Normal Operation

Normal OperationEXFOR

1Year

Basic Information

Country

MalaysiaMarket Type

foreign exchangeEnterprise Type

BrokerageService

We offer trading services for a variety of financial products, including Forex, CFDs, stocks, commodities, and indices.Support Languages

Chinese and EnglishDomain Registration Date

2024-09-18Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

EXFOR is an international online forex and CFD broker dedicated to providing diversified financial trading services to clients worldwide. With a mission to "make trading more transparent and efficient," the company's business covers multiple asset classes including forex, commodities, precious metals, indices, and cryptocurrencies.

EXFOR's core strengths lie in its advanced trading infrastructure and user-centric service philosophy. The platform provides retail and institutional clients with a flexible trading environment, enhancing the overall trading experience through low spreads, fast execution, and no hidden fees. The company uses the industry-leading MetaTrader 5 (MT5) trading platform, compatible with both desktop and mobile devices, to meet the diverse operational habits and technical strategy needs of different traders.

Furthermore, EXFOR emphasizes trading transparency and fund security, supporting a multi-currency account system and independent fund custody mechanism, providing clients with an efficient deposit and withdrawal experience. Through continuous technological optimization and a global footprint, EXFOR is gradually becoming one of the most promising brands in the emerging brokerage service sector.

🌐Global footprint and brand background

EXFOR is headquartered in Dubai, United Arab Emirates, and expands its business partnerships in Europe and Asia. With innovative technology and customer trust at its core, the company serves traders from various countries through multilingual support and a regional partner network.

In its global communication strategy, the brand emphasizes the core concepts of "safety, efficiency, and transparency." EXFOR adopts a relatively conservative approach in its marketing and partnership strategies, with technology-driven development and compliance building as its long-term development direction.

💹Trading products and services

EXFOR offers trading products covering forex, commodities, stock indices, precious metals, and cryptocurrency CFDs. The platform supports trading in over 60 currency pairs and major indices, and provides a fast execution technology architecture for high-frequency and institutional traders.

The company provides in-depth market quotes, real-time chart analysis, Expert Advisors (EAs), and Multi-Account Management (MAM/PAMM) tools through the MT5 platform. This technological integration enables traders to manage multiple strategies and automate their execution.

EXFOR's product design emphasizes compatibility and flexibility, providing traders with different account types and leverage options to adjust flexibly according to market fluctuations and personal strategies.

💻Trading technology and platform experience

EXFOR uses MetaTrader 5 as its core trading terminal, providing a cross-platform experience covering Windows, macOS, iOS, and Android systems. Its trading interface is simple and intuitive, supporting multi-window monitoring and indicator customization, offering a good environment for short-term, swing, and automated trading users.

The company claims its order matching speed is fast and latency is low, and it uses high-performance infrastructure in its server deployment to ensure trading stability during periods of high liquidity. For investors who prefer quantitative and algorithmic trading, EXFOR's API and EA functions also offer considerable flexibility.

🛡️Regulatory compliance and fund security

EXFOR is currently registered in offshore regulatory jurisdictions (such as St. Vincent and the Grenadines), where the regulatory environment is more flexible, but it is not part of the first-tier regulatory systems such as the UK's FCA, Australia's ASIC, or Cyprus's CySEC.

The company states on its official website that it has implemented a segregated account system for customer funds and uses SSL encryption and two-factor authentication mechanisms to ensure account security. While offshore regulation provides the company with greater operational flexibility, investors should still assess the relevant risks and fund protection terms before opening an account.

⚡Transaction Terms and Experience

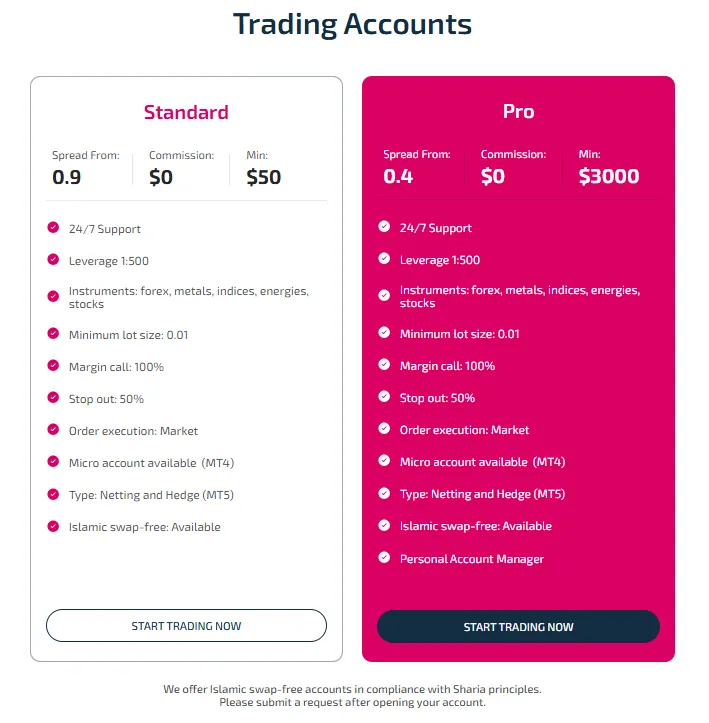

EXFOR offers flexible leverage (up to 1:400, depending on region and account type) and low spreads, with transparent trading costs and no hidden fees. The minimum deposit is low, and it supports multiple payment methods, including bank cards, wire transfers, and major e-wallets.

The platform offers differentiated terms across different account types to cater to the needs of both novice and professional traders. Its execution speed and cost structure make it competitive among small and medium-sized brokers.

🎓Customer Support and Value-Added Services

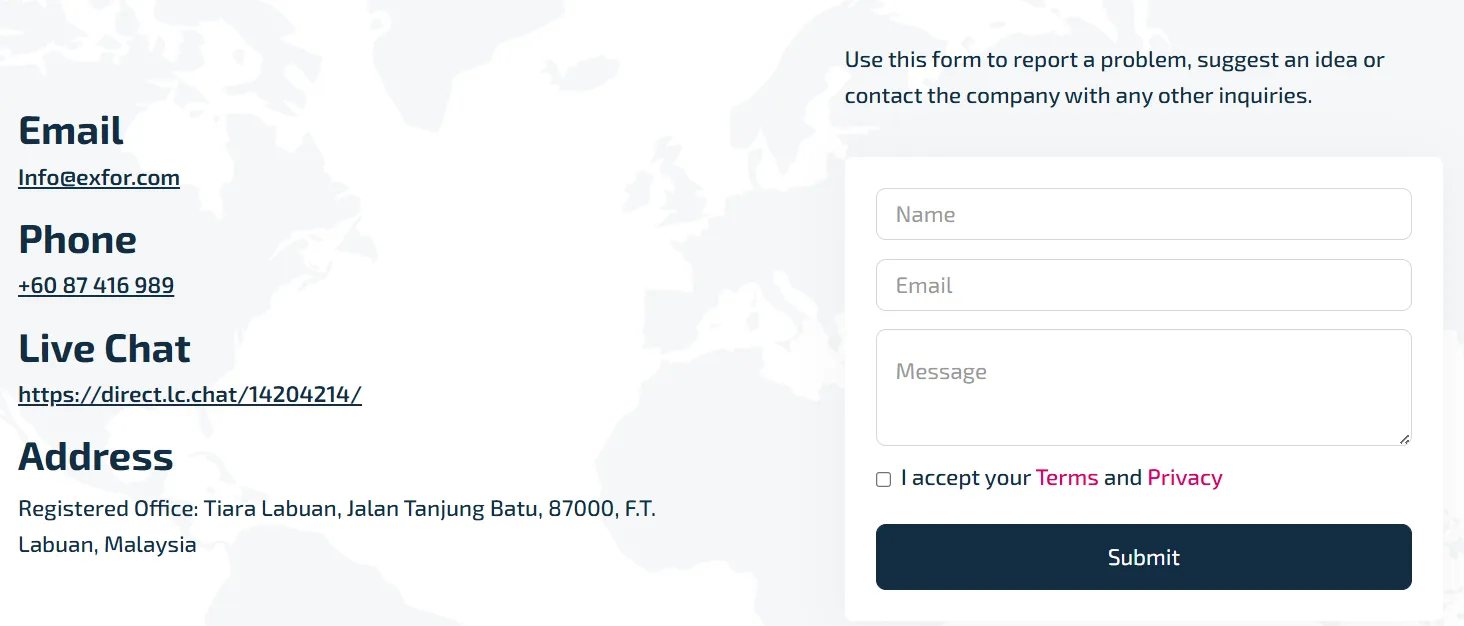

EXFOR offers 24/5 multilingual customer support through online chat, email, and phone. The customer service team can assist with account, technical, and trading issues.

In addition, the company invests resources in education and market analysis, providing basic trading knowledge, economic calendars, and market news updates to help investors understand macroeconomic trends and strategy applications. The overall customer service style leans towards professionalism and timely response.

⚠️Risk Warning and Platform Positioning

Foreign exchange and CFD trading carries a high degree of risk and may result in the loss of invested capital. EXFOR clearly lists its risk disclosure statement on its official website, reminding users to fully understand the trading mechanism and their personal risk tolerance before engaging in leveraged trading.

In terms of positioning, EXFOR is more suitable for traders with some experience who value execution efficiency and multi-asset allocation. For investors who prioritize regulatory security, it is recommended to further confirm its compliance information and fund protection mechanisms before opening an account.

🔍Comprehensive Analysis and Evaluation

Overall, EXFOR is an emerging brokerage firm characterized by its technology-driven approach and diverse product offerings. Its strengths lie in:

Using the MT5 platform is a mature technology that executes quickly.

The trading environment is transparent, and the cost structure is clear;

A diverse product portfolio covering assets in multiple markets;

Customer service is responsive, and educational resources are practical.

However, the offshore regulatory framework and the lack of mainstream financial licenses mean that there is still room for improvement in terms of fund protection and legal support for investors.

As a growing international trading platform, EXFOR has attracted a new generation of traders with its flexibility, convenience, and technological features. Its future brand development still depends on its continued investment in compliance and long-term reputation building.

Selected Enterprise Evaluation

3.00

Total 4 commentsEXFOR delivers a solid trading experience with its MT5 platform, offering fast execution and a wide range of assets suitable for modern, tech-driven traders.

Reply

Although the broker promotes transparency and efficiency, investors should be mindful of its offshore registration and confirm all risk disclosures before trading.

Reply

ni***dd

ni***ddRecovering your lost investment funds as the case might be, is not what you can do alone, you’d require the service of a trained recovery specialist. A recovery specialist is a person or a group of people who are well equipped to work around the brokerage network. They have vast knowledge about the whole network and have the right software and private keys to follow any transaction. I was scammed 175k trading online to an investment broker, good thing I got every penny back through the help of Gavin ray he’s a genius Contact MAIL : Gavinray78 @ gmail .com or WhatsApp +1 352 322 2096 It is also important to be patient and really calm during the process.

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

~ There's nothing more ~

About EXFOR's questions

Ask:Is EXFOR regulated by international financial regulatory agencies?

Answer:EXFOR is registered in offshore jurisdictions and is not currently directly regulated by major financial regulators such as the UK's FCA, Australia's ASIC, or Cyprus's CySEC. The company states on its website that it implements a segregated client funds system and employs multi-layered data encryption and security verification mechanisms to ensure transaction security and account privacy. While offshore regulatory structures offer greater operational flexibility, investors should still review relevant legal documents and fully understand regulatory differences and potential risks before opening an account.

Ask:What trading products and account types does EXFOR offer?

Answer:EXFOR offers a diverse range of products, including forex currency pairs, precious metals, crude oil, global stock indices, and cryptocurrency CFDs. The platform provides trading services through the MetaTrader 5 (MT5) trading terminal and supports multiple account types to cater to investors with varying experience levels and strategy needs. Investors can choose appropriate leverage ratios and minimum deposit requirements based on their trading size. The platform also supports automated trading and multi-terminal operation, making it suitable for a wide range of traders, from beginners to professional.

Ask:How do I deposit and withdraw funds on the EXFOR platform?

Answer:EXFOR supports various mainstream payment methods, including credit cards, wire transfers, and e-wallets. Deposits are typically instant, while withdrawal requests are processed within 1-3 business days after review. The company claims to have no hidden fees, but some payment channels may incur bank or intermediary fees. To ensure fund security, users must complete the Know Your Customer (KYC) process, providing proof of identity and proof of residential address. Investors are advised to read the platform's deposit and withdrawal policies before using the platform to clearly understand fees, processing times, and account verification requirements.