Suspected of fraud

Suspected of fraudOrbit Global FX

1Year

Basic Information

Country

AmericaMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provide trading services for a variety of financial products such as foreign exchange (Forex), contracts for difference (CFD), stocks, commodities, indices, etc.Support Languages

Chinese, EnglishDomain Registration Date

2024-09-18Business Status

Suspected of fraudCompany IntroductionWeb Analytics

Company Introduction

Orbit Global FX is a brokerage firm that claims to provide global foreign exchange and contracts for difference (CFD) trading services. Its website states that it was founded in 2021 and is headquartered in Mauritius. The platform claims to offer investors over 100 financial products, including foreign exchange, precious metals, indices, energy, and cryptocurrencies. However, the company's actual visibility in the global financial market is minimal. Related information reveals numerous doubts about its operational and regulatory qualifications, and its overall transparency is insufficient.

Orbit Global FX's website boasts attractive slogans like "professional trading environment," "low spreads," and "fast execution." However, the lack of detailed regulatory disclosures and financial safeguards raises questions about the authenticity of these marketing claims. There is no publicly verifiable information regarding the company's background, management team, or capital strength, making it difficult for ordinary investors to accurately assess Orbit Global FX's actual operations and risk profile.

🌐Global layout and brand background

Orbit Global FX claims to offer services in "over 25 countries," but fails to provide specific office locations, license numbers, or branch details. A third-party database search reveals that while its Mauritius registration is available, it is not registered with major regulatory bodies such as the FCA, ASIC, CySEC, and the NFA. Mauritius's regulatory system is considered relatively lax globally, posing significant risks in both accountability for investment disputes and protecting funds.

Furthermore, Orbit Global FX uses multiple domain names (including orbitglobalfx.com and orbitglobal.io) on some external platforms. This multi-domain operation is often used to circumvent regulations and conceal a company's identity, failing to meet transparency standards. This trait further undermines its brand credibility. Overall, the platform's so-called "global presence" remains more of a promotional exercise than a substantive, licensed operation.

💹Trading products and services

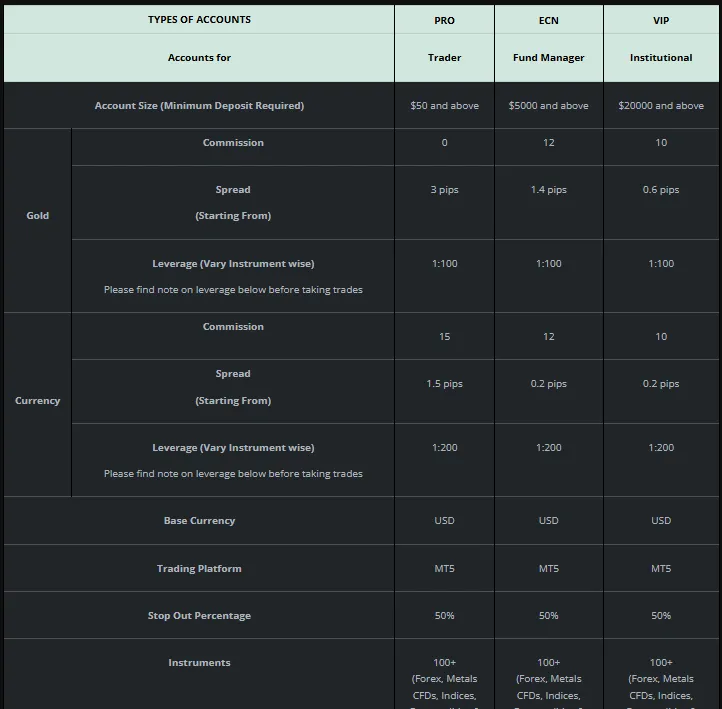

Orbit Global FX offers trading products including forex currency pairs, precious metals, index CFDs, and some cryptocurrency CFDs, primarily through the MetaTrader 5 (MT5) platform. While its product line may appear diverse, all are actually contracts for difference (CFDs) and do not involve the delivery of physical assets.

This pattern often means the platform can adversely impact trading outcomes by adjusting quotes, widening spreads, or delaying execution. Some users have reported on external review websites that they experience issues such as "significant slippage," "forced account liquidations," and "inability to withdraw funds," suggesting risks with both transaction execution quality and fund security.

💻Trading technology and platform experience

Orbit Global FX claims to utilize advanced technology and stable servers to provide high-speed order execution. However, actual user feedback indicates that the platform's stability is mediocre, with issues such as delays and disconnections. Furthermore, some trading terms and conditions do not clearly describe the order matching mechanism (whether it utilizes STP/ECN or an internal hedging model), making it difficult for investors to determine whether the broker is engaging in market-making operations that conflict with their clients' interests.

While it supports the MetaTrader 5 platform, this software only provides technical access and does not guarantee the broker's trading transparency or fund security. In multiple independent reviews, Orbit Global FX has received low scores for execution efficiency and customer satisfaction, making it lack competitiveness.

🛡️Regulatory compliance and fund security

Orbit Global FX claims on its website that it is regulated by the Financial Services Commission of Mauritius (FSC Mauritius). However, verification has failed to locate any valid license for the company on publicly available regulatory lists. Furthermore, some external sources indicate that the company was previously registered under the Mwali International Services Authority (MISA), which is not an internationally recognized foreign exchange regulator.

This low-level or offshore regulation means that investors have little legal protection or access to fund recovery in the event of a dispute. Orbit Global FX also fails to disclose whether client funds are segregated, a significant departure from the practices of mainstream compliant brokers. Overall, the platform's regulatory compliance is extremely weak, posing a high risk to investors.

⚡Trading conditions and experience

Orbit Global FX offers leverage of up to 1:500 and advertises "low spreads and no commissions." However, the company fails to disclose its true transaction cost structure and spread data, and lacks third-party price verification. With such high leverage, investors could suffer significant losses even with the slightest fluctuation.

Numerous investors have reported on overseas complaint platforms that the company has issues such as "withdrawal refusal," "account freezing," and "long periods of unresponsive customer service." Such behavior is often considered a hallmark of non-compliant or potentially fraudulent platforms in the industry.

🎓Customer support and value-added services

While Orbit Global FX has a "Contact Us" page on its official website, it only provides an email address and an online form, without a fixed office phone number or headquarters address. Some email inquiries have been reported to go unanswered for extended periods, suggesting a highly inefficient customer support response.

Furthermore, the platform offers no systematic educational resources, market analysis, or risk training, using only marketing language to attract account openings. This lack of customer education and risk disclosure further exposes the unprofessional nature of its service system.

⚠️Risk Warning and Platform Positioning

Orbit Global FX attracts speculative investors seeking quick returns by leveraging high leverage and lax registration requirements. However, its weak regulatory credentials, murky corporate background, and opaque fund segregation system all indicate high risk.

For investors who wish to participate in long-term forex or CFD trading, such platforms lack the security and compliance foundations. If a platform ceases operations or shuts down its website, investors face significant risk of losing their funds.

🔍Comprehensive analysis and evaluation

Overall, Orbit Global FX is a typical "offshore registered, high leverage, low transparency" foreign exchange platform. Its main characteristics include:

Failure to obtain effective regulatory approval in major countries;

There is a discrepancy between the company entity and the domain name operation;

Frequent customer complaints and high withdrawal risks;

There is a lack of fund isolation and auditing mechanisms.

Overall, Orbit Global FX carries a high risk rating and is not recommended for average investors. For those prioritizing fund security and regulatory compliance, choosing a reputable broker regulated by major institutions such as the FCA, ASIC, and CySEC is a more reliable option.

Selected Enterprise Evaluation

2.50

Total 5 commentsOrbit Global FX operates under offshore registration with unclear regulatory oversight, making it a high-risk platform for retail traders.

Reply

Despite marketing claims of global presence and advanced trading tools, Orbit Global FX lacks transparency, reliable licensing, and proven fund security.

Reply

After years of unsuccessful attempts to recover my missing funds and falling victim to several fraudulent agents, I was beginning to lose hope. Fortunately, I came across Laura Cooper Terms, and although I was initially skeptical due to my past experiences, I decided to give them a chance. That decision changed everything they provided exceptional service and successfully helped me recover my lost funds, even offering valuable additional support. I highly recommend Laura Cooper Terms as a fast, reliable, and trustworthy recovery company. Resoxit 40 at gmail . c o m WhatsApp: +1 (309) 208-5151

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

I had difficulty withdrawing funds after trading and felt stuck at first. (alg @ nordevamber. com, +1 334 679 5376) support team provided clear instructions, answered my questions patiently, and helped me complete the withdrawal successfully. The whole process was handled professionally and I appreciated the transparency. This would be helpful for anyone who needs guidance with similar problems.

Reply

~ There's nothing more ~

About Orbit Global FX's questions

Ask:Is Orbit Global FX really regulated?

Answer:Orbit Global FX claims to be regulated by the Mauritius Financial Services Commission (FSC), but no valid license has been found on the FSC's official list of licensees. Some external information suggests that it was previously registered under the Mwali International Services Authority (MISA). However, MISA is not a globally recognized foreign exchange regulatory body and cannot provide investors with real legal protection. This means the platform's regulatory credentials are extremely weak, and there is no substantial protection for the security of customer funds. If the platform encounters financial difficulties or shuts down its website, it would be extremely difficult for investors to recover their losses through legal means.

Ask:Is Orbit Global FX's trading environment and withdrawal process safe and secure?

Answer:Based on multiple third-party reviews and user feedback, Orbit Global FX's trading environment suffers from numerous issues of opacity. Although the platform utilizes the MetaTrader 5 (MT5) system, users have repeatedly reported significant slippage, forced liquidations, and delayed withdrawals. Some users have even reported experiencing fund freezes or requests for additional "verification documents" after their accounts became profitable. These withdrawal barriers are often a warning sign of a non-compliant or high-risk broker, indicating potentially opaque internal risk controls and potential for chargebacks.

Ask:Is Orbit Global FX suitable for novice investors?

Answer:Not recommended. While Orbit Global FX advertises "low barriers to entry, high leverage, and global service" to attract new traders, its weak regulatory environment, lack of fund protection, and limited customer support mean that novice investors face high risks. Inexperienced users can quickly lose money through high-leverage trading, or even be unable to withdraw funds due to the platform's opaque terms. For beginners, it's safer to choose a reputable platform regulated by the FCA, ASIC, or CySEC.