BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX

Time: 10+Year

| Company

Company Regulatory

Regulatory Risk Monitor

Risk Monitor Download

Download Documents

DocumentsCAPEX.com offers a wide range of CFDs and supports MT5, but its reliance on mid-tier and offshore regulation raises concerns for long-term investors.

![]() Reply

Reply

Attractive leverage and multi-asset coverage make it appealing for short-term traders, yet the lack of transparency and limited investor protection remain significant risks.

![]() Reply

Reply

~ There's nothing more ~

CAPEX.com is an online CFD and multi-asset trading platform, established in 2016. Its registered entities include KW Investments Ltd (Seychelles, FSA regulated) and Key Way Investments Ltd (Cyprus, CySEC regulated). The company markets itself as a "global fintech brokerage," offering services across a range of sectors, including forex, indices, commodities, stocks, cryptocurrencies, and ETFs.

However, its core CAPEX competitiveness is not outstanding. Despite offering multi-asset services, its overall product architecture still relies on standardized CFD contracts, and platform innovation is limited. In practice, investors experience more of a typical retail CFD broker model than a truly differentiated fintech breakthrough.

CAPEX emphasizes its "global presence," claiming to have branches in Cyprus, Seychelles, the UAE, and South Africa. However, a closer look reveals that its business is primarily concentrated in offshore and emerging markets, with limited penetration into strictly regulated markets like Europe and the United States. This strategy means that its market expansion relies more heavily on less regulated regions with lower compliance barriers.

From a branding perspective, CAPEX has previously used marketing and advertising to boost its visibility, but lacks a deep industry heritage. Compared to traditional brokerages with decades of operating history, CAPEX's risk resilience and long-term credibility still require time to validate.

CAPEX offers a wide range of products, including foreign exchange, stock indices, ETFs, commodities, bonds, and cryptocurrencies, all presented as CFDs. While this diversification may superficially offer more options for retail investors, due to the inherent riskiness of CFDs, which lack physical delivery, investors with limited risk tolerance are susceptible to high volatility and margin risk.

External analysis points out that although CAPEX has a full range of trading categories, it does not include physical stocks or spot crypto assets, which limits its appeal in medium- and long-term investment and asset allocation, and is more inclined towards short-term speculative users.

CAPEX offers its own WebTrader platform and mobile app, and supports MetaTrader 5 (MT5). While its interface is simple and meets basic trading needs, it still lags behind leading international platforms in terms of execution speed, deep liquidity, and support for high-frequency trading.

Some users have reported slippage and latency during periods of market volatility, which can pose additional risks for investors relying on short-term trading. For automated strategies or institutional traders, CAPEX's platform experience doesn't fully meet the high standards.

CAPEX is subject to dual regulation by both Cyprus' CySEC and the Seychelles' FSA, which appears to be compliant, but its effectiveness is limited. CySEC is an EU regulatory body, but its investor protection and compensation mechanisms remain limited, while the Seychelles FSA is considered a relatively lax offshore regulator.

Regarding fund security, CAPEX claims to implement segregated custody of client funds, but it does not publish detailed audit reports on its website. For investors, this lack of transparency means that if the platform encounters operational risks, it may be difficult to fully safeguard funds.

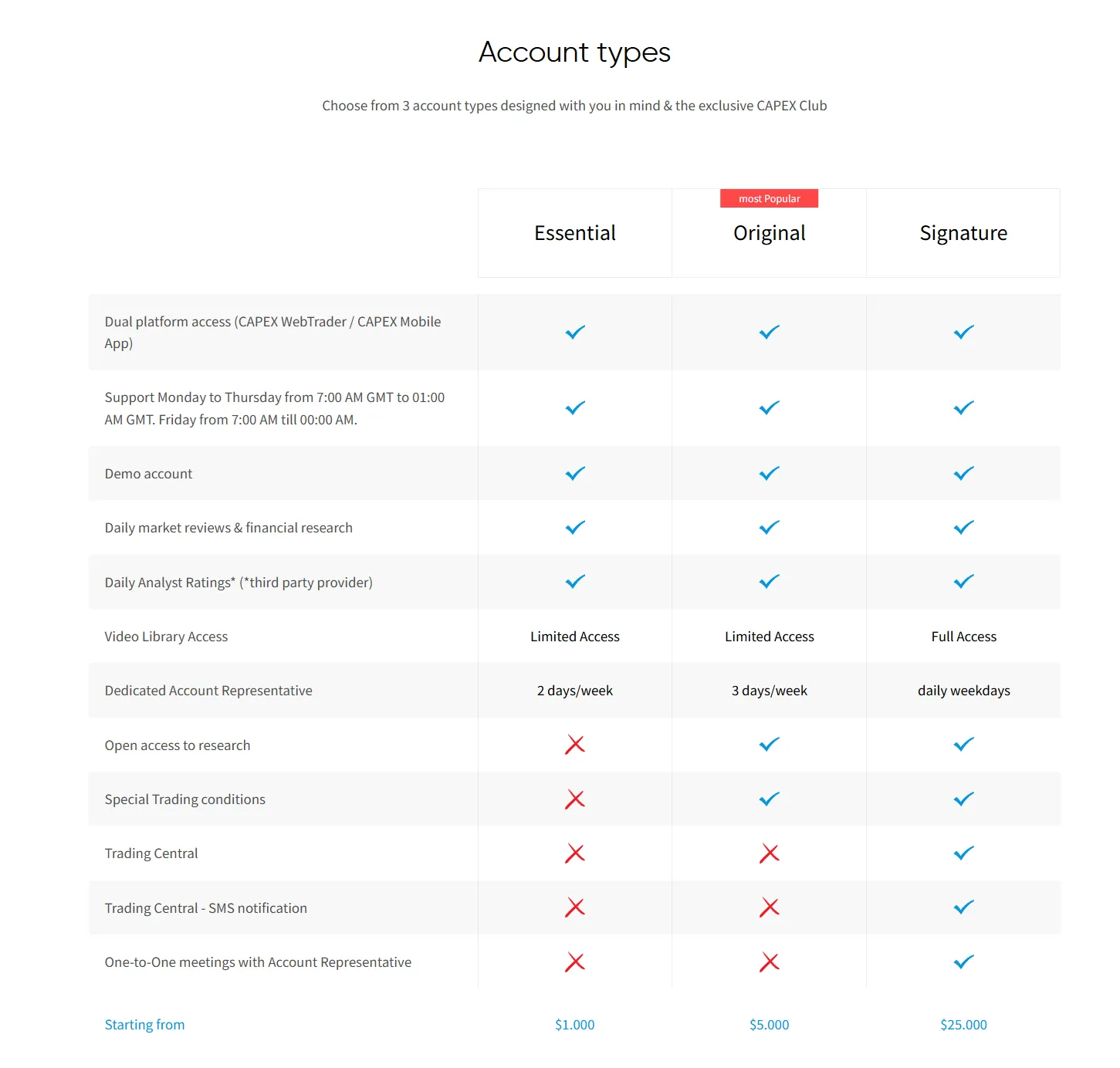

CAPEX offers leverage of up to 1:30 (EU) or higher (up to 1:400 for offshore markets), along with floating spreads and zero commission. While seemingly competitive, the high leverage and complex margin requirements can put novice investors at risk of margin calls.

For traders seeking low costs, CAPEX's spreads and conditions are only average and do not offer significant advantages.

CAPEX offers multilingual customer support, primarily through email and online customer service channels. Response efficiency is average, with users in the community reporting delayed responses and untimely issue resolution. Its educational offering, CAPEX Academy, offers video courses and articles, but these primarily focus on basic knowledge and lack in-depth research and practical strategy guidance.

Overall, its value-added services are more of a marketing package and have limited practical help for serious investors.

CFDs and high-leverage trading are inherently high-risk. While CAPEX provides risk disclosure, its marketing emphasizes potential returns, which can easily attract inexperienced retail investors. Its positioning is more like a speculative platform for those with a high risk appetite, rather than an ideal choice for long-term, prudent investors.

Overall, CAPEX.com has a certain market coverage capability and a diversified product line, but it still has shortcomings in regulatory compliance, financial transparency, technical stability, and customer service.

Strengths: Multi-asset coverage, support for MT5 and proprietary platforms, active marketing.

Disadvantages: Lack of top-level licenses, insufficient financial transparency, products mainly consisting of high-risk CFDs, and mixed user experience reviews.

CAPEX’s positioning and risk structure are not friendly to users who want long-term, stable investments; it is more suitable for short-term, high-risk speculators rather than investors seeking security and transparency.

Answer:CAPEX is currently primarily regulated by Cyprus' CySEC and the Seychelles FSA. While CySEC is part of the EU system, investor protection is limited, while the Seychelles FSA is an offshore regulator with less stringent oversight. Therefore, CAPEX's regulatory compliance is considered average within the industry, and investors should carefully consider these regulatory differences when choosing a broker.

Answer:CAPEX primarily offers Contracts for Difference (CFDs), covering forex, stocks, indices, ETFs, commodities, and cryptocurrencies. CFDs inherently carry high leverage and carry high risk, making them susceptible to margin calls during market fluctuations. While the platform offers low spreads and leverage up to 1:400 (in offshore accounts), this also increases risk, and investors should exercise caution when using leveraged instruments.

Answer:CAPEX's strengths lie in its multi-asset coverage and MT5 platform support. However, due to its focus on high-risk CFDs and its reliance on medium- and offshore regulations, it is more targeted towards short-term, high-risk traders. Those seeking stable, long-term investments may want to consider other platforms with stricter regulations and more transparent products.