Normal Operation

Normal OperationFTAG Capital Markets

1Year

Basic Information

Country

MalaysiaMarket Type

NoneEnterprise Type

BrokerageService

We offer trading services for a variety of financial products, including Forex, CFDs, stocks, commodities, and indices.Support Languages

Chinese and EnglishDomain Registration Date

2024-09-18Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

FTAG Capital Markets is a financial brokerage firm offering online forex and CFD trading services, committed to providing global clients with diversified investment options and an efficient trading experience. The company operates on a "technology-driven, customer-centric" philosophy, and its business scope covers CFD products in forex, precious metals, energy, stock indices, and cryptocurrencies.

FTAG Capital Markets caters to diverse trader needs through its flexible account system, low transaction costs, and multi-platform access. The platform provides a one-stop trading environment for retail and institutional investors, supporting multi-currency accounts and multi-language interfaces. Positioned as a "global brokerage service brand," the company's key strengths lie in transparent execution and technological stability.

🌐Global footprint and brand background

FTAG Capital Markets is headquartered in a vibrant international region with active financial services sectors and expands its business partnerships across multiple markets. The company emphasizes serving global clients with a robust international presence and expanding its market reach through partnerships.

The brand emphasizes professionalism and integrity, and its official website presents the corporate image in a simple and modern style, with core messages revolving around "trust, execution, and transparency." The company claims to implement strict standards in areas such as financial security, compliant operations, and risk management to enhance brand credibility and long-term customer trust.

💹Trading Products and Services

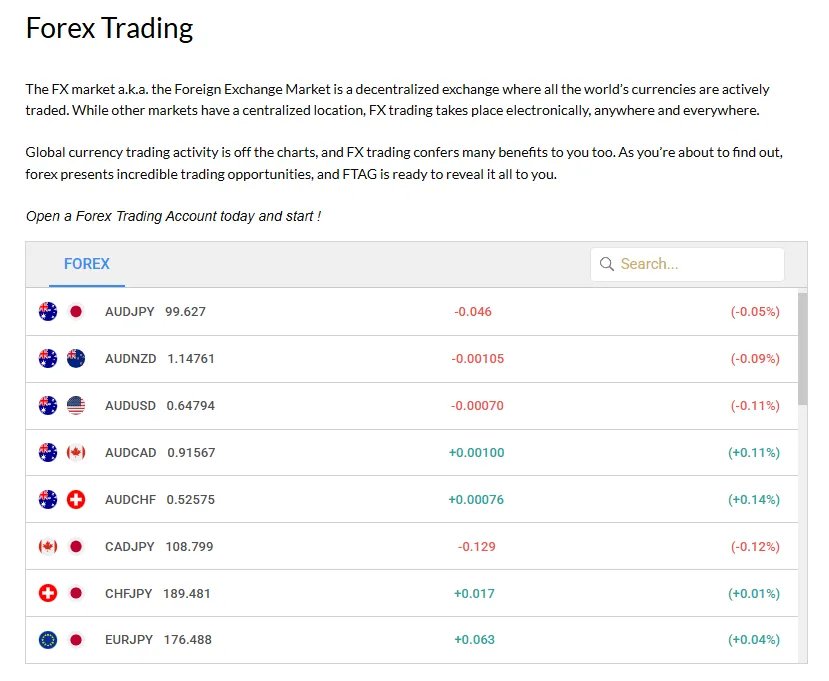

FTAG Capital Markets offers trading products covering forex currency pairs, indices, precious metals, crude oil, and digital asset CFDs. Clients can choose different leverage and account types according to their individual strategies. The platform claims to provide a flexible trading environment for investors of all levels, with low spreads, high liquidity, and fast execution as its core advantages.

Its service system includes market analysis tools, price charts, and technical indicators to help users make real-time decisions. The company provides investors with efficient and competitive trading conditions through multi-asset portfolios and transparent pricing mechanisms.

💻Trading technology and platform experience

FTAG Capital Markets utilizes industry-leading trading terminals to provide users with an intuitive and high-performance trading experience. The platform supports both desktop and mobile devices, allowing users to monitor market dynamics, manage orders, and execute trades anytime.

The company prioritizes technological stability and system responsiveness, striving to reduce transaction latency and slippage risks. Its official website advertises that its technological infrastructure supports automated trading and intelligent strategy applications, suitable for short-term, high-frequency, and algorithmic trading users. Overall, the platform boasts a simple design and smooth operation, making it suitable for traders of varying experience levels.

🛡️Regulatory compliance and fund security

FTAG Capital Markets is currently registered in offshore financial jurisdictions, and its regulatory status is not indicated by third-party data as being directly regulated by primary financial regulatory bodies (such as the FCA, ASIC, CySEC, etc.). The company emphasizes on its website that client funds are held independently in segregated accounts and that multiple layers of encryption technology are used to protect user information and fund security.

Although offshore regulatory structures offer companies greater operational flexibility, investors should still carefully review their compliance documents and risk disclosures before opening an account, and understand the relevant fund protection clauses and applicable legal environment.

⚡Transaction Terms and Experience

FTAG Capital Markets offers various account types, supports flexible leverage ratios, and has a low minimum deposit requirement. The platform claims transparent trading costs, low spreads, and no hidden fees, allowing users to choose different leverage settings based on their individual risk preferences.

The company supports multiple payment channels, including bank transfers, credit cards, and e-wallets, aiming to provide users with a fast and convenient fund transfer experience. Transaction execution speed and cost control are considered among the platform's competitive advantages, but investors should still be aware of the high risks associated with leveraged trading.

🎓Customer Support and Value-Added Services

FTAG Capital Markets offers 24/5 multilingual customer support via online chat, email, and phone. The customer service team can assist with account, platform, and fund-related issues.

The company also provides supplementary tools such as market information, educational materials, and economic calendars to help traders understand market trends and risk management strategies. The overall service system emphasizes professional response and customer experience, suitable for investors at different levels for self-learning and strategy optimization.

⚠️Risk Warning and Platform Positioning

Foreign exchange and CFD trading involves high risk and high leverage, which may result in the loss of some or all of your investment capital. FTAG Capital Markets provides a risk disclosure statement on its website, reminding users to fully understand market mechanisms and their own risk tolerance before trading.

In terms of positioning, FTAG Capital Markets is more suitable for users with some market experience who value flexible operations and multi-asset trading. For investors who prioritize regulatory protection and long-term stability, it is recommended to further evaluate the platform's compliance and fund security before opening an account.

🔍Comprehensive Analysis and Evaluation

Overall, FTAG Capital Markets' main competitive advantages lie in its flexible account system, diverse product structure, and intuitive trading platform. The platform offers fast execution, a good user experience, and demonstrates considerable technical strength and user adaptability.

However, their offshore registration background and limited regulatory information mean that investors should exercise caution when making their choices, especially regarding the safety of funds and compliance transparency.

In summary, FTAG Capital Markets is suitable for investors seeking multi-asset trading who value technical fluency and operational flexibility. However, it is still recommended to fully understand the relevant risks and terms before making any actual investments to ensure sound investment decisions.

Selected Enterprise Evaluation

3.25

Total 4 commentsFTAG Capital Markets provides a smooth multi-asset trading environment with fast execution and competitive spreads, appealing to traders seeking flexibility and accessibility.

Reply

Hello everyone, I want to share my experience." I was scammed by an online platform that promised quick profits. Unfortunately, I couldn’t withdraw a single cent, and customer support went silent. After nearly giving up, I came across MRS SELETINA DE-ALAGRENS through some online forums. She guided me step by step, and to my surprise, I had my money back in just a few days. I'm beyond grateful. If you're in a similar situation, don’t hesitate to reach out to her. Contact: [email protected])

Reply

While the platform emphasizes transparency and efficiency, investors should remain cautious and review its offshore regulatory framework before committing funds.

Reply

My so-called “profits” vanished the moment I was locked out of my trading account. Desperate for answers, I found MRS SELETINA DE-ALAGRENS. They didn’t waste time — just reviewed the facts and got to work. Less than two days later, my funds were back. It was the first real relief I’d felt in weeks.

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

Hello everyone. I just want to quickly share my experience, in case it helps someone out there. A few months ago, I fell into an online investment scam that looked very professional. At first, everything seemed fine, but when I tried to withdraw, I realised I had been tricked. It felt horrible. I was embarrassed and honestly didn’t know what to do. That’s when I found Mrs. Nora. She was calm, professional, and didn’t make any fake promises. She asked for the right documents and kept me updated. Within a few days, I had my money back. I didn’t think it was possible, but it was. So if you’ve been in a similar situation, don’t stay silent — there’s still a way out. brucenora 254 (@) gmail. com | WhatsApp: +1 (8=7=0) 8=1=0-54=42

Reply

Hello everyone, I want to share my experience." I was scammed by an online platform that promised quick profits. Unfortunately, I couldn’t withdraw a single cent, and customer support went silent. After nearly giving up, I came across MRS SELETINA DE-ALAGRENS through some online forums. She guided me step by step, and to my surprise, I had my money back in just a few days. I'm beyond grateful. If you're in a similar situation, don’t hesitate to reach out to her. Contact: [email protected])

Reply

~ There's nothing more ~

About FTAG Capital Markets's questions

Ask:Is FTAG Capital Markets regulated by financial regulators?

Answer:FTAG Capital Markets is registered in offshore financial jurisdictions and has not yet publicly disclosed its licensing information with major regulatory bodies such as the UK's FCA, Australia's ASIC, or Cyprus's CySEC. The company states on its website that it implements a client fund segregation system and employs multi-layered security encryption to protect account and transaction security. Investors should carefully review relevant legal documents and risk disclosure statements before opening an account to fully understand the regulatory framework and potential risks.

Ask:What trading products does FTAG Capital Markets offer?

Answer:FTAG Capital Markets offers a variety of trading products, including contracts for difference (CFDs) in forex, stock indices, precious metals, energy, and cryptocurrencies. The platform provides flexible leverage settings and low spreads for traders of all levels, suitable for short-term, swing, and multi-strategy investors. The company offers diversified trading opportunities and multi-market access through a multi-asset portfolio structure.

Ask:How do I deposit and withdraw funds on FTAG Capital Markets?

Answer:Investors can conduct fund transactions through various methods, including bank cards, wire transfers, and mainstream e-wallets. The company claims that deposits are instant, while withdrawals are processed within 1-3 business days after submission for review. To ensure fund security, users must complete the Know Your Customer (KYC) process before any transaction. Investors are advised to review the platform's deposit and withdrawal policies before conducting any transactions to understand potential fees and processing times.