Suspected of fraud

Suspected of fraudNovaTrust Markets

1Year

Basic Information

Country

AmericaMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provide trading services for a variety of financial products such as foreign exchange (Forex), contracts for difference (CFD), stocks, commodities, indices, etc.Support Languages

Chinese, EnglishDomain Registration Date

2025-05-20Business Status

Suspected of fraudCompany IntroductionWeb Analytics

Company Introduction

NovaTrust Markets claims to be an international broker providing foreign exchange and contracts for difference (CFD) trading services, but its background and founding date are lacking. Despite its attractive website, boasting a wide range of financial products and a comprehensive trading system, its lack of a clear corporate history and publicly disclosed legal qualifications raises significant doubts. Compared to established, compliant brokers, this platform lacks credibility and transparency, making it difficult to effectively protect the safety of investors' funds.

🌐Global layout and brand background

NovaTrust Markets deliberately emphasizes its "global presence" and "multi-regional services" in its marketing, attempting to project the image of an international financial institution. However, an investigation has found no sufficient evidence to prove its operational presence or robust capital base in major financial centers such as the UK, Australia, or continental Europe. Its so-called "cross-regional capabilities" are more like marketing rhetoric, and its brand credibility is far inferior to that of established, regulated brokers.

💹Trading products and services

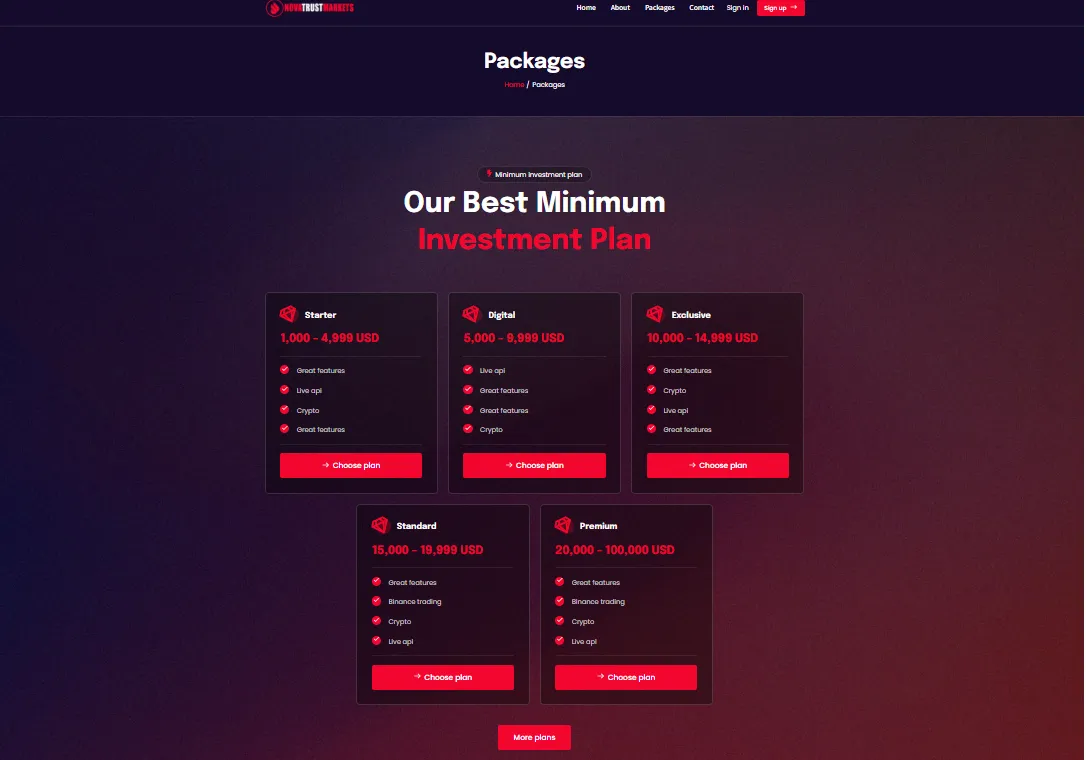

The platform claims to offer a wide range of trading options, including forex, indices, commodities, and cryptocurrency CFDs. However, its trading details lack transparent disclosure, particularly regarding spreads, fees, and leverage. The lack of independent external reviews or real-world user verification raises significant uncertainty about the authenticity and usability of its products. For investors, this ambiguity significantly increases potential risk.

💻Trading technology and platform experience

NovaTrust Markets claims support for common platforms like MetaTrader on its website, but it doesn't provide independent data on order execution speed, server stability, or liquidity sources. Investors cannot verify whether its matching trades are truly connected to the market or whether there's potential for back-end manipulation. This opaque trading environment can easily lead to slippage, delays, and even unfair order execution, potentially exposing users to financial losses.

🛡️Regulatory compliance and fund security

The most critical issue is regulatory compliance. While NovaTrust Markets mentions compliance on its website, it fails to provide a clear, authoritative regulatory license number. A search revealed that its name does not appear in the databases of international regulators such as the FCA, ASIC, and CySEC. This means that funds on the platform lack legal protection, leaving investors with virtually no legal recourse should they encounter withdrawal difficulties or have their funds withheld.

⚡Trading conditions and experience

The platform claims to offer high leverage and low spreads, but this is not supported by transparent data. Some investors have reported difficulties or significant delays in withdrawing funds, further exposing its fund management issues. In an unregulated environment, high leverage is more likely to be used as a means to lure novice investors into the market rather than as a genuine trading advantage.

🎓Customer support and value-added services

NovaTrust Markets advertises multilingual customer support and educational resources, but its actual service performance is subpar. Some users report slow customer service responses, shirking responsibility, and even disconnection when it comes to financial issues. The so-called education and market analysis content is mostly basic and lacks practical depth, significantly falling short of the value-added services offered by a truly compliant platform.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading are inherently high-risk investments, and the lack of regulation and transparency on NovaTrust Markets exacerbates these risks. Investors risk not only losses from market volatility but also potential withdrawal issues and account manipulation. The platform is positioned more as a high-risk trap than a safe and compliant trading platform.

🔍Comprehensive analysis and evaluation

In summary, NovaTrust Markets has the following prominent problems:

There is no effective supervision and funds lack legal protection;

The company's information is vague and lacks transparency;

The transaction conditions are unclear, and there is suspicion of false advertising;

Insufficient customer service and services make it difficult for investors to protect their rights.

Therefore, NovaTrust Markets carries an extremely high overall risk and does not provide a safe and reliable investment environment. Investors should exercise caution and avoid investing in such opaque, non-compliant platforms to prevent irreparable losses.

Selected Enterprise Evaluation

2.70

Total 5 commentsNovaTrust Markets presents itself as a global broker, but the lack of valid regulation and unclear company background make it highly suspicious. Investors risk losing their funds due to poor transparency and withdrawal issues.

Reply

The platform advertises attractive trading conditions like high leverage and low spreads, but these claims are not backed by any independent verification. Weak customer support and no credible license make it a risky choice.

Reply

After years of unsuccessful attempts to recover my missing funds and falling victim to several fraudulent agents, I was beginning to lose hope. Fortunately, I came across Laura Cooper Terms, and although I was initially skeptical due to my past experiences, I decided to give them a chance. That decision changed everything they provided exceptional service and successfully helped me recover my lost funds, even offering valuable additional support. I highly recommend Laura Cooper Terms as a fast, reliable, and trustworthy recovery company. Resoxit 40 at gmail . c o m WhatsApp: +1 (309) 208-5151

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

I had difficulty withdrawing funds after trading and felt stuck at first. (alg @ nordevamber. com, +1 334 679 5376) support team provided clear instructions, answered my questions patiently, and helped me complete the withdrawal successfully. The whole process was handled professionally and I appreciated the transparency. This would be helpful for anyone who needs guidance with similar problems.

Reply

~ There's nothing more ~

About NovaTrust Markets's questions

Ask:Is NovaTrust Markets regulated by any authoritative financial regulator?

Answer:No. While NovaTrust Markets mentions "compliance" on its website, it doesn't provide any valid regulatory license numbers. Upon verification, it doesn't appear in the databases of authoritative international regulators like the FCA, ASIC, and CySEC, indicating a lack of regulatory oversight.

Ask:Is it safe to deposit and withdraw funds with NovaTrust Markets?

Answer:It's not safe. The platform hasn't stated whether it implements a segregation system for customer funds, and some users have reported withdrawal delays or rejections. If the platform encounters problems, investors' funds are likely to be irrecoverable.

Ask:Why does NovaTrust Markets still attract some investors?

Answer:Platforms often attract investors with claims of high leverage, low spreads, and global services, but these advantages are often superficial, lacking transparent data and independent verification. Some investors, driven by the pursuit of high returns, are misled by these platforms, ignoring regulatory gaps and potential risks to their fund security.