BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Comprehensive analysis of real-world asset allocation cases, covering conservative, balanced, and aggressive investment portfolios. Combined with real market data from 2023-2025, this book helps investors manage risk scientifically and achieve steady wealth growth.

Asset allocation is one of the core concepts in investment and financial management. Compared to simply investing in stocks or funds, a balanced portfolio of assets (stocks, bonds, cash, gold, commodities, alternative investments, etc.) balances risk and return, helping investors achieve long-term, stable growth. This article will analyze investment portfolios, ranging from conservative to aggressive, using real-world examples to help investors with different risk appetites find the right investment path for them.

Diversification : Avoid putting all your eggs in one basket.

Risk Tolerance : Young investors can tolerate greater volatility, while those approaching retirement need to be more conservative.

Investment Goals : Education, retirement, and wealth appreciation. Different goals determine different allocations.

Dynamic adjustment (Rebalancing) : Regularly review the portfolio to prevent deviation from the original risk level.

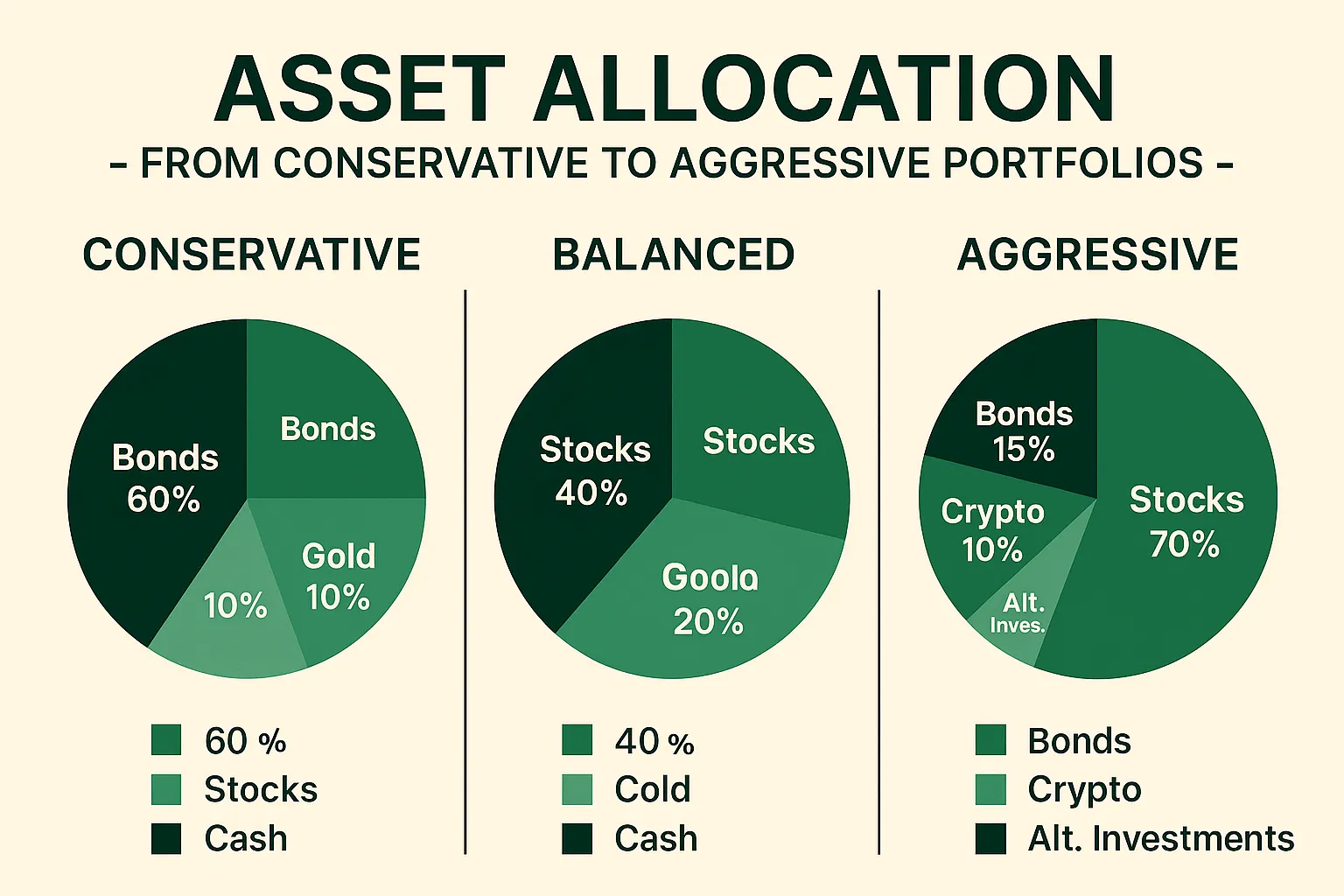

60% bonds/fixed income products (government bonds, investment-grade corporate bonds)

20% stocks (blue chip stocks, dividend stocks)

10% Gold or Commodity ETF (inflation hedge)

10% cash or money market funds (liquidity)

👉 Suitable for: retirees, investors with low risk preference.

📈 Historical performance: During the 2008 financial crisis and the 2020 epidemic, the maximum decline of this portfolio was less than 10%.

40% Stocks (S&P 500 Index Fund + Emerging Markets ETF)

30% bonds (long-term government bonds + corporate bonds)

20% Commodities & REITs (gold, commodities, global real estate trusts)

10% Cash 👉 Suitable for: mainstream office workers, medium risk appetite.

📈 Historical performance: The average annualized return from 2010 to 2020 was approximately 6% to 7%, with the maximum drawdown controlled at 15%.

70% stocks (tech, growth ETFs, some small-cap stocks)

15% Bonds (High Yield)

10% digital currency (BTC, ETH)

5% Alternative investments (PE, venture capital funds)

👉 Suitable for: young investors and those pursuing high growth.

📈 Historical performance: During the bull market of 2019–2021, the portfolio had an annualized return of more than 15%, but when cryptocurrencies plummeted in 2022, the portfolio's maximum drawdown was as high as 25%.

Stock Market : Nasdaq hits new high, S&P 500 has risen more than 50% from its 2022 low.

Bond market : U.S. Treasury yields remain at 4%–5% for a long time, which is attractive to conservative portfolios.

Gold : In 2024, it once exceeded $2,400 per ounce and became a safe-haven tool.

Digital currency : Bitcoin has exceeded $120,000 in August 2025, with both risks and opportunities.

Different investors should choose appropriate asset allocation based on their own risk tolerance + investment goals + time period .

Conservative: Emphasizes capital preservation and stable cash flow.

Balanced: Suitable for most investors, taking into account both growth and stability.

Aggressive type: pursues wealth maximization, but needs to withstand severe fluctuations.

📌 Tip: Regardless of the combination, regular rebalancing is necessary to keep the risk level constant.

The examples in this article are for educational purposes only and are not intended as investment advice. Invest with caution due to market uncertainty.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.