Suspected of fraud

Suspected of fraudUnited Holdings & Finance

1Year

Basic Information

Country

AmericaMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provide trading services for a variety of financial products such as foreign exchange (Forex), contracts for difference (CFD), stocks, commodities, indices, etc.Support Languages

Chinese, EnglishDomain Registration Date

2025-07-16Business Status

Suspected of fraudCompany IntroductionWeb Analytics

Company Introduction

United Holdings & Finance (UHF) claims to provide foreign exchange and financial investment services, but its overall positioning and background are clearly problematic. While its website features a comprehensive company profile and business description, it lacks transparent historical and authoritative information. The company's founding date, capital background, and operational history cannot be verified publicly. This type of vague corporate narrative is often a hallmark of high-risk financial platforms. In contrast, legitimate licensed brokers typically clearly disclose regulatory license numbers, parent company information, and shareholder structure. UHF's lack of disclosure in these areas creates significant uncertainty for investors.

🌐Global layout and brand background

UHF's website emphasizes its international presence and service coverage, but lacks any substantive evidence proving its legal presence in major financial markets. Failure to provide regulatory verification information, and lack of clear office addresses or licenses, suggests its so-called "global presence" is more marketing rhetoric than genuine operational capability. In the financial investment sector, regulatory compliance and a physical presence are crucial for assessing a company's credibility. A brand lacking this support easily raises questions about its reliability and long-term viability.

💹Trading products and services

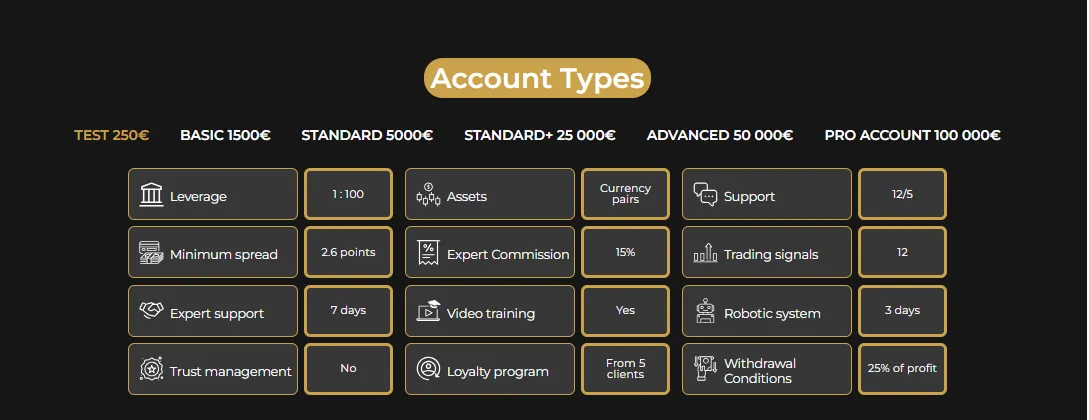

UHF's website indicates it offers a wide variety of financial products, including foreign exchange, commodities, indices, and cryptocurrencies. However, these products are primarily presented as contracts for difference (CFDs), and transparent disclosure of trading conditions, spreads, and leverage ratios is lacking. This means investors lack a clear understanding of transaction costs and actual risks. More seriously, the platform fails to indicate whether it segregates client funds for custody, creating a potential risk of commingling client funds with the platform's own funds, making it difficult to guarantee investor capital security.

💻Trading technology and platform experience

UHF claims to provide clients with an efficient trading platform, but it lacks clarity on whether its trading terminal is the mainstream MT4/MT5 or a proprietary platform. While reputable brokers typically offer verifiable third-party platform support, UHF only vaguely mentions terms like "efficient execution" and "low latency" on its promotional page, without providing substantive testing data or third-party evaluation results. Therefore, it's likely that the platform experience doesn't live up to its hype, and investors may face significant slippage and difficulty in depositing and withdrawing funds.

🛡️Regulatory compliance and fund security

UHF faces serious regulatory and compliance risks. Its website fails to provide any regulatory license numbers or verification links, nor does it mention whether it is regulated by major regulators such as the FCA, ASIC, and CySEC. This suggests that UHF is highly likely an unlicensed platform. If operational problems or financial disputes arise, investors will struggle to pursue legal action, placing their financial risks at significant risk. Financial traders should remain vigilant against such companies lacking regulatory oversight.

⚡Trading conditions and experience

While UHF claims to offer high leverage and tight spreads on its website, its transparency is extremely poor, lacking specific leverage ranges and risk disclosures. This overemphasis on "high returns" and understating "risk warnings" is inherently in line with the marketing logic of fraudulent platforms. Investors who blindly deposit funds based on this credulity risk exposure and risk manipulation or being unable to withdraw funds.

🎓Customer support and value-added services

UHF claims to offer multilingual customer service and market analysis, but its website structure reveals a limited content and a lack of substantive educational resources. Compared to the systematic training courses and professional research reports offered by established brokers, UHF's so-called "value-added services" seem more like superficial promotional material. Investors may struggle to obtain timely and effective support should they encounter practical problems, further exacerbating operational risks.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading are inherently high-risk investments, yet UHF provides virtually no risk disclosure on its official website. This opaque approach to risk disclosure essentially demonstrates a disregard for investor protection. Overall, the UHF platform appears to be attracting investors with promises of high returns rather than providing a truly compliant and transparent trading environment.

🔍Comprehensive analysis and evaluation

Overall, United Holdings & Finance has the following obvious problems:

Lack of publicly verifiable regulatory information and compliance qualifications;

The company's background is unclear and it fails to provide transparent shareholder and capital information;

The trading platform and product conditions are not transparent, and there is a lack of fund security;

The website’s promotion focuses more on marketing and less on compliance, and there are serious deficiencies in risk warnings.

Based on the above issues, UHF is positioned as a high-risk and even possible black platform. Investors should be cautious to avoid financial losses due to credulous propaganda.

Selected Enterprise Evaluation

2.33

Total 3 commentsUnited Holdings & Finance looks like a typical unregulated broker. No valid license numbers, no clear company background, and no transparency in trading conditions. This is a high-risk platform, and I would not recommend depositing any funds here.

Reply

The website makes big promises about global coverage and diverse products, but fails to provide proof of regulation or security measures. Without client fund protection or clear compliance, this company raises serious red flags. Better to stay away.

Reply

When the platform froze my withdrawals, I initially hoped it was just a technical issue—but soon realised I had fallen victim to a scam. Mrs. Doris Ashley came highly recommended, and from our first interaction, she was transparent, professional, and responsive. Within 72 hours, she successfully recovered my funds—delivering exactly what she promised, with no false assurances. Email: (dorisashley71 (@) gmail. c 0 m ) WhatsApps:+1 (404) .-721 . -56 .-08 She’s the only one I personally trust when it comes to financial recovery. Stay safe and protect your money

Reply

~ There's nothing more ~

About United Holdings & Finance's questions

Ask:Is United Holdings & Finance regulated by any authoritative financial regulator?

Answer:Currently, no valid license number or regulatory information for UHF can be found on its official website or in the databases of authoritative regulatory bodies (such as the FCA, ASIC, and CySEC). This means it is highly likely an unlicensed platform. If a financial platform with no oversight were to encounter financial disputes or collapse, investors would have difficulty pursuing legal action, posing a significant risk to the security of their funds.

Ask:Are the trading products and conditions provided by the UHF platform transparent?

Answer:While UHF advertises its services as offering contracts for difference (CFDs) on forex, commodities, indices, and cryptocurrencies, its website fails to clearly disclose spreads, leverage, or transaction fee structures. While reputable brokers clearly outline transaction costs and risk disclosures, UHF's vague advertising may mask high fees or the risk of manipulation. Investors may face significant slippage and difficulty withdrawing funds during actual trading.

Ask:Is investing in UHF safe? Can I deposit my funds with confidence?

Answer:Based on the available information, UHF lacks regulatory compliance, segregated funds, and a transparent operational history, placing its overall credibility at a low level. Its official website fails to provide information on fund security measures or explain how to store customer funds, posing the risk of misappropriation or malicious freezing of funds by the platform. Overall, UHF fails to meet the basic requirements of a qualified financial services provider, and investors should remain vigilant and avoid depositing funds with this platform.