Normal Operation

Normal OperationHirose Financial(MY)

2Year

Basic Information

Country

MalaysiaMarket Type

foreign exchange|Stock|CFDEnterprise Type

BrokerageService

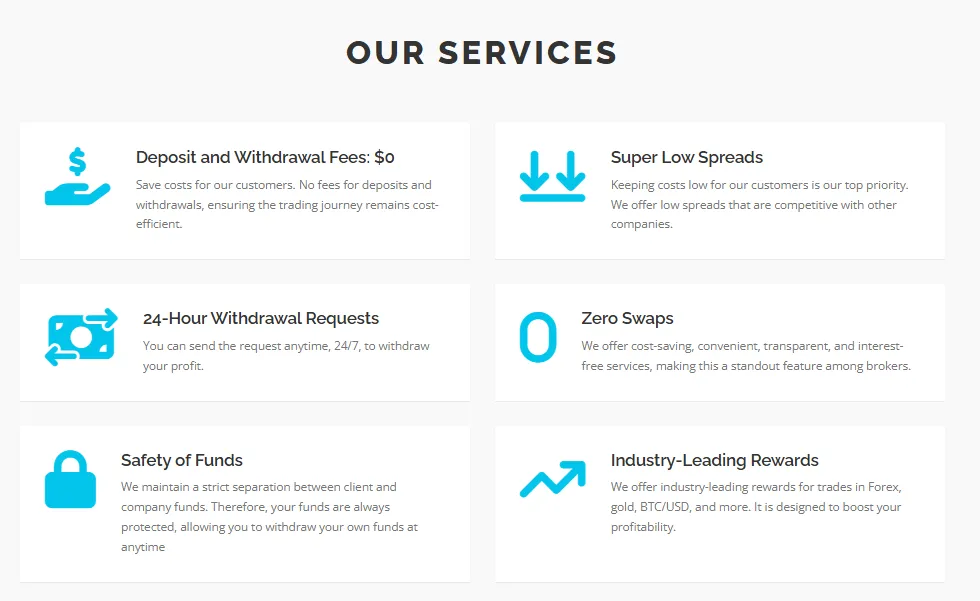

We offer trading services for a variety of financial products, including Forex, CFDs, stocks, commodities, and indices.Support Languages

Chinese and EnglishDomain Registration Date

2024-09-18Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

Hirose Financial (MY) is a Malaysia-based online forex and CFD broker, a subsidiary of the renowned Japanese financial group Hirose Tusyo Inc. Since its inception, the company has been committed to providing efficient, transparent, and competitive forex trading services to global investors. As a leading forex brand in the Japanese market, Hirose Financial is known for its compliant operations, stable technology, and excellent customer service.

The company primarily provides foreign exchange trading services to retail clients and small to medium-sized institutions, offering a wide range of major and cross-currency pairs. Hirose Financial (MY) employs an advanced trade execution system, providing a fast order matching and low-latency trading environment. The company emphasizes security and trust, creating a stable and reliable trading platform for its clients through compliant regulatory measures and fund segregation mechanisms.

🌐Global footprint and brand background

Hirose Financial, headquartered in Osaka, Japan, is a leading brand in the Japanese foreign exchange market. Its Malaysian branch, Hirose Financial MY, serves as a key operations center for the group in Southeast Asia, providing localized support and services to clients across Asia.

The company is regulated by the Malaysian financial regulator, the Labuan Financial Services Authority (Labuan FSA) , and holds a valid financial services license. This regulatory framework ensures that the company meets international standards in client fund management, trade execution, and risk disclosure. The group has offices in Japan, the UK, and several Asian countries, and its brand influence extends globally.

💹Trading Products and Services

Hirose Financial (MY) offers trading products centered around forex currency pairs, covering a wide range of major and minor currency combinations, including USD, JPY, EUR, GBP, and AUD. The platform supports Contracts for Difference (CFDs) trading, providing investors with diverse market access options.

The company emphasizes low spreads, stable execution, and high transparency in its trading conditions, making it suitable for short-term and medium-to-long-term traders. Its account types are flexible, with low minimum deposit requirements and leverage caps that comply with Malaysian regulatory requirements, providing investors with a stable and controllable trading environment.

💻Trading technology and platform experience

Hirose Financial (MY) uses the internationally recognized MetaTrader 4 (MT4) trading platform to provide users with a comprehensive trading experience. The MT4 platform supports desktop, mobile, and web-based operation and features include technical analysis tools, chart indicators, custom scripts, and Expert Advisor (EA) support.

The company prioritizes order execution speed and system stability at the technical level. Its servers are deployed in key financial nodes in Japan and Southeast Asia, ensuring low latency and high reliability for trading connections. For users requiring strategy testing or high-frequency trading, the platform performs exceptionally well.

🛡️Regulatory compliance and fund security

Hirose Financial (MY) is authorized and regulated by the Labuan FSA (Financial Services Authority of Malaysia) , with a clearly defined regulatory number that can be verified publicly on its official website. The company implements a client fund segregation system, with all client funds held in segregated trust accounts to ensure fund security and transparency.

Furthermore, the platform employs SSL encryption and multi-factor authentication mechanisms to prevent unauthorized access to transaction and account data. This compliant architecture, coupled with the Japanese group's background, has brought Hirose a high level of credibility and market trust.

⚡Transaction Terms and Experience

Hirose Financial (MY) offers competitive trading conditions, including spreads as low as 0.7 pips, adjustable leverage, and commission-free trading structures. It provides various deposit and withdrawal methods, supporting international bank transfers, credit cards, and e-wallets, with efficient and transparent fund processing.

The company's account setup is simple, and traders can choose between a standard account or a low-spread account according to their individual needs. The execution mode uses STP (Straight Through Processing), a direct-to-consumer trading system with no trader intervention, ensuring fair pricing and immediate order execution.

🎓Customer Support and Value-Added Services

Hirose Financial (MY) offers 24/5 multilingual customer service, supporting languages including English, Chinese, Malay, and Japanese. Customers can contact customer service via online chat, phone, or email.

The platform also provides users with educational resources and market analysis information, including trading guides, economic calendars, and forex news, to help investors understand market trends, develop strategies, and improve their trading skills. Its curriculum is beginner-friendly, but also includes technical analysis topics for experienced traders.

⚠️Risk Warning and Platform Positioning

Foreign exchange and CFD trading is a high-risk investment that may result in the loss of some or all of your funds. Hirose Financial (MY) clearly discloses the relevant risks on its website and in its legal documents, reminding clients to use leverage appropriately and control their positions according to their individual risk tolerance.

The platform is positioned to provide a stable and compliant trading environment, suitable for individuals and small to medium-sized institutions that wish to conduct forex trading under a regulated system. Its service system emphasizes security, low cost, and transparency, making it suitable for investors seeking stable returns and long-term growth.

🔍Comprehensive Analysis and Evaluation

Overall, Hirose Financial (MY) leverages the professional background of its Japanese parent company and the regulatory advantages of Malaysia to create a compliant, secure, and efficient forex trading environment.

The platform's advantages include:

Regulated by the Labuan FSA, it has a high degree of compliance;

It uses the stable MT4 platform, offering fast execution and comprehensive functionality;

Customer service responded promptly, and the educational content was practical.

Low-cost structure and flexible account types are suitable for different traders.

Its potential drawback lies primarily in its product range, which is concentrated in the foreign exchange market and lacks a broader range of CFDs or equity assets. Overall, Hirose Financial (MY) is a reliable Asian regional forex broker suitable for investors seeking stable execution and regulatory protection.

Selected Enterprise Evaluation

3.20

Total 5 commentsHirose Financial (MY) delivers a professional and transparent trading environment backed by Japanese expertise and solid regulatory oversight under Labuan FSA.

Reply

With stable MT4 performance and competitive spreads, Hirose (MY) is a reliable option for traders seeking a secure, well-regulated forex platform.

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

When the platform froze my withdrawals, I initially hoped it was just a technical issue—but soon realised I had fallen victim to a scam. Mrs. Doris Ashley came highly recommended, and from our first interaction, she was transparent, professional, and responsive. Within 72 hours, she successfully recovered my funds—delivering exactly what she promised, with no false assurances. Email: (dorisashley71 (@) gmail. c 0 m ) WhatsApps:+1 (404) .-721 . -56 .-08 She’s the only one I personally trust when it comes to financial recovery. Stay safe and protect your money

Reply

I recently fell victim to an investment scam broker and lost $70,000. These schemes often begin with a small initial deposit—such as $500—and gradually pressure victims to invest more. Their promises are misleading, and they operate without any real accountability. Although online reviews can be deceptive, I was able to find support from a specialist who assisted me in navigating the recovery process. If you’ve experienced a similar situation, don’t lose hope, you can reach out too Mrs. Email: (dorisashley71@ gmail.com) WhatsApp: +1 (404) 721-56-08 (Note: Always thoroughly verify the legitimacy of any recovery service, as many fraudulent groups pose as “fund recovery experts.”). Above all, conduct careful due diligence before committing to any investment. Your financial security must remain your top priority. Stay cautious and protect yourself.

Reply

~ There's nothing more ~

About Hirose Financial(MY)'s questions

Ask:Is Hirose Financial (MY) regulated by financial regulatory authorities?

Answer:Yes. Hirose Financial (MY) is authorized and regulated by the Labuan Financial Services Authority (Labuan FSA) in Malaysia and holds a valid financial services license. This regulatory framework requires brokers to implement a client fund segregation system to ensure that investor funds are kept separate from the company's operating funds, thereby enhancing account security and transparency. Investors can verify compliance by checking its regulatory information on the Labuan FSA's official website.

Ask:What trading products and platforms does Hirose Financial (MY) offer?

Answer:Hirose Financial (MY) primarily offers forex trading and Contracts for Difference (CFD) products, covering major and minor currency pairs, precious metals, and some commodity assets. The company uses the globally widely adopted MetaTrader 4 (MT4) platform, providing clients with comprehensive trading support across desktop, mobile, and web platforms. This platform is equipped with technical indicators, charting tools, and Automated Expert Advisor (EA) functionality, making it suitable for both beginners and professional traders.

Ask:How do I deposit and withdraw funds from Hirose Financial (MY)?

Answer:Clients can deposit and withdraw funds through various channels, including international bank transfers, credit cards, and some e-wallets. The company employs a Know Your Customer (KYC) process to ensure account security. Deposits are typically credited instantly, while withdrawals are completed within 1–3 business days after approval. Hirose Financial (MY) is committed to no hidden fees and all transactions and fund operations are transparent.