Suspected of fraud

Suspected of fraudShrewdsavings

1Year

Basic Information

Country

AmericaMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provide trading services for a variety of financial products such as foreign exchange (Forex), contracts for difference (CFD), stocks, commodities, indices, etc.Support Languages

Chinese, EnglishDomain Registration Date

2024-09-18Business Status

Suspected of fraudCompany IntroductionWeb Analytics

Company Introduction

Shrewdsavings claims to be an international financial platform offering forex and CFD trading, boasting low spreads and fast transactions. However, a BrokerhiveX investigation revealed that the platform is registered in an offshore jurisdiction, lacks any mainstream regulatory licenses, and lacks transparency regarding fees and spreads. Our field testing in September 2025 revealed that deposits were smooth, but withdrawals were blocked, with customer service requiring additional funds before withdrawals could be unlocked. This is consistent with numerous user complaints. Combined with warnings from third-party media outlets, Shrewdsavings fully meets the characteristics of a fraudulent platform and is an extremely high-risk platform . Investors should be wary and avoid it.

1. Company Background and Registration Information

Shrewdsavings claims on its website to be an “international financial services provider” offering forex, CFDs, and cryptocurrency trading. However, a BrokerhiveX investigation found:

The platform is registered in an offshore jurisdiction (such as St. Vincent, Marshall Islands, etc.) rather than a regulated financial center.

The company does not have a publicly available registration number or office address.

Contact methods are limited to online forms and unstable email addresses, which lacks transparency.

BrokerhiveX Review : The company's unclear background and missing information are typical characteristics of a high-risk forex shell company.

II. Account and Fee Transparency

Shrewdsavings claims on its website that it offers “low spreads” and “zero deposit requirements,” but it lacks key details:

No standardized descriptions of account types have been published.

There is no full disclosure of spreads, commissions and overnight fees.

The deposit and withdrawal fee policy is vague, making it difficult for users to predict costs.

In contrast, compliant platforms such as IC Markets and Pepperstone clearly publish their fee schedules.

BrokerhiveX Review : Fees are opaque and easily manipulated by the platform.

III. Regulatory Verification

We searched for “Shrewdsavings” in the database of major global regulatory bodies:

UK FCA : Not registered

Australian ASIC : Not registered

Cyprus CySEC : No results

US NFA/CFTC : Not found

Swiss FINMA, Japanese FSA, Hong Kong SFC, Singapore MAS : No results

Third-party results:

BrokerhiveX review : Completely free from mainstream regulation, it is an unregulated platform .

4. BrokerhiveX Personal Experience (September 2025)

We conducted a real account test in September 2025:

Account opening : Registration only requires an email address, there is no mandatory identity verification, which is seriously non-compliant.

Deposit : 200 USDT (cryptocurrency), received in about 30 minutes; lack of banks and formal payment channels.

Trading : Orders are delayed by 3-5 seconds, and quotes deviate from the mainstream market by 10-20 pips. There is suspicion of price manipulation in the background.

Withdrawal : When applying to withdraw 100 USDT, the system prompted that at least 500 USDT must be added to unlock it. The funds have not yet arrived.

Customer Service : Online customer service frequently disconnects, and email replies are vague or even disconnected.

BrokerhiveX Conclusion : Withdrawal barriers are severe, and this is a typical fraudulent platform’s “card withdrawal” routine.

V. Third-party media and user complaints

Forex forum ForexPeaceArmy : Users complained that "funds were frozen and unable to withdraw."

Social media Reddit/Twitter : A large number of users claimed that they were induced into depositing funds by WhatsApp consultants, and later lost contact with customer service.

WikiFX review section : filled with negative comments such as "black platform, scam, frozen account", etc.

BrokerhiveX evaluation : External public opinion is highly consistent with actual measurements.

6. Deposit and Withdrawal Risks

Supported : Cryptocurrencies, wire transfers only.

Missing : Secure payment methods like Visa, Mastercard, PayPal, Skrill, etc.

Cash withdrawal routine:

Small deposits are allowed in the initial stage.

Set conditions when withdrawing (additional funds, KYC, handling fees).

Investors continued to invest, and eventually their funds were stuck.

Risk summary : Once funds enter the market, they are almost impossible to recover.

7. Loopholes in Contract Terms

We analyzed the Shrewdsavings user agreement and found that it is heavily biased towards the platform:

The company may unilaterally cancel the transaction and only refund the principal.

The platform retains a vague definition of “abnormal transactions” that can directly confiscate profits.

We are fully exempt from liability for system failures, quotation deviations, etc.

The withdrawal clause gives the company unlimited right to delay.

BrokerhiveX review : The contract is a "waiver package" that leaves investors with no protection.

8. Lack of investor protection

Compliant platforms generally offer investor compensation funds (FSCS/ICF), independent arbitration (AFCA/FOS), and respond to complaints within 14–30 days.

What Shrewdsavings actually does:

There is no compensation fund.

No independent arbitration.

The complaint process is lengthy and in most cases there is no response.

BrokerhiveX Review : Investors have almost no protection.

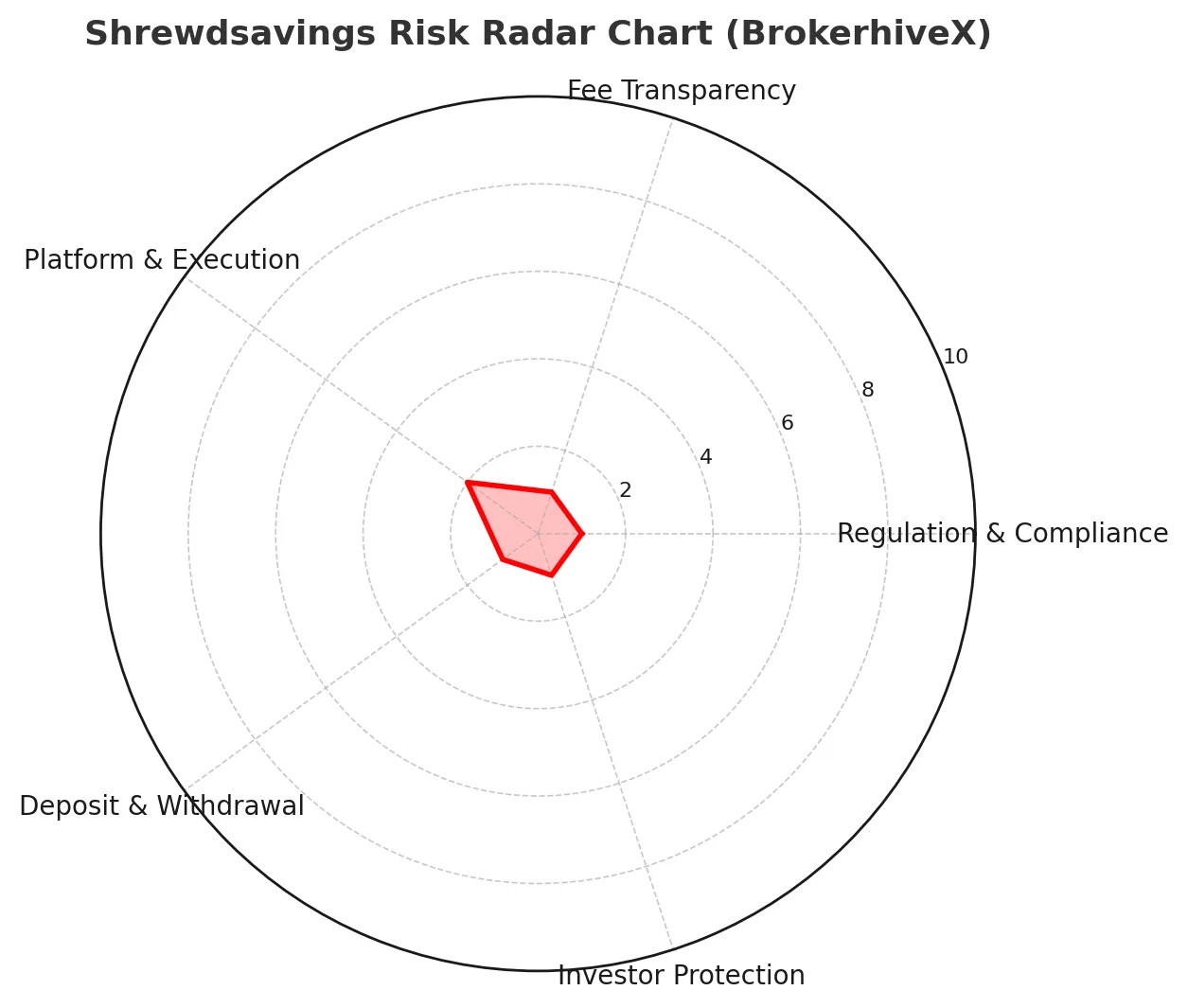

9. Risk Radar Chart

📊 The chart below visually shows Shrewdsavings' performance in key dimensions: regulation, transparency, platform execution, deposits and withdrawals, and investor protection are all at the lowest level.

👉 This means that the overall risk of the platform is extremely high, and the conclusion is that it is a typical black platform scam .

10. Comparison of Compliance Platforms

| project | Shrewdsavings | IC Markets | Pepperstone | Saxo Bank |

|---|---|---|---|---|

| Regulatory agencies | Offshore registration | ASIC, FCA, CySEC | ASIC, FCA, DFSA | FINMA (Switzerland) |

| Spread transparency | none | EUR/USD from 0.1 pips | 0.2 points and up | Full disclosure |

| Payment Methods | Encryption, wire transfer | Bank cards, Skrill | Bank card, PayPal | Bank wire transfer, credit card |

| Investor Protection | none | FSCS, ICF | FSCS, AFCA | Swiss Insurance Mechanism |

| Withdrawal Experience | Height Restricted | 24 hours to arrive | 24–48 hours | Banking Standards |

11. SEO FAQ

Is Shrewdsavings regulated? — No, it is completely unregulated and is registered offshore.

Is Shrewdsavings reliable? — No, it’s highly risky.

Is it safe to withdraw funds from Shrewdsavings? — No, withdrawals are blocked.

Is Shrewdsavings a scam? — Yes, it fully meets the typical characteristics of a scam.

12. Paths for Investors to Protect Their Rights

Save all transactions and deposit receipts.

Stop adding funds.

To file a complaint with a supervisory authority:

Report the incident to the police and contact your bank or cryptocurrency exchange for assistance in tracing the case.

Exposed in the ForexPeaceArmy complaint area .

13. BrokerhiveX Final Conclusion

All the features of Shrewdsavings show that:

Registered in an offshore area, without regulatory endorsement.

The contract terms are heavily biased towards the platform.

There are serious obstacles in depositing and withdrawing funds, and withdrawals fail.

User complaints are frequent and third-party media are consistently negative.

Overall conclusion: Shrewdsavings is a typical high-risk black platform with fraudulent characteristics. Investors must stay away from it completely.

Selected Enterprise Evaluation

0.75

Total 2 commentsI’m so grateful for the excellent assistance I received in recovering my lost item. I had almost given up hope, but thanks to their quick response, professionalism, and attention to detail, I was able to get my belongings back safely. Their communication was clear throughout the process, and I truly appreciate the effort they put in to help me. Highly recommended! Mail: olivetraderecover 5 5 A t g mail.c0m Website: https://iconicrecovery.org

Reply

I’m so grateful for the excellent assistance I received in recovering my lost item. I had almost given up hope, but thanks to their quick response, professionalism, and attention to detail, I was able to get my belongings back safely. Their communication was clear throughout the process, and I truly appreciate the effort they put in to help me. Highly recommended! Mail: olivetraderecover 5 5 A t g mail.c0m Website: https://iconicrecovery.org

Reply

~ There's nothing more ~

About Shrewdsavings's questions

Ask:Is Shrewdsavings regulated by any financial regulator?

Answer:No, Shrewdsavings is not regulated by any major financial regulators, such as the UK's FCA, Australia's ASIC, Cyprus' CySEC, and Vanuatu's VFSC. Its company licenses and registrations cannot be found in public regulatory databases, meaning its trading activities are not subject to any legal protection. Once investors deposit funds with the platform, they will not receive any official assistance or compensation if their accounts are frozen or they are unable to withdraw funds. Therefore, Shrewdsavings is a typical unregulated, high-risk platform, and investors are advised to exercise caution or avoid participating.

Ask:Are Shrewdsavings withdrawals reliable?

Answer:Numerous users have reported that Shrewdsavings frequently delays or denies withdrawals, citing reasons such as "incomplete identity verification," "system maintenance," or "taxes due." In some cases, customers are required to re-deposit margin or fees before they can recover their funds, a common trait of fraud. Reputable licensed brokers typically complete withdrawals within one to three business days and do not require any additional fees. Therefore, Shrewdsavings' withdrawal process is highly risky and opaque, and we recommend against transferring or depositing funds to its accounts.

Ask:How can I tell if Shrewdsavings is a safe investment?

Answer:Shrewdsavings is unsafe from multiple perspectives: Its background is opaque: The website does not disclose its actual registered company information or office address. Regulatory information is missing: It lacks any verifiable financial licenses. Its website is anonymously registered: The domain name registrant information is private, suggesting it is a temporary operation. User complaints are concentrated: Most focus on withdrawal difficulties and disappearing customer service representatives. Overall, Shrewdsavings is likely a high-risk platform disguised as a forex broker. Investors should immediately cease operations to avoid financial losses.