Suspected of fraud

Suspected of fraudApexTrust Markets

1Year

Basic Information

Country

AmericaMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provide trading services for a variety of financial products such as foreign exchange (Forex), contracts for difference (CFD), stocks, commodities, indices, etc.Support Languages

Chinese, EnglishDomain Registration Date

2024-09-18Business Status

Suspected of fraudCompany IntroductionWeb Analytics

Company Introduction

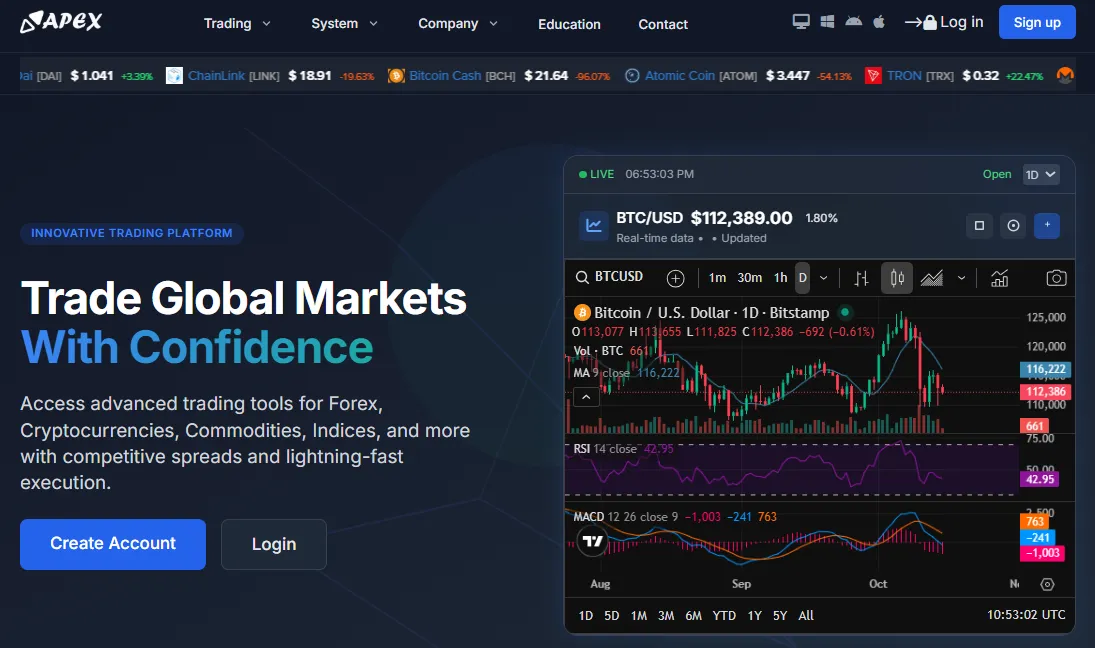

ApexTrust Markets claims to be a global brokerage platform offering foreign exchange, contracts for difference (CFD), and crypto asset trading services. Headquartered in London, UK, it promotes itself as a platform with the slogan "Secure Trading, Professional Trust, Global Vision." However, investigations have revealed that the platform is not authorized by any financial regulator. Its official website ( https://apextrustmarkets.com/) features a rudimentary technical architecture, minimal transparency, and a recent domain name registration, clearly contradicting its claims of "long-term, stable operation."

The company's official website frequently uses marketing slogans such as "zero-risk investment," "secure fund custody," and "24-hour fast withdrawals," but fails to provide any verifiable compliance certificates, custodian bank information, or audit reports. This high-profile promotional campaign stands in stark contrast to the actual lack of regulation, suggesting that ApexTrust Markets is more likely an unregulated, high-risk investment platform than a true international financial services provider.

🌐Global layout and brand background

ApexTrust Markets claims on its website that its services cover markets in Europe, Asia, the Middle East, and Africa. However, it does not provide any branch addresses or independent offices, nor does it disclose any partner banks or liquidity providers (LPs). No corresponding entity can be found in the UK Companies House or other official databases.

While the platform's branding uses terms like "Trust" and "Markets" to project a professional image, the domain registration information, server locations, and traceability within the website's source code all point to anonymous hosting and overseas virtual hosting. This concealed background is typical of high-risk brokers, suggesting the platform's operators may be deliberately evading regulatory scrutiny.

💹Trading products and services

The ApexTrust Markets website lists a variety of products, including forex, precious metals, indices, energy, and cryptocurrencies, but does not provide core data such as actual spreads, leverage, and minimum trade sizes. It also does not display the actual trading platform or market source.

The so-called "instant trading platform" page is only a static display. After registration, users still need to manually activate their accounts through customer service, and the recharge page will jump to the third-party payment channel.

This model, which relies on manual operations and lacks a trading system, is highly susceptible to the risk of fund misappropriation or account freezes. Some users have reported on external forums that the platform's complicated withdrawal process, disconnected customer service, and long-term account fund freezes suggest fraud.

💻Trading technology and platform experience

ApexTrust Markets does not offer support for mainstream trading software (such as MT4, MT5, or cTrader), nor does it offer a download link for its standalone app. Its web-based "WebTrader" interface is limited in functionality, similar to a template-generated simulation display system, lacking real-time price updates and execution history.

Furthermore, the website lacks a valid SSL security certificate, and some subpages experience loading errors and code warnings. This technical infrastructure falls far short of the standards of a licensed broker, suggesting the site is more likely used to attract deposits than as a live trading environment.

🛡️Regulatory compliance and fund security

ApexTrust Markets is not licensed by any recognized financial regulators (e.g., FCA, ASIC, CySEC, FMA). The "regulatory number" displayed on the website has been verified to be fictitious and does not match any of the databases of any real institutions.

The platform also did not disclose information about client fund custody arrangements, segregated accounts or independent auditors, which means that investor funds are likely to go directly into the platform's own accounts.

This unregulated "self-collection and self-management" model is a typical operating method of a fraudulent platform. Once investors try to withdraw cash or report complaints, the platform will usually delay or refuse payment with reasons such as "identity verification failed" or "background review in progress".

⚡Trading conditions and experience

The platform claims to offer leverage ratios up to 1:500 and "zero spread" trading, but such conditions are extremely unrealistic. Under normal regulatory frameworks, retail trading leverage in regions such as the UK and Australia is capped at between 1:30 and 1:100. ApexTrust Markets clearly violates industry regulations.

Furthermore, users were unable to access transparent transaction records or reports after depositing funds, and the profit data displayed by some accounts was suspected to be fabricated. All evidence suggests that the platform may have used virtual backend operations to create the illusion of profit and induce additional investment.

🎓Customer support and value-added services

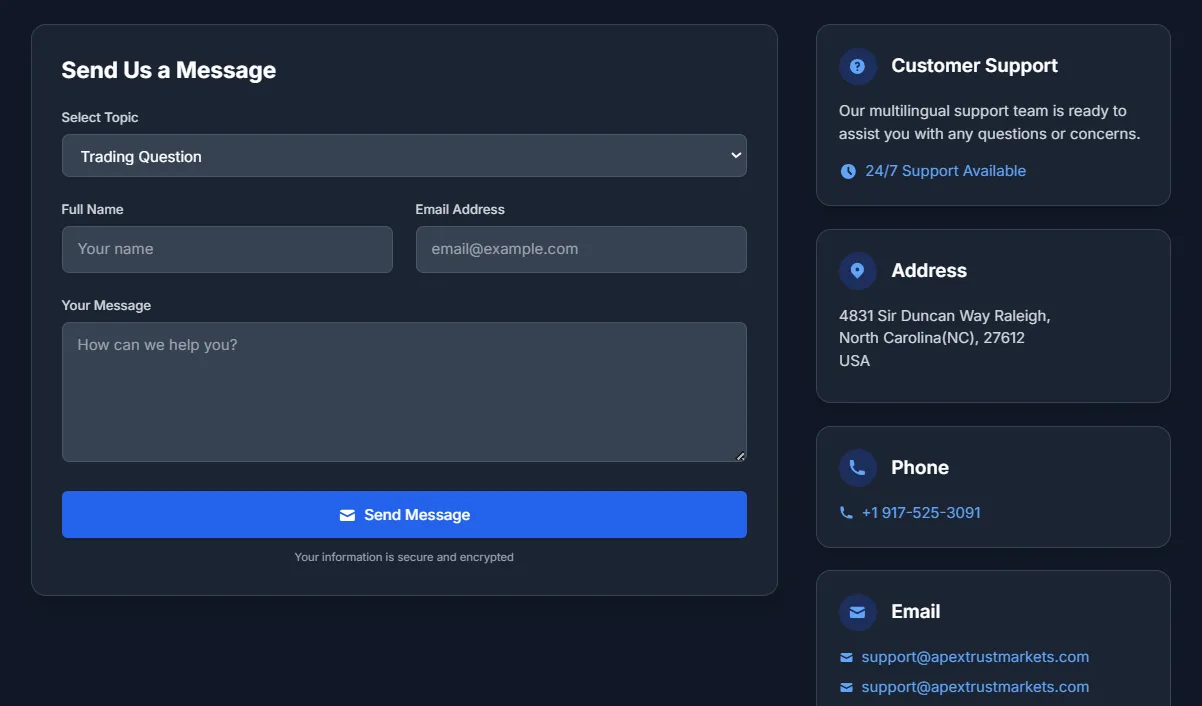

ApexTrust Markets' customer service email and live chat lines often go unanswered, with a high bounce rate. ApexTrust Markets also doesn't provide a physical office phone number or address. While the website claims to offer "24/7 multilingual customer support," it's actually impossible to reach a live customer service representative.

Similarly, the platform does not provide educational resources, market analysis reports or compliance disclosures, and all "value-added services" columns are blank pages or jump ads, indicating that its operations lack any real customer service system.

⚠️Risk Warning and Platform Positioning

Judging from its structural and behavioral characteristics, ApexTrust Markets is more like a Ponzi scheme using "investment returns" as bait than a regulated trading platform. Investors who deposit funds are highly likely to encounter account freezes, withdrawal difficulties, and unavailable customer service.

Factors such as high leverage, fake regulatory numbers, and the lack of an audit mechanism indicate that this platform poses serious compliance and financial risks. Investors are advised to stay away from such unregulated platforms and avoid all forms of fund transfers or reinvestment.

🔍Comprehensive analysis and evaluation

Based on various indications, ApexTrust Markets has the following high-risk characteristics:

No regulatory qualifications, false registration information;

No real trading platform and data support;

It is easy to deposit but difficult to withdraw cash, and the number of complaints is increasing;

Poor technical security and frequent page failures;

Lack of customer service support and risk disclosure.

In summary, ApexTrust Markets is considered a high-risk, non-compliant, and potentially fraudulent platform . Investors are advised to immediately cease all financial transactions with the site and verify the qualifications of any financial platform through official channels (such as the FCA or ASIC) before investing.

Selected Enterprise Evaluation

1.00

Total 3 commentsApexTrust Markets shows every red flag of an unregulated offshore broker — fake license claims, non-functional trading platforms, and repeated withdrawal issues. It lacks transparency and fails to meet even the basic standards of a legitimate financial service provider.

Reply

With no verified regulatory oversight, no clear company ownership, and multiple user reports of frozen accounts, ApexTrust Markets appears more like a high-risk scam operation than a genuine forex broker. Investors should avoid depositing any funds here.

Reply

I invested a massive chunk of my capital and savings into the care of this unregulated broker who vividly convinced me into investing more over time. I was told pulling out of the investment is easy and I could make withdrawals. They kept asking for more funds, while using charges and taxes as an excuse. This kept going on for weeks, I couldn't stop because I'd invested over $240,000. Later I told my wife about what I did with all the money. Then, we started to research how to recover the funds. We found an article about Jeff silbert a wealth recovery agent specialist that took up the case. With no further hassle, we were able to recoup 95% of the funds. All thanks to him, I recommend you contact him on email - J𝐞𝐟𝐟𝐬𝐢𝐥𝐢𝐛𝐞𝐫𝐭 𝟑𝟗 𝕒𝕥 gmail cOm or 𝑾𝒉𝒂𝒕𝒔𝒂𝒑𝒑 him +① ⑤ ⓪⑤ .⑤.③ ④ ⓪⑨ ⑨⓪

Reply

~ There's nothing more ~

About ApexTrust Markets's questions

Ask:Is ApexTrust Markets a regulated Forex broker?

Answer:No. ApexTrust Markets is not regulated by any reputable financial regulator, such as the UK's FCA, Australia's ASIC, Cyprus' CySEC, or New Zealand's FMA. The so-called "regulatory number" mentioned on its website has been verified to be fraudulent or invalid. Without regulation, investor funds lack legal protection. If the platform ceases operations or absconds with funds, investors will not be able to recover their losses through formal channels.

Ask:Why are there anomalies in ApexTrust Markets' trading platform and deposit and withdrawal processes?

Answer:ApexTrust Markets' website does not offer any mainstream trading software (such as MT4 or MT5). Its so-called "WebTrader" page is merely a static interface, lacking real-world trading functionality. Some investors have reported being unable to log in to their accounts after depositing funds, having their funds frozen, or having withdrawals rejected. Without a custodian bank or third-party payment guarantee, the platform likely uses an internal virtual backend to fabricate trading data and trick investors into adding funds, a typical high-risk practice.

Ask:Are the high returns promised by ApexTrust Markets credible?

Answer:Untrustworthy. This platform claims to deliver high returns with low risk through an "automated system" and "expert advisory team," but it has not released any audit reports or actual trading records. Reputable brokers will not promise fixed returns, let alone guarantee "stable profits." These false high-yield claims are often a hallmark of Ponzi schemes or fraudulent projects. Investors should remain vigilant to avoid being deceived.