Suspected of fraud

Suspected of fraudNPBFX

1Year

Basic Information

Country

AmericaMarket Type

foreign exchangeEnterprise Type

BrokerageService

We offer trading services for a variety of financial products, including Forex, CFDs, stocks, commodities, and indices.Support Languages

Chinese, EnglishDomain Registration Date

2024-09-18Business Status

Suspected of fraudCompany IntroductionWeb Analytics

Company Introduction

NPBFX (claiming to be affiliated with NMarkets Limited) claims to have been established in 1996 and is a broker offering CFD trading in forex, indices, metals, and energy. However, despite its promotional claims of "over 20 years of industry experience," "fast execution," and "low spreads," it has significant issues regarding regulatory legitimacy, fund security, and transparency. Headquartered in St. Vincent and the Grenadines (SVG), the company employs a typical offshore registration structure and lacks valid authorization from any major financial regulatory body (such as the UK's FCA, Australia's ASIC, or Cyprus's CySEC), posing significant risks to investor protection and compliance oversight.

Historically, NPBFX initially operated in Russia before rebranding itself as a "global financial services provider" through the offshore company "NMMarkets Limited." However, external documents reveal a lack of clear legal continuity between the brand and its original operating entity, and its claimed "operating history since 1996" lacks verifiable audit or regulatory documentation. This ambiguous corporate structure and brand continuity make its true operating entity and fund flows a key concern for investors.

🌐Global footprint and brand background

🌐Global footprint and brand background

NPBFX claims on its website to "provide trading services to global clients," but its business entity is registered in a less regulated offshore jurisdiction and has not publicly disclosed its actual office location, legal representative information, or regulatory audit reports. Compared to international brokers subject to strict regulations in multiple jurisdictions (such as platforms regulated by the FCA and ASIC), NPBFX's operational structure is clearly opaque, making it difficult for investors to verify its custodian and the segregation of client funds.

Its website deliberately emphasizes a "technology-driven trading experience," attempting to use marketing language to mask its lack of regulatory oversight and unclear brand history. Industry analysts point out that NPBFX's claim of "global licenses and trust structure" is not recognized by any international financial regulatory body and is highly likely merely a marketing ploy. The brand has not actually obtained any valid financial services licenses in Europe, Asia, or the Middle East.

💹Trading Products and Services

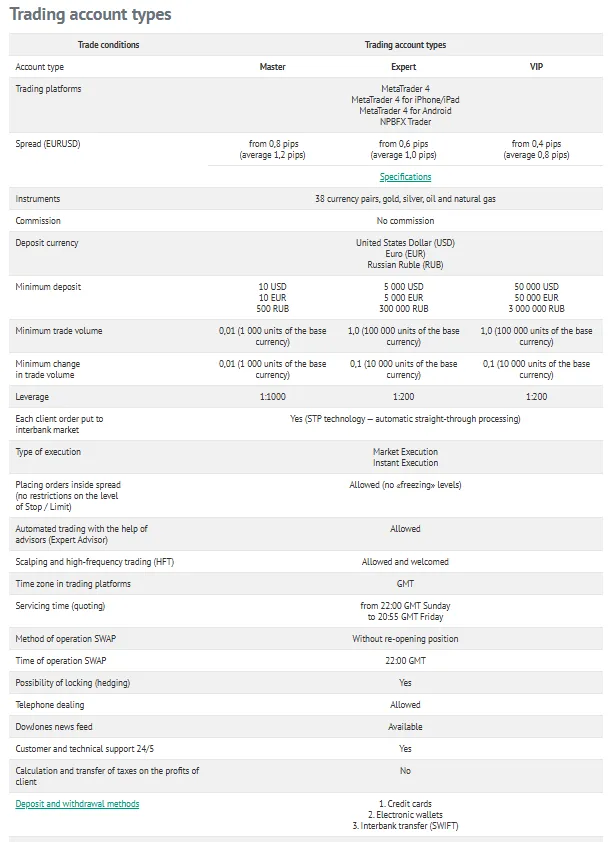

NPBFX's product list includes basic categories such as forex currency pairs, precious metals, crude oil, and index CFDs, but the product structure is relatively simple, and it does not offer physical stocks or regulated digital asset investment channels. Although the official website claims spreads as low as 0.4 pips and maximum leverage of 1:1000, in the absence of compliance and regulation, such high leverage settings may become a major source of risk that amplifies investor losses.

Several independent evaluation agencies have pointed out that although the NPBFX platform supports MetaTrader 4 (MT4), there are no third-party execution reports to prove its actual trading depth or liquidity source. Some users have reported significant quote delays and slippage, and even the inability to execute stop-loss orders properly during periods of high volatility. In addition, some complainants have alleged suspicious operations such as "back-end price adjustments" and "trading freezes," further raising questions about its back-end manipulation and system security.

💻Trading technology and platform experience

NPBFX primarily relies on the MT4 platform for trading services but does not offer its own or any innovative trading terminals. Its website's claims of "high-speed execution" and "professional liquidity provider" are largely unverified marketing statements, and it does not disclose any partner banks or clearing institutions. Some external users have reported on social media platforms that their trading accounts have experienced login issues, data synchronization problems, and even being unilaterally frozen by the platform.

From a technical perspective, the company lacks industry-recognized server latency test data and does not provide trade execution transparency reports. Compared to mainstream brokers regulated by the FCA, its execution speed, system redundancy, and stability lack credibility. For traders seeking a stable and fair execution environment, NPBFX's technical performance presents significant uncertainty.

🛡️Regulatory compliance and fund security

NPBFX's most significant risk lies in its lack of regulation . According to publicly available information, the platform only claims to be registered with the St. Vincent and the Grenadines (SVG FSA), but this organization does not have the regulatory functions for forex brokerages and assumes no responsibility for the safety of client funds or for handling disputes. This means that once the platform closes or refuses withdrawals, investors will have no way to recover their funds through regulatory channels.

Multiple financial risk warning agencies have listed NPBFX as a potentially high-risk entity. For example, financial regulators in some European countries have pointed out that the company has engaged in "false regulatory statements," "high-risk leverage marketing," and "suspicious client recruitment activities." The lack of an independent audit report or proof of client fund segregation on its website raises significant concerns about fund security.

⚡Transaction Terms and Experience

NPBFX offers a high-leverage, high-risk trading environment. While it claims low spreads and fast execution, investors cannot verify the authenticity of these claims in the absence of independent regulatory oversight. Some users have reported that when attempting large withdrawals, the platform delays processing them under the pretext of "compliance review" or "system maintenance," and sometimes even refuses withdrawals altogether.

Furthermore, its promises of "negative balance protection" and "zero slippage execution" lack third-party regulatory documentation, which is a common marketing tactic used by offshore brokers. Because its operating entity is located in a region with opaque legal jurisdiction, traders will find it extremely difficult to protect their rights through legal means if disputes arise.

🎓Customer Support and Value-Added Services

NPBFX's customer service primarily relies on an online system and email replies, but these are slow and inefficient. Users report that customer service often provides template-based responses, avoiding any discussion of financial issues or trading disputes. The platform's so-called "educational resources" are meager, consisting mostly of basic trading introductions or market advertising posts, lacking substantial investment guidance value.

External reviews generally agree that NPBFX's customer support system lacks professionalism, with its customer service team primarily focused on marketing rather than risk assessment or technical support. Compared to compliant platforms in the industry, the company offers virtually no transparency in its customer education, after-sales service, and complaint handling mechanisms.

⚠️Risk Warning and Platform Positioning

NPBFX is a typical high-risk offshore broker . Although its website emphasizes "secure trading" and "global trust," it actually lacks any effective regulatory or fund protection mechanisms. Investors who engage in high-leverage trading on this platform face the risk of manipulated pricing, frozen funds, or denied withdrawals.

From a platform positioning perspective, NPBFX is not a truly "compliant international brokerage," but rather a marketing company that attracts speculative funds through high leverage. Experts advise investors to prioritize platforms regulated by authoritative regulatory bodies (such as the FCA, ASIC, and CySEC) to ensure fund security and trading transparency.

🔍Comprehensive Analysis and Evaluation

Overall, NPBFX has significant issues with its brand history, regulatory structure, transparency, and customer reputation.

The main negative characteristics include:

Without authorization from mainstream regulatory agencies, the safety of funds is not guaranteed.

Frequent customer complaints and severe withdrawal delays;

The execution and pricing mechanisms lack transparency;

The website contains false information and exaggerated claims.

While it attracts some short-term traders with its "low-cost trading," the platform poses extremely high risks in terms of security and credibility in the long run.

Therefore, NPBFX is widely regarded in the industry as a high-risk, low-transparency offshore broker, and investors are advised against participating in its trading activities.

Selected Enterprise Evaluation

1.13

Total 4 commentsUnregulated offshore broker with unclear transparency — high risk for investors.

Reply

Attractive leverage, but weak oversight and withdrawal issues raise serious concerns.

Reply

I Appreciate RESOXIT.CC Looking back, I realize I should have done more research before trusting that fake company. Reading reviews and verifying their legitimacy could have saved me a lot of stress and loss. I'm incredibly grateful that RESOXIT.CC listened, acted promptly, and proved they genuinely care about their clients. Their swift action brought me peace of mind, and I can confidently say they’re a company that stands behind their customers. WhatsApp +1 309 208 5151

Reply

Exercise extreme caution when engaging with this website. Deposits are accepted easily, but withdrawals are consistently blocked. My attempts to recover funds for over a week have been unsuccessful, and the so-called “financial manager” became hostile when questioned. Many of the platform’s positive reviews also appear inauthentic. If you encounter similar issues, consider seeking professional chargeback assistance. You may contact Madam Doris at Email: dorisashley71 @ gmail. com or via WhatsApp at +1 .- (404) -.721.-56.-08.

Reply

~ There's nothing more ~

About NPBFX's questions

Ask:Is NPBFX properly regulated?

Answer:No. NPBFX is only registered in St. Vincent and the Grenadines (SVG), and financial institution registration in this region is not equivalent to regulation. The SVG Financial Services Authority (FSA) does not actually supervise forex or CFD brokers and does not provide any client fund protection mechanisms. This means that if the platform refuses withdrawals or goes bankrupt, investors will have no way to recover their funds through legal or regulatory means. It is recommended to choose brokers regulated by authoritative regulatory bodies such as the UK's FCA, Australia's ASIC, or Cyprus's CySEC to ensure compliance and fund security.

Ask:Why are some users complaining about difficulties withdrawing funds from NPBFX?

Answer:Many investors have reported being repeatedly asked to submit documents or told about "system maintenance" or "compliance review" when trying to withdraw funds, or even experiencing prolonged delays or outright refusal of withdrawals. Such behavior is common on platforms lacking oversight. Because NPBFX lacks an independent custody mechanism, client funds are directly controlled by the platform. If the platform freezes accounts or refuses withdrawals based on internal rules, investors face the risk of losing their funds.

Ask:Is the high leverage (1:1000) offered by NPBFX worth trying?

Answer:It is not recommended. While high leverage may seem to amplify profits, it also greatly amplifies risks. More importantly, NPBFX lacks regulatory oversight and negative balance protection. In the event of severe market volatility, investors could not only lose their entire principal but also face debt risks. Without regulatory protection and with questionable transparency, high leverage only multiplies the risks and is unsuitable for ordinary investors.