BrokerHiveX

BrokerHiveXBasic Information

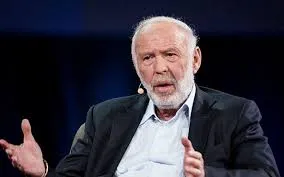

Name: James Harris Simons

Identity: Quantitative investment guru | Hedge fund legend Expertise: Mathematical modeling, quantitative trading, financial engineering

James Harris Simons (often referred to as Jim Simons) is one of the world's most renowned quantitative investors. He gained fame as a mathematician early on, making outstanding contributions to geometry and code-breaking. He later joined Wall Street, where, leveraging his deep foundation in mathematics and computer science, he pioneered a new era in quantitative investing. Simons is the founder of Renaissance Technologies, whose Medallion Fund is considered one of the world's most successful hedge funds.

Simons graduated from the Massachusetts Institute of Technology (MIT) and received a PhD in mathematics from the University of California, Berkeley. He worked for the US Department of Defense during the Cold War, studying codebreaking, and later became chairman of the mathematics department at the State University of New York at Stony Brook, where he gained international recognition for his research in geometry.

Representative achievements

Founded Renaissance Technologies and built it into the world's most renowned quantitative hedge fund

The Medallion Fund managed by the company has maintained an extremely high annualized rate of return for decades, far exceeding the market average.

He was awarded the Oswald Veblen Geometry Prize of the American Mathematical Society for his contributions to geometry.

He successfully applied mathematical modeling and data analysis to the financial market and is known as the "Father of Quantitative Investment."

He is a well-known philanthropist who has donated billions of dollars to education, scientific research, and medical care through his foundation.

Investment Philosophy

“Markets are complex systems, and mathematics is the key to understanding them.”

James Simons firmly believed that statistical analysis of large-scale data and algorithmic modeling could reveal hidden patterns in financial markets. He abandoned traditional intuitive investing methods in favor of rigorous mathematical models and high-frequency data processing, driving the transformation of Wall Street toward quantitative and automated trading. His philosophy was that human emotions create market inefficiencies, and that mathematical and scientific methods could capture and exploit these inefficiencies to achieve long-term excess returns.