Suspected of fraud

Suspected of fraudFullerton Markets

1Year

Basic Information

Country

AmericaMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provide trading services for a variety of financial products such as foreign exchange (Forex), contracts for difference (CFD), stocks, commodities, indices, etc.Support Languages

Chinese, EnglishDomain Registration Date

2024-09-18Business Status

Suspected of fraudCompany IntroductionWeb Analytics

Company Introduction

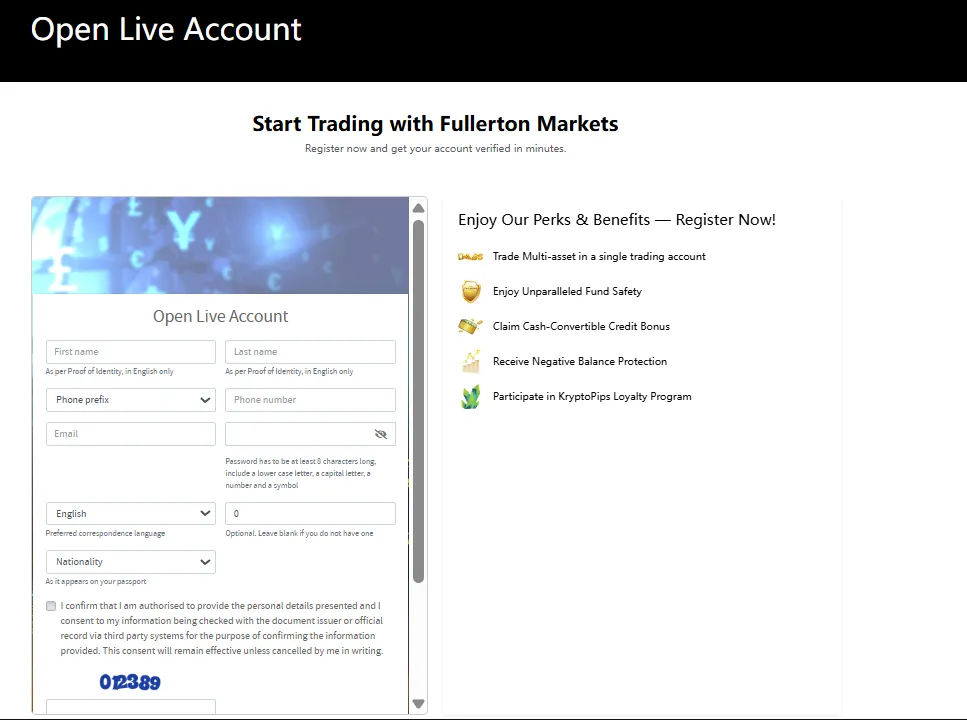

Fullerton Markets claims to be a forex and contracts for difference (CFD) broker headquartered in Saint Vincent and the Grenadines (SVG), offering a wide range of trading products, including forex, indices, precious metals, energy, and cryptocurrencies. Since 2016, the company has claimed to be one of the "fastest-growing brokers in the world," but in reality, it is not regulated by any major financial regulator, such as the UK's FCA, Australia's ASIC, or New Zealand's FMA. While its official information mentions "compliance with international regulatory standards," it only holds an offshore registration license and lacks the financial security guarantees of strict oversight.

Fullerton Markets' core business model relies heavily on marketing and an affiliate program (IB), attracting client deposits through high commissions and promotional incentives, rather than focusing on trade execution and client fund security. This model is often considered "high-risk" in the industry due to the lack of transparency in fund flows and third-party audit oversight. If the platform ceases operations or encounters financial difficulties, it would be extremely difficult to recover investor deposits.

🌐Global layout and brand background

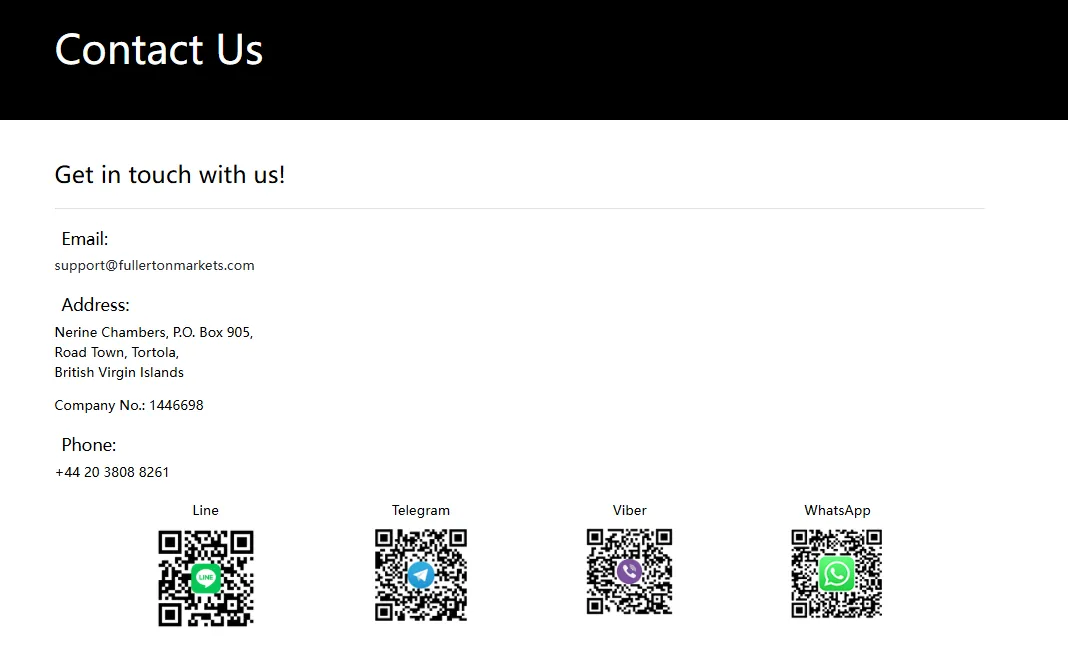

While Fullerton Markets claims to have a significant client base in Asia and the Middle East, there is no solid evidence that it has physical branches in these regions. The company's registered address listed on its website is in Kingstown, St. Vincent and the Grenadines (SVG) , a region known for its low regulation and transparency, long considered a high-risk offshore location by international financial regulators.

Furthermore, Fullerton Markets repeatedly mentioned in its marketing that it was once registered and regulated in New Zealand, but its New Zealand FMA regulatory status has been revoked since 2018. The company currently holds no valid licenses in any developed financial market. This means it has completely transformed into an unregulated offshore broker , yet it continues to use its old regulatory credentials in its marketing, potentially misleading investors.

💹Trading products and services

Fullerton Markets offers products including CFDs on foreign exchange (forex) currency pairs, precious metals, crude oil, indices, and cryptocurrencies. The platform claims to offer ultra-low spreads, leverage up to 1:500, and no-dealer-intervention execution, but these claims are unsubstantiated. Its product pricing mechanisms, liquidity sources, and order execution model (ECN/STP or Dealing Desk) are all undisclosed, demonstrating a high level of transparency.

Some users reported experiencing excessive slippage, delayed order execution, and forced liquidations. Furthermore, the "bonus program" and "referral cashback" promotions offered on the Fullerton Markets website frequently changed rules, and withdrawal requirements were stringent. Some users reported that attempts to withdraw funds were denied by the platform, citing reasons such as "locked funds" and "system maintenance." Overall, the company appears to prioritize marketing over genuine trade execution quality.

💻Trading technology and platform experience

Fullerton Markets offers the MetaTrader 4 (MT4) trading terminal and claims to be based in Singapore to ensure low latency. However, third-party speed tests show inconsistent server response times, with significant latency in some regions. The platform also fails to publish order execution statistics or independent technical audit reports.

Furthermore, Fullerton Markets has long promoted its "Secure Gateway Technology" (Fullerton Shield) as a selling point, claiming it provides multiple layers of protection to safeguard client funds. However, the substance of this mechanism remains vague and has not been independently audited. Industry analysts believe this marketing concept is more of a branding exercise than a legally binding safeguard.

🛡️Regulatory compliance and fund security

The most questionable aspect of Fullerton Markets' regulatory structure is that it is currently registered in SVG as a general business entity. The regional regulator, FSA SVG, explicitly states that it "does not regulate forex or financial services firms," meaning that Fullerton Markets has no mandatory compliance obligations.

Regarding fund security, the company has not disclosed the banks where client funds are held, whether it implements a segregated account system, or provided independent audit reports. Investors often deposit funds through third-party payment gateways or cryptocurrency channels, leaving funds unaccounted for. Overall, Fullerton Markets lacks transparency regarding fund security and poses an extremely high investment risk.

⚡Trading conditions and experience

Fullerton Markets offers high leverage (up to 1:500) and low deposit requirements (minimum $100). While these conditions are attractive to retail investors, they also carry significant risks. According to external complaints and reviews, some users have experienced slippage and unexplained margin calls in high-leverage trading, with customer service refusing compensation due to "market volatility." The platform also entices investors to make additional deposits under the guise of "account upgrades" and "margin optimization," a practice particularly common on unregulated platforms.

The combination of high leverage and lack of real market execution makes Fullerton Markets highly risky, especially for novice investors. Once they suffer margin losses, they will face the dilemma of not being able to recover their funds.

🎓Customer support and value-added services

Fullerton Markets' website offers 24/7 customer support with multilingual options, but service quality is inconsistent. Some users report that customer service responses are mostly automated, with little real-world assistance. While the company maintains extensive social media presence and webinars, these are largely promotional in nature and lack substantive educational value.

Its so-called "Education Center" primarily provides basic market concepts and introductory trading content, but lacks in-depth market analysis or risk management guidance. Overall, Fullerton Markets' customer support system leans more towards branding than professional customer service.

⚠️Risk Warning and Platform Positioning

Comprehensive analysis shows that Fullerton Markets has the following high-risk characteristics:

No major financial regulatory licenses;

Regulatory gaps in offshore registration locations;

The flow of funds is unclear and withdrawal is difficult;

High leverage and exaggerated publicity;

A high-risk structure that relies on marketing and commissions to attract customers.

These characteristics make the company considered an unregulated, high-risk broker . When investors trade on this platform, the safety of their funds depends entirely on the company's self-regulation, with no external oversight mechanism.

🔍Comprehensive analysis and evaluation

Overall, Fullerton Markets invested heavily in branding and marketing, but suffered from serious deficiencies in regulatory compliance, fund security, and transparency. The company has long relied on offshore registration and marketing to maintain its business, with virtually no risk management or fund protection mechanisms.

Despite its professional website and rich content, Fullerton Markets operates in an environment lacking credible regulatory support. Based on a comprehensive assessment of multiple indicators, Fullerton Markets should be considered an unregulated offshore broker with potentially high risks , and investors should avoid depositing funds or trading with it.

If you have already deposited money into the platform, you should immediately stop trading, keep relevant receipts, and report to the local financial regulatory agency or anti-fraud agency.

Selected Enterprise Evaluation

1.50

Total 2 commentsFullerton Markets operates under an offshore registration in Saint Vincent and the Grenadines with no recognized financial regulation. Many traders have reported delayed withdrawals and poor transparency in fund management. The company’s marketing promises of “safety” and “speed” are misleading — proceed with extreme caution.

Reply

Despite its professional-looking website, Fullerton Markets lacks credible supervision and fails to provide verified proof of fund segregation or audit. The platform’s reliance on high leverage and promotional bonuses is a red flag for serious investors. It behaves more like a marketing scheme than a legitimate broker.

Reply

~ There's nothing more ~

About Fullerton Markets's questions

Ask:Is Fullerton Markets regulated by any international financial regulator?

Answer:Currently, Fullerton Markets is not regulated by mainstream financial regulators such as the UK's FCA, Australia's ASIC, Singapore's MAS, or New Zealand's FMA. The company is registered in Saint Vincent and the Grenadines (SVG), where the FSA explicitly states that it "does not regulate forex and CFD brokerage businesses." Therefore, Fullerton Markets is essentially an unregulated offshore broker. This means that investor funds are not protected by any regulatory body, making it extremely difficult to recover in the event of a dispute or misappropriation.

Ask:How secure are my funds with Fullerton Markets? Are my deposits protected?

Answer:Fullerton Markets has not disclosed the custodian bank for its client funds, nor has it stated whether it employs a "client segregated account system." Nor does it have any third-party audit reports verifying its fund security mechanisms. While the platform's "Fullerton Shield" claims to guarantee fund security, this is not independently endorsed and is viewed primarily as a marketing gimmick. Some users have reported being charged additional fees or experiencing lengthy withdrawal delays, further demonstrating the platform's lack of transparency regarding fund security. Investor funds are subject to significant risk once they enter the platform.

Ask:Is Fullerton Markets suitable for individual investors? What is the trading experience like?

Answer:Fullerton Markets attracts retail investors with high leverage (up to 1:500) and low deposit requirements, but these conditions often come with high risks. External reviews and complaint records indicate the platform suffers from significant slippage, delayed execution, unusual account liquidations, and a lack of timely response from customer service. For novice investors, the platform does not offer a secure, transparent, or stable trading environment and may instead become a high-risk trap. Investors are advised to avoid unregulated platforms and choose reputable brokers with strict regulations and financial guarantees.