BrokerHiveX

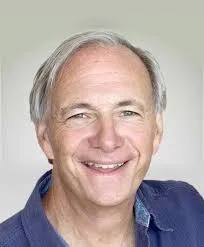

BrokerHiveXRay Dalio is the founder of Bridgewater Associates, the world's largest hedge fund. He is known as a thinker and master of macroeconomic trend analysis in the modern investment community. He is known for his unique "principled" management philosophy, all-weather investment strategy and accurate grasp of the global financial cycle. He is one of the most influential figures on Wall Street.

📖 Biography

Born : 1949, born in Queens, New York, USA.

Education : Dalio graduated from Long Island University with a degree in economics and later received an MBA from Harvard Business School.

Entrepreneurial journey : Founded Bridgewater Associates in his own apartment in 1975, initially serving family offices and small and medium-sized clients, and later rose to become the world's largest hedge fund with its unique macro strategy.

Important turning point : In 1982, he wrongly predicted that the U.S. economy would fall into the Great Depression and be on the verge of bankruptcy, but he took this as an opportunity to rebuild the decision-making system and establish a corporate culture of "extreme truth-seeking" and "extreme transparency."

🏆 Achievements

Bridgewater's assets under management once exceeded US$150 billion, and its clients included central banks, sovereign wealth funds and university endowment funds.

The "All Weather Portfolio" he created has become a classic example of institutional portfolio management.

Published the best-selling book "Principles: Life and Work", which has been translated into many languages and influenced countless managers and investors.

He has been on the Forbes Global Billionaires List many times.

💡 Investment philosophy

Ray Dalio's investment philosophy emphasizes:

The principle of economic machine : The economy operates like a machine, and understanding its structural cycles is the key to successful investment.

Risk balance : Achieve "risk parity" through asset allocation and obtain stable returns in different economic environments.

De-emotional trading : Rely on data, models and collective wisdom to make decisions and minimize subjective bias.

Principled management : Emphasis on openness, transparency and a culture of vigorous but constructive debate within the organization.

✅ Summary

Ray Dalio is a thought architect of the financial market. He has not only reshaped the hedge fund industry, but also influenced global investors through his books and video education. His success comes from his deep insight into the rules, his facing and reflection on failure, and his continuous refinement of organizational culture and principles. At a time when global economic uncertainty is increasing, Ray Dalio's thoughts still provide important reference value for investors.