BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:A detailed explanation of forex leverage: What is forex leverage? How does it amplify returns and risks? How do regulatory authorities (FCA and ESMA) limit leverage? This article combines case studies with risk comparisons to provide investors with a comprehensive explanation and practical advice.

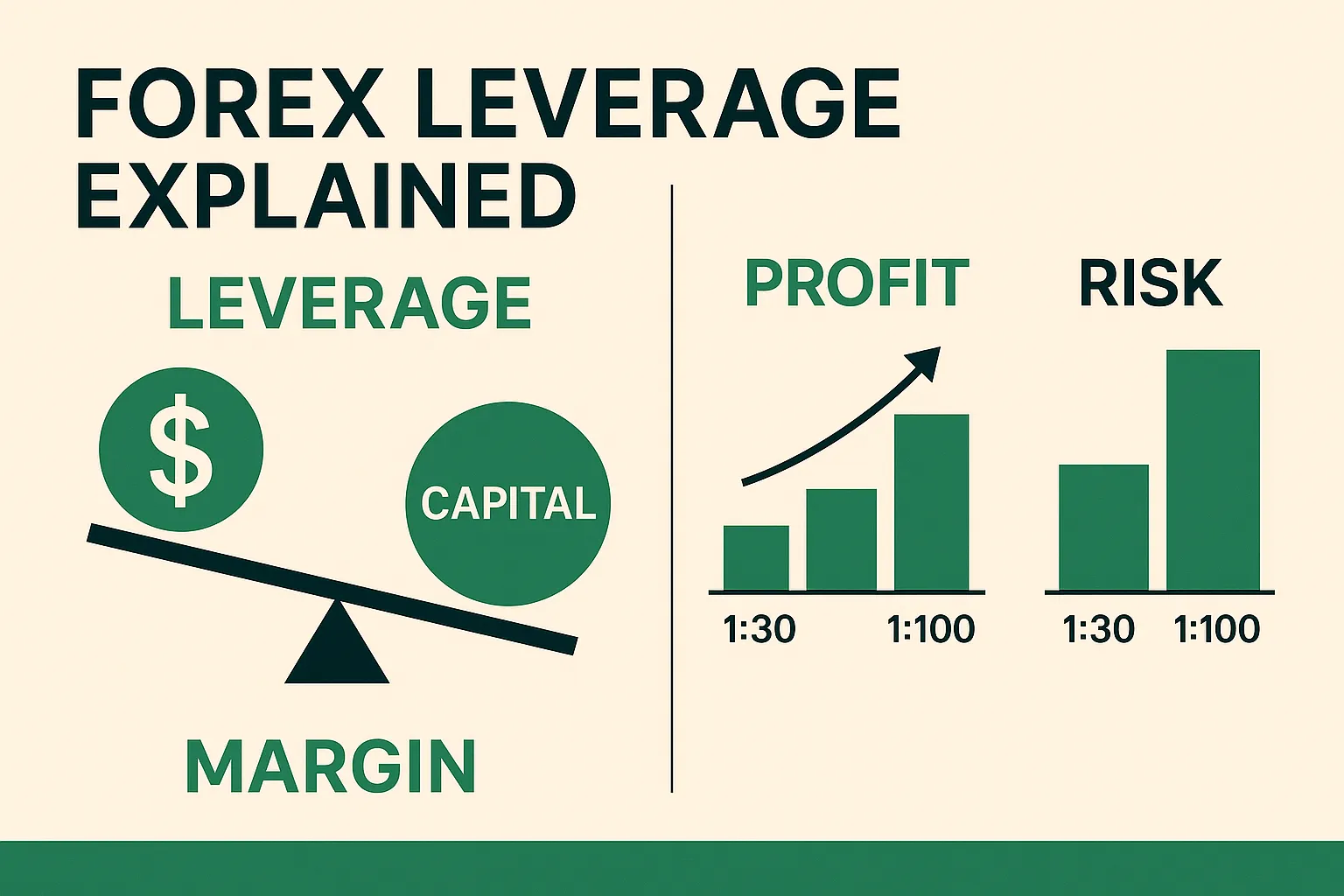

Forex leverage refers to an investor's ability to leverage their trading capital through the credit provided by a broker. Simply put, it allows them to trade larger amounts with less margin. For example, 1:100 leverage means they can trade a $100,000 forex contract with only $1,000 in margin.

Authoritative financial textbooks (such as "International Finance") and the definition of the UK Financial Conduct Authority (FCA) both emphasize that leverage is a double-edged sword : it can magnify profits as well as losses.

Example 1: Low Leverage (1:30)

An investor invests $1,000 and uses 1:30 leverage to trade a $30,000 contract. If the exchange rate rises by 1%, the investor earns $300, a 30% return.

Example 2: High Leverage (1:500)

With the same $1,000 investment and 1:500 leverage, you can trade a $500,000 contract. If the exchange rate rises by 1%, you'll earn $5,000, a 500% return.

From the perspective of returns, the higher the leverage, the greater the capital utilization rate, but the risks behind it increase exponentially.

High leverage can lead to severe losses during market fluctuations:

Volatility amplification : A high-leverage account may trigger a margin call if the market reverses by 0.2%.

Psychological pressure : Excessive leverage exposes investors to over-trading and emotional distress.

Regulatory risk : Most developed markets have restricted leverage for retail traders.

⚠️Examples of authoritative regulatory restrictions

ESMA (European Securities and Markets Authority) : Maximum leverage for retail clients in the EU is 1:30.

FCA (UK) : Also limits retail forex leverage to 1:30.

ASIC (Australian Securities and Investments Commission) : The maximum leverage for retail foreign exchange traders is 1:30.

Some offshore regulations : For example, Belize and Seychelles allow 1:500, attracting traders seeking high leverage.

| Leverage Ratio | Profit and loss magnification | Margin Requirements | Probability of liquidation | Suitable for people |

|---|---|---|---|---|

| 1:30 | medium | Higher | Lower | Beginners and conservative investors |

| 1:100 | high | medium | medium to high | Experienced traders |

| 1:500 | Very high | Very low | Very high | High risk takers |

Set your risk tolerance : limit your single trade risk to 1%–2% of your account balance.

Avoid full-position operations : Even with high leverage, transactions should be diversified and not over-concentrated.

Choose a compliant broker : give priority to platforms regulated by FCA, ASIC, and NFA.

Combined with stop-loss mechanism : Any leveraged trading must be accompanied by strict stop-loss.

Forex leverage is a tool that maximizes capital utilization, but it's also a major cause of margin calls and account wipeouts. Authoritative regulatory bodies generally limit leverage for retail clients to 1:30 to protect investor interests. New traders should understand the nature of leverage, choose a rational ratio, and strictly implement risk management to successfully navigate the forex market.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.