Suspected of fraud

Suspected of fraudIronFX Seychelles

1Year

Basic Information

Country

Anguilla IslandMarket Type

foreign exchange|Stock|Futures|CFDEnterprise Type

Service

Provide trading services for a variety of financial products such as foreign exchange (Forex), contracts for difference (CFD), stocks, commodities, indices, etc.Support Languages

English, German, Spanish, French, Japanese, Korean, Indonesian, Chinese, etc.Domain Registration Date

2008-02-10Business Status

Suspected of fraudCompany IntroductionWeb Analytics

Company Introduction

IronFX (ironfx.com) operates across multiple entities. Its global platform is operated by Notesco Int Limited (registered in Anguilla); its EU platform is licensed by Notesco Financial Services Limited (Cyprus) (CySEC license number 125/10); and its South African platform is operated by Notesco SA (Pty) Limited (FSCA FSP 45276). Despite touting its "globalization, multi-product offering, and MT5 trading," its multi-entity structure and overseas registrations have long sparked controversy regarding compliance consistency and investor protection.

🌐Global layout and brand background

Publicly available information reveals that IronFX's global website footer and legal documents repeatedly emphasize "IronFX is a trading name of Notesco Int Limited (Anguilla)" and its registered address is located at The Valley, AI-2640. EU disclosure materials clearly state "IronFX is a trading name of Notesco Financial Services Limited (CySEC 125/10)." The South African website's registered address is disclosed as 5–38 Katherine & West, 114 West Street, Sandton 2196. This parallel framework of "EU regulation and offshore registration for a global clientele" results in fragmented information and inconsistent terms, exacerbating the difficulty of user identification and the cost of cross-border rights enforcement.

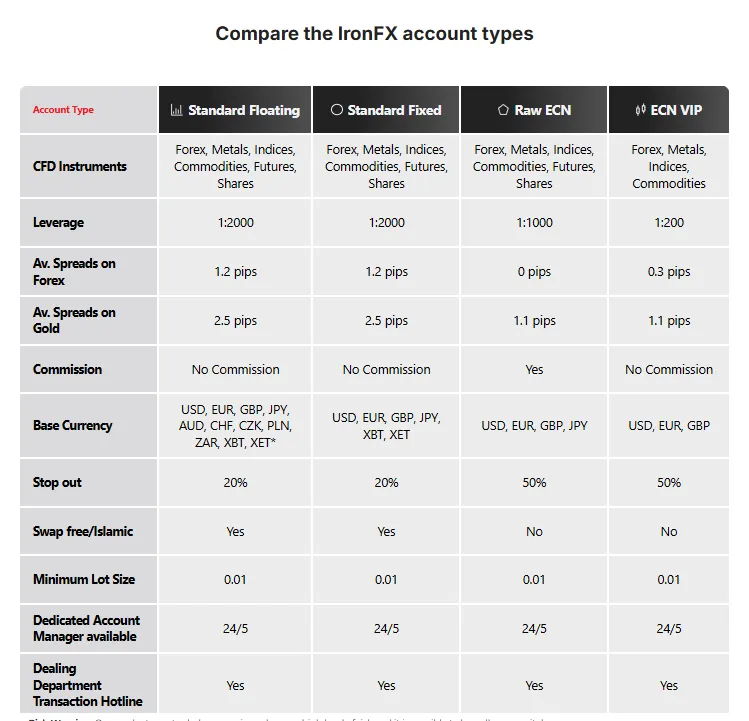

💹Trading products and services

The brand claims to cover forex, indices, commodities, and stock/crypto CFDs, and offers an MT5 terminal. However, with offshore entities handling global account openings, there's a lack of unified external constraints on product and terms. Key details like fee structures, overnight fees, and margin calls/margin calls often require users to compare documents page by page across different sites, making it difficult to cross-check tradability and counterparty quality.

💻Trading technology and platform experience

IronFX uses MT5 as its main selling point, but it's important to note that MT5 is merely trading software and doesn't guarantee platform compliance or fund security. With offshore entities able to independently deploy servers, the controllable scope for spreads, quotes, and order execution is expanded. Furthermore, given the varying terms and conditions across multiple entities, slippage and order rejection disputes during periods of high volatility require small-scale, field-tested verification.

🛡️Regulatory compliance and fund security

EU Entity: Notesco Financial Services Ltd (125/10) is verifiable on the CySEC's official website; however, the brand has a history of attracting attention due to customer complaints and compliance issues, including media coverage and regulatory action in 2015, leaving behind a deeply negative reputation.

Global Entity: ironfx.com explicitly states that its services are provided by Notesco Int Limited in Anguilla. Offshore entities typically do not offer the same level of investor protection and compensation mechanisms as first-tier regulators, making withdrawal disputes and cross-border arbitration more difficult.

South African entity: The FSCA discloses Notesco SA (Pty) Limited (FSP 45276) as a regulated provider, but its regulatory boundaries only apply to the corresponding services and clients provided locally and do not automatically spill over to the global site.

Furthermore, industry media outlets reported on IronFX’s withdrawal delays and customer complaints in 2015-2016. Even though the brand subsequently adjusted its processes and continued operations, the accumulated risks of these historical disputes remain a valuable consideration for new account holders.

⚡Trading conditions and experience

Marketing copy often mentions "low spreads/multiple account types/high leverage (offshore entities)." However, key fees and execution policies are scattered across multiple documents (Global, EU, and South Africa), making comparisons more complex. For the average investor, it's best not to base decisions on claims like "promotions, bonuses, and ultra-fast deposits and withdrawals" without a clear list of fees and execution policies.

🎓Customer support and value-added services

While brands have FAQs, legal documents, and customer service portals, service commitments and dispute resolution procedures are not uniformly presented across entities. When it comes to sensitive topics like rebate/promotion restrictions, identification of unusual transactions, and withdrawal reviews, there have been public outcries of inconsistency between customer service explanations and applicable terms and conditions. Before placing a firm trade, it's recommended to request and confirm the applicable entity, applicable terms, and complaint channels via email, and retain all necessary evidence.

⚠️Risk Warning and Platform Positioning

Forex/CFDs are high-leverage, high-risk products. In the case of IronFX, its offshore presence, global client base, and historical complaints create additional non-market risk. For investors seeking a stable experience and the availability of legal protection, using IronFX as their primary trading account is not recommended. If experimenting with it, it's crucial to adopt a conservative strategy of "small, step-by-step transactions, limited deposits and withdrawals, and strict leverage control."

🔍Comprehensive analysis and evaluation

The compliance landscape is split: the EU/South Africa are verifiable, the global site is the Anguilla entity, and the protection levels are inconsistent.

Historical controversies have not completely dissipated: there are many public reports related to withdrawal and promotion disputes, and the reputation has been significantly discounted.

Dispersed information disclosure: Key terms are distributed across different domain names/files, making comparison and verification more difficult.

Conclusion (Negative Positioning): IronFX's brand and entity structure are not friendly to beginners. If investor protection, consistent terms, and stable rights protection are key concerns, it is recommended to prioritize brokers with a single, first-tier regulatory body (such as the FCA/ASIC/CySEC) and directly open an account with that regulated entity. Before making a deposit, complete a license verification, compare fees and execution terms, and perform a small withdrawal test. As of September 15, 2025 (New Zealand time), this conclusion remains relevant.

Selected Enterprise Evaluation

3.75

Total 2 comments ni***dd

ni***ddRecovering your lost investment funds as the case might be, is not what you can do alone, you’d require the service of a trained recovery specialist. A recovery specialist is a person or a group of people who are well equipped to work around the brokerage network. They have vast knowledge about the whole network and have the right software and private keys to follow any transaction. I was scammed 175k trading online to an investment broker, good thing I got every penny back through the help of Gavin ray he’s a genius Contact MAIL : Gavinray78 @ gmail . com or WhatsApp +1 352 322 20 96 It is also important to be patient and really calm during the recovery process.

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

~ There's nothing more ~

About IronFX Seychelles's questions

Ask:Who regulates this platform? Which entity is my account with?

Answer:IronFX operates through multiple entities. Global sites often correspond to offshore entities (such as Anguilla's Notesco Int Limited), EU clients correspond to Cyprus entities (CySEC 125/10), and South African clients correspond to FSCA-licensed entities. Before opening an account, please ensure: Confirm your actual counterparty's company name using the registration/account opening email and contract letterhead; Verify the "Trade name/Legal entity/Registered address" in the official website footer against the legal documents; Search the relevant regulatory website for the entity's license number and status. If the address does not match your location or is unavailable, consider it a significant risk and proceed with caution.

Ask:Are deposits and withdrawals safe? How long does it take for funds to be credited to my account?

Answer:Offshore entities typically offer weaker investor protections and face difficulties in cross-border rights enforcement. Historical disputes have often centered around delayed/rejected withdrawals. Recommended practices: Deposit funds in small amounts, test them with a minimum deposit and a T+0/T+1 small withdrawal. Keep records: Keep a record of all communications, bill of lading receipts, and screenshots of bank statements. Avoid bonus restrictions: Be cautious when participating in bonus/rebate programs, as these clauses often serve as a basis for withdrawal restrictions. Choose a payment channel: Prioritize traceable and reversible channels (such as bank cards/regular payment institutions) and avoid anonymous on-chain transfers. Handle timeouts: If funds are not received within the promised timeframe, escalate the process by following the work order -> compliance email -> regulatory complaint process.

Ask:How to evaluate spreads/fees/slippage and execution quality?

Answer:Marketing claims (low spreads/ultra-fast execution) are not binding and are subject to written terms and actual testing: Request a complete fee schedule (spreads, commissions, overnight fees, withdrawal fees, dormancy fees); Check the order execution policy (market/pending orders, requotes, positive and negative slippage symmetry, and handling of extreme market conditions); Test slippage and execution rates using simulations or small-scale real trading during periods of high volatility such as non-farm payrolls/CPI; Strictly control leverage and position concentration, set liquidation lines/margin calls, and limit the risk of a single platform to a small portion of the total funds; If the results are seriously inconsistent with the promotion, take screenshots of the evidence and follow the complaint process to protect your rights.