Normal Operation

Normal OperationXS.com

1Year

Basic Information

Country

SeychellesMarket Type

foreign exchangeEnterprise Type

BrokerageService

We offer trading services for a variety of financial products, including Forex, CFDs, stocks, commodities, and indices.Support Languages

Chinese and EnglishDomain Registration Date

1992-09-25Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

XS.com (also known as XS Group) is a multi-asset online brokerage founded in 2010 and headquartered in Seychelles, with branches in Cyprus, the UAE, and Hong Kong. The company offers a diversified range of financial products including forex, stocks, indices, metals, energy, and cryptocurrencies, serving both retail and institutional clients. XS.com is committed to providing a high-efficiency trading experience for global traders through advanced technology and deep liquidity.

According to its official website, XS.com's trading services are centered on the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, supporting multilingual services and multi-currency accounts. XS.com emphasizes compliant operations and is registered or licensed by multiple international regulatory bodies to enhance investor trust. With over a decade of industry experience and a continuously expanding international business network, the brand's influence in the Middle East and Asian markets is steadily increasing.

🌐Global footprint and brand background

XS.com has built its global business system through a multi-regional layout, with regulatory entities in Seychelles (FSA), Australia (ASIC), and Cyprus (CySEC) to provide localized support for different markets. Its international headquarters is located in the Dubai International Financial Centre (DIFC), while it is actively expanding in Asian and Latin American markets.

In terms of branding, XS.com emphasizes a strategy of "global coverage and localized services," enhancing brand exposure through multilingual customer support, educational content, and regional events. The company has repeatedly sponsored industry trade shows and financial forums, showcasing its dual positioning in retail trading and institutional solutions. However, some analysts point out that the company is still in the brand-building phase, and its global brand recognition lags behind established brokerages.

💹Trading Products and Services

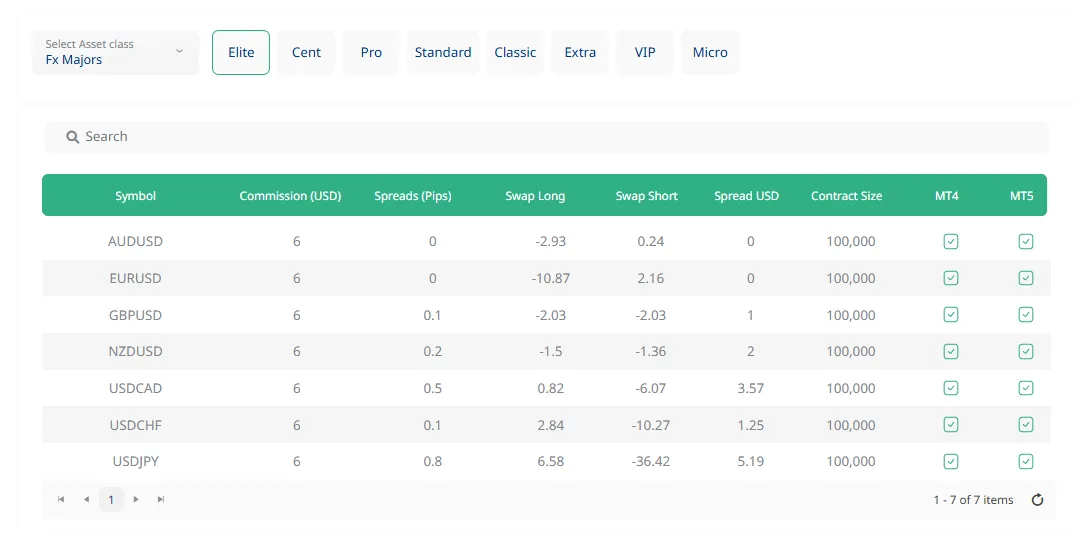

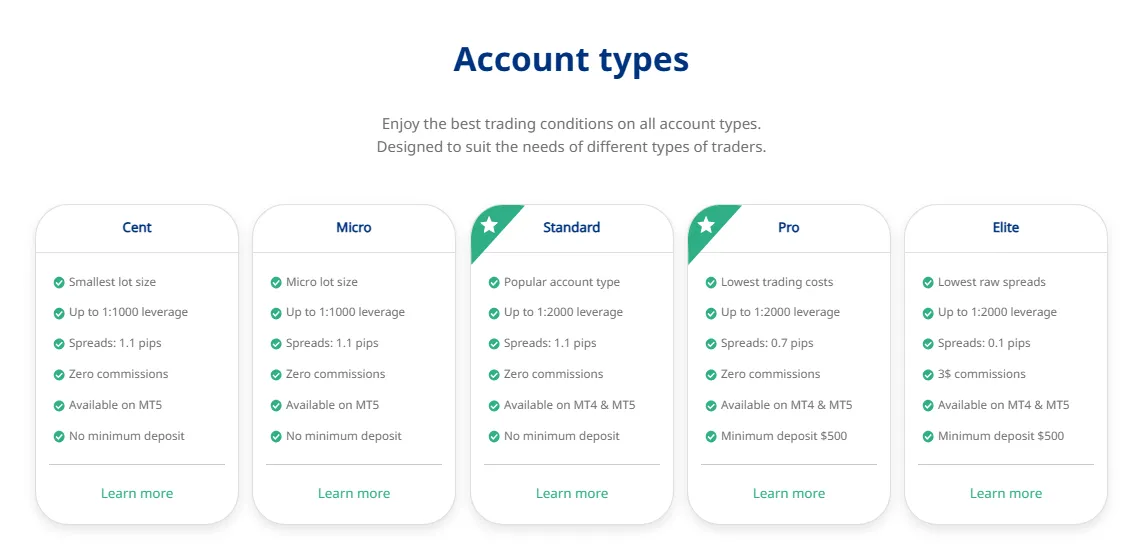

XS.com offers a comprehensive range of trading products, including major asset classes such as forex, commodities, energy, indices, equity CFDs, and cryptocurrencies. The platform provides different account types for retail and professional clients to meet diverse trading needs.

Investors can trade through the MT4 and MT5 platforms, enjoying instant execution, automated strategies, and multi-dimensional technical analysis tools. XS.com's multi-asset portfolio and flexible leverage settings offer traders considerable freedom, but high leverage also means higher risk. Overall, its product structure is suitable for users with a medium-to-high risk tolerance who wish to diversify their portfolios.

💻Trading technology and platform experience

XS.com leverages the MetaTrader platform to provide a relatively stable trading experience. MT4 and MT5 support both mobile and desktop platforms and offer a wealth of charting tools, technical indicators, and automated trading experts (EAs).

The company also offers VPS services to meet the low-latency needs of high-frequency traders and claims its servers are located at data nodes in major financial centers. User feedback indicates that the platform's execution speed is generally smooth, but access latency occurs in some regions. Overall, XS.com demonstrates robust performance in terms of trading technology, but it has not launched its own self-developed platform and still primarily relies on traditional systems.

🛡️Regulatory compliance and fund security

XS.com's regulatory framework includes:

Seychelles Financial Services Authority (FSA) – the primary regulatory entity;

Cyprus Securities and Exchange Commission (CySEC) – Provides compliant access to the EU market;

The Australian Securities and Investments Commission (ASIC) – oversees certain agency services;

Dubai Financial Services Authority (DFSA) Registration – Regional Operations Registration.

While XS.com claims to implement a segregated customer funds policy and employs encryption technology to protect data security, investors should be aware of significant regulatory differences across regions. Some registered entities have lower regulatory oversight and do not cover all trading activities. Clients are advised to confirm the specific regulatory body associated with their account before opening an account.

⚡Transaction Terms and Experience

XS.com offers flexible trading conditions, including leverage up to 1:500, low spreads, and no-deal-table execution (NDD). It offers various account types such as Standard, Pro, and Raw, with relatively low minimum deposit requirements, making it suitable for traders of different experience levels.

Spreads vary depending on account type and trading product, starting as low as 0 pips, but may widen during periods of high market volatility. Some third-party reviews indicate that XS.com performs reasonably well in terms of execution speed and slippage control, but occasional delays occur. Overall, its trading conditions are attractive to short-term and intermediate traders.

🎓Customer Support and Value-Added Services

XS.com offers 24/5 multilingual customer service, including online chat, email, and telephone support, covering multiple languages such as English, Arabic, Chinese, and Vietnamese. The platform also features an education center offering basic trading courses, webinars, and market analysis reports.

In addition, XS.com remains active on social media and in industry events, expanding its brand influence by hosting regional seminars and sponsoring financial trade shows. While its educational resources are abundant, the content is largely basic, offering relatively limited research support for professional traders.

⚠️Risk Warning and Platform Positioning

Foreign exchange and CFD trading are high-risk investments. XS.com provides a clear risk statement on its website, reminding investors that they may lose all their funds. As its operations cover multiple regulatory jurisdictions, investors should be aware of the differences in laws and risks in each location and ensure compliance with local regulatory requirements.

In terms of positioning, XS.com primarily targets the Middle East and Asian markets, focusing on serving multilingual clients and multi-asset traders. The platform's technology and liquidity support are adequate, suitable for users who prioritize execution experience and diversified investment options. However, its appeal is limited for investors who demand top-tier regulation and ultra-low spreads.

🔍Comprehensive Analysis and Evaluation

Overall, XS.com is a multi-asset broker with a relatively complete compliance structure and a broad market presence. Its strengths lie in its multi-regional licensing, support for both the MetaTrader and MetaTrader platforms, and multilingual customer service. However, regulatory differences, brand recognition, and technological innovation capabilities remain its main areas for improvement.

XS.com is suitable for investors who seek a flexible trading environment and international support, but they should carefully assess their own risk tolerance and the compliance guarantees of the location where their account is supervised.

For users looking to participate in the foreign exchange and CFD markets globally, XS.com offers a balanced option.

Selected Enterprise Evaluation

2.33

Total 3 commentsXS.com offers a broad range of assets and reliable MT4/MT5 support, making it suitable for multi-market traders.

Reply

be***h2

be***h2I lost a substantial amount of money to a scammer after investing and being promised high returns. Once I tried to withdraw my profits, my account was suddenly frozen. I battled with the scammer, but nothing worked.Just when I had almost given up, I came across Mr. Nora, a recovery expert. I shared my experience with her, and to my surprise, in just about 52 hours, she successfully recovered my money in full. If you've been a victim of a similar scam, I strongly recommend getting in touch:Email: brucenora 254 @)gmail. com Phone: + 1 870-810-5442 Help is out there—don’t lose hope.

Reply

While XS.com provides strong regional coverage, its regulatory consistency across jurisdictions could be improved.

Reply

I lost a substantial amount of money to a scammer after investing and being promised high returns. Once I tried to withdraw my profits, my account was suddenly frozen. I battled with the scammer, but nothing worked.Just when I had almost given up, I came across Mr. Nora, a recovery expert. I shared my experience with her, and to my surprise, in just about 52 hours, she successfully recovered my money in full. If you've been a victim of a similar scam, I strongly recommend getting in touch:Email: brucenora 254 @)gmail. com Phone: + 1 870-810-5442 Help is out there—don’t lose hope.

Reply

~ There's nothing more ~

About XS.com's questions

Ask:Is XS.com regulated by an authoritative financial regulatory body?

Answer:Yes, XS.com has regulatory registration entities in multiple regions, including the Seychelles Financial Services Authority (FSA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). It is also registered with the Dubai International Financial Centre (DIFC). However, investors should note that regulatory strength varies across regions, and it is recommended to confirm the regulatory body for your chosen account before opening an account.

Ask:What trading products and account types does XS.com offer?

Answer:XS.com offers trading in multiple assets including forex, stocks, indices, energy, metals, and cryptocurrencies, catering to various trader types. The platform supports multiple account types (Standard, Pro, Raw, etc.), has a low minimum deposit threshold, and supports leverage up to 1:500, allowing users to flexibly configure trading strategies according to their risk tolerance.

Ask:Is it safe to trade on XS.com? How are customer funds protected?

Answer:XS.com claims to have a segregated custody system for customer funds and uses SSL encryption and multi-factor authentication to protect user data and funds. However, due to the relatively weak regulatory oversight by some regulatory bodies (such as the FSA), investors should remain cautious and are advised to open accounts only in regions with clearly defined and strong regulatory oversight and strictly control trading risks.