Basic Information

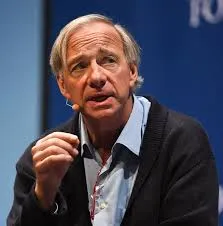

Name: Ray Dalio

Identity: Founder of Bridgewater Associates | Global Macro Investment Master Expertise: Global Macro Hedging, Risk-Balanced Investment, Economic Cycle Research

Ray Dalio is one of the world's most influential hedge fund managers, known for his unique macroeconomic investment strategies and systematic risk-balancing philosophy. A graduate of Harvard Business School, he founded Bridgewater Associates in 1975 and grew it into the world's largest hedge fund.

Dalio is renowned for his research on economic cycles, monetary policy, and global market connections, emphasizing risk hedging and asset balance through his "all-weather portfolio." He firmly believes that systematic research and a disciplined investment framework are the keys to long-term, stable profitability.

Representative achievements

Founder & Chief Investment Officer, Bridgewater Associates (the world's largest hedge fund, with over $160 billion under management)

Proposed and implemented the "All Weather Portfolio" theory, which is widely used in institutional investment.

Author of the best-selling book "Principles," which has become a classic in the field of investment and management.

Has been selected into Time magazine's "100 Most Influential People in the World" list many times

Named a billionaire by Forbes, his personal net worth once exceeded $15 billion

Investment Philosophy

“Don’t rely on forecasts, build a portfolio that can survive a variety of environments.”

The core of Ray Dalio's investment philosophy lies in risk diversification and hedging . He believes that the market cannot be fully predicted, but by studying long-term economic cycles, central bank policies, and cross-asset correlations, one can mitigate risk and capitalize on trends. He emphasizes a corporate culture of "fierce independent thinking" and "radical transparency," driving the team to continuously optimize investment strategies through collective decision-making.

The "all-weather portfolio" concept he advocates aims to enable investors to maintain relatively stable returns in various economic environments of inflation, deflation, growth and recession.