BrokerHiveX

BrokerHiveXPersonal experience

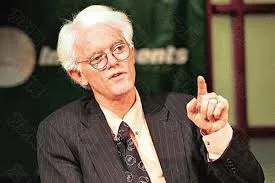

Peter Lynch was born on January 19, 1944 in Newtown, Massachusetts, and grew up in an Irish family. His early life was not smooth. His father died of cancer when he was 10 years old, leaving his family in financial difficulty. In order to supplement the family income, he worked as a caddy on a golf course since he was a teenager. It was during this period that he came into contact with senior executives of Fidelity Funds, and this experience deeply influenced his subsequent career path.

Lynch received a bachelor's degree in finance from Boston College in 1965, and then entered the Wharton School of the University of Pennsylvania to pursue an MBA. During this period, he invested in the stock market for the first time with his part-time savings and soon received rich returns. In 1969, he joined Fidelity Investments as a researcher, focusing on the metal and mining industries.

In 1977, he was appointed as the fund manager of the Fidelity Magellan Fund at the age of 33, thus starting his legendary investment career.

Main achievements

During the 13 years that Peter Lynch managed the Magellan Fund (1977–1990), the fund's assets grew from US$20 million to US$14 billion , with an average annual return of 29.2% , making it one of the best performing public funds in the United States during the same period.

Lynch is a model of the "bottom-up" stock selection method. He emphasized studying the fundamentals of the company itself rather than the macroeconomic trends. He put forward the famous investment concept of "Invest in what you know" and encouraged ordinary investors to pay attention to the brands and industries they come into contact with on a daily basis.

He has made accurate bets on a series of stocks including Ford Motor, Burger King, DHL Express, Best Buy, Procter & Gamble, Kodak, etc. He is not restricted by industry or scale, but attaches great importance to the matching of corporate growth potential and financial data.

Lynch announced his retirement in 1990 to devote more time to charity and family life.

Management Essence

"The best stocks may be hidden in your daily life, as long as you keep your eyes open." - Lynch always emphasizes the importance of discovering investment opportunities in life.

"You don't need to be an expert, you just need to understand the business, be willing to think and be patient." - He encouraged individual investors to think proactively and hold for the long term.

"Understanding the companies you hold is much more important than understanding market trends." - Lynch firmly believes that fundamental analysis is the core of successful investing.

He is also a best-selling author. His representative works include " One Up on Wall Street " and " Beating the Street ". He is widely welcomed by investors around the world and is known as "the person who can best explain complex financial theories in a simple and understandable way."