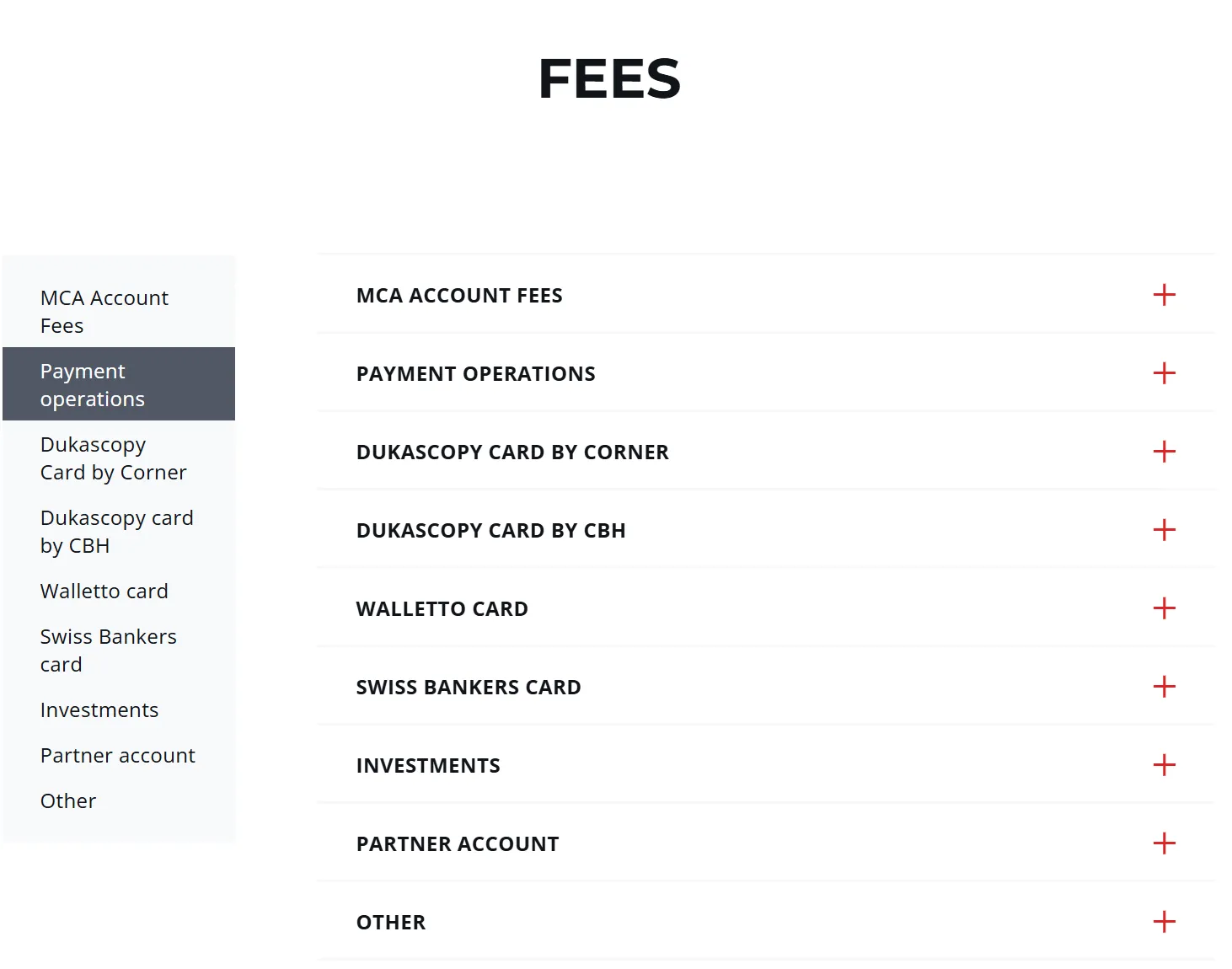

Dukascopy's product line encompasses foreign exchange, CFDs (stocks, indices, and commodities), cryptocurrencies (including Bitcoin and Ethereum), binary options, and spot metals trading. Clients can access global markets through a single account, enjoying multi-currency bank accounts, Visa/Mastercard bank cards, and online payment solutions. Its digital banking platform also offers instant payments, P2P transfers, and investment management capabilities, meeting the daily needs of retail clients and the cross-border settlement and multi-asset allocation requirements of institutional clients. This integration of traditional finance and emerging digital assets makes Dukascopy a multi-layered financial platform.

💻Trading technology and platform experience

Dukascopy's core strength lies in its proprietary JForex platform , which supports algorithmic trading, strategy backtesting, and automated execution, making it a popular choice among professional traders. Furthermore, the platform is compatible with both desktop and mobile platforms, providing users with a flexible trading experience. JForex boasts a rich suite of technical indicators, charting tools, and APIs, making it suitable for algorithmic traders and quantitative trading teams. The platform boasts industry-leading execution speed and stability, and offers direct access to liquidity providers for enhanced market depth and transparency. For beginners, the platform also offers demo accounts and educational resources to help them gradually understand the market and trading tools.

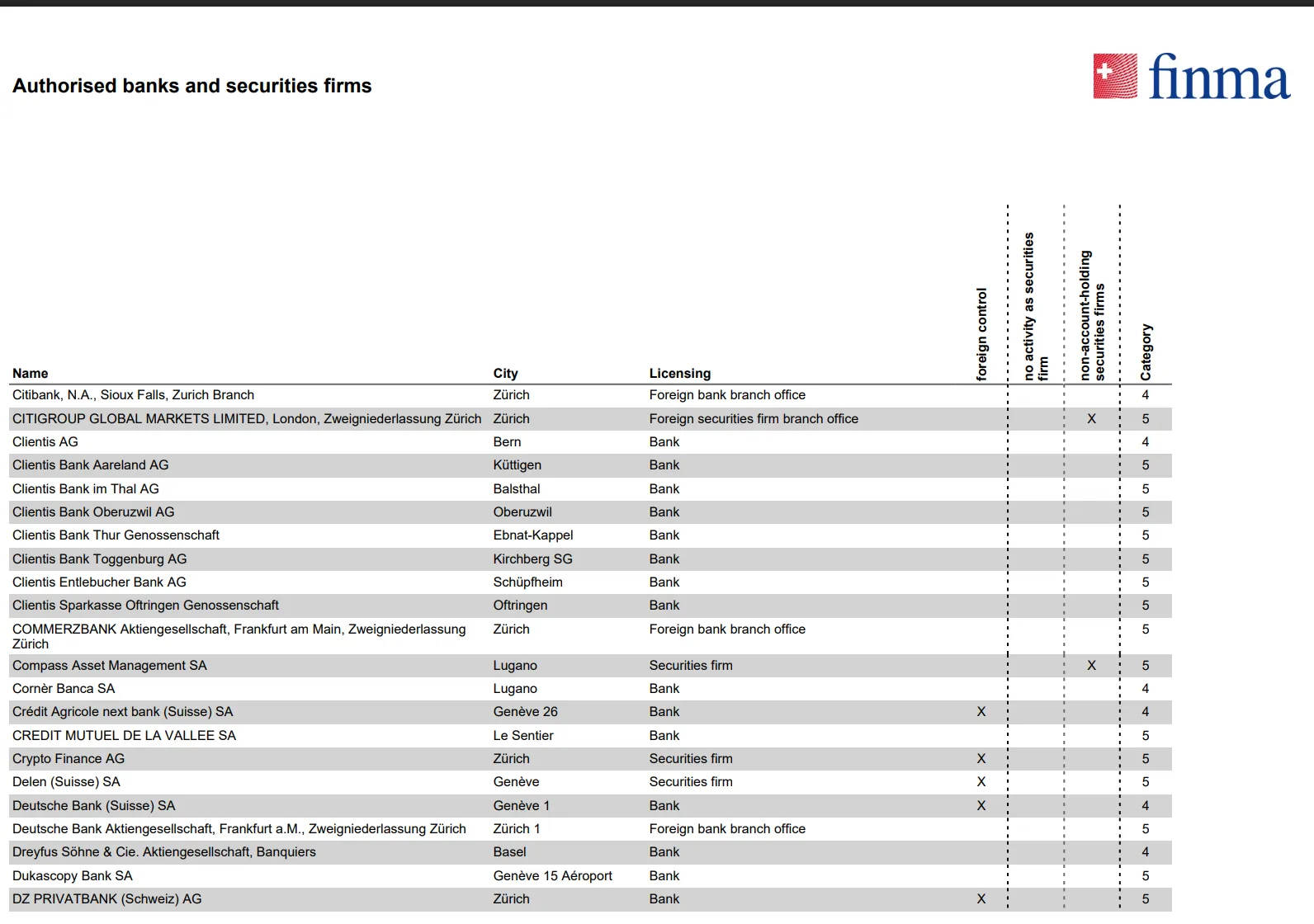

🛡️Regulatory compliance and fund security

As a licensed Swiss bank, Dukascopy Bank SA is directly regulated by the Swiss Financial Market Supervisory Authority (FINMA) and adheres to strict client funds segregation regulations. All client deposits are protected by the Swiss Deposit Insurance System (esisuisse), providing investors with exceptional financial security. Its European and Japanese subsidiaries are also subject to local regulatory oversight, ensuring compliance and transparency. Compared to some unregulated offshore platforms, Dukascopy's compliance framework and financial security significantly enhance its market credibility and investor trust.

⚡Trading conditions and experience

Dukascopy offers competitive trading conditions, including low spreads, a transparent commission structure, and leverage of up to 1:200 (varies by region based on regulatory requirements). Orders are executed through an ECN model, providing direct access to market liquidity and reducing the risk of human intervention and slippage. Investors can access near-institutional-level liquidity in a highly transparent environment. It's important to note that while leverage is relatively high, it remains within regulatory limits, making it suitable for investors who prioritize capital security and trading efficiency.

🎓Customer support and value-added services

Dukascopy offers 24/6 multilingual customer support in over ten languages, including English, Chinese, Japanese, French, and Russian, to meet the needs of its global clientele. The platform also provides educational seminars, market analysis, research reports, and news to enhance investor knowledge. Its digital banking app integrates financial tools and convenient payment functionality, offering users both financial services and educational resources. Overall, its comprehensive customer support and educational resources cater to a diverse user base, from beginners to professional traders.

⚠️Risk Warning and Platform Positioning

Despite Dukascopy's regulatory compliance and high transparency, the forex and CFD products it offers are inherently high-risk investments that can result in total capital loss. The bank provides clear risk disclosures on its website and platform, reminding investors to carefully manage their funds and conduct risk assessments before trading. Dukascopy is positioned more towards investors who prioritize compliance and security and possess some trading experience, rather than speculators seeking high leverage and returns.

🔍Comprehensive analysis and evaluation

Overall, Dukascopy Bank SA has distinctive features in the following aspects:

With a Swiss banking license and FINMA supervision, the funds are highly secure;

Wide product coverage, ranging from traditional foreign exchange to digital assets;

The technology platform is independently developed and powerful, suitable for professional and programmatic traders;

The international layout is reasonable, and the European and Japanese subsidiaries have enhanced compliance;

It supports both retail and institutional users, but investors still need to manage trading risks carefully.

As a hybrid banking, trading platform, and fintech institution, Dukascopy's strengths lie in its ability to balance compliance with innovation. For users seeking diversified investments in a secure environment, Dukascopy offers a trusted channel.

Selected Enterprise Evaluation

4.67

Total 3 commentsDukascopy Bank stands out with Swiss FINMA regulation, strong fund protection, and a professional-grade JForex platform, making it a trusted choice for experienced traders.

Reply

I thought I was being smart when I joined what looked like a legitimate trading platform. At first, everything seemed perfect — my balance appeared to grow, and the support team responded quickly. But the moment I tried to withdraw even a small amount, everything changed. That’s when I realized I had been deceived. A colleague referred me to MRS SELETINA DE-ALAGRENS, who patiently guided me through every step of the recovery process. Within just a few days, I was stunned to see the funds returned. It truly felt like a second chance to get in contact with: ([email protected])

Reply

The bank offers a wide range of products including Forex, CFDs, and crypto, but the complexity of its platform and higher learning curve may be less friendly for complete beginners.

Reply

I had already accepted that my investment was gone for good. But a friend encouraged me to contact MRS SELETINA DE-ALAGRENS. They asked the right questions, helped me stay calm, and showed me it was still possible to recover what I’d lost. Within a few days, the money was back in my account. I’ll always be grateful for that.Get in contact with her if scammed ([email protected])

Reply

One has to be careful with the brokers on the internet now. Last year I was scammed in the binary trade option by a broker I met on Instagram. I invested $14000 which I lost, I couldn’t make a withdrawal and I slowly lost access to my trade account for 3 months I was frustrated and depressed. After a few months, I met Barry white who is A recovery expert that works along side with the Federal Bureau of Investigation (FBI) and other law firm. he worked me through the process of getting my money back and all the extra bonus which I got during my trading. he can be of help to anyone who has a similar situation. You can contact him via his mail: barry white4390 @gmail.com

Reply

My so-called “profits” vanished the moment I was locked out of my trading account. Desperate for answers, I found MRS SELETINA DE-ALAGRENS. They didn’t waste time — just reviewed the facts and got to work. Less than two days later, my funds were back. It was the first real relief I’d felt in weeks. Get in contact with her if scammed ([email protected])

Reply

~ There's nothing more ~

About Dukascopy's questions

Ask:Is Dukascopy Bank regulated and are my funds safe?

Answer:Yes. Dukascopy Bank SA is a licensed Swiss bank regulated by the Swiss Financial Market Supervisory Authority (FINMA), and client funds are protected by the Swiss Deposit Insurance System (esisuisse). Compared to many unregulated or offshore platforms, Dukascopy offers superior compliance and fund security.

Ask:What are the main trading products offered by Dukascopy?

Answer:Dukascopy offers trading products such as forex, contracts for difference (CFDs, including stocks, indices, and commodities), precious metals, cryptocurrencies (such as Bitcoin and Ethereum), and binary options. Furthermore, it provides multi-currency bank accounts, bank cards, and digital banking services to meet the diverse needs of retail and institutional investors.

Ask:What are the features of the Dukascopy trading platform? Is it suitable for beginners?

Answer:Dukascopy's proprietary JForex platform supports algorithmic trading, strategy backtesting, and API access, making it suitable for both professional and programmatic traders. It also offers a demo account and educational resources to help beginners get started. While JForex offers powerful features and a slightly higher learning curve for beginners, it remains suitable for long-term use with the educational support it provides.