Normal Operation

Normal OperationD prime(Doo Prime)

1Year

Basic Information

Country

SeychellesMarket Type

foreign exchangeEnterprise Type

BrokerageService

We offer trading services for a variety of financial products, including Forex, CFDs, stocks, commodities, and indices.Support Languages

Chinese and EnglishDomain Registration Date

2024-09-18Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

D Prime (Doo Prime) is an international brokerage firm that provides online forex and CFD trading services, and is part of the Doo Group. The company claims to be committed to providing diversified financial products and one-stop trading services to individual and institutional investors worldwide, covering multiple asset classes including forex, precious metals, energy, indices, stocks, and cryptocurrencies.

The platform's core business focuses on technology-driven trade execution and efficient liquidity integration. Doo Prime provides users with a stable trading environment through the two major trading systems, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and is complemented by its self-developed multi-account management system (MAM/PAMM) to meet the needs of traders of different sizes.

The company emphasizes its transparency and technological capabilities, and provides investors with trading learning and market analysis content through its official website, educational courses, and market information sections. Overall, Doo Prime is striving to build greater brand awareness and trust in the global retail trading and institutional services market.

🌐Global footprint and brand background

Doo Prime is part of the Doo Group, headquartered in Mauritius, with offices in Hong Kong, Dubai, London, and Singapore. The group's overall business covers major regions including Asia Pacific, Europe, the Middle East, and Africa.

According to company disclosures, Doo Prime holds financial services licenses in multiple regions, including regulatory authorization from the Financial Services Commission (FSC) of Mauritius, a license from the Financial Services Commission of Vanuatu (VFSC), and registration with the Cayman Islands Monetary Authority (CIMA). These licenses provide a compliance framework for its cross-border brokerage services in various locations.

However, these regulations still differ from top-tier regulators (such as the UK's FCA, Australia's ASIC, or the US's NFA) in terms of investor protection and fund segregation standards. Therefore, users should pay attention to the actual level of regulatory coverage and safeguards when choosing an account region.

💹Trading Products and Services

Doo Prime offers products covering forex, precious metals, crude oil and energy commodities, index CFDs, US and Hong Kong stock CFDs, and mainstream cryptocurrency trading. The company aims to provide investors with flexible market choices and risk diversification opportunities through a multi-asset portfolio.

The platform offers a variety of account types to suit traders of different levels. Standard and ECN accounts offer different spreads and commission structures, with relatively flexible minimum deposit requirements and leverage up to 1:500. Doo Prime also provides demo accounts for beginners to practice trading.

Overall, the product range is quite comprehensive, catering to the diverse strategic needs of short-term, swing, and long-term investors. However, investors should exercise caution and fully understand the associated risks when engaging in high-leverage trading.

💻Trading technology and platform experience

Doo Prime supports mainstream MetaTrader 4 and MetaTrader 5 platforms and comes equipped with independent account management tools and API interfaces, making it suitable for institutional and algorithmic traders. The platform claims significant optimizations in execution speed and stability, enabling low-latency matching.

In addition, Doo Prime offers multi-platform support, including web, mobile, and desktop clients, ensuring users can access the marketplace anytime. Custom reports and strategy testing tools are supported for some account types.

However, based on feedback from some third-party testing platforms and users, actual execution latency and slippage may vary due to market fluctuations and server region differences. While the overall technical environment is relatively mature, user experience still depends on network quality and the configuration of the individual trading terminal.

🛡️Regulatory compliance and fund security

Doo Prime is regulated by the FSC of Mauritius and the VFSC of Vanuatu, and holds registration authorizations in some jurisdictions. Its parent company, Doo Group, also operates subsidiaries in multiple jurisdictions. The platform implements a customer funds segregation policy, meaning customer funds are held separately from company operating funds to enhance fund security.

Nevertheless, the regulatory rigor of these offshore regulators is generally lower than that of major financial markets such as the UK, US, and Australia, and their protection of investor disputes and compensation mechanisms is relatively limited. Users should pay attention to the source of the regulatory license and fund custody arrangements when choosing a trading account to avoid mistakenly believing that it offers top-tier financial security.

⚡Transaction Terms and Experience

Doo Prime offers competitive trading conditions, including forex spreads as low as 0.1 pips, ECN account execution, and various leverage options (up to 1:500). The company claims its matching technology comes from multiple top liquidity providers, aiming to provide users with a fast and stable trading execution experience.

Doo Prime also offers flexible deposit options, including bank wire transfer, credit card, e-wallet, and cryptocurrency deposits. Withdrawal processing typically takes 1 to 2 business days.

However, some users have reported that spreads and slippage widen significantly during periods of high market volatility. Overall, the trading environment is competitive, but there is still room for improvement in terms of stability and cost consistency.

🎓Customer Support and Value-Added Services

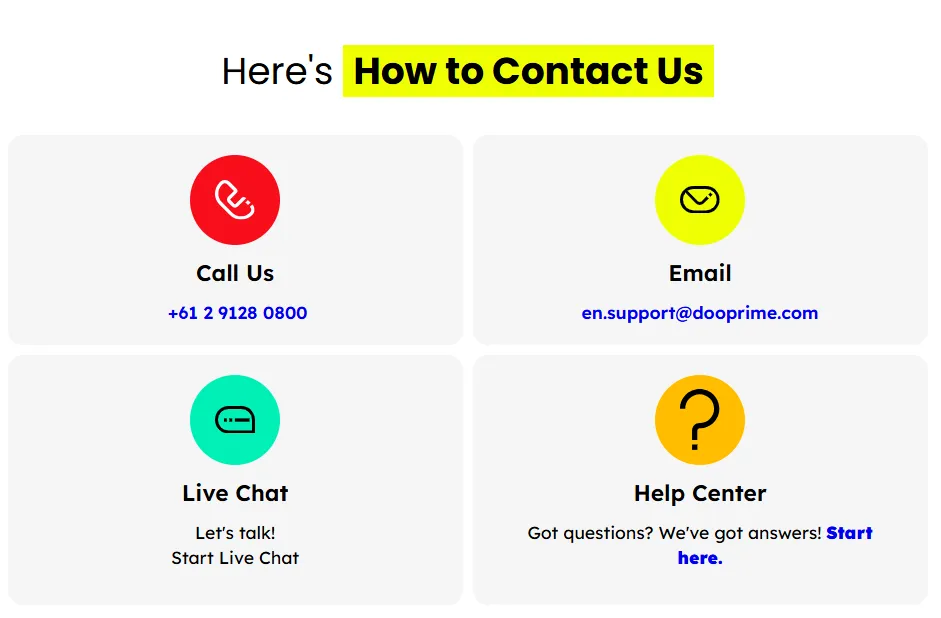

Doo Prime offers 24/7 multilingual customer support, covering major market languages such as English, Chinese, Vietnamese, and Arabic. Customers can access service via online chat, email, or telephone.

In addition, the platform operates an education center, providing trading guides, video courses, and daily market reports. Investors can access financial market analysis materials through its news section or "Doo Academy".

However, some users pointed out that customer service response time is affected by time zones, and processing is slower outside of working hours. The educational resources are primarily geared towards beginners, with relatively limited support for research tools for advanced traders.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading is a high-risk investment activity that may result in the loss of all capital. Doo Prime clearly states its risk disclosure on its website and reminds investors to use high leverage with caution.

From a platform positioning perspective, Doo Prime aims to attract investors from Asia and emerging markets by leveraging multi-asset trading and technology-driven strategies as its core competitive advantages. Although regulatory and fund security mechanisms are still primarily based on offshore structures, the company's overall operations are highly transparent and it possesses a certain market influence.

🔍Comprehensive Analysis and Evaluation

In summary, Doo Prime, as an international brokerage firm operating in multiple regions, has the following characteristics:

A global multi-license network covering the Asia-Pacific and Middle Eastern markets;

A wide range of products are available, supporting forex, commodities, indices, stocks, and crypto assets;

The technology system is mature and supports MT4/MT5 and API trading.

Offshore regulation is the primary focus, with limited investor protection mechanisms.

Customer service and educational resources are comprehensive, but the depth of professional research is insufficient.

Overall, Doo Prime is suitable for users seeking multi-asset trading and flexible account conditions, but investors who prioritize strong regulation and top-tier fund protection should still carefully evaluate it. While the platform is competitive in terms of technology and services, its regulatory framework and transparency in fund custody remain key considerations for investors.

Selected Enterprise Evaluation

3.00

Total 3 commentsDoo Prime offers a wide range of trading instruments and solid platform support, but its offshore regulation may raise caution for risk-conscious investors.

Reply

A globally expanding broker with strong technology and flexible account options, though transparency and investor protection could be improved.

Reply

be***h2

be***h2Please do not fall prey to their sweetly spoken Customer Executives. I lost US$1,700 just because of greed, thinking it would multiply and I could get attractive returns. Anyhow, I managed to get their Head Office address and Phone No. (mentioned on their website) physically verified at Seychelles and found that there is nothing related to Capitalix at that address. Even if you invest, initially everything will look very smooth and fine. After a few days, all your investment will start going negative and will never recover. Now you have lost all your money. Don’t believe the good reviews about them on different websites, it’s all managed by them. I am mentioning what I personally faced. Thankfully, I was later able to recover my money with the help of Mrs. Bruce Nora, whom I came across through the internet (and was also recommended by a friend). Without that support, I would have lost everything. don’t give up—Mrs. Nora is someone you can truly trust. Email: bruce.nora254(@)gmail.com | .web, trazevault.org"Be careful out there—scams are everywhere these days."

Reply

Exercise extreme caution when engaging with this website. Deposits are accepted easily, but withdrawals are consistently blocked. My attempts to recover funds for over a week have been unsuccessful, and the so-called “financial manager” became hostile when questioned. Many of the platform’s positive reviews also appear inauthentic. If you encounter similar issues, consider seeking professional chargeback assistance. You may contact Madam Doris at Email: dorisashley71 @ gmail. com or via WhatsApp at +1 .- (404) -.721.-56.-08.

Reply

~ There's nothing more ~

About D prime(Doo Prime)'s questions

Ask:Is Doo Prime a regulated broker? Is it safe?

Answer:Doo Prime, part of the Doo Group, currently holds several regulatory licenses, including the Mauritius FSC and Vanuatu VFSC. These licenses allow it to provide financial services in multiple regions. However, it's important to note that these are offshore regulatory bodies, and their regulatory力度 and investor compensation mechanisms are relatively limited compared to top-tier regulators (such as the FCA and ASIC). Investors should understand the account registration location and fund custody arrangements before opening an account and rationally assess the risks.

Ask:What trading products and account types does Doo Prime offer?

Answer:Doo Prime offers trading in a variety of asset classes, including forex, precious metals, energy, index CFDs, equity CFDs, and mainstream cryptocurrencies. Account types are primarily divided into standard accounts and ECN accounts, with flexible minimum deposit requirements and leverage up to 1:500. Traders can choose the appropriate account based on their capital and trading preferences, while beginners can practice using a demo account.

Ask:Is withdrawal smooth on Doo Prime? Are funds held in segregated locations?

Answer:Doo Prime supports various deposit and withdrawal methods, such as bank transfers, credit cards, e-wallets, and cryptocurrencies. Withdrawal processing typically takes 1-2 business days. The platform implements a segregated customer funds system, meaning customer funds are held separately from the company's own funds. However, as it primarily operates under an offshore regulatory structure, its fund protection mechanisms may not be comparable to the compensation systems in major markets like the UK, US, and Australia. Investors should carefully manage trading risks.