BrokerHiveX

BrokerHiveXBasic Information

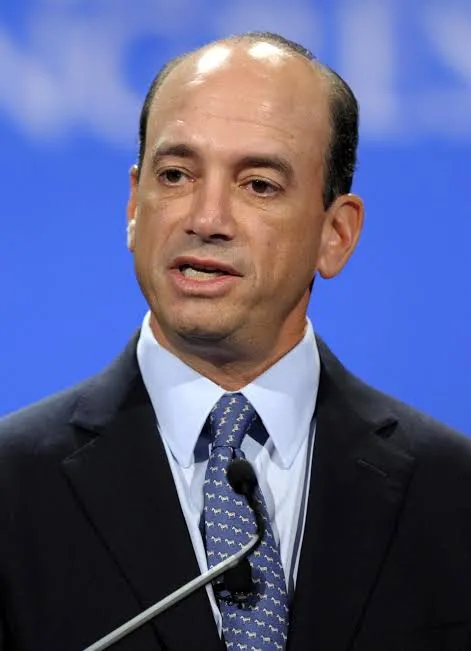

Name: Joel Greenblatt

Identity: Value investing theorist | Professor at Columbia Business School. Expertise: Special situation investing, value investing models, education, and fund management.

Joel Greenblatt is a renowned American investor, fund manager, and educator, widely regarded as the epitome of the "formulated value investing" philosophy. A graduate of the Wharton School of the University of Pennsylvania, he served as a professor at Columbia Business School, teaching value investing. In 1985, he founded Gotham Capital, an investment fund that achieved long-term annual returns exceeding 40% with a small portfolio, becoming a Wall Street legend.

Greenblatt is known for his "Magic Formula Investing," a method that emphasizes identifying high-quality stocks using simple, quantitative metrics (high return on capital and low price-to-earnings ratios). His book, "The Little Book That Beats the Market," has become a classic on value investing, profoundly influencing both individual investors and institutional investors.

Representative achievements

Founded Gotham Capital investment fund, achieving super high long-term returns

He has been teaching at Columbia Business School for a long time and has trained a large number of value investment talents.

Author of investment classics: The Little Book That Beats the Market and You Can Be a Stock Market Genius

Proposed the "magic formula investment" model, which promoted the development of quantitative value investment

Its fund management philosophy is both practical and theoretical, and is regarded as a modern extension of value investing.

Investment Philosophy

“Good company + good price = long-term returns.”

The core of Joel Greenblatt's investment philosophy is the simplification and quantification of value investing . He believes that investors don't need complex models; simply by consistently identifying stocks with high returns on capital (indicating a company's strong operating performance) and low valuations (signifying reasonable prices) and holding them for the long term, they can achieve excess returns in the capital market.

He emphasizes the importance of discipline and systematic approach, believing that most investors fail due to emotional volatility and a lack of patience. Through his "Magic Formula Investing," Greenblatt translates the value investing philosophy into a simple, actionable approach for everyday investors, helping more people share in the long-term dividends of the capital market.