BrokerHiveX

BrokerHiveXBasic Information

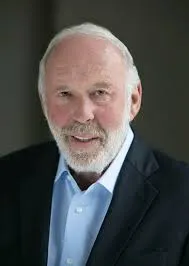

Name: James Simons

Identity: Mathematician | Quantitative investment pioneer | Hedge fund manager Expertise: Quantitative trading, mathematical modeling, data analysis

James Simons is one of the world's most successful quantitative investors and the founder of the hedge fund Renaissance Technologies. A distinguished mathematician, he studied mathematics at MIT and the University of California, Berkeley, earning his doctorate at the age of 23. Simons served in the US Department of Defense's Cryptanalysis Agency during the Cold War and was also the chairman of the mathematics department at Stony Brook University, where he made significant contributions to geometry and topology.

In 1978, Simons founded Renaissance Technologies, introducing advanced mathematical models, statistical methods, and computer algorithms to the financial markets. His flagship Medallion Fund is renowned for its impressive annualized returns, consistently outperforming the market over the long term. Simons' success demonstrates the immense power of data-driven and scientific approaches in financial investment.

Representative achievements

Founded Renaissance Technologies, a pioneer in quantitative trading in the hedge fund industry

Managed the Medallion Fund, achieving an annualized return of over 30% (after fees) over the long term

Made important academic contributions in the fields of differential geometry and cryptanalysis

Won the Oswald Veblen Prize from the American Mathematical Society and other academic awards

Long-term funding for scientific research and education, donating billions of dollars through the Simons Foundation

Investment Philosophy

“A good mathematical model outperforms intuition.”

James Simons believes that market price movements contain quantifiable and predictable patterns, and that science and technology can help investors identify and capitalize on these opportunities. He emphasizes the importance of teamwork and interdisciplinary research, advocates for validating all hypotheses with data, and continuously optimizes algorithms to respond to market dynamics. In his investment philosophy, rationality and rigor are the core weapons for defeating the market.