BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX

Time: 10+Year

| Company

Company Regulatory

Regulatory Risk Monitor

Risk Monitor Download

Download Documents

DocumentsAMarkets provides access to 550+ instruments across forex, stocks, commodities, indices, and crypto, backed by MT4/MT5 platforms and fast execution. Its membership in The Financial Commission and regular audits add credibility.

![]() Reply

Reply

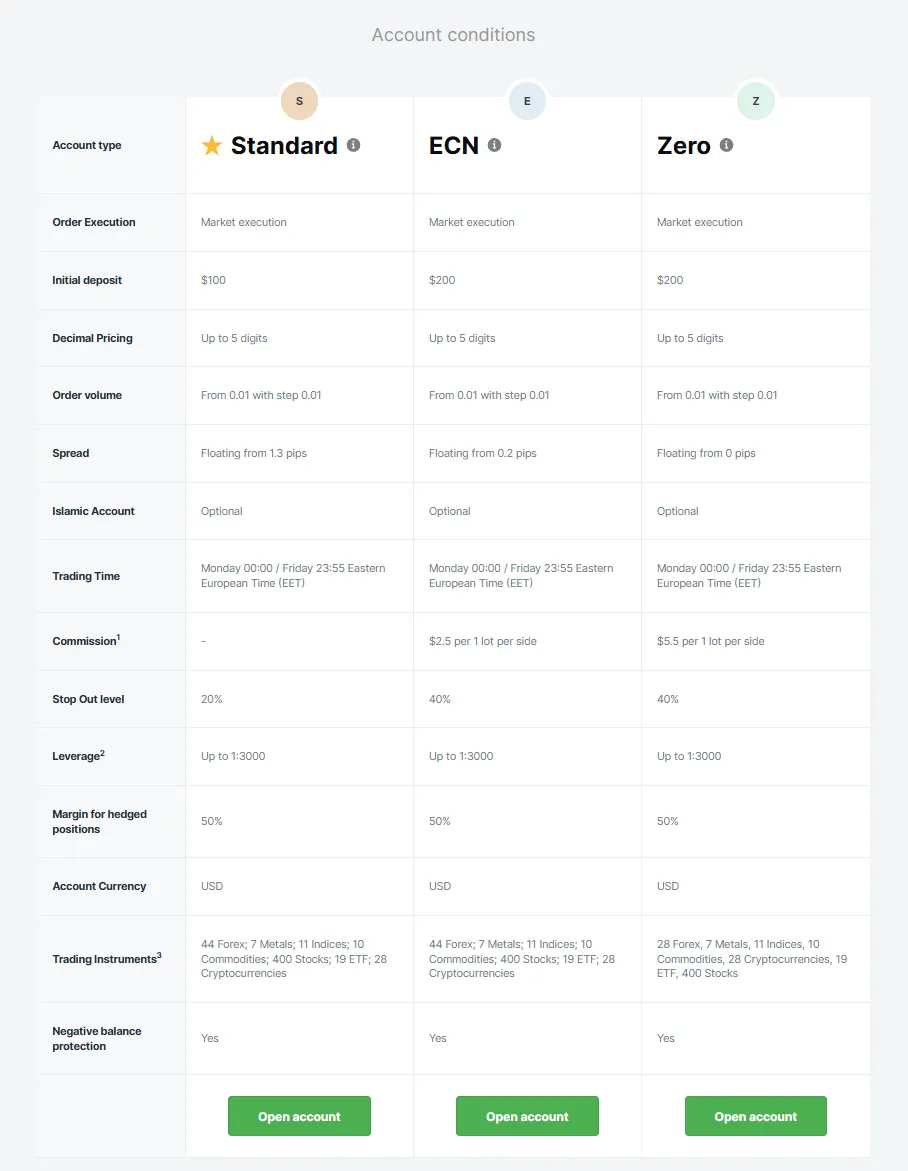

With high leverage up to 1:3000, multiple account types, and rich educational resources, AMarkets is suitable for both beginners and experienced traders. However, the absence of top-tier regulation like FCA or ASIC may concern some investors.

![]() Reply

Reply

~ There's nothing more ~

Founded in 2007, AMarkets is a global online forex and contracts for difference (CFD) broker headquartered in Saint Vincent and the Grenadines, with registered operations in the Cook Islands and Comoros. As a veteran broker with over 15 years of industry experience, AMarkets specializes in providing a diverse range of financial products and professional trading services to both retail and institutional clients.

The company offers clients over 550 trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. Supporting the globally used MetaTrader 4 and MetaTrader 5 platforms, AMarkets is committed to providing users with an efficient, convenient, and stable trading experience. Through its continued investment in financial technology and services, AMarkets has become a leading platform for emerging markets and international investors.

AMarkets has extensive global reach, with a focus on Asia, Africa, the Commonwealth of Independent States, and the Middle East. Its legal entity, AMarkets LTD, is registered in Saint Vincent and the Grenadines and licensed in the Cook Islands and the Comoros, ensuring cross-regional compliance and diversified market expansion.

As a member of the Financial Commission, AMarkets clients are protected against losses up to €20,000, and the company undergoes monthly independent execution quality audits by Verify My Trade (VMT), underscoring its transparent and accountable brand image.

AMarkets offers CFD trading across forex, stocks, indices, commodities, and cryptocurrencies, catering to investors with varying risk appetites and strategies:

Foreign exchange trading offers a wide range of currency pairs and low spreads;

Stock and stock index trading provides diversification options for investment portfolios;

Commodities and cryptocurrencies provide investors with increased hedging and emerging market opportunities.

External reviews generally believe that AMarkets' product line is comprehensive and particularly suitable for traders who want to invest across categories.

AMarkets supports both MetaTrader 4 and MetaTrader 5 platforms and offers multi-terminal access, including web and mobile. With execution speeds as fast as 0.03 seconds and leverage up to 1:3000, it meets the needs of high-frequency trading and multi-strategy investing.

In addition, the company offers clients trading tools such as AutoChartist analysis, market sentiment indicators, and copy trading capabilities, enhancing their strategy execution and market analysis. The overall experience is rated above average by industry experts and is particularly popular among mid- to advanced-level investors.

AMarkets' entities are registered in Saint Vincent and the Grenadines, the Cook Islands, and the Comoros, and are licensed by local financial services regulators. The company implements strict segregation of client funds and utilizes the Financial Commission's third-party protection mechanism to ensure client fund security and transaction transparency.

Although it is not directly regulated by top regulators such as the UK FCA or Australia's ASIC, its compliance measures and external independent audits still provide customers with a certain degree of financial security and market confidence.

AMarkets offers low spread accounts, leverage up to 1:3000, fast order matching, and a variety of account types to suit investors of all levels. Its execution speed and convenient access to funds make it competitive in emerging markets.

It’s important to note that high-leverage trading carries a higher risk, but AMarkets clearly discloses risks on its website and during the account opening process, and provides educational resources to help users understand risk management.

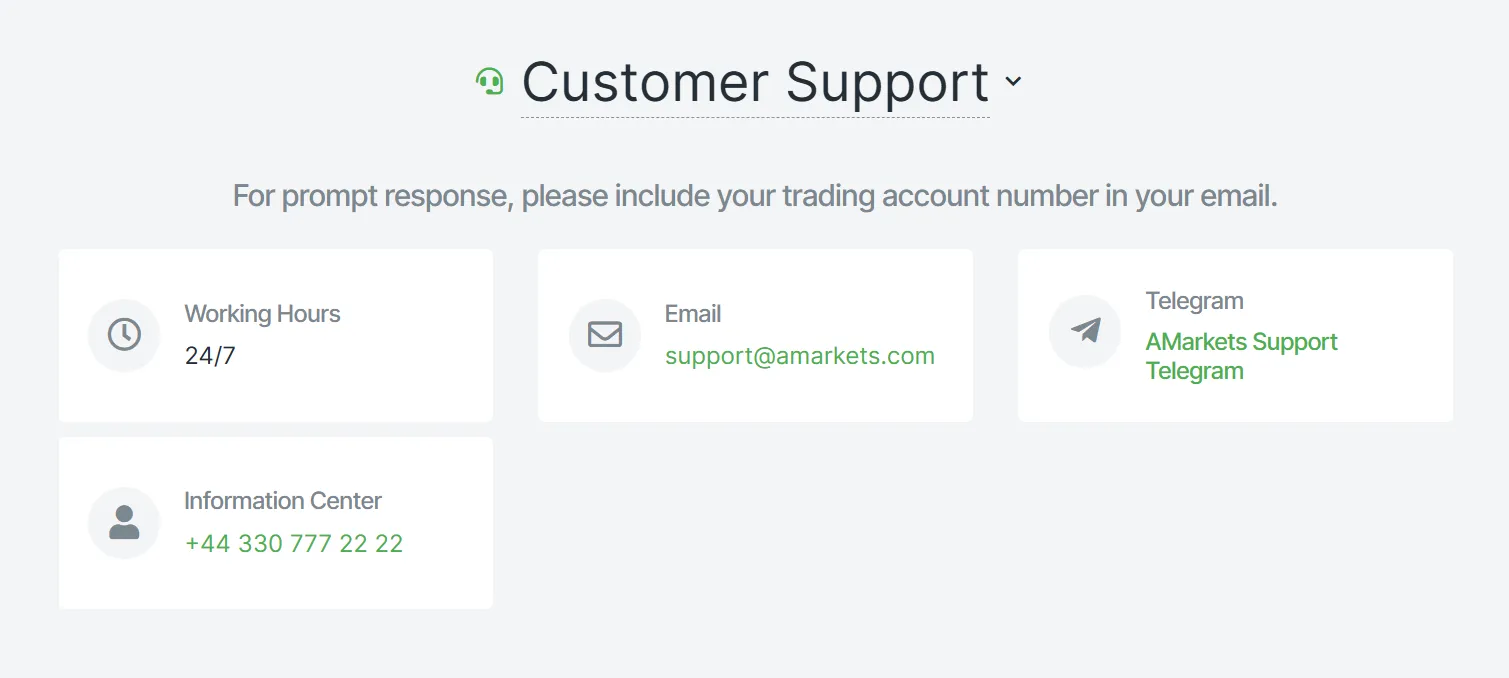

AMarkets offers 24/5 multilingual customer service in English, Turkish, Russian, and localized support in various regions. The company also provides clients with a wealth of educational resources, including market analysis reports, trading guides, webinars, and video courses, to help users of all experience levels improve their trading skills.

Its investment in education and customer support adds value to the platform, making it particularly suitable for novice investors to get started and improve.

AMarkets explicitly states in its external communications that forex and CFD trading are high-risk investments that may result in the loss of principal. The company strives to mitigate potential risks faced by clients through fund segregation, compensation mechanisms, and educational support.

From a positioning perspective, AMarkets is more suitable for investors who want flexible investment through diversified products and value transaction efficiency and service guarantees.

In summary, AMarkets has the following features:

Established over 15 years ago, the brand is stable;

The product line covers foreign exchange, stocks, indices, commodities and cryptocurrencies;

The platform is technologically advanced, with fast execution and support for multi-strategy trading;

The compliance mechanism is transparent, and the fund security and compensation guarantees are relatively complete;

The education and customer support system is robust, suitable for both novice and professional traders.

As an online broker that continues to expand globally, AMarkets has become a premium choice for investors in the CFD and Forex markets thanks to its diverse product offerings, strong technical support, and transparent service model.

Answer:AMarkets is registered and licensed in St. Vincent and the Grenadines, the Cook Islands, and the Comoros, and is a member of the Financial Commission. It offers payouts up to €20,000 per trade and is independently audited by Verify My Trade (VMT) to ensure transparency and execution quality. The company also implements segregated client funds for enhanced security.

Answer:The platform supports over 550 trading instruments, including forex currency pairs, stocks, indices, commodities, and cryptocurrency CFDs. Investors can trade both traditional assets and the emerging digital currency market, meeting diverse investment needs.

Answer:AMarkets offers MT4/MT5 platforms, multiple account types, and leverage options up to 1:3000. It also provides trading tutorials, market analysis, and webinars. New investors can learn the rules of the market through educational resources and demo accounts. However, as forex and CFD trading are inherently high-risk investments, beginners are advised to start with small trades to gradually gain experience.